2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Many companies were in unpleasant situations associated with the sudden withdrawal of funds from circulation. Getting out of them is extremely difficult and may be accompanied by large losses.

Relevance of the issue

Often the director decides to withdraw amounts from the account to finance a project, assuming its payback and the possibility of repaying obligations due to this to suppliers. Meanwhile, as practice shows, the scenario in such situations is standard. After some time, it turns out that there is not enough money to pay for the delivered material and raw materials. Accordingly, it is necessary to urgently look for additional sources, ask debtors to pay off their debts ahead of schedule, negotiate with banks, and so on. Similar cases took place in large corporations, thoughtlessly changing the terms of settlement with suppliers and providing buyers with payment deferrals. For this, new contracts were concluded with contractors. Their essence was to refuse the use of delays in exchange for a decrease in the purchase price of the goods. Together with thatbuyers purchased products at an increased selling price. However, they were given at the same time twice as much as before, a delay. A few months later, companies began to face an acute shortage of working capital. Accordingly, they had to urgently borrow money from banks. The company will not have problems with a lack of current assets if the management begins to strictly control the proportions between equity and debt capital, through which operations are financed. To do this, it is necessary to develop an effective management model. It involves planning the duration of the operating and financial cycles. In addition, you will need to determine the current liquidity.

Operating cycle of an enterprise

It includes several processes. During it, in particular, the purchase of materials and raw materials, the creation of products, their sale, as well as the repayment of debts (if any). In other words, during the operating cycle, a full turnover of assets takes place.

Key elements

The following components stand out within the operating cycle:

- Full turnover of MPZ. It is also called the production cycle. It shows the average number of days it takes to convert raw materials and materials into finished products. Accordingly, it starts from the moment stocks arrive at the warehouse and ends when finished products are shipped to the consumer.

- Receivables turnover. He isthe average amount of time it takes for buyers who purchase products on credit to pay off their obligations.

- Turnover of accounts payable. It represents the period of time during which the company pays off its obligations to other organizations.

Operating and financial cycle

If there is a reduction in the dynamics, then this is considered a positive trend. The financial cycle is the gap between the date of payment for obligations to counterparties and the receipt of funds from debtors (buyers). During this period, own funds make a full turnover. The reduction in the operating cycle may be due to the acceleration of other operations. For example, the duration of storage of inventories, the manufacture of products, and their maintenance in a warehouse are reduced. The duration of the operating cycle may also change under the influence of the acceleration of receivables turnover.

Refinery turnover

Efficiency of management depends on the ratio of the duration of the financial and production cycle. The latter includes turnover periods:

- Commodity stocks.

- Work in progress.

- Inventory of finished goods.

Production and operation cycle

These equations are used to determine them. The following equation is used to calculate the duration of the production cycle:

- PC=POgp + POzp + POpz, where:

- POpz - quantitydays spent on the turnover of stocks of semi-finished products, materials, raw materials;

- POZP - the number of days of turnover of work in progress;

- POgp - the duration of the turnover of stocks of finished goods (products) in days.

The operation cycle is calculated using the parameter found above. In addition, the calculation uses a value that characterizes the average turnover period of debtors' debts. Their sum will show how long the operating cycle lasts. The formula looks like this:

- OC=POdz + MC.

Relationship of indicators

When analyzing the structure of a company's current assets, the importance of time characteristics for effective capital management becomes clear. Of particular importance is the distribution of the firm's need for current assets in specific periods. For calculations, a methodology based on the duration of the financial and operational cycle and the estimated costs of current activities is used. The first indicator includes the time for the delivery, manufacture and assembly of products, their implementation, waiting for the repayment of buyers' debts. The financial cycle - the duration of cash circulation - is the period during which funds do not participate in circulation. Its duration can be determined as follows. From the indicator characterizing the operating cycle, the time of circulation of debt to creditors is subtracted. Working capital management is carried out to reduce the period in whichfunds are not used. With a decrease in the duration of the financial cycle, accordingly, the time for using your working capital becomes shorter.

