2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be associated with the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children. What are the specifics of the tax deductions most demanded by Russian citizens?

Views

For what can I get tax deductions in accordance with the legislation of Russia? The Tax Code of the Russian Federation provides for the following set of them: standard, paid for children, property, social, professional, as well as those that are calculated on the fact of losses associated with the circulation of securities. The first four types of deductions are the most requested.

Methods of obtaining

How are tax deductions calculated and paid? Russian legislation provides for two relevant mechanisms. Under the first, the deduction is calculated and paid once a year at the end of the tax period on the basis of payments already made to the treasury in the form of personal income tax (from wages and otherincome).

The second mechanism assumes that a citizen legally may not pay personal income tax to the state for a certain period and from certain amounts of income. Depending on the specific type of deduction, one or another scheme is implemented.

Who has the right to deduction

This type of tax preferences can be provided to citizens who receive income that is taxed at a rate of 13%. Most often it is, as we noted above, salary. But the corresponding income can also be generated, for example, after the sale of real estate and other types of property. Is it possible to get a tax deduction with a simplified system for calculating fees to the treasury? No, there are no such mechanisms. Similarly, the right to a tax deduction cannot be exercised by persons in the status of non-residents.

How deductions are processed

Where can I get a tax deduction? The corresponding preference for citizens is issued by the Federal Tax Service - in territorial divisions by regions and municipalities of Russia.

In order to receive a payment, you must contact the Federal Tax Service with a package of documents provided for each type of deduction. Let us consider the specifics of the various types of financial preferences in question in more detail.

Standard deductions

For what can I get tax deductions related to the standard category? This type of payment is made to certain categories of persons. deductions, ohin question are fixed. Depending on the basis, they can be calculated on the basis of, for example, 3 thousand rubles. or 500 rubles. linked to the month. The indicated amounts thus form the basis for calculating the deduction - at a rate of 13%. That is, a person is not paid 3 thousand rubles. and not 500 rubles, but 13% of the corresponding amount - 390 rubles. or RUB 75

The legislation of the Russian Federation provides for several categories of citizens who are en titled to receive the type of deduction in question.

Firstly, these are participants in the liquidation of the accident at the Chernobyl nuclear power plant, the consequences of other nuclear tests, as well as citizens who received disabilities while participating in hostilities. In relation to them, the legislation of the Russian Federation provides for a tax deduction based on the amount of 3 thousand rubles.

Secondly, these are the heroes of the USSR and Russia, citizens with disabilities of groups 1 and 2 and having disabilities since childhood, participants in hostilities, as well as residents of Chernobyl evacuated after the accident at a nuclear power plant. Persons in this category can receive standard deductions based on the amount of 500 rubles.

Thirdly, individuals who do not belong to the above categories of citizens can count on a tax preference based on the amount of 400 rubles. But it is guaranteed to them until their annual income reaches 40 thousand rubles.

How many tax deductions can a person get if he has several reasons for that, and if we are talking about standard preferences? Only one - the one that involves the largest payout. At the same time, standard deductions may well be combined with other types.preferences, for example, property.

Deductions for children

Strictly speaking, this type of deduction also belongs to the standard ones, but at the same time it is sufficiently isolated from it. In particular, it can be combined with any of the above. Tax deductions of the type in question can be received by parents or adoptive parents. The amount of the corresponding preference is based on the amount of 1000 rubles. per child per month.

The tax deduction in question can be paid until the child turns 18, and if he goes to full-time education, then until he reaches 24 years of age. Another limitation regarding the relevant payments is that a person's income should not exceed 280 thousand rubles. in year. If the salary or other sources of income are greater, then the deduction is not provided.

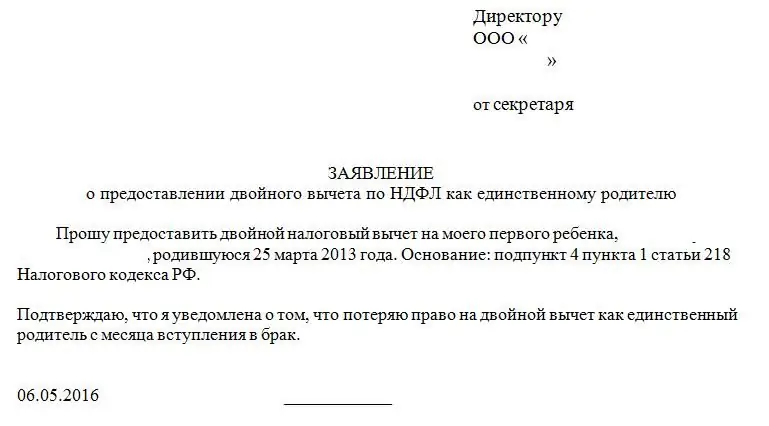

Also, the legislation of the Russian Federation provides for payments based on the amount of 2 thousand rubles. They are provided if the child has a disability or is being raised by a single parent.

