2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Indicators on the Forex exchange serve to make life easier for traders. The most famous of them is the EMA indicator. It allows you to predict the trend and smoothes the quote data. In conditions of high volatility, this is important.

EMA is the most respected indicator

The most favorite and popular tool for all investors is moving averages. At the same time, it doesn’t matter at all whether the capital is large or small, this indicator will equally only bring benefits on any exchange asset and timeframe.

The EMA indicator is included in many trading strategies and makes it possible to filter out false signals in many cases. It has a sharp reaction to market fluctuations and therefore it is used by most traders in their techniques.

The last price of a product gives the most accurate reflection of the position of the players on Forex, which formed the basis for calculating the formula for the rsi ema signals indicator. The final value of an asset is more important than its other values, since the previous ones are not so significant.

Calculation of the EMA instrument

In order to calculate the required point ontimeframe, you should add a part of the real closing cost to the previous price. Practically it looks like this:

EMA (t)=EMA (t-1) - EMA (t-1)) + 2(P(t), where:

- EMA (t)- exponential indicator for a specific cycle;

- P(t)- the price at which the previous Japanese candle closed;

- EMA (t-1) - the size of the previous segment to be measured.

Many traders don't learn the rules of indicator calculation, but only remember when to use EMA and when not. The main advantage of the indicator is its fast response, and if the trader's system is based on entering at the very moment when a new trend in the market is just emerging, you just need to set the parameter correctly for the timeframe on which you are trading. You can find a description of the EMA indicator on the website of any Forex broker.

Customizable values of the EMA indicator

Like all indicators, to set the EMA on the selected chart, you can simply drag it from the window called "Navigator" directly to the timeframe. You can also open the "Insert" tab, go to "Indicators" and click on the desired element there. Then, in the "MA Method" window, select Exponential. At the same time, you can immediately specify which marks the curve will pass through. You can build it on Low, High, Close and Open.

Also, the indicator contains a shift and a period. It is the trader who decides which parameters to set, depending on the chosen trading model, having previously understoodhow the EMA indicator works.

Find Moving Average in the list and drag it to the chart with the price. You will see a window in which you need to change the type of moving average from Simple to Exponential. You also need to set the EMA period, in other words, the number of candles on the basis of which the exponential moving average will be calculated. In addition to the usual setting of the required period, you can move the indicator line by a certain number of bars. Such a simple function helps to approach the indicator from an extraordinary side.

EMA and Caesar strategy

The well-known strategy "Caesar" uses the EMA indicator for the MT4 terminal, using the period 21:

- By the slope of the EMA21, this strategy reveals the direction and trend of the market.

- The intersection of the asset price with the moving average reflects a trend change. The closer the angle is to a straight line, the stronger the trading momentum.

- When flat, the curve splits the chart in half and moves in a horizontal position, without issuing trading commands.

- Crossing the price and EMA21 is a signal of a change in the mood of bulls and bears.

Puria method

The Puria method is another Forex trading technique that can be quite profitable when used correctly.

It uses an EMA indicator with a short period of 5.

When the slow weighted WMA95 and WMA85 curves cross with the exponential line, the current trend usually changes to the medium term. At workfor this technique, you must specify in the settings: "apply to" - Close.

So the EMA reflecting the crossover of fast and slow moving averages is the signal to open an order that the indicator provides when properly set up and applied properly.

"Rainbow" - a strategy with three moving averages

When trading on Forex using moving averages, which are used in various combinations, depending on the construction method, you can apply several EMA indicators at once instead of one.

The "Rainbow" strategy can serve as such an example. She uses 3 moving averages. Many traders prefer this strategy and the EMA indicator for binary options, considering it to be of sufficient quality. Periods in "Rainbow" are used with values of 6, 14 and 21. The purchase of a lot is carried out when the curves intersect with different parameters.

FX50 strategy

This trading strategy uses a longer period than "Rainbow" and "Caesar", equal to 50.

