2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:36

Technical indicators are indispensable tools in trading. Based on them, trading strategies are developed and market movement is analyzed. Almost every trader in his methodology has 2 or more technical indicators. When forecasting changes in market quotes, experts use a wide variety of tools in their analysis, which allows them to study the market as accurately as possible and assume its further possible movement.

All technical indicators have their own characteristics, features, purpose and parameters. Some are used in a calm market in forecasting and trading, while others are used only during strong impulses and trends. A special role is played by instruments showing volumes, for example, the Volume indicator. It is about him that will be discussed in our article. We will talk about its characteristics, features, varieties, as well as how it can be used in trading and for analyzing the financial market.

Description of the Volume indicator

Thisthe tool is available on all popular trading platforms. For example, on MetaTrader it is set by default at the very bottom of the chart and is displayed as a histogram. If the trader changes the timeframe, the indicator values will also change, but it will still be displayed at the bottom of the chart.

Histogram bars have different sizes. The higher they are, the greater the interest (supply and demand) of market participants. With this tool, you can track the volume of transactions. When the histogram bars decrease in size, this means that the interest of the players has decreased, and the volume of positions in the financial market has decreased.

According to the technical characteristics, the Volume indicator is an oscillator. Therefore, it has all the advantages, disadvantages and features of this class of trading instruments. It independently performs calculations and generates results immediately on the chart.

In trading, there are 5 types of oscillators that measure functionality:

- Momentum and trend.

- Market volatility.

- Speed in price range.

- Cycles and their lengths.

- Volumes.

The Volume indicator refers to an oscillator that measures the volume of positions in the market.

Classification and types

Volumes in trading on the financial market are very important indicators. They allow traders to track the positions of large players and open trades at the most favorable moments.

Classification of volume indicators:

- Horizontalvolume (horizontal images) - determines indicators by price levels, that is, inside a candle or a bar.

- Vertical volume - the histogram is displayed vertically and shows volumes per unit of time, which depends on the set timeframe.

In principle, there are only two types of volume indicators: for obtaining values and their changes inside the candle, that is, a horizontal view, and for determining the volume of oppositions in any period of time. Tick volumes are used only in Forex and binary options. They show how many positions are taken in the desired time range.

Types of volume instruments:

- On Balance Volume - an indicator that determines volume balance indicators.

- Volume Rate of Change - displays the rate of volume change.

- Klinger Oscillator - to determine short-term trends, used during pullbacks in protracted trends.

- Volume oscillator - determines the general direction of the volume trend. It is based on the difference between two moving averages that are superimposed on trade volume.

- Accumulation-distribution is a tool used in trading as a filter for both market volatility and trend. It analyzes the movement of impulses with market volumes.

- Chaikin Oscillator - showing divergence and other indicators.

Technical instrument functions

The Market Volume indicator performs one of the main functions in trading on the financial market. Depending on purpose and useas a trader, it performs the following functions:

- Defines the overall market positions.

- Shows the values of volumes in a certain period of time.

- Displays statistics in the desired bar or candle.

Using this tool, you can get information about the market situation: what is happening on it at the moment, what may be changes in the future, about the interest of players in a certain time period and the opening of transactions by large market participants.

In trading, the volume indicator is widely used by traders. Based on it, many trading strategies have been developed that allow them to consistently earn on the financial market.

Settings and parameters of the indicator

From the description of the Volumes indicator, which is a standard tool on many well-known trading platforms and is installed free of charge, you can understand that this tool practically does not need any settings. To attach it to the chart, you need to make literally a couple of clicks, that is, select it in the "Tools" and click the "ok" button.

Developers recommend leaving the original settings. The only thing that can be changed at the discretion of the trader is the color scheme of the histogram display and the line thickness. He does not need any additional testing.

Usually the Volumes indicator has two colors: red and green. If it has more columns of the first option, it means that the market price went down more often, and with superioritygreen - increased. This indicator is installed in a separate window below the chart and does not interfere with the analysis of market quotes at all.

Description of Better Volume

This trading tool belongs to custom technical indicators. All values in it are presented in the form of a histogram, which completely coincides with the Volumes indicators. The Better Volume indicator is an improved version of the standard tool.