The right to receive deductions for children can be legally delegated by one parent to another. This mechanism is useful if one of the parents has an unstable job. In order to exercise this right, the person refusing the deduction must draw up documents confirming the intention to transfer the right to the preference in question to another.

Nuances of a standard deduction

If a person expects a standard tax deduction, when can I get it? First of all, we note that direct assistance to a citizen in exercising the right tothe appropriate preference must be provided by the employer, who has the status of a tax agent. To calculate the deduction and ensure its payment, or more precisely, to allow legal non-payment of personal income tax in the appropriate amount, is the responsibility of the company.

However, in order to start receiving standard tax deductions, the employee must notify the employer of his desire to use the corresponding preference. This can be done through a written application in the prescribed form. Documents confirming the employee's right to receive a standard deduction must also be attached to it.

Note that there is an alternative scenario. It involves applying to the Federal Tax Service at the end of the tax year. But this scheme is usually not very popular for the type of deduction under consideration, since it requires the employee to spend a lot of time collecting the necessary documents and interacting with the department.

Property deductions

What can I get property type tax deductions for? The right to issue them arises from citizens most often upon the implementation of certain real estate transactions: purchase, sale or construction, as well as in connection with transactions with other high-value property, such as cars.

Regarding real estate, it can be noted that there are two main categories of property deductions of this type - those related to the cost of acquiring housing or those that can be issued in connection with the income received by a citizen from the sale of hispossessions. The mechanisms within which a person can enjoy this type of preferences are different. And therefore, each type of deduction, despite its classification as a general category, is usually considered within a separate scheme.

Property deductions when buying a home

The first type of property deduction is associated with the acquisition of residential real estate by citizens. It can be an apartment, a room or a house. The acquisition mechanism can be expressed in the form of a sale and purchase transaction, the construction of an object or participation in an equity project. Most importantly, the citizen bears personal expenses.

From the purchase of an apartment, a person can return up to 260 thousand rubles. from among the funds transferred to the seller of real estate or invested in repairs, that is, on the basis of an amount of up to 2 million rubles. Until 2014, the corresponding deduction could be issued only for one apartment, after - for any number of residential properties. If a citizen made a purchase of real estate through a mortgage, then he can also return up to 390 thousand rubles. from the amount of interest payments to the bank, that is, on the basis of an amount up to 3 million rubles. Note that for transactions made before 2014, the maximum amount of payments from the Federal Tax Service on interest transferred on a mortgage loan is not limited.

Methods for making a deduction when buying an apartment

Where can I get a tax deduction for buying an apartment? As in the case of standard payments, you can apply for the appropriate preference both through the employer and by contacting the Federal Tax Service. At the same time, unlike the scenario with the previous type of deduction, the second method is very popular among Russians. It's inlargely due to the fact that a person receives a significant amount in his hands, the equivalent of which is not easy to collect, using the monthly "increases" in salary in the form of legal non-payment of personal income tax.

Where you can get a tax deduction when buying an apartment, the citizen determines for himself, based on personal preferences. It can be noted that the set of documents for obtaining the corresponding preference in both scenarios is approximately the same.

What can I get tax deductions for when building a house? In this case, the base amount for calculating payments may include the costs of contractors' services, as well as the purchase of building materials. The corresponding costs must be confirmed by receipts, checks and other documents, the legal force of which is recognized by the inspectors of the Federal Tax Service.

How many tax deductions can you get when buying apartments? As soon as a citizen exhausts the maximum amount of payments - 260 thousand for housing costs and 390 thousand for interest (if the mortgage is issued), after that he loses the right to apply to the Federal Tax Service for the appropriate preference, no matter how many real estate objects he subsequently acquires.

