2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Development of small and medium business in Russia has significant reserves. Judge for yourself: the share of SMEs in the country's GDP is about 21%, the employment market is covered by 23.4%. World practice assumes this indicator is 2-2.5 times higher. The advanced experience in the development of small and medium-sized businesses has been accumulated in the USA, France, and Great Britain. It is believed that a developed SME gives the country's economy stability, as it easily adapts to various macroeconomic changes.

Stages in the development of Russian tax legislation for SMEs

A significant incentive in the development of SMEs is the taxation system. Its reform in Russia began in the 90s (the Soviet system simply did not imagine such a business). This constructive process was started in 1996 by the Federal Law "On the Simplified Taxation System". USN "Income minusexpenses” and, as an alternative, the simplified tax system “Income” were proposed as options for easing the tax burden for start-up entrepreneurs. They were followed in 1998 by the "Law on a single tax on imputed income …", relating to certain types of activities. Further improvement in state regulation of the business sector was manifested in 2013 with the adoption of the law “On Patent Taxation.”

Benefits from a simplified taxation system

Through the introduction of a single tax, entrepreneurs were offered a truly simplified tax accounting, allowing even people who do not have a special accounting education to fill out an accounting register - a journal of financial receipts and expenses. In this journal, records are kept in accordance with the methodology of the simplified tax system. "Income minus expenses" - this ratio is determined directly from the journal. Once a year, a tax return is submitted, as well as a report on the average personnel. This system for SMEs is the opposite of classical taxation, suggesting for a legal entity an alternative to value added tax, profit, property, and for individual entrepreneurs - to the tax on income of individuals and on property of individuals.

It is estimated that direct-to-consumer businesses benefit by 10% more due to the above tax optimization, which contributes to profit growth by at least 30%.

Preferential treatment for suspended business

The transition to a simplified taxation system minimizesformal costs for entrepreneurship for a period when business was practically not conducted. If during this period there was no movement of funds in bank accounts, at the cash desk, then the entrepreneur, in accordance with the Order of the Ministry of Finance No. 62n dated July 10, 2007, submits to the tax authority a simplified declaration “with zeros” until January 20 of the next year, which is useless does not oblige him.

Legislation on the use of "simplification"

Chapter 26.2 of the Russian Tax Code clearly limits the right to use the simplified tax system to the size of the business. “Income minus expenses” or purely “Income” as a tax base can be used by an entrepreneur (legal entity) in the context of a simplified system if the business meets certain criteria.

"Simplification" is recommended if the company's assets are not more than 100,000,000 rubles, the staff is limited to a hundred employees, and the revenue for the year does not exceed 60,000,000 rubles. At the same time, the participation of other legal entities in the authorized capital of the enterprise should not go beyond 25%.

Simplified system options

A taxpayer who meets the above criteria is given a free choice of the type of simplified tax system: income minus expenses or the total income from all types of commercial activities will be independently chosen by him as a tax base. In the first case, the tax rate will be 15%, in the second 6%. The second option is used less frequently, it is beneficial for entrepreneurial activities with minimal costs.

It should be noted that at a rate of 15%, the entrepreneurmust keep and take into account the documents confirming the fact of expenses. They are the basis for reducing the payment of tax. The simplified tax rate “Income minus expenses” is generally considered by entrepreneurs to be more practical and closer to their active business activities. Therefore, this option is more often chosen by the simplified tax system.

If we talk about the practice of paying a single tax, it is paid into the budget as an advance payment, which is determined based on the turnover for the previous period. In addition to the amount of tax, the entrepreneur also makes mandatory payments to off-budget funds.

In the business environment, it is generally accepted that with the help of a simplified taxation system, it is easier for them to start a business, especially if the STS tax "Income minus expenses" is chosen, that is, with a minimum tax base.

Tax return

The methodology for filling out a declaration under the simplified taxation system for legal entities and individual entrepreneurs is presented in chapter 26.2 of the current Tax Code. An entrepreneur or an accountant (director) of a legal entity fills it out and pays a single tax to the budget within a certain time frame. The declaration of the simplified tax system for the past year is provided:

- organizations - until March 31;

- entrepreneurs - until April 30.

