2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

In our time, credit institutions are actively trying to increase their profits in a variety of ways. One of them is the purchase by the client of the policy when applying for any banking service. In this regard, you need to know how to return Sberbank insurance in case of early repayment of the loan. In order to have a complete understanding of this program, you need to know what it is.

Basic concepts

Loan insurance is a product that reduces the risk of the bank in case of adverse situations in the life of the borrower, and also protects his life.

Thus, if the borrower loses his job or other adverse situations occur, the organization assumes full responsibility to the financial institution.

The percentage of insurance depends on the amount of money that the clientSberbank took a loan. The larger the loan amount from a financial institution, the more expensive the policy. Of course, not a single bank will work at a loss, so you should not be surprised at its "price" for a large loan.

Insured events

Many people are concerned about the question: what can you protect a loan from? Insured events in this case are:

- loss of he alth by the borrower, getting disability;

- a serious illness, as a result of which the bank client cannot continue to pay the loan;

- job loss;

- borrower's death;

- deterioration of financial situation.

In this regard, the question arises, is it possible to return insurance on a Sberbank loan if such a case has not occurred? The answer to this question can be found by reading the article to the end.

If a Sberbank client is going to take a consumer loan (including for a car), then it will be necessary to insure only liability and his life. And in the case of any other loans, for example, with a mortgage, where collateral is required, in addition to your life, you will also need to insure the mortgaged property against damage.

According to the norms of the Civil Code of the Russian Federation, the protection of consumer loans is not considered mandatory and is carried out solely at the request of the borrower. It would seem that the answer to the question of whether it is possible to return insurance on a Sberbank loan is obvious. At the same time, the protection of collateralized property is mandatory in cases where it is a mortgage or other type of lending, which requires the provision of collateral. However, in this case, insurancethe customer is no longer liable.

Goals

In the interests of any bank that develops successfully and stably, the maximum reduction in the percentage of defaults on loans. As far as Russian financial institutions are concerned, the situation is rather complicated, and therefore many of them have no choice but to impose insurance on all clients. This is a very profitable business. For this reason, many banks create their own insurance organizations, which subsequently become part of a single holding. Thus, banks make a profit both on interest on lending to their customers and on a dubious service called credit insurance.

Is it beneficial for the borrower?

If we consider the issue from the point of view of an ordinary person, then, of course, insurance is unprofitable for him. This is due to the fact that the loan amount also increases by the amount of the policy. But no one wants to just give away their money. However, if the borrower's activity is associated with risks and the likelihood of being fired or incapacitated is high, then such a client will have some benefit.

Cost and terms

The price of the policy in different banks is different, but may vary within the following limits:

- life insurance - 0.30-4% of the total cost of the loan per year + some additions to the base rate;

- from an accident - 0, 30-1% of the cost of the loan + many additions to the maintariff;

- from oncological diseases - 0.10-1.7% + additions;

- deposit insurance - over 0.70% + paid extras.

The amount depends on two main criteria: the level of interest rate for the policy and the size of the loan.

Features of insurance in Sberbank

As for this financial institution, there are some features of insurance that should be considered when concluding loan agreements.

- Purchasing a policy when applying for consumer loans is not mandatory.

- Discrepancies between reality and legal norms: in case of refusal of insurance, the bank may refuse to issue a loan to the client.

- The client has the right to return money for insurance on a Sberbank loan ahead of schedule, without waiting for its expiration, but no more than 30 days must pass. In this case, the borrower must return half the cost of the policy or recalculate the balance of the loan by day.

- In the case of a mortgage agreement, the client is obliged to protect the property, which is the collateral for lending, from damage (enshrined in regulations).

- The return of insurance on a Sberbank loan is carried out on the basis of the provisions of the Civil Code of the Russian Federation.

- The client of this financial institution has the full right to refuse the imposed service even after issuing a loan within one month from the date of signing the contract and return insurance to Sberbank as an unnecessary product without changing the terms of the contract.

Insurance organizations accredited by Sberbank

In the process of choosing a company, all customers worry about its impeccable reputation and reliability. It is important for payers to receive payments in a timely manner and without problems if an insured event occurs. There are a number of firms that are accredited by Sberbank. Whether the loan insurance will be returned if it is insured in another organization is unknown. The list of companies accredited by Sberbank today includes:

- Ingosstrakh company;

- AlfaInsurance;

- Oranta organization;

- Sogaz;

- Rosgosstrakh, etc.

Types of insurance from Sberbank

This large bank offers clients a range of programs that allow them to protect their money in a variety of situations. For example, insurance is mandatory for car loans, mortgages and other popular programs.

In addition, here you can use special premium packages "Status" or "Prestige", which allow you to use programs for tourists traveling abroad.

Below are the main and most popular programs of Sberbank.

- Life insurance is an ideal option for a family if the client wants to protect it from the hard blows of fate. The accumulative version of such a program allows you to receive a certain amount of money upon reaching the deadline specified in the contract.

