2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

Estimated expenses or costs are designed to group the upcoming expenses of the enterprise, directed to the implementation of any activity. In addition, there are estimates aimed at financing the activities of any enterprise or organization. The purpose may be the execution of design or construction work, and the like. Thus, this document represents a financial plan, the preparation and approval of which must take place in accordance with the procedure established by the charter of the enterprise and the legislation.

Estimated costs are compiled for each type of cost. These can be raw materials and basic materials, an expense item for returnable waste, auxiliary materials, fuel and energy, for wages (it is necessary to include both basic and additional), as well as for social insurance contributions and other expenses.

The overhead costs in the estimate are not tied to any intermediate result, but are related to the whole project. That is, it can be the cost of a consultant, trainingprofessionals or travel expenses. Also distinguish between fixed costs - these are administrative and general overhead costs. These types of costs do not imply immediate payment, but they take place, and if the company seeks to continue to exist, then eventually they must be paid.

The cost estimate is the document that should always be kept in front of your eyes. By comparing the actual indicators with those included in the estimate, it is possible to monitor the implementation of the financial plan. Knowing how to read the estimate data correctly, it will always be possible to catch the moment when the actual expenses do not correspond to the planned ones. This is what a cost estimate is for. Drawing up a local estimate will more accurately reflect the estimated costs. As a rule, it includes a detailed calculation with detailed transcripts. A local cost estimate is compiled if the scope of work and costs for these works are not final and are subject to further clarification. This type of estimate is compiled for buildings and structures, as well as for general site works. In order to compile this document, the source material can be graphs, working drawings, equipment specifications, guiding technical materials, it can also be information on tariffs and prices for consumption resources, and the like.

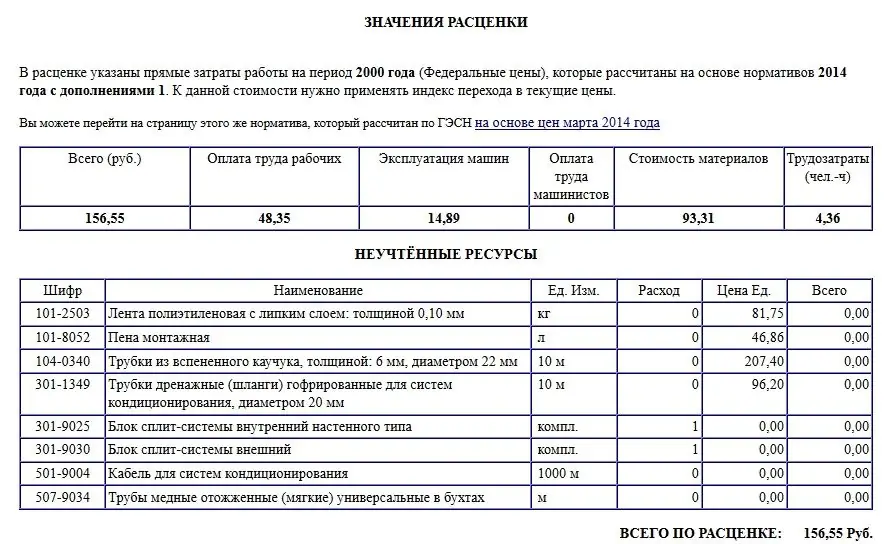

For any project, the preparation of estimate documentation is considered the most necessary moment. The information contained in thisthe document must be reliable, otherwise the calculation of profitability will be fictitious. As a result, instead of a profitable enterprise, you can get a loss-making one. Compilation of such an estimate is carried out at the basic price level, then recalculated to the current level, according to indexing to cost elements.

Thus, the cost estimate is the documentation that includes the expenses planned by the enterprise for the upcoming period of production and financial activities.

Recommended:

Why do we need BDR and BDDS?

To control the financial flows in the enterprise, the management makes different budgets and balances. These reports are supplemented by BDR and BDDS. The abbreviations hide the budget of income and expenses, as well as the cash flow budget. The purpose of these reports is the same, but they are generated in different ways

Why do you need a business plan. Tasks, structure and goals of the business plan

A business plan is needed to identify the strengths and weaknesses of a product/service. It is also important for the reason that it allows you to draw up a complete and competent strategy for the development of the project, taking into account the characteristics of the market. In addition, without such a document, investors will not consider a specific idea

Toothbrush case - why do you need it and how to choose?

Toothbrush case is an item that is needed not only for travel. What is its purpose, how to choose the right case, what types exist at the moment? More on this later

Do I need to pay tax when buying an apartment? What you need to know when buying an apartment?

Taxes are the responsibility of all citizens. The corresponding payments must be transferred to the state treasury on time. Do I need to pay taxes when buying an apartment? And if so, in what sizes? This article will tell you all about taxation after the acquisition of housing

Step by step instructions on how to read estimates. An example estimate for the installation of a split system

How to understand the estimates? Examples of estimates for installation. Drawing up an estimate using the example of a local estimate calculation for the installation of a split system. Completion of estimates for installation work. Regulatory documents for determining the cost of construction products in the territory of the Russian Federation