Income of the simplified tax system

Russian Tax Code in terms of art. 26.2 defines three groups of income accounted for by legal entities and individual entrepreneurs under the simplified tax system:

- from the implementation of works(service);

- from the sale of property rights and property (defined by Article 249 of the Tax Code);

- non-operating income (according to Article 250 of the Tax Code).

At the same time, income does not include the receipts of funds listed in Art. 251 NK.

If an organization or entrepreneur, working under the simplified tax system, receives dividends from another organization, and the transferring company pays, withholds and transfers corporate income tax, respectively, Art. 214, 275 of the Tax Code of the Russian Federation, then in this case dividends are not taken into account in the income of the recipient organization. Income also includes both property received as a gift and property received under an exchange agreement, as the simplified taxation system implies. The income of an enterprise operating under a simplified system also includes several potentially legally contentious issues. Let's say, according to the income received in advance.

We recommend entrepreneurs not to enter into an unnecessary dispute with the tax authorities on this issue, but to accept their point of view in advance (it's cheaper for themselves). According to paragraph 1 of Art. 346.17 of the Russian Tax Code, the date of receipt of funds to the account or cash desk is the date of receipt of income. Entrepreneurs who have a practice of working with partners who prefer advance payments are advised to specifically familiarize themselves with the legal interpretation of this issue.

STS expenses

An entrepreneur or legal entity using the simplified taxation system should take into account only those expenses that correspond to the list provided in Article 346.16 of the currentTax Code. The tax authorities reconcile the income declared by the entrepreneur for the last year with the actual income presented by the records of primary documents in the transaction log (complete with the documents themselves). They also carefully analyze the costs that affect the assessed tax.

The simplified taxation system, to summarize, involves such expenses that are associated with the main business activity. These include, for example:

- purchase, manufacture, repair of fixed assets;

- acquisition of working capital;

- rent;

- wages;

- taxes and mandatory payments;

- travel costs;

- business trips;

- expenses for servicing bank loans.

Entrepreneurs should take into account that the simplified taxation system is designed for scrupulous observance of the regulated list. Expenses, we recall, must be checked against the strict list presented in Article 346.16 of the Tax Code.

Economic meaning of "simplification"

As practice shows, this taxation system is very popular for start-up entrepreneurs. Indeed, a nascent business that is gaining momentum in a natural way, according to its parameters, falls under the criteria of “simplification” and, accordingly, saves money using preferential taxation.

However, going beyond the revenue of 60 million rubles. or assets of 100 million rubles, personnel of 100 people, an enterprise according to the logicof its development should move to VAT taxation, income tax, etc. That is, the USN tax “Income minus expenses” should, in principle, be abandoned by entrepreneurs. However, some of them continue to think in old categories, not noticing the new opportunities for their business, which has grown out of "short pants" - opportunities to increase labor productivity; attracting new investors; simplification of internal processes; reducing the share of administrative costs; improving the terms of cooperation offered to partners. How do they do it?

Artificial "delay" of the stage of simplified taxation

Instead of switching to new work criteria, these entrepreneurs continue to work "the old fashioned way", in particular, trying to keep the tax accounting of the simplified tax system "income minus expenses". Such unfortunate businessmen, instead of building a new corporate structure, see the priority in creating artificial prerequisites for maintaining the old tax benefits offered by the single tax with “simplification”. They split their corporate structure into separate legal entities, each of which falls under the criteria of the simplified tax system. However, such an approach for them results in significant costs of lost opportunities, which we will try to show below.

Organizational and tax costs of "splitting" the structure of the enterprise

Formally, each such mini-enterprise is independent and has “its own” management. In reality, this is a “soap bubble”. Owner-entrepreneur, instead of centrally and efficiently managing allstructure from a "single center", you have to negotiate with each of your "vassals".

