2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

One of the key concepts in technical analysis is the trend. Many strategies are based on determining where the market is moving and whether it is at the beginning or at the end of this process. Such information is extremely useful for a trader. The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum, and there are a number of indicators designed to measure it.

Measuring the strength of a trend

The most well-known indicators of market dynamics are the convergence and divergence of the MACD moving averages, the RSI relative strength indicator and the stochastic indicator. The last two are oscillators, meaning their values fluctuate within a limited range of values (often between 0 and 100).

This article discusses yet another momentum oscillator that some say is just as effective as its better-known counterparts. This is the Momentum indicator, which is a curve that oscillates on either side of the centerline at 100. Like the RSI andStochastic, it helps to determine the moment when players have bought or sold too much. That is, does the trend have enough momentum to keep the price moving. When a falling market is oversold, a rebound is likely. When a rising market is overbought, it can fall.

Calculation formula

Momentum is a standard indicator that is available in many trading systems by default.

Calculating it is quite simple: each price is compared with the price for a certain number of time periods before it. The first step is to choose the number of periods N to be used in the calculation. For example, in the MT4 system, the default N=14, but you can set any other number that the trader considers necessary to use.

Thus, the current closing price and N periods ago are compared. The formula for the Momentum indicator is as follows: Momentum=(Price / Price N periods ago) x 100.

The good news is that all calculations are made automatically and instantly displayed on an additional chart below the main one.

Description

The Momentum indicator is displayed as a graph, the peaks and troughs of which reflect key shifts in the rate dynamics. In this case, the center line may not be displayed. The higher the chart rises above 100, the faster the price moves up. The lower he goes, the faster she falls.

The momentum indicator is one ofseveral trend oscillators available to traders. In addition to the standard RSI and Stochastic, there are additional indicators (for example, the SMI stochastic momentum index), but they can only be used in many systems after a separate installation and configuration.

Indicator "Momentum" in the trading strategy

Traders can use the momentum oscillator directly or as a confirmation tool.

The simplest signal is the crossing of the center line. At the same time, you should buy when the value rises above 100 and sell when the indicator crosses the 100 mark from top to bottom. However, this is a primitive approach and should be used with great care. Such signals are often late and come when most of the price up or down has already been covered.

The performance of the indicator can be improved by superimposing it on a moving average.

How to add a moving average?

Some traders like to compare the momentum curve to a simple SMA moving average.

This can be done by clicking on the Moving Average in the Trend Indicators selection in the MT4 Navigator and dragging it into the Momentum chart. The standard dialog box will appear. In the "Apply to" drop-down menu of the "Parameters" section, select the "First indicator data" item. You can choose any period of the moving average, but the usual values are 10, 14 or 21. Setting up the Momentum indicator is now complete. In this case, the moving average line should be superimposed on the momentum oscillator in order to be able touse the signal that occurs when they cross.

Trading strategy is to buy when the indicator line crosses the moving average from the bottom up, and sell when the movement is reversed. This should slightly improve the signal arrival time, but at the same time the trader receives a lot of false signals. To eliminate them, only transactions in the direction of the market movement can be taken into account. It is also possible to take into account the signals only after reaching the overbought or oversold conditions of the RSI indicator.

Verification Tool

Momentum begins to perform a really useful function when used as a means of confirming the signals of a single primary indicator. One of the best methods is to look for a divergence between price and momentum as a way to measure the strength of a trend. Momentum Divergence is a simple yet powerful concept in technical analysis.

Thus, the signal to buy or sell will come from a pre-selected main indicator. It should then be checked for whether the price-momentum divergence is bullish or bearish.

Trend detection

A bullish divergence suggests that the market is oversold. The price falls to new lows, but the Momentum indicator (or other oscillator) does not make new lows.

Bearish divergence suggests the market is overbought. Price rises to new highs but momentum fails to reach new levels.

This dichotomy givestrader only early hints of weakening momentum, which may lead to a correction or a complete reversal of the trend. Divergence occurs at market peaks, when prices move too much and, like a spring, should return to the real level.

Thus, it is enough to follow the signal to buy the main indicator, if it is confirmed by a bullish divergence from the momentum. Similarly, sell signals should be monitored if they are confirmed by a bearish divergence.

Divergence works in a variety of situations, but during strong trends it can give many false signals. Also, do not use only this tool. Understanding what happens over a long period of time often helps filter out unlikely predictions. Finding support and resistance levels and using them as background can increase the chances of a profitable trade.

Momentum of divergence in the Zigzag pattern

How to use the Momentum indicator in this case? The model is based on Elliott wave theory. It consists of three waves: initial A, pullback B, restoring the price to less than 100% of the previous one, and continuation C, which moves in the initial direction and goes beyond it.

To create a trading strategy, you need to determine the general trend of the market, find a zigzag-like correction and make sure that the model diverges. If a divergence is confirmed between the Momentum indicator and the price, then the actual entry signal will occur on a break of the trend line that extends fromthe beginning of wave A to the beginning of wave C. In this case, the stop order must be placed outside the last swing created before the breakout of the AC line. The area at the beginning of wave A is selected as the position closing point.

Pulse compression indicator

It is often useful to combine different indicators so that their various aspects complement each other. An example of this is the combination of the Momentum indicator and volatility measurements to form the Momentum Squeeze indicator.