- Credit insurance, as employees of this bank say, is by no means a method to shift secondary financialload. On the contrary, it is insurance that will, if necessary, protect family or personal financial assets. There are no programs in Sberbank that are prescribed for a certain type of loan: they are all quite variable and diverse. At the same time, what type of insurance to choose, what nuances to include in the policy, this is all decided on an individual basis.

- Mortgage insurance in Sberbank. Each client of this financial institution applying for a mortgage must insure the property (apartment or house) against possible loss and damage. The recipient of funds in the event of an insured event is the bank. This will allow the borrower not to repay the loan if something happens to housing. In addition, in some cases, it is necessary to insure the he alth and life of borrowers. This is required for the financial protection of the parties. When obtaining a mortgage loan, customers can purchase a policy at a bank branch or at the office of an organization that has been accredited by Sberbank. What other protection options are available?

- Apartment insurance. Sberbank will not issue a loan if the borrower does not protect the apartment being purchased from damage and loss. This is done in accordance with the requirements of the law. You can avoid acquiring a policy only when the house in which the housing is purchased has not yet been completed. In this situation, the purchase of insurance is postponed until the receipt of documents of ownership.

- Insurance card. This can be done at a fairly low cost. Such a program will protect against unauthorized withdrawal of funds in case of loss or theft of the card, ifits damage or in the case of cash within a period of not more than two hours after withdrawing them from the ATM. You can report the occurrence of an insured event at any time of the day by phone.

How to return insurance at Sberbank?

Purchasing a policy is often imposed by banks as a mandatory service. After concluding a loan agreement, borrowers are interested in the following question: is it possible to return insurance at Sberbank, where to apply and what procedure is used for such a procedure.

When entering into a loan agreement, customers do not receive a separate personal protection agreement. In essence, they join the program of voluntary he alth and life insurance. A detailed procedure for reimbursing risks and instructions on how to return insurance at Sberbank are published on the official website of this institution, they are periodically adjusted. The client is charged for connection to the system. Therefore, it is most advantageous to contact a special company that specializes in these services - Sberbank Life Insurance LLC.

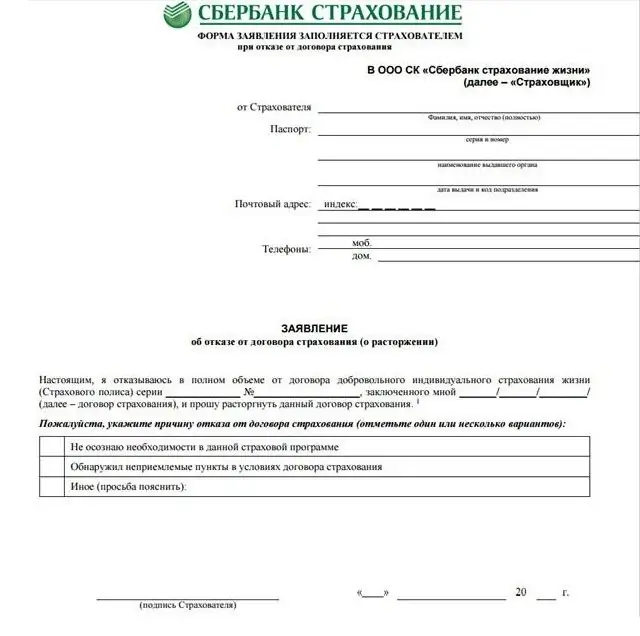

Before returning money for insurance at Sberbank, the client must write an application. It is provided by a bank branch employee. As a rule, the borrower is provided with a template to fill out, but it is also possible to complete an application in any form. Below is a sample that you can refer to if necessary.

You should pay attention to the fact that the application contains all the necessary details:

- To whom - the name of the insurance organization, location address, name of the head, TIN, PSRN.

- From - borrower's surname, initials.

- The number of the loan agreement and the individual insurance policy.

- Applicant's signature, date of issue.

The application is made in two copies - one is given to the applicant with a mark of acceptance by the insurance company, the second remains with the insured and is kept until the stage of resolving the case.

You can refuse to issue a policy only in the case of an individual agreement, but under collective programs, a refund is not made.

Rejection Policy

You can apply for compensation for the cost of insurance services on the basis of termination of the agreement at any time during the validity of the contractual relationship. It is not necessary to do this immediately after the loan is granted or during the period of its payment.

If the policy is canceled within a month after the loan is issued, the full amount is refundable. If the notification is submitted after the end of the specified period, it is possible to return no more than half of the amount paid before the end of the entire crediting period.

In case of early repayment of the Sberbank loan, it is real to return the insurance. It should be noted that the protection period in this case is calculated as a multiple of the time of using credit money. When making early payments, the amount is proportionally reduced.

Documents required for return

Request for refusal must be submitted to the organization. In order to return insurance on a loan at Sberbank afterrepayment, you must provide the following list of documents:

- request in the appropriate form indicating the number of the policy and loan agreement, the name of the borrower;

- duplicate policy;

- copy of loan agreement and payment schedule;

- insured's passport and its copy;

- statement of no debts to the bank in case of early repayment of the loan.

