2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

The world reserve currency, which today is the US dollar, is designed to solve the problems of financing international trade, as well as the storage and accumulation of their financial reserves by countries. For more than 65 years, the US dollar has done an excellent job of this function, but it seems that its time is coming to an end, and the mono-currency system will soon cease to exist, giving way to a dual-currency or other world standard.

To substantiate this statement, let's consider in detail what a reserve currency is. This is such a monetary unit that does not have any restrictions associated with its circulation, and which is most actively used in investment and commodity exchange operations, playing the role of a generally recognized reserve.

In order for the currency of any country to receive the status of a reserve, the following necessary conditions must be met:

- This country should lead in world production, export of capital and goods, storage of gold reserves.

- The credit market should be sufficiently capacious and have a high level oforganizations

- A country should have a wide, well-developed network of credit and banking institutions both at home and abroad.

In addition, the reserve currency must be convertible, stable exchange rate and favorable legal regime for use in international transactions.

The global financial crisis has clearly demonstrated that it is difficult for the dollar alone to cope with the functions that a reserve currency should perform. In the United States itself, the macroeconomic situation is far from ideal, in particular, this concerns the threat of a fiscal cliff, a constantly growing national debt (according to forecasts in 2014 it will amount to $18,532 billion), and a tense situation in the employment sector.

All this suggests that in the near future a new currency order will come, in which the concept of "main reserve currency" will disappear, and will most likely be replaced by a basket of several reserve currencies.

In this regard, there are more and more various assumptions regarding the future prospects of the Russian ruble, which may well turn into a regional reserve currency.

In principle, it is quite real, such chances do exist. However, for this it is necessary that a full-fledged market for government bonds be formed in Russia. While it is absent, it makes no sense to talk about any status, since this condition is key for the ruble to become onefrom reserve currencies.

The second condition is low inflation and stability. In the future, these goals can be achieved by 2014-2018. The current reality is that Russians are reluctant to keep their savings in investment institutions or banks. At the same time, euros or dollars are mainly chosen for storage. It is unlikely that the situation will change dramatically in the near future.

It is necessary that the government promote in every possible way the development of exchange trading, the free conversion of the ruble and the sale of Russian bonds on international markets. The protection of property rights in Russia, the development of the stock and financial markets, corporate legislation and a stable banking system - this is what can significantly help the ruble become a new reserve currency. If the government also makes every effort to improve the investment climate, then there will be a lot of investors interested in using the Russian ruble as a reserve reserve currency.

Recommended:

How to create a reserve for vacation pay. Formation of a reserve for vacation pay

In art. 324.1, clause 1 of the Tax Code contains a provision requiring taxpayers who plan to calculate the reserve for vacation pay to reflect in the documentation the method of calculation they have adopted, as well as the maximum amount and monthly percentage of income under this article

How historically the lira changes against the dollar

The lira against the dollar is prone to extremely strong fluctuations. The article describes the causes and possible consequences for the economy of such exchange rate jumps

World reserve currencies are How many reserve currencies are there in the world?

Modern business society under the concept of world reserve currency understands the monetary unit that is required by banks of other states to create a certain currency reserve. First of all, it is used as a tool for trade between different countries. It is also used as an international asset, establishing a strong relationship between the two leading currencies

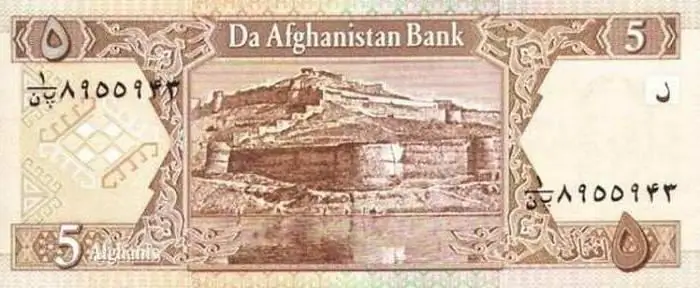

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article