2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

What is OSAGO, every vehicle owner knows, because at least once a year he has to contact the insurance company for its registration. The OSAGO policy compensates for the costs of the motorist in the event of unpleasant situations on the road, that is, accidents, which is why it is so important that you always have OSAGO insurance with you. What documents are needed and how much you have to pay - these questions always remain relevant. Let's try to figure it out.

What do you need to apply for a policy?

Many drivers assume that the previous insurance will be enough to obtain OSAGO, but this is not the case. To conclude an agreement between the selected insurance company and the insured, a number of documents will be required.

However, you won't have to collect them for a long time and spend precious time on this, drivers usually always have them with them. So, in order to conclude an OSAGO agreement, you must provide the originals of the following documents.

Documents for the car

This is usually either a vehicle registration certificate -STS (it is also called a "pink card"), or a vehicle passport - PTS (popularly - "blue"). These documents indicate the technical data of the car, as well as the basic data of the owner - full name, address.

Identity document

Usually this is a passport of a citizen of the Russian Federation - the owner of the vehicle. If the policyholder and the owner are different persons, then the policyholder's passport is also required.

Vehicle inspection form

Now, at the stations conducting technical inspection of the vehicle, the owner is issued a diagnostic card that contains data about the car, the date of the current and future inspection. In order for OSAGO insurance to be concluded, you must have a valid diagnostic card. It must be valid for at least another 24 hours.

Many drivers, wanting to save their own money, avoid passing the technical inspection and try to have time to issue an OSAGO with a valid technical inspection, but they either forget to issue a new one or do not want to. Remember that in the event of an accident, if the database does not contain data on the technical inspection of the vehicle, the insurance company has the right to refuse to pay you.

Driver's license

This document is required if the OSAGO agreement is concluded with a limited list of drivers. Moreover, certificates of all drivers who will be included in the insurance policy are required. In extreme cases, you can provide copies of them. It is important to know that the number of drivers eligible fordriving, can not exceed four persons. Otherwise, you can take out insurance without limitation. Unlimited coverage does not require driver's licenses.

In some cases, representatives of the insurance company may require a contract of sale or some other documents. But this is more the exception than the rule.

Only after everything necessary is prepared, OSAGO insurance can be issued. You already know what documents are needed for this, so there should be no problems. The next question that quite logically arises for the owner of the car: "How much money to prepare?"

CTP cost

Pleasure is not the cheapest, but it is still necessary to issue a policy. In this case, driving becomes safer. After all, no matter how confident the driver is in his professionalism, no matter what driving experience he has, situations are different. Even one minute, during which the driver is distracted, can turn into an accident. Therefore, it is still cheaper to take out a policy than to pay for the repair of a damaged car.

The cost of OSAGO is the sum of the base rate multiplied by several coefficients. The maximum base rate for individuals is 4118 rubles, the minimum is 3432. Insurance companies have the right to set the base themselves, so the price of the policy may vary slightly.

In addition to the coefficients that are taken into account when calculating the cost, insurance companies are also required tosee the driver's discount, which is provided to him for each accident-free year in the amount of 5%. The data is contained in a single database and does not depend on the preferences of insurers. Now let's talk about odds in more detail.

Coefficients of insurance rates

The following insurance rate coefficients exist.

1. Territory of primary use of the vehicle.

Determined by the place of residence of the owner of the vehicle. It is established by the law on OSAGO, for example, the coefficient in Moscow is 2, in Irkutsk 1.7, but in Sevastopol it is only 0.6.

2. Age and experience of the driver.

If the driver is under 22 years old, and his experience is less than three years, or any of this item separately, then an increased coefficient is applied within 1, 6-1, 8.

3. Number of people allowed to drive a car.

If the insurance policy does not provide for a limit on the number of drivers, then a multiplying factor of 1.8 is also applied.

4. Vehicle horsepower

The greater the power, the greater the ratio. For example, the coefficient applied to the base rate for a car with 135 hp. equals 1, 4. Up to 50 hp. - 0, 6.

5. Use period.

Basically, the owner concludes an OSAGO policy for a year. The applied coefficient in this case is equal to one. But if you take out insurance for six months, you will have to pay 70% of the cost of the policy for a year, that is, the coefficient will be 0.7.

That's all the coefficients that are taken into account when calculating the cost of the policy. Don't forget aboutexisting discount. If the owner has it, but it was not taken into account, then OSAGO insurance may also be invalid. What documents are needed to confirm the discount? Only a driver's license or, if the insurance is unlimited, the passport of the owner of the vehicle.

After reading this article, each policyholder will find valuable information regarding the cost, coefficients, rules that apply when applying for a policy. You have learned how necessary a thing is OSAGO insurance, what documents are needed, now it is also known. And a competent policyholder who knows everything will never encounter problems when applying for a policy. And besides, it will inspire respect from insurers, because it is always more pleasant to deal with knowledgeable people.

Recommended:

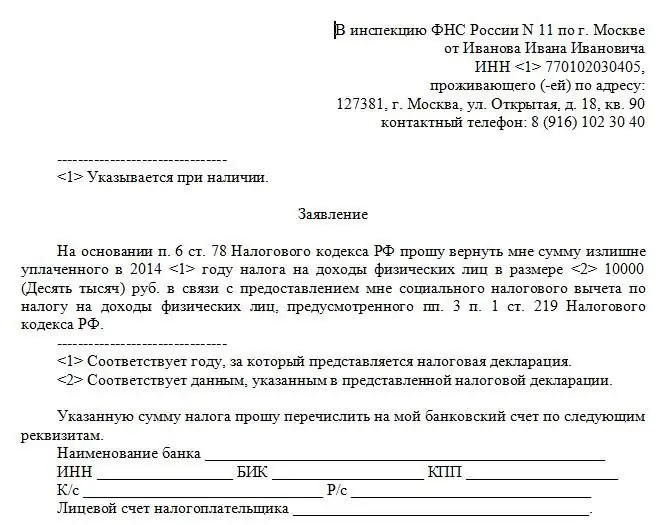

What documents are needed for deduction for treatment: list, rules of registration

In Russia, many citizens can apply for a so-called tax deduction. For example, social type. People are able to recover part of the cost of medical services. But how to do that? This article will talk about the tax deduction for treatment in the Russian Federation

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

What documents are needed for registration of SNILS: list, procedure for registration, terms

SNILS is an important document that every resident of the Russian Federation should have. This article will show you how to arrange it. What is useful for obtaining SNILS? And what are the most common challenges people face?

What documents are needed for a tax deduction: a list of papers for registration

Tax deduction - the right to a refund of part of the costs for certain services. This article will explain how to request this service

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?