The process of receiving these important documents, as well as their consideration, is done formally. Insurers are not en titled to demand other papers from the borrower and an explanation of the reasons for terminating the contract. Due to the refusal, the banking organization does not have the right to present a notice of loan repayment ahead of schedule.

Bank responsibility

Under the law, it is forbidden to impose on the client the protection of life, he alth, property. For coercion to acquire it when lending, a financial institution may be subject to sanctions regulated by Art. 938 of the Civil Code of the Russian Federation. If an unsatisfactory decision is made on the issue of reimbursement of the cost of the policy, you should appeal against the actions of the bank in the prosecutor's office, Rospotrebnadzor and the court. From the next paragraph, we will find out whether it is possible to return insurance at Sberbank when repaying a loan ahead of schedule.

Return on early repayment of a loan

Such an event requires separate consideration. It should be noted that in case of early repayment of a loan, it is possible to return insurance at Sberbank much easier than in other cases. What to do in this situation:

- Designapplications addressed to the insurance company for a refund (two copies).

- Attach required documents.

- Personal submission to the office of the insurance company or sending an application by mail with acknowledgment of receipt.

When submitting an application, you must personally make sure that the employee of the company has put a mark on the acceptance of documents. Then it remains only to wait for the receipt of funds to the current account.

Judicial Dispute Resolution Procedure

Each client should know their legal rights and understand how to return insurance on a loan at Sberbank, including through the courts. In order to restore violated interests and rights, for example, if the protection of life and property was imposed, it is imperative to comply with the pre-trial dispute settlement regime. That is, if you refuse to return the insurance to Sberbank (both in full and in part), you should initially file a claim. The document can be taken personally to the office of the insurer, through a representative operating on the basis of a power of attorney, or by mail.

If it is not possible to return the insurance within the established time frame after receiving a loan from Sberbank, or the institution leaves the claim without consideration at all, the borrower has the right to go to court.

Recommended:

Filling out a 3-personal income tax return: instructions, procedure, sample

Filling out a 3-personal income tax return: what does a taxpayer need to know in order to avoid mistakes? Nuances and features of reporting in the form 3-NDFL

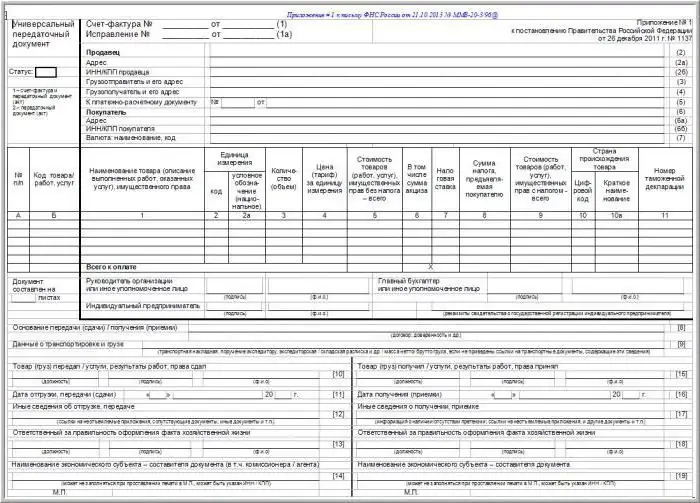

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Filling out a sick leave: the procedure for filling out, norms and requirements, an example

To receive a payment from the employer, it is necessary that the sick leave is filled out correctly. How to do this and how to work with sick leave in general is described later in the article. An example of filling out a sick leave will also be given below

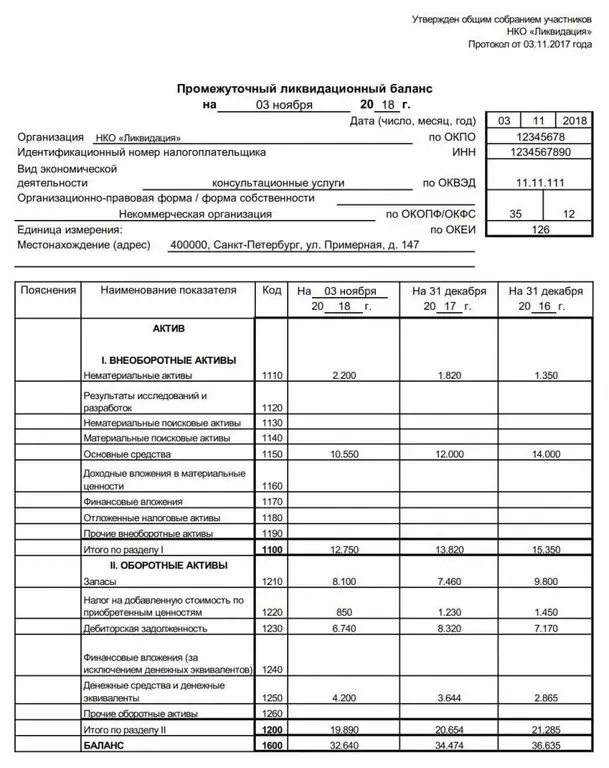

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service