2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Tax deduction through employer. What it is? How and when can they be used? What needs to be prepared to bring the idea to life? Answers to all of these questions and more will definitely help you deal with tax-type deductions. It's not as hard as it looks.

Description

Tax deduction is the process of getting money back for some civil expenses. Usually this operation is carried out after the acquisition of large property, payment for medical treatment or educational services. The money will be returned to the person on account of the transferred income tax.

Today, you can get a tax deduction through the employer or on your own in the Federal Tax Service. Let's take a look at the first layout. He raises the most questions.

Types of deductions

What kind of returns are required and what can they be issued for? There are a lot of options for the development of events.

Today you can make a refund for:

- mortgage;

- buying property without a loan;

- paymenteducational services (self, sibling or children);

- medical care.

These are the most common spreads. The first two deductions are called property, the second two - social. It is extremely important to know about this. Otherwise, you may face the impossibility of refunding money against taxes.

Refund limits

Receiving a tax deduction through the employer, as well as independently resolving the issue, has certain limitations. The legislation regulates the deduction limit, that is, the amount is determined, exceeding which it is no longer possible to receive a benefit.

Firstly, in general, thirteen percent of the amount of expenses is reimbursed for a transaction or service, but no more than the current restrictions. You cannot demand more money than a citizen transferred to the state treasury in a given tax period.

Secondly, there are deduction limits. They look like this:

- property return - 260,000 rubles;

- mortgage - 390,000 rubles;

- social deductions - 120,000 rubles;

- for all social returns per year - 15600 rubles;

- for the education of brothers, children or sisters - 50,000 per person in general.

Expensive treatment circumvents these limitations. It is reimbursed in the amount of 13% of the expenses incurred by the citizen.

Basic conditions

Tax deduction through the employer is not so difficult to issue. Moreover, the citizen will be freed from the paperwork that bringspeople have a lot of trouble. But we'll talk about that later.

First, let's find out under what conditions a potential recipient of funds can apply for a deduction. The following are the government requirements:

- Citizenship of the Russian Federation;

- the person has an official place of employment;

- the potential recipient of the refund concluded one of the previously indicated transactions in his name and from his own funds;

- a person transfers personal income tax in the amount of thirteen percent.

Accordingly, if a person works unofficially or pays more/less than the specified percentage in taxes on income, his right to deduction is abolished.

Important: if the previously specified limits have been exhausted, a refund cannot be requested. It will simply be denied.

Features of the deduction through the boss

The return of the tax deduction through the employer is a process that will ultimately differ from a similar operation carried out directly with the Federal Tax Service. What exactly?

A person will have to collect fewer documents and will also need to fill out a special application form. You can ask for it both at the tax office and from your boss.

In addition, the tax deduction for treatment through the employer (or for any other operation) will be expressed as the exemption of the subordinate from paying personal income tax. The deduction will allow you to receive the entire amount of the salary without income tax. How long? As much as it takes to exhaust the due return. The usual tax deduction in this case is expressedone-time payment in the prescribed amount. The citizen's salary will not be affected.

Instructions for receiving

How to return a tax deduction through an employer? With proper and timely preparation, there will be no problems.

In general, the instruction for the implementation of the task is as follows:

- Prepare a package of documents. It will change depending on the situation. We will get acquainted with possible variations of the documentation for this or that case later.

- Submit an application for a refund of expenses incurred.

- Submit the application to the employer.

- Waiting for a response from the authorities and the Federal Tax Service.

If a citizen is properly prepared for the operation, he will definitely get his money back. After a positive response to the petition, it remains simply to receive a salary in full, without paying income tax.

Important: due to this method of reimbursement, not all citizens are interested in deductions through the employer.

Property return - documents

You can request a property tax deduction through your employer quickly and without much difficulty. The main thing is to collect a certain package of documents. He, as already mentioned, will change depending on the situation.

How to return a tax deduction through an employer? To return a property type, you will have to prepare:

- identity card;

- contract of sale;

- USRN statement;

- application for return;

- acceptance certificatereal estate;

- marriage certificate (if any);

- receipt for the transfer of money for the transaction.

When applying for a tax deduction through an employer, a citizen does not have to prepare an income statement and tax returns. The boss will do it.

Repayment for the mortgage and interest on it

How to apply for a tax deduction through the employer? The answer directly depends on what type of return the slave wants to receive. What will it take to deduct mortgage and interest?

Under such circumstances, you need to prepare and bring to your boss:

- identity document;

- certificates of ownership of the property;

- mortgage agreement;

- act of acceptance and transfer of property;

- loan interest payment schedule;

- statements confirming the transfer of money for a mortgage.

It is also recommended to bring with you:

- marriage or termination certificates;

- children's birth certificates.

The last two papers can come in handy if the mortgage real estate has several owners. There is nothing difficult or incomprehensible about this.

Treatment

Getting a tax deduction through your employer is easier than you think. Only this version of the development of events is not very interested in the modern population. This is due to the peculiarities of providing payments.

When requesting a refund of income tax for treatment and medicinesthe supplicant will need the following ingredients:

- any identity document;

- contract for the provision of medical services;

- checks for payment for services rendered and purchase of medicines;

- an extract with prescriptions and a doctor's report;

- medical company license;

- work permit for a particular specialist (if it is provided for by the profile of his activity).

