2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Child tax deduction - what is it? Questions of this kind arise in many family citizens. The thing is that the presence of children in the cell of society allows you to use special forms of state support. For example, tax deductions. It is about them that we will talk further. Who can apply for them? How much government assistance is provided? And what do you need to know about her request? The answers to these questions will make life much easier for all modern parents. Especially those who have the right to a deduction for children. It is possible that the bulk of citizens are endowed with the relevant rights.

Description

Tax deduction for a child - what is it? So in Russia it is customary to call a special bonus offered to family officially working citizens. It is issued only when there are children in the cell of society, including adopted children.

A tax deduction for a child is a way to reduce the tax base when calculating personal income tax. A certain amount will be deducted from the salary before tax is calculated. Due to this, the amount of personal income taxwill be slightly reduced.

Request Conditions

Tax deduction for a child - what is it? Some form of state support that allows you to reduce the income tax levied on wages. True, not everyone is en titled to it.

To be eligible for this deduction, a person must:

- have minor children;

- be a Russian citizen;

- be officially employed.

In addition, some restrictions are imposed on the applicant's annual income. But this issue should be given special attention.

Salary limit

Child tax deduction up to what amount of earnings will be provided? The thing is that in Russia, as already mentioned, certain restrictions are imposed. Citizens who receive a high income will not be able to apply for a standard tax deduction. This is simply not provided for by current legislation.

At the moment, the standard "per child" tax refund is terminated if the applicant's annual income exceeds 350,000 rubles. Up to this point, both the mother and father of the child can demand a reduction in the tax base when calculating personal income tax from wages.

How much will be returned

The amount of the tax deduction for children is another point of interest to many citizens. As a rule, the demand for state aid is accompanied by paperwork. And not always the preparation done justifies the expectations of a person.

What is the tax deduction for children in this or that case?The answer depends on the number of offspring raised, as well as on their he alth status. You can focus on the following data:

- 1,400 rubles - for one and two children;

- 3,000 rubles - for three or more;

- 6,000 rubles - to adoptive parents for a disabled child;

- 12,000 rubles - for each disabled child (parents).

It is worth noting that these refunds are for each child. So, if there are 2 he althy babies in the family, you can get a total of 2,800 rubles in the form of a standard type tax deduction.

Social return and children

Tax deduction for a child - what is it? Thus, it is customary to call the process of processing a refund on account of paid income taxes or reducing the tax base when calculating personal income tax from a person’s salary.

In addition to the standard deduction, you may encounter a return of the social type. It is divided into 2 categories:

- for treatment;

- for education.

In the first case, you can return part of the costs spent on medical services and medicines. In the second - for educational services. The social deduction differs from the standard deduction in many ways. For example, the conditions for registration and the amounts returned to citizens.

Treatment refund information

The amount of the tax deduction for children, as you can see, is different. A lot depends on the type of "bonus" being issued. We figured out the standard deduction. What about social?

Refund for treatmentis also divided into 2 categories - expensive treatment and conventional medical services. In the first case, you can return the money in the amount of 13% of the costs incurred. In the second - 13 percent, but not more than 120,000 rubles for the entire time and 15,600 rubles a year.

Such refunds are issued to those who pay for services. That is one parent. It has nothing to do with income. True, it will not be possible to recover more than taxes paid for a particular tax period.

Study refund information

What are the tax deductions for children? You can demand a refund for educational services paid by parents or other legal representatives. This is a fairly common "bonus". It also applies to social returns.

Refundable limits are the same as medical deductions. You can reimburse no more than 15,600 rubles per year and 120,000 rubles for the entire time. In this case, refunds for medical services will also be taken into account. In total, more than 50,000 rubles cannot be returned for one child.

Important: Expensive medical treatment is not included in this deduction.

Conditions for social deductions

Tax deduction for a child - what is it? The answer to such a question will no longer put a person in an awkward position. We figured out the standard deduction. And what conditions must be met in order to issue a social return for a child?