The EMA "Forex" indicator in the FX50 strategy is an indicator of resistance and support levels, signals the presence of a trend in the market, and also gives commands to open orders.

A fast moving line reflects how the trend changes in a short time, while a slow one rounds small quotes and shows a broader price direction - up or down. When two lines or two trends intersect, it is possible to enterdeal. More precisely, when the fast Exponential Moving Average breaks the slow line upwards, you can buy. Sell when EMA crosses above slow EMA down.

Ways to use the EMA indicator

To understand how to use the EMA indicator, you should understand how it works.

Breaking through the EMA price is the most popular use of the indicator. So, a signal to buy is when the price crosses the EMA from below, and to sell - when it crosses above. This principle is explained by the fact that the price of the pair has broken its average, and accordingly, a new trend has appeared on the market.

To determine the moment of entering the market, most traders use the period of fast and slow moving averages 21 and 100. In this case, you need to focus on the intersection of several EMA indicators with each other.

Moving average EMA with a period of 50

- The slope indicates the presence of a trend.

- When moving vertically, indicates a sideways trend.

Is resistance/support:

- After breaking through the EMA, the price most often returns and rebounds again, either from the resistance level in a bearish trend, or from the support level in a bullish one.

- When using EMA with a long period, these lines can be applied on the charts as resistance and support levels (just by themselves).

With this approach, it is very easy to use the indicator:

- If during an uptrend the price valuedropped and reached the support level, then you can enter the purchase.

- If during a downtrend the price level rose and touched the resistance level, then you can enter the sale.

- Performs crossover analysis on fast or slow lines only.

- Crossing with an asset makes it clear about a change in market positions.

- The intersection of slow and fast movings is a signal to sell or buy.

- Helps analysis when crossing lines that differ in their method of constructing lines. Such as EMA + WMA + SMA.

- Used in conjunction with technical analysis indicators within patterns.

The period settings are selected individually for each time period. Works better on H1 and H4 intervals. Since each trader independently chooses a trading strategy for himself, it is advisable to deal with all the Moving Averages in order to choose the one that suits him best.

Many traders use the EMA indicator to set stop losses. They are usually placed behind the line. In order for the indicator to be used with the least number of errors, it is necessary to be very scrupulous in setting its parameters. So, small timeframes do not require large values of the EMA period, when hourly, daily, weekly and higher charts will work more correctly with larger periods in the indicator settings.

Disadvantages of the EMA indicator

The EMA's weakest point is flat. During a prolonged relative calm in the market, the price oftenrandomly crosses the moving average in different directions and this confuses the understanding of signals. Many inexperienced traders "catch" stops during this period and lose money.

To avoid such a problem, it is recommended to always use EMA with other tools for safety net and more accurate detection of false signals. On the site of the Forex broker Olymp Trade, an entire section is devoted to the EMA indicator, which contains all the necessary information on setting up and using it.

The EMA indicator is also used as a specific filter for trading trends in the market. It is generally accepted that when finding the price, bulls dominate its average value. When using the EMA as a trend indicator, set large values for the period in the settings. The most popular is 200. Sometimes traders pay attention to the angle at which the indicator line is inclined. There is an opinion that if the angle is very steep, then there is a powerful price surge in the market. It is considered optimal when the line does not run at too steep an angle.

EMA differs from other MAs

Sliding simple - like a journey in which you either have to go in a straight line, then go uphill, then dive to the bottom of the sea, then fly by plane from one continent to another. And this takes into account only the average time spent on the entire journey.

Moving weighted is more like stepping. More important is the place where the price is located or the stage where it is necessary to rise. The steps that have already been passed are no different from those that are waitingahead.

The EMA indicator can be compared to climbing uphill. Sometimes the path is straight and simple, sometimes it turns into a serpentine, sometimes gentle, sometimes steep, but only the place where the price is now matters. The path traveled is completely irrelevant.