If you need to request a refund for the treatment of a close relative, you will additionally need to bring certificates of relationship between the patient and the payer. They can serve:

- adoption or birth certificates;

- marriage certificates.

It is advisable to bring all statements along with their copies. In this way, you will be able to cope with the task with minimal difficulties. Not all employers will accept original documents and photocopy them themselves.

Educational Services - Return Documentation

Need to get a tax deduction through your employer? Documents to achieve the desired goal will, as noted earlier, be different. In each individual situation, you will have to prepare different packages of references.

It was previously said that the boss can provide a deduction for educational services. Typically, the corresponding operation provides for the presentation of the following statements to the employer:

- student reference;

- contract for the provision of educational services (in the name of the recipient);

- statements confirming the transfer of money for educational services;

- organization license;

- speci alty accreditation;

- documents confirming kinship with the student (if necessary).

The application for a tax deduction through the employer should not be forgotten either. Without a corresponding application, a citizen will not be able to claim a refund.

Standard return - description

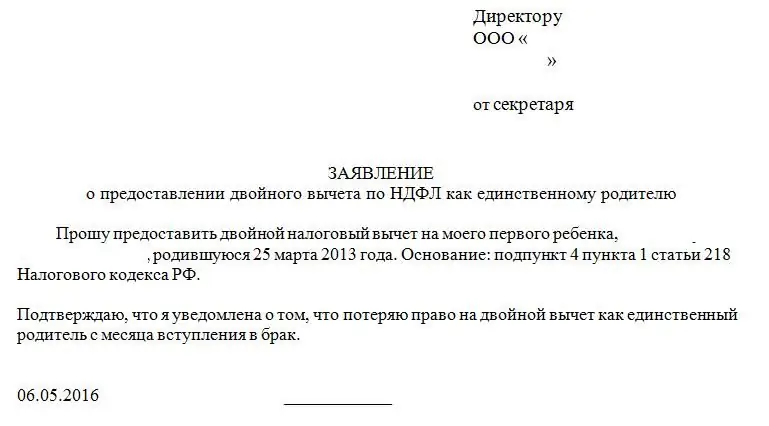

The main deductions faced by modern citizens were considered. But there is one type of return, which is allowed only for certain categories of subordinates. This is the standard child tax deduction.

Under such circumstances, the tax base when calculating personal income tax will be reduced by one or another amount. It directly depends on the number of children in the family. At the same time, only those who receive less than 350,000 rubles in the form of a salary per year can apply for a refund.

Standard deduction amount

A standard tax deduction through an employer can be requested by every officially working citizen if he has minor children. As we said, refunds are subject to certain sizes.

Namely:

- 1400 rubles - having one or two children;

- 3000 rubles - 3 or more children in a family;

- 6000 rubles - to adoptive parents or guardians of a disabled child under the following conditions;

- 12,000 rubles - for parents of disabled children under 18 or for a disabled student under 24.

The deduction is given in the indicated amounts per child. Mothers can use this right, anddads. If the parent is single and unmarried, a double refund is allowed.

References for standard returns

How to return the deduction through the employer? We got acquainted with the most common layouts. But what if you want to claim the standard deduction for children? The instructions for implementing the task will be exactly the same as in the situations described earlier. The difference lies only in the package of documents necessary to bring the idea to life.

A tax deduction through the employer is provided if a citizen brings to the authorities:

- application of the established form;

- identity document;

- SNILS;

- birth or adoption certificates for children;

- certificates of marriage.

May come in handy in some cases:

- certificates of the death of a spouse;

- documents depriving the second parent of the relevant authority;

- notarized refusal of the spouse from the deduction.

In reality, everything is simpler than it seems at first. Every conscientious employee can request a tax deduction through the employer. The standard refund will end when children reach 18.

Record of applications

Next, consider the features of obtaining social and property type deductions. These returns have a statute of limitations. After a certain period of time, for certain transactions, the money will not be returned.

The limitation period for applying for tax deductions in Russia is 3 years. During thisperiod, a person can apply to the Federal Tax Service or to the employer for income tax reimbursement. Moreover, reimbursement of money immediately for 36 months is allowed. This is very convenient, especially when applying for a student/mortgage deduction other than through your boss.

Change of job and part-time jobs

We figured out how to claim a tax deduction through your employer. But what if a citizen changes his place of employment? Under such circumstances, you can demand money from the new boss from the next calendar year. The service is not available in two places at the same time.

If a person works part-time, it is allowed to receive returns in several places at once. At the same time, in petitions for a deduction, it will be necessary to indicate the procedure for the distribution of funds. Because of this, many are simply satisfied with the return from one employer.

Recommended:

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Property tax deduction for an apartment. Mortgage apartment: tax deduction

When buying an apartment, a tax deduction is required. It consists of several parts, but is invariably present and amounts to a significant amount. To work correctly with this aspect, you need to study its features

Deduction of taxes when buying a car. How to get a tax deduction when buying a car

Tax deductions are quite an interesting question that interests many. Of course, because you can get back 13% of the transaction! But is there such an opportunity when buying a car? And what is required for this deduction?

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children