2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Russian entrepreneurs can use different systems for calculating taxes. Quite interesting is the tax on imputed income. What is ENVD? It is represented by a tax regime, on the basis of which tax is paid by individual entrepreneurs. When calculating it, physical performance indicators are taken into account, as well as the potential income from a particular job. Additionally, coefficients are applied that are set separately for each region.

System concept

To understand what UTII is, you should carefully study the features of this tax regime. These include:

- use this system is allowed only in a limited number of regions, so entrepreneurs must first clarify the possibility of applying an imputed tax;

- the main factor influencing the amount of tax is the physical indicator of activity, which can be represented by the size of the premises, the number of seats for passengers in public transport or other elements;

- applying regime exclusively for limitednumber of areas of activity;

- it is not taken into account during the calculations exactly what amount of funds the entrepreneur receives from activities;

- it is impossible to draw up a zero declaration under this regime, therefore, regardless of the presence of income or losses, a businessman has to pay a constant amount of funds;

- correction factor is set by the regions independently, for which the economic state of the industry and the market, as well as other factors are taken into account;

- payments under this regime are paid quarterly, and once every three months there is a need to submit a declaration.

Until 2013, all entrepreneurs falling under this regime had to work under it by force. But now individual entrepreneurs independently choose the optimal system. Having figured out what a single tax on imputed income is, many entrepreneurs voluntarily switch to it due to the presence of numerous advantages.

When can I use the mode?

UTII is valid only for some areas of activity. Therefore, before choosing this system, entrepreneurs should find out the answers to several questions:

- is the system allowed in the specific region where the IP plans to operate;

- is the chosen direction of work suitable for the mode;

- is it planned to employ more than 100 people.

Experienced businessmen assure that it is advisable to use UTII for individual entrepreneurs whose physical indicator is low. For example, the size of the trading floor is notexceeds 15 sq. m. or there is a small number of employees. Under such conditions, the amount of tax will be low. For high rates, it is advisable to use the simplified tax system.

Also, it is not always relevant to apply imputed income when starting a new business. This is due to the fact that the entrepreneur cannot be sure of receiving high profits. If there are losses, you will still have to pay fixed payments to the budget.

What types of activities are eligible for UTII?

This mode can only be selected when working in a limited number of directions. All areas of activity are listed in Art. 346.29 NK. These include:

- household services provided to the public, including hairdressing, cleaning or mending clothes;

- veterinary services;

- creation of catering establishments;

- provision of housing for rent;

- transport transportation of people or goods;

- advertising on transport or other objects.

A significant condition for the transition to this mode is work in the above areas of activity. ENVD - what is it? This taxation system was originally created for small businesses, so it has many undeniable advantages for entrepreneurs.

What other conditions apply?

To switch to this mode, it is important not only to choose the current direction of work, but also to meet other significant requirements. To themapplies:

- for a year of work, an entrepreneur cannot have more than 100 officially employed workers;

- if the direction of work related to trade is chosen, then the size of the premises cannot exceed 150 sq. m., and only the size of the showroom is taken into account, so the area of the warehouse or utility room is not included;

- the value of assets owned by an entrepreneur cannot exceed 150 million rubles;

- an entrepreneur cannot be one of the largest taxpayers.

In each region, different requirements for businessmen may additionally increase.

What are the fees?

When using the UTII tax, the taxpayer is exempted from transferring numerous fees to the budget. Therefore, this system is not required to calculate and pay taxes:

- property tax;

- personal income tax or income tax;

- VAT.

At the same time, the entrepreneur is not exempted from insurance premiums for himself and his employees. If an individual entrepreneur uses cars to carry out activities, then they are additionally paid a transport tax.

Mode Benefits

Having figured out what UTII is and what features this regime has, many entrepreneurs decide to work on this system. This is due to significant benefits:

- only one tax is paid;

- does not change the size of the payment over time if it remains unchangedphysical indicator of activity;

- does not take into account the profit received by the entrepreneur from work, and often it is significant, so payments to the Federal Tax Service are low for a successful IP;

- It is required to submit quarterly tax returns to the Inspectorate, which are easy to fill out, so businessmen themselves often do accounting without hiring an experienced accountant.

UTII for individual entrepreneurs has not only pluses. The disadvantages include the fact that if at the beginning of work the entrepreneur receives a low income or even faces losses, then it will still not be possible to reduce the amount of the payment, so the tax burden will be significant. Also, in many regions, the authorities decide to impose a ban on the use of this regime.

How is tax calculated?

To calculate the amount to be transferred to the budget, the standard formula is used:

Tax amount=implied yieldphysical indicatordeflator coefficientregional coefficienttax rate.

Each indicator has its own nuances:

- multiplying the estimated return by a physical indicator results in imputed income;

- The deflator coefficient is set by the Ministry of Economic Development annually based on the growth rate of prices for various goods;

- regional coefficients are calculated by local authorities, for which the economic condition of the region and other important criteria are taken into account;

- tax ratevaries from 7.5 to 15 percent, and it is the regional authorities who decide on its size.