Such a transition from classic management to informal relationships complicates and confuses the workflow of mini-enterprises, which is easy to notice for an experienced tax specialist. The procedure for filing a claim with an entrepreneur that his accounting for the simplified tax system “Income minus expenses” is unreasonable has already been worked out and diverts real financial resources from the business.

The real value of a business is falling

However, some successful entrepreneurs manage to develop such a "fragmented" structure. However, sooner or later, a natural question arises about external investment in the capital of the enterprise or about its sale. The use of a simplified taxation system in these cases, as we understand it, again becomes a brake. Investors are suspicious of a segmented business, they value optimization and manageability. And the profitability of such a business, obtained through dubious tax incentives, is overestimated by them with the help of financial multipliers. As a result, the real price of a business falls.

Conclusion

Special taxation policy (which includes the Russian simplified taxation system) is practiced by many countries in relation to small and medium-sized businesses. How can tax support for small and medium-sized businesses change in the future of Russia?

Our opinion is that in this rather subtle matter it is not worth inventingbike. It is much more promising to use the experience of other states. For example, the United States, Britain, France. These countries, oddly enough, demonstrate different approaches to taxation, stimulating the development of small businesses with its help.

According to experts, the most effective state support program operates in the United States, a recognized world leader in the development of SMEs. Instead of tax regimes in the New World, income tax is paid at lower rates. For example, if the annual profit of a business does not exceed $50,000, then a tax rate of 15% is applied, with a further increase in profits in the range of $50-70,000, the tax percentage increases accordingly - up to 25%.

Unlike the US, France, like Russia, uses special preferential tax regimes for SMEs. At the same time, the taxation of SMEs in innovative industries was reduced by 50%. There is a humane practice of tax deferral in the "country of musketeers" for small businesses.

The British acted differently: they, without declaring small and medium-sized businesses in principle, gave entrepreneurs with an income of less than £15,000 the right to use a simplified declaration, especially “without carping” about the details of how they display their assets and activities. A significant legislative assistance to British entrepreneurs is their fundamental exemption from advance payments (if their annual financial obligations are paid off on time and amount to less than 500£.) In Foggy Albion, there are also tax incentives for start-up entrepreneurs when they purchase technological equipment.

Which way will Russia go further in the development of tax legislation for SMEs? This will depend on the adoption of the relevant laws by the deputies, who will be elected by the Russians themselves.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Styrofoam production business plan: step-by-step opening steps, manufacturing technology, calculation of income and expenses

Polyfoam can be attributed to one of the most widely used building materials. The demand for it is quite high, as there is a development of sales markets, which, with a competent marketing approach, can provide stable profits for a long period of time. In this article, we will consider in detail the business plan for the production of foam plastic

Taxation "Income minus expenses": features, advantages and disadvantages

Income minus expenses taxation has many significant advantages for every entrepreneur over other systems. The article explains when this tax regime can be used, as well as how the amount of the fee is correctly calculated. The rules for compiling a tax return and the nuances of maintaining KUDiR are given

Accounting for working hours in the summary accounting. Summarized accounting of the working time of drivers with a shift schedule. Overtime hours with summarized accounting of wor

The Labor Code provides for work with a summarized accounting of working hours. In practice, not all enterprises use this assumption. As a rule, this is due to certain difficulties in the calculation

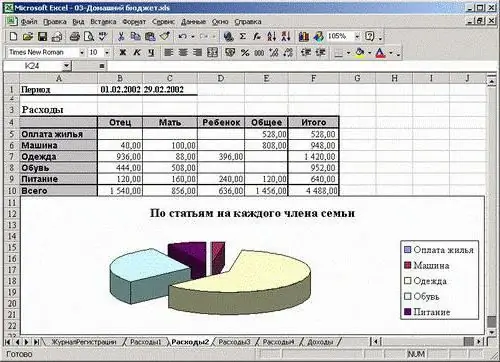

Family income and expenses - calculation features and recommendations

Maintaining a family budget is not an easy question. You need to know how to properly carry out this operation. What can help? How to budget? How to save and even accumulate it? All the secrets of this process are presented in the article