Features of receivables

Obligations of counterparties act as an integral element of the work of any company. A large share of receivables in the total system of assets significantly reduces the liquidity and solvency of the company, while increasing the risk of losses. The operating cycle of a modern company involves the dynamism of transactions. In today's conditions, much attention must be paid to the debt of debtors. It is often defined as a component of working capital. This element represents specific requirements for organizations and citizens regarding payment for services, products or work. There is also a trend in which receivables are identified with commercial credit. As a rule, the economic benefit from such obligations is expressed in the fact that the company, making an operating cycle, expects to receive cash or equivalents. In this case, receivables may be recognized as an asset if it is probable that they will be repaid. If it is absent, the amount of obligations is subject to write-off.

Resilience management

To create an effective model, you need information from the budget of expenses and income, some predicted indicators of balance sheet items. Monthly payment is a mandatory requirement.breakdown. The more often the process of budget execution and, consequently, the solvency of the company is monitored, the better. When developing the model, you will also need turnover values, indicators of the duration of the operating and financial cycles. Of particular importance will be such values as:

- The need for short-term loans to replenish working capital.

- The planned value of the liquidity ratio at the current moment.

The first indicator is defined as the difference between the total need for working capital and own funds. The calculation of the planned value Ktl can be carried out as follows:

- Ktl=PPV x average daily spending/short-term liabilities.

This model allows you to understand how OC and FC affect the ratio.

Conclusion

Each manager must clearly understand what constitutes an operating cycle and a period of turnover of funds. Thanks to this, he can obtain all the necessary information to determine the need for his own assets. In addition, you need to understand the very essence of the business, understand how the processes are built within the company, how optimal they are, and whether there are reserves for optimization. In the course of performing calculations, it is also necessary to take into account that the size of their current assets is constantly changing throughout the year. In this regard, every month, when comparing actual and planned indicators, it is necessary to constantly monitor the adjustmentmodel parameters. So that not only the financial director has an understanding of the significance and importance of the terms of the cycles, it is advisable to determine the responsibility of the heads of departments for each element. This can be done by linking the existing system of bonuses and bonuses in the organization with the required indicators.

Recommended:

Diamond boring machine: types, device, operating principle and operating conditions

The combination of a complex cutting direction configuration and solid-state working equipment allows diamond boring equipment to perform extremely delicate and critical metalworking operations. Such units are trusted with the operations of creating shaped surfaces, hole correction, dressing of ends, etc. At the same time, the diamond boring machine is universal in terms of application possibilities in various fields. It is used not only in specialized industries, but also in private workshops

Dry period in cows: feeding, features, duration and standards

Feeding cows during the dry period is an important part of animal care. However, many novice farmers neglect this rule and continue to feed the cow in the same way as during lactation. As a result, the animal gets various diseases and does not bring productivity. In our article, we will talk not only about the rules for compiling a diet, but also about other features of the dry period, which any self-respecting farmer should know about

Formula for calculating vacation days. Duration of annual basic paid leave

Vacation is a long-awaited period. However, despite the fact that the number of days is established by law, there are always some nuances

How long does a bee live, and what determines the duration of its life

In response to the question of how long a bee lives, you can hear another question: what kind of bee? Although they are similar, bee to bee is different. Worker bee, drone and queen - each insect has its own age

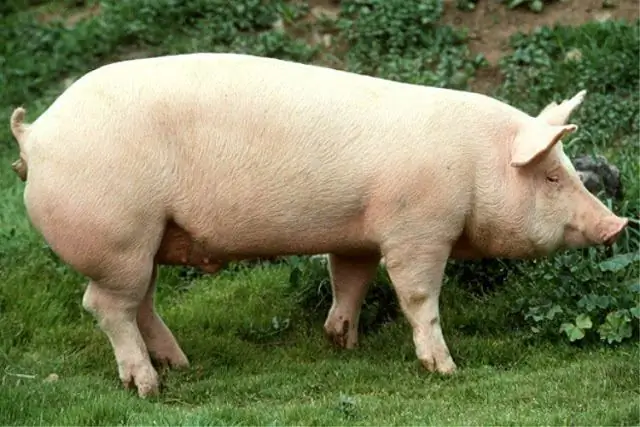

How many years does a pig live in a household: average duration

How long does a pig live at home? The answer to this question depends primarily on the conditions of the pig. Wild boars in nature usually do not live more than 10 years. Domestic pigs, in principle, can reach the age of 20, and sometimes 30-45 years