Having understood what UTII is and how the tax is calculated, each entrepreneur will be able to independently deal with calculations and draw up a declaration.

When is the tax paid and the declaration submitted?

The fee is required to be transferred quarterly, and a UTII declaration is submitted to the Federal Tax Service every three months.

The tax is paid by the 25th day of the month following the end of the quarter. The declaration must be handed over to tax officials by the 20th of this month.

Calculation example

Calculating the UTII tax is quite simple if you know exactly the different values. For example, an entrepreneur is engaged in the sale of non-food products. For this, a stationary store is used, the size of which is 45 square meters. m. For the calculation, indicators are used:

- base income for this area of work is 1800 rubles. per month;

- physical indicator is represented by the area of the retail space, therefore it is equal to 45 sq. m.;

- deflator coefficient equals 1, 798;

- the regional coefficient must be found out at the local branch of the Federal Tax Service, but it is approximately equal to 1;

- The rate is set to a maximum of 15%.

Using these indicators, you can get the amount of the fee:

1800451, 79810, 15=21845.7 rubles per month.

For the quarter the amount of the fee is: 21845, 73=65537, 1 rub.

Such a tax is consideredhigh enough, so often the activity of UTII is considered not very profitable. If the physical indicator is significant, then it is advisable to use the simplified tax system.

Reporting rules

UTII declaration is submitted quarterly to the Federal Tax Service. This must be done before the 20th day of the month following the end of the quarter.

You can hand over a correctly drawn up document in different ways:

- in electronic form, for which you can use the website of the Federal Tax Service or use the capabilities of electronic document management operators;

- in paper form, for which the entrepreneur must personally bring the document to the FTS office.

If the second option is used, then it is advisable to make two copies of the document at once, so that the service worker marks acceptance on the second declaration. This serves as proof that the puffiness was indeed submitted for inspection in a timely manner.

It is allowed that a declaration in paper form be submitted by an authorized person, but he must have a power of attorney correctly certified by a notary.

Conclusion

It's enough just to figure out what it is - UTII. This mode has many advantages for the entrepreneur, although it has some disadvantages.

The legislation clearly establishes which types of activities can be carried out according to UTII. Therefore, a limited number of businessmen can use the system. At the same time, it is important to understand how to correctly calculate andtax is paid. Declarations should be submitted quarterly, as the lack of payments and reports is an administrative offense.

Recommended:

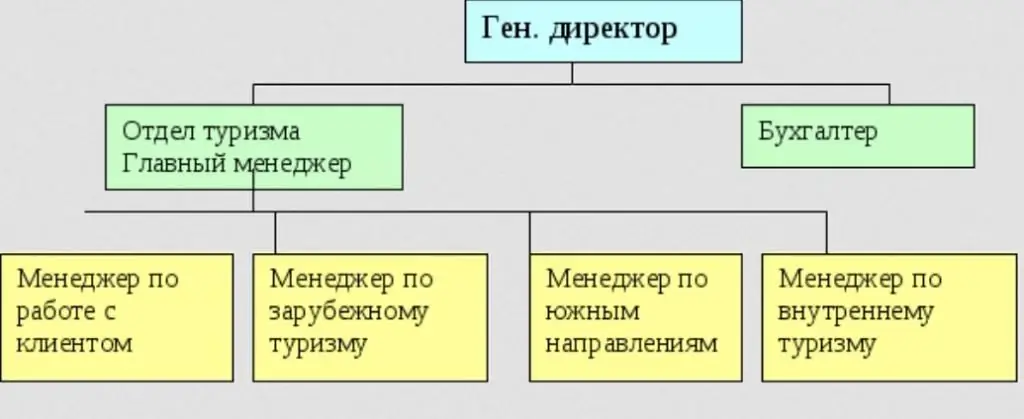

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

Suspension of LLC activities. Application for suspension of activities of LLC

Suspension of the activities of an LLC may be required in cases where it is important for the founders to maintain a legal entity, but it is not planned to conduct active activities. In making such a decision, the taxpayer must present the sequence of actions to be taken and their consequences. All this will be discussed in the article

Features and types of publishing activities

Currently, publishing activity should be understood as the production, economic and organizational and creative activities of persons who are publishers, for the production of electronic, printed products. In the article we will consider all aspects of this issue

Recreational activities: types, essence and features

Modern rhythm of life requires unimaginable physical and moral dedication from a person. But still not work! If the average worker is not given a vacation at least once a year, not allowed to have a good rest, then the result of his work will be deplorable. The essence of the concept of "recreational activity" lies in the satisfaction of such needs, which are not alien to each of us

UTII tax period. Single tax on imputed income for certain types of activities

UTII is the preferred tax for many Russian entrepreneurs. What is the reason for its demand? What are its main features?