As a rule, this requires:

- be a Russian citizen;

- be officially employed;

- payfrom salary 13 percent in the form of personal income tax;

- make a deal on your behalf and with your own money.

It is worth paying attention to the fact that the deduction for the child's education can be requested until the child reaches the age of 24. At the same time, the student must study full-time at the university and have no official income.

Important: the contract for the provision of social services must be executed in the name of the potential applicant.

Where to apply?

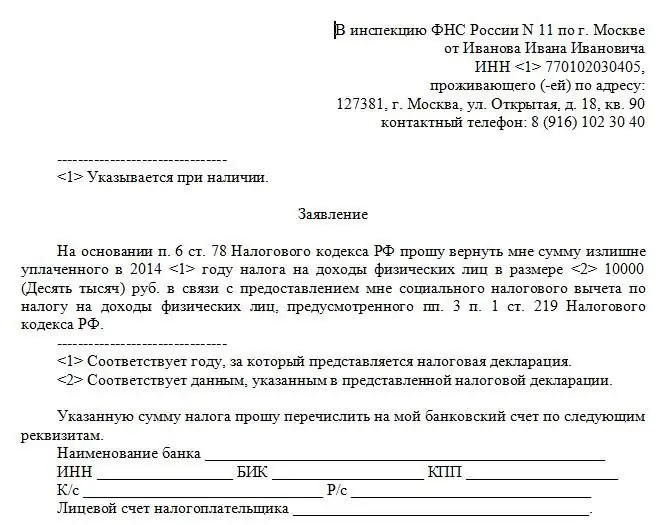

An application for a tax deduction for children is submitted to the competent authorities. They are companies-employers or district departments of tax services. It all depends on what kind of return we are talking about.

The standard type deduction is issued exclusively through employers. But the rest of the returns can be requested at the MFC, and at the Federal Tax Service, and at the head. The latter option is not in great demand. And there are reasons for that. For example, this technique allows you to reduce the base when calculating income tax from wages. And the usual social deductions issued through the Federal Tax Service are to receive a specific amount of cash.

The main thing is to contact either your employer or the authorized body at the place of residence of a person. Otherwise, service may be legally denied.

Procedure of actions

The amounts of tax deductions for children have been studied. And the basic conditions for their registration, too. How do I request a tax refund? It's not as difficult as it seems. Especially with proper timely preparation.

To issuechild tax deduction, need:

- Prepare a specific package of references.

- Write an application in the prescribed form.

- Submit a request to the authorized body.

- Waiting for an answer.

If everything is done correctly, then deductions through the employer will be provided with the first salary. Otherwise, approximately 1.5-2 months from the date of the response of the Federal Tax Service on the provision of a refund, the funds will be credited to the applicant's account.

Record of applications

What tax deductions are provided for children, of course. It is only important to remember that social returns can not always be returned. They are subject to the so-called statute of limitations.

She is 3 years old. This means that you can claim money from the Federal Tax Service or the employer as a social tax deduction within 36 months. Moreover, it is allowed to issue the amount for this period. Very convenient, especially when it comes to tuition reimbursement.

Documents for employer - standard return

Child tax deductions often depend on how much the parent spent on the transaction. True, this principle does not work with standard deductions. By law, you can reduce the tax base when calculating personal income tax by a certain amount and no more.