Indicator benefits:

- It is much more convenient for a trader or expert to perceive information by coloring values in different colors.

- 100% match of indicators with the standard instrument.

- The Better Volume indicator fully performs all the basic functions, but is more convenient to use.

Experts have recognized this tool as the best for determining vertical volumes.

Indicator decoding

Since it is displayed on the chart, more precisely, in a separate window as a histogram, the bars have the following meanings:

- Red color. Appears after large volumes. If the signal is formed at the peak, then it can mean a change in trend or momentum, as well as a correction. They are shown especially well by the Better Volume 1 5 indicator with a period of 15.

- Yellow color. It is an auxiliary signal, usually formed at the end of a correction or impulses. It indicates their completion and informs the trader that at this time there are no people willing to make any purchases or sales in the market.

- Green color. This is a reversal signal. It usually announces the exit of large players from the market and is a powerful indicator. He informs the trader that large participants have begun fixing their profits and leave the market, passing it on to smaller players.

- Blue color. Neutral signal, practically meaningless. It shows changes in ticks.

- Brown color. Formed at the end of a downstream direction. It can usually be seen after high volumes. If this signal appears at the end of the upward movement, then it should be ignored.

Besides the color marking of the histogram, the indicator has the MAPeriod parameter showing the value of the period for the moving average. You can install it yourself. This line is also displayed in the indicator window below the chart. Its function is to indicate the significance of the volume and the probability of the veracity of the histogram signals. If it is above the bars, then the values of the technical instrument are greater than the average, below - less.

Description of Volume Profile

Along with vertical volumes, horizontal indicators are widely used in trading. The Volume Profile indicator allows you to analyze price levels and find out what the situation is on the market between buyers and sellers. Horizontal volumes are one of the important parameters for predicting market movement.

When attached to a chart, Volume Profile displays its values directly at market prices. It is shown as a horizontalhistograms for each level. The larger the volumes, the longer the indicator bar. With the help of this tool, traders determine the balance between the positions placed for buying and selling.

Description On Balance Volume

This tool was developed by Joseph Granville. It is an indicator of equilibrium volume and has an abbreviation - OBV. According to its properties, this technical instrument is characterized as an indicator of changes in the speed of price and volume. OBV follows market quotes.

The On Balance Volume indicator is displayed on the chart as a line that follows the trend movement. In trading, it is used by traders as an indicator of the reversal of the market direction.

Description of Volumes Divergence

One of the most favorite phenomena for traders in the financial market is divergence. To determine it in trading, a special tool was developed - the Volumes Divergence technical indicator.

It can be used to calculate the interest of market participants in a certain time period in a particular asset. Volumes Divergence shows the difference in directions between market quotes and the histogram values of the volume indicator.

Scope of application

All volume indicators are used to quantify positions at a price level or per unit of time. Based on horizontal and vertical volumes, special trading strategies have been developed.

These technical instruments, based on their indicators, determine tradingmarket entry and exit signals. They are widely used during trading and for analytical forecasting of market movement.

In addition, volume indicators can be used in trading as filters to filter out false signals for other instruments.

Using Volume in trading on the financial market

The Volume indicator is used in trading as a tool that confirms and determines the seriousness of market quotes. If prices are characterized by high volumes, then the continuation of such a movement will be much more likely than with small values.

In situations where the market price has made a sharp leap in any direction, but at the same time its volume indicators are small, this jump should be regarded as an accident. That is, such a phenomenon has the least probability of continuing the direction. Therefore, in trading, Volume is used as a tool to confirm trading signals, candlestick patterns, technical analysis figures and divergence.

For example, the "Head and Shoulders" graphical figure is always accompanied by large volume values, which determines the high probability of its triggering. In this situation, Volume acts as a confirmation signal for a reversal of the market movement.

In candlestick analysis, it is also used as a filter to filter out false signals in combinations and configurations. For example, the Shooting Star pattern has formed on the market. If aat the same time, the volumes of positions shown by Volume have increased significantly, then such a signal (for a reversal of movement) can be considered confirmed and open an order.