Property deductions for home sales

What can I get tax deductions for when selling an apartment? The mechanism for their design is as follows. The fact is that income from the sale of housing, like wages, is taxed at a rate of 13%. An appropriate fee must be calculated if a person has owned the property for less than 3 years. But the legislator guaranteed the participants in real estate purchase and sale transactions a deduction in the amount of 1 million rubles. This amount canreduce the cost of housing, appearing in the contract between the seller and the buyer of the apartment. That is, if the price of housing under the contract is 1 million 200 thousand rubles, then the basis for calculating personal income tax when using the marked type of deduction will be 200 thousand rubles.

It can be noted that both types of property deduction - provided that the transactions are made in the same tax period - it is permissible to mutually compensate. For example, if a person bought an apartment for 2 million rubles, then the state must return 260 thousand rubles to him. If in the same year he sold another property for 1.5 million rubles, then his debt to the Federal Tax Service in the amount of 13% of 500 thousand rubles. (remaining when using the second type of deduction), namely 75 thousand rubles, he can cancel by reducing the obligations of the state. That is, in the end, the Federal Tax Service will have to pay the citizen 185 thousand rubles after two transactions made by him.

Other deductions for the sale of property

The legislation of the Russian Federation allows citizens to receive not only those property deductions that are associated with the sale of housing. There is also a more universal preference in the amount of 250 thousand rubles. It can be applied to any type of property, such as a car. The main criterion for calculating income tax here is similar to the operation with the sale of an apartment - the corresponding fee must be paid if the object has been owned for less than 3 years. Note that a citizen can try to prove to the Federal Tax Service that he once had expenses associated with the acquisition of property, as an option - a caror other valuable property. If this can be done, then they are also used as a kind of deduction. In this case, the legally guaranteed preference may not be included in the calculation at all or may be used partially.

Now you know where you can get a tax deduction for an apartment. We have studied the mechanisms within which it can be implemented, as well as other types of property preferences. Let's move on to the following types of payments - social.

Specificity of social deductions

What tax deductions can be obtained from among those related to social? The legislation of the Russian Federation forms their varieties, calculated on the basis of the following types of expenses:

- for charity;

- for education - both the taxpayer himself and his children;

- for treatment - the citizen himself, as well as members of his family;

- to participate in programs of non-state pension funds.

The principle of calculating the deduction is the same as for the types of payments discussed above: the Federal Tax Service must return 13% of the corresponding base.

Regarding charitable expenses, the deduction can be calculated on the basis of their entire amount, but not exceeding 25% of the citizen's income for the tax period.

As for the cost of education, they can be calculated on the basis of an amount of up to 120 thousand rubles. per year for participation in educational programs of the taxpayer and up to 50 thousand rubles. per year for the education of each child. Where canget a tuition tax credit? The most convenient mechanism is to contact the Federal Tax Service at the end of the tax year.

Regarding the cost of treatment, it should be said that they are calculated on the basis of the amount, the maximum value of which is equivalent to the indicator for paying for education - 120 thousand rubles. Where can I get a tax deduction for medical treatment? It is best to contact the Federal Tax Service in the year following the reporting year.

Occupational deductions

Professional tax deductions can be received by the following categories of fee payers:

- entrepreneurs under the general tax regime;

- citizens performing work and services under contract contracts;

- notaries, lawyers and other professionals in private practice.

It can be noted that the structure of occupational deductions is quite complex. The basic principle of realizing the rights of citizens to these preferences is their ability to submit to the Federal Tax Service documents confirming the costs associated with a particular activity.

If they succeed, the corresponding amounts can be used as a deduction - they reduce income. But even if a person does not submit such documents to the Federal Tax Service, the department can approve unconfirmed expenses for him. Their value depends on the professional specialization of a person and is approximately 30-40% of income.

Recommended:

What is a property deduction, who is en titled to it and how to calculate it? Article 220 of the Tax Code of the Russian Federation. property tax deductions

Russia is a state in which citizens have a lot of rights and opportunities. For example, almost every citizen of the Russian Federation has the right to receive a property deduction. What it is? Under what conditions can it be issued? Where to go for help?

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Until what age are child tax deductions? Article 218 of the Tax Code of the Russian Federation. Standard tax deductions

Tax deductions in Russia - a unique opportunity not to pay personal income tax on wages or to reimburse part of the costs for some transactions and services. For example, you can get a refund for children. But until when? And in what sizes?

Maximum amount of tax deduction. Types of tax deductions and how to get them

Tax deduction is a special government bonus. It is offered to some citizens of the Russian Federation and may be different. The article will talk about how to issue a tax deduction, as well as what is its maximum amount. What should everyone know about the respective operation? What difficulties can you face?

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent