2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

Control of the presence of assets in the enterprise is carried out during the inventory. Goods, cash, stocks and other fixed assets can be the objects of verification. The inventory sheet reflects the results of the audit. The enterprises use the unified form INV-26. Consider next a sample of filling out an inventory sheet.

Revision overview

To confirm the presence of assets listed in the enterprise according to the documents, to check the condition of the property, an inventory is being carried out. It also assesses the quality of storage of objects. Timely inventory allows you to prevent damage to material assets. In practice, cases of abuse of authority by financially responsible persons, theft of objects are not uncommon. Individual assets are subject to natural deterioration or shrinkage.

These factors affect the actual amount of fixed assets. Inventory list generatedbased on the results of the audit, allows you to identify discrepancies between the information in the accounting documentation and the actual state of the assets.

Information content

In enterprises, as a rule, several unified forms are used to reflect the results of the audit. This can be a collation sheet, an inventory list, an act, etc.

General information about the shortcomings and surpluses of assets identified during the audit is entered into the INV-26 form. When conducting audits, filling out the inventory sheet is the responsibility of the responsible persons. This requirement is confirmed in the Methodological Guidelines of the Ministry of Finance, approved by the order of the department No. 49 of 1995

Meanwhile, the inventory list, the form of which was developed by the State Statistics Committee, is not a mandatory form. The enterprise can independently create a document, taking into account the specifics of the activity. However, in any case, the form of the inventory sheet must contain the mandatory details established by GOST.

Document structure

Regardless of which form of the inventory sheet is used at the enterprise (developed by the organization independently or approved by the State Statistics Committee), it must contain:

- Accounts.

- Information about the discrepancies identified during the audit. They are indicated in monetary terms.

- Information on the cost of damaged materials and goods.

- Information about sorting, write-off, detected losses due to faultfinancially responsible employees. This data is indicated in rubles.

Design nuances

The inventory list should contain information about the enterprise itself, which is being audited. If the check is performed in a separate subdivision (workshop, department), its name is also indicated.

The statement should contain information not only separately for each account, but also general data on the amounts of identified surpluses or shortages. According to the final result, information in the financial statements is adjusted.

The information reflected in the statement must be confirmed by the signatures of responsible employees, the head, members of the audit commission.

Meaning of document

The actual state of assets in the enterprise should, in fact, confirm the information in accounting documents. For this, in fact, an inventory list is formed.

The form reflects information about all audits performed during the year. Based on this information, the causes of deviations are identified, the perpetrators are identified, and measures are taken to prevent similar situations in the future.

Comparison statements

If during the inventory discrepancies are revealed between the information reflected in the accounting documents and the actual state of the objects, a document is drawn up in the form of INV-18 or INV-19. The first statement is used for intangible assets and fixed assets, the second - for inventoryvaluables.

Collation sheets are issued in 2 copies. One must remain in the accounting department, the second is transferred to the materially responsible employee.

Separately draw up collation statements for property that does not belong to the enterprise, but is taken into account in accounting documents. It includes, in particular, leased or deposited objects.

Reflection of surpluses and shortages

The rules for processing the results of the audit are regulated in the 5th section of the Order of the Ministry of Finance No. 49 of 1995. In accordance with the established procedure, the surplus identified during the inventory process is accounted for and included in the financial results.

If shortages are found within the wastage rate, the accountant writes them off as production costs. The norms are determined for different types of products by authorized departments and ministries. It is worth saying that many of them were installed back in Soviet times, but they continue to be used today.

For tax purposes, losses from damage or shortages within the limits of loss rates are included in expenses. The corresponding provision is enshrined in subparagraph 2 7 of paragraph 254 of Article NC.

Peculiarities of recovery

Shortages in excess of the established norms of attrition are issued to the guilty employees and must be compensated by them. Excess shortages can be included in production costs if it was not possible to identify the perpetrators or ifcollection denied.

In any case, the facts must be supported by documents. If, for example, it was refused to satisfy the claims for the recovery of the losses caused to the enterprise from the perpetrators, the evidence of this is the court decision or the decision of the investigating authority.

Setting off sorting

Regulations allow offsetting shortages and surpluses. However, certain conditions must be met for this to happen. Offsetting by sorting is allowed:

- For one period.

- For shortages / surpluses from one financially responsible person.

- One type of inventory items.

- In equal numbers.

In closing

Inventory sheet is considered one of the most important documents in the enterprise. It is necessary to ensure continuous monitoring of the state of inventory items.

Recommended:

Certificate of advanced training: sample, form and filling rules

In the process of professional activity, it is necessary to periodically improve the level of training. Time passes - technologies, standards and requirements for the work of specialists are constantly changing. A certificate of professional development is a guarantee of high professionalism of an employee. Here you can find a sample and form of a certificate of advanced training, as well as familiarize yourself with the rules for filling it out

How to return insurance at Sberbank: types, procedures and a sample of filling out the form

In our time, credit institutions are actively trying to increase their profits in a variety of ways. One of them is the purchase by the client of the policy when applying for any banking service. In this regard, you need to know how to return Sberbank insurance in case of early repayment of the loan. In order to have a complete understanding of this program, you need to know what it is

Sample of filling in the timing of working hours. Observation time sheet

Filling out the timekeeping form correctly, as well as fixing working hours, is a difficult process that requires special attention. The main thing is to take into account all the time spent, as well as correctly describe all the working stages and periods

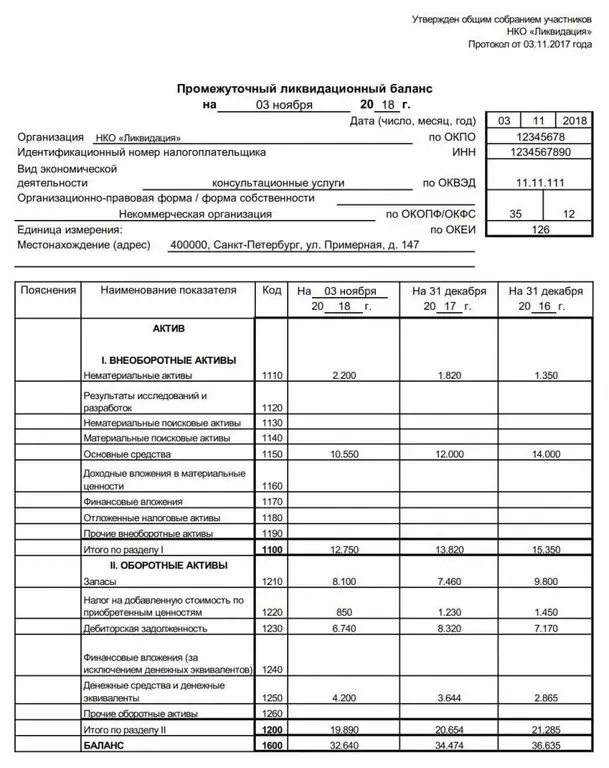

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

Act of inventory of emission sources. Order on the inventory and the composition of the inventory commission

Inventory of waste emissions into the atmosphere is a set of activities that are carried out by nature users, including systematization of data on pollutant emissions, identification of their location, determination of emission indicators. Read more about how this process goes and how the act of inventory of emission sources is filled out, read on