Features of the volume tool

The Volume technical indicator, as well as other instruments developed on its basis, show the interest of players in a particular movement in the direction of the market price. Horizontal volumes allow you to analyze the market by price levels, while vertical volumes - within a certain time range.

The greater the interest of market participants in any movement, the stronger the probability of continuation of this movement increases and the higher the value of the volume indicator. The features of volume oscillators (when compared with other indicators) include their ability to anticipate future events and signal changes in market quotes in advance.

Tips and tricks for traders

A wide variety of volume indicators opens up great opportunities for traders and experts in the field of financial market analysis. Professionals advise beginners to carefully study the characteristics and features of the selected instruments before using them, as well as to start using them in real trading only after testing on a demo account, so as not to expose their deposit to financial risks.

Rules for volume indicators:

- If the volume indicators decrease, this means a decline in interest in the trading asset. Therefore, there are two possibledirection of the event development: short-term price stabilization or change in the direction of market quotes.

- An increase in the values of indicators is a signal of an increase in demand for an asset or a market reversal.

- In some cases, a gradual decrease in volume values may indicate a sharp price change.

- After the formation of peaks on the chart, there is a high probability of a market reversal of momentum or trend.

In trading, it is important to minimize financial risks as much as possible and trade based on the patterns and fundamentals of the market.

Recommended:

Momentum indicator: description, configuration and use, methods of application

The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum and there are a number of indicators designed to measure it. The Momentum indicator helps identify when players have bought or sold too much

EMA indicator: description, how to use?

Indicators on the Forex exchange serve to make life easier for traders. The most famous of them is the EMA indicator. It allows you to predict the trend and smoothes the quote data. This is important in times of high volatility

ATR-indicator: description and use on Forex

What is the ATR indicator and how is it used in the Forex market. How to understand its signals, what can be seen with its help

CCI indicator: what is it and how to use it? Combination of CCI and MACD indicators when trading on the Forex market

CTI, or the commodity channel index, was developed by Donald Lambert, a technical analyst who originally published an article about it in Commodities (now Futures) in 1980. Despite its name, CCI can be used in any market. And not just for goods. The indicator was originally designed to detect long-term trend changes but has been adapted by traders for use on time frames

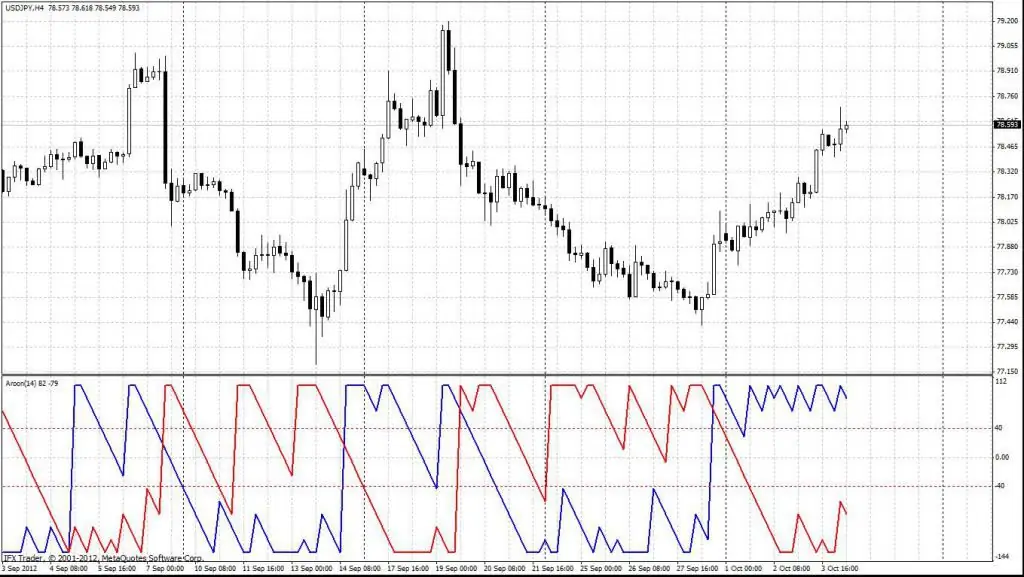

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement