2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

In the economic literature, such a concept as "leverage" (operational and financial) is quite common.

Definition

Thus, production leverage is represented by the ratio of variable and fixed costs of the enterprise, which affects operating profit, which is determined without taxes and interest.

With a significant amount of fixed costs, a high-level operating leverage is inherent in a business entity, which leads to significant changes in operating profit with small changes in production volumes.

In other words, the effect of such production leverage also manifests itself in generating strong changes in profits with any changes in sales revenue.

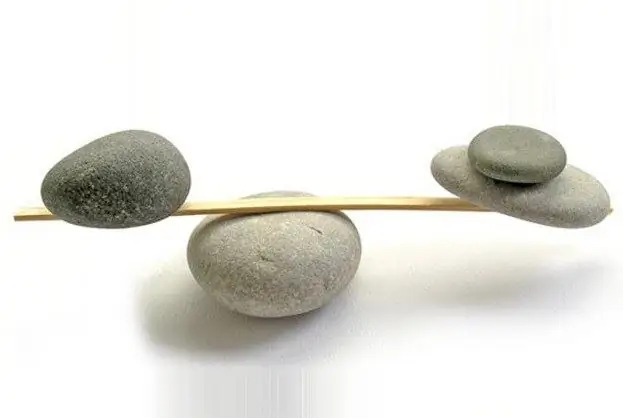

It is not without reason that along with the term “leverage”, this article uses its synonym - “leverage”. Indeed, in translation from English leverage means "lever".

Thus, production leverage (operational - its other name) is a mechanism for effective profit management of any business entity, which is based on improving the ratio of variable and fixed costs. By usingof this indicator, it becomes possible to plan any changes in profit at the enterprise, depending on changes in sales volumes. In this case, the break-even point can be calculated.

Cost classification

A necessary condition under which operating leverage can be used is the use of a margin method based on the division of all costs into variable and fixed.

Thus, the higher the share of fixed costs in the total costs of a business entity, the less the amount of profit will change in relation to the rate of change in the company's revenue.

Returning to the classification of expenses, it should be noted that their level (for example, fixed costs) in the company's revenue has a significant impact on the trend of changes in the value of costs or profits. This is due to the fact that additional profitability, which goes to cover fixed costs, is formed from an additional unit of production. At the same time, the increase in total income from such an additional unit of finished product (or product) is expressed in a change in the amount of profit. When the break-even level is reached, profit is formed, which is characterized by a faster growth than sales volume.

Effect of operating leverage

This operating lever serves as a fairly effective tool in determining and analyzing the above dependence. In other words, its main purpose is to establish the impact of profit on any changes in sales volumes.

The essence of its action - an increase in revenue contributes to a greater increase in the amount of profit. At the same time, this growth rate can be limited by variable and fixed costs. Economists have proven that the higher the share of fixed costs, the higher its constraint.

Production leverage (operational) in quantitative terms is characterized by a comparison of fixed and variable costs in their total amount with the value of such an economic indicator as profit before interest and taxes. The following types of leverage are known: price and natural.

By calculating the production operating leverage, it is possible to predict with sufficient accuracy any change in profit with various changes in the amount of revenue.

For a better understanding of this economic indicator, it is necessary to consider the procedure for its calculation.

Operating leverage

The formula for calculating production leverage is quite simple: the ratio of revenue and profit from sales.

Considering revenue as the sum of costs (variable and fixed) and profit, we can understand that the formula for calculating operating leverage will take the following form:

Ol \u003d (Pr + Rper + Rpost) / Pr \u003d 1 + Rper / Pr + Rpost / Pr.

Estimation of operating leverage is not made as a percentage, since this indicator is represented by the ratio of marginal income to profit. Due to the fact that marginal income, in addition to profit, also includes the amount of fixed costs, the valueproduction lever is always above one.

Operating leverage as an indicator of an enterprise's activity

The value of this indicator is considered to reflect the riskiness of not only the business entity itself, but also the type of business in which it is engaged. This is due to the fact that the ratio of costs in the structure of all costs is a reflection not only of the characteristics of the enterprise with its accounting policy, but also of individual industry-specific features of its economic activity.

Economists have proven that a high level of fixed costs in the overall cost structure of a business entity is not always a negative phenomenon. This is due to the fact that it is impossible to simply absolutize the value of marginal income. The increasing level of operating leverage shows the increase in the overall production capacity of the company, technical re-equipment, and an increase in labor productivity. The profit of a business entity with a high level of production leverage is too sensitive to any changes in the value of revenue. With a sharp drop in sales, this enterprise quickly "falls" below the break-even limit. In other words, a very highly leveraged venture is risky.

Characteristics of other types of economic leverage

In the economic literature, one can find the simultaneous use of such indicators as operational and financial leverage. At the same time, if the operating lever characterizes the dynamics of profit depending on changes in the amount of the company's revenue,then financial leverage already characterizes changes in the value of profit minus interest payments on loans and credits in response to changes in operating profit.

There is another economic indicator - the total leverage, which combines operating and financial leverage and shows how (by how many percentage points) there will be a change in profit after paying interest with a change in revenue by one percent.

Credit (financial) leverage

This economic indicator represents the ratio of equity and debt capital of the enterprise, as well as its impact on profits.

With an increase in the share of borrowed capital, the value of net profit decreases. This is due to rising interest costs on loans.

The ratio of debt to equity shows the level of risk (financial strength). An enterprise with a high level of borrowed funds is a financially dependent company. If an enterprise finances its own economic activity only at the expense of its own capital, then it can be classified as a financially independent company.

Payment for the use of borrowed capital is often lower than the profit, which is provided by them additionally. This additional profit can be added to the profit received using equity, which contributes to an increase in the profitability ratio.

Problems to be solved

For a complete analysis of this economicindicator, it is necessary to list the tasks solved with the help of this operating leverage:

- determining the financial result both for the enterprise as a whole and for individual types of products using the "expenses - volumes - profit" scheme;

- calculation of a critical production point using it when making certain management decisions, as well as setting the cost of work;

- making decisions on the implementation of additional orders and considering them for a possible rise in price in terms of fixed costs;

- consideration of the issue of stopping the production of certain types of goods when the price falls below the level of variable costs;

- profit maximization through relative reduction in fixed costs;

- using the level of profitability with the development of production programs, setting the price of goods.

Conclusion

Summarizing what has been said, it should be noted that operating leverage can be increased by raising borrowed funds. A very high production leverage can be leveled using financial leverage. Considered in this article, such effective economic instruments contribute to the achievement of the necessary return on investment by the enterprise with control over the level of risk.

Recommended:

Operating personnel: instructions and duties. Who belongs to the operational staff

What are operational personnel in electrical installations. What are their requirements and what are their responsibilities?

Financial leverage or financial collapse?

Throughout the times, technologies, cultures, lifestyles and beliefs have changed, but only one thing has remained unchanged - money. For centuries, they have been daily present in people's lives, performing their functions

How is the value of an apartment estimated? Property valuation. Cadastral valuation of real estate

Very often in a person's life there are circumstances that force him to make transactions with his own apartment. For example, when he moves to another city or intends to take out a loan

Turnover ratio: formula. Asset turnover ratio: calculation formula

The management of any enterprise, as well as its investors and creditors, are interested in the company's performance indicators. Various methods are used to conduct a comprehensive analysis

Income effect and substitution effect - the key to understanding the change in demand

A change in the price of a good generally leads to a decrease in demand for it. This is explained by the fact that there is an income effect and a substitution effect, which determine this type of demand curve. These two phenomena are so intertwined that scientists are still developing methods to help quantify their influence