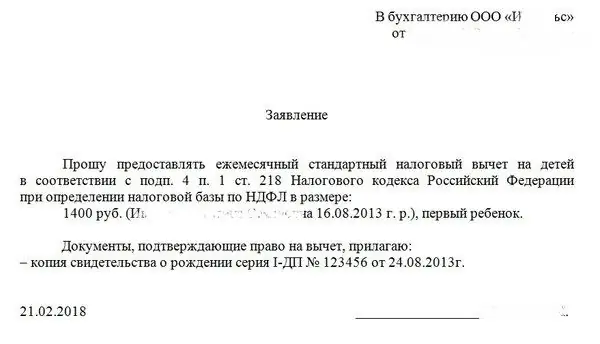

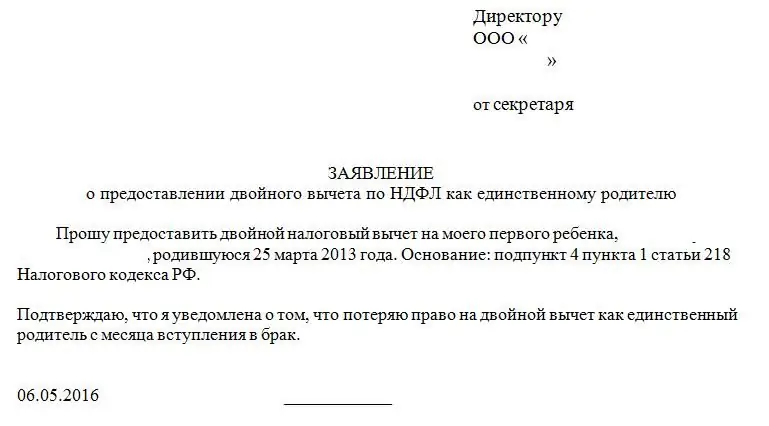

To apply for a standard tax deduction, it is recommended to prepare:

- passport;

- statement;

- birth or adoption certificates for children;

- information aboutdisability.

If the other parent/adoptive parent waives the standard refund, it is best to document this. Then the applicant will be able to receive an increased deduction.

Documents for social deductions

Preparing for the registration of social tax returns is much more troublesome. This process comes with a lot of paperwork.

At this point the person will have to prepare:

- application of the prescribed form;

- passport;

- contract for the provision of certain services;

- checks indicating payment for services;

- student's/student's references (during training);

- licenses and accreditations of educational or medical institutions;

- tax return;

- income certificates;

- birth/adoption certificates;

- details of the account to which you want to receive money.

As a rule, with proper preparation, filing a tax deduction will not cause any trouble. You just have to be patient - applying to the Federal Tax Service takes a lot of time. And consideration of the application takes about a month or two.

Important: it will not be possible to receive money in the form of a cash deduction through the MFC or the Federal Tax Service. Funds are initially credited to a bank account or card.

When does the standard deduction end?

Want to take advantage of the above opportunities? Then it is important to understand that this is not always possible. Especially when it comes to standard taxdeductions for children. The age of the descendants plays an important role in this matter.

Payments stop if:

- child turns 18;

- minor issues emancipation;

- child dies or goes missing.

In addition, standard deductions are terminated when the applicant's annual income exceeds 350 thousand rubles. There is nothing difficult to understand in this.

Conclusion

Now it's clear what the tax deduction for a child is. A sample application form is provided above. It will help you understand how to correctly request a return of one type or another.

If there are problems in the process of making deductions, you can seek advice from the Federal Tax Service of the Russian Federation. They will definitely tell you what deductions and under what conditions a person can demand.

Should I use these bonuses? Yes. They are completely legal and regulated by the RF Tax Code.

Recommended:

What is a property deduction, who is en titled to it and how to calculate it? Article 220 of the Tax Code of the Russian Federation. property tax deductions

Russia is a state in which citizens have a lot of rights and opportunities. For example, almost every citizen of the Russian Federation has the right to receive a property deduction. What it is? Under what conditions can it be issued? Where to go for help?

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Until what age are child tax deductions? Article 218 of the Tax Code of the Russian Federation. Standard tax deductions

Tax deductions in Russia - a unique opportunity not to pay personal income tax on wages or to reimburse part of the costs for some transactions and services. For example, you can get a refund for children. But until when? And in what sizes?

How child support is calculated. Formula and example for calculating child support for one and two children

Helping loved ones who cannot take care of themselves on their own is reflected in the legislation of the Russian Federation. The state created alimony as a protection mechanism for low-income relatives. They can be paid both for the maintenance of children and other close relatives who cannot take care of themselves. Read more about how child support is calculated

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?