Recommended:

Momentum indicator: description, configuration and use, methods of application

The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum and there are a number of indicators designed to measure it. The Momentum indicator helps identify when players have bought or sold too much

Volume indicator: description, classification, setting and use

Technical indicators are indispensable tools in trading. A special role is played by instruments showing volumes, for example, the Volume indicator. We will talk about its characteristics, features, varieties, as well as how it can be used in trading and for analyzing the financial market

ATR-indicator: description and use on Forex

What is the ATR indicator and how is it used in the Forex market. How to understand its signals, what can be seen with its help

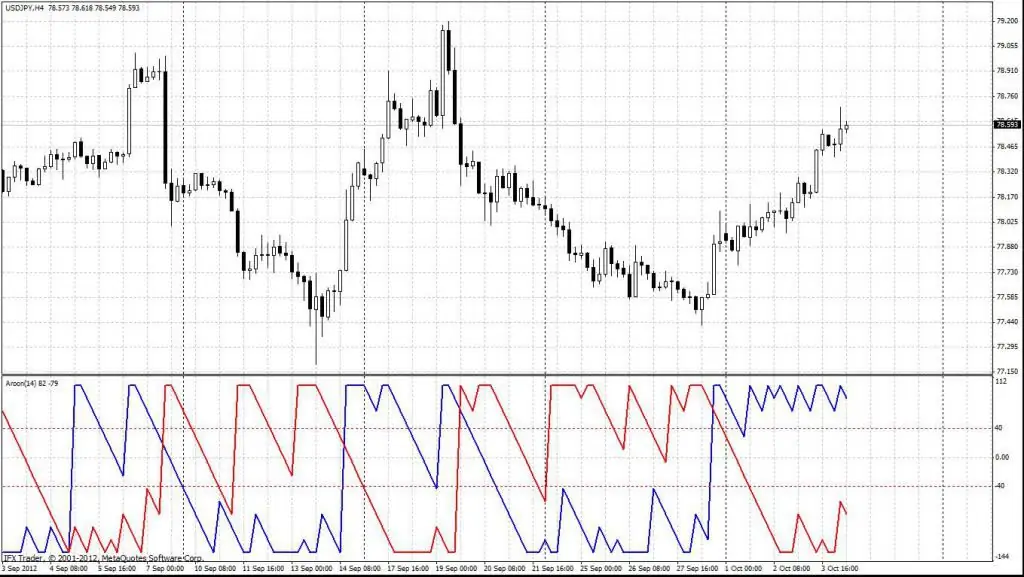

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement

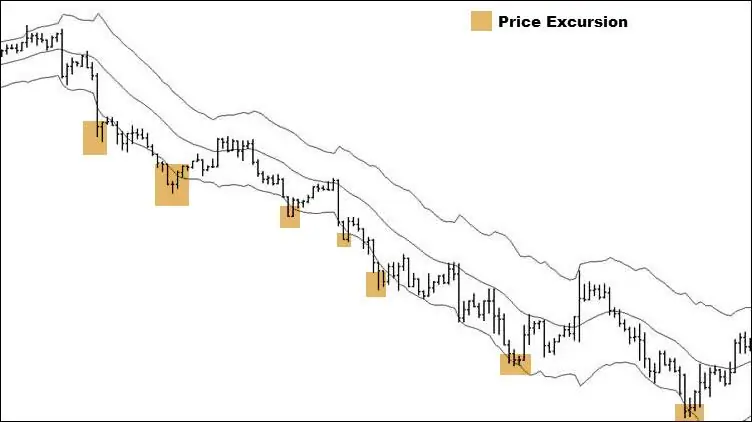

Keltner Channel: indicator description, how to use

The Keltner Channel is in high demand among experienced traders. In appearance, this indicator is very similar to other analysis tools. What is the characteristic of the indicator? How to use it correctly in trading and what you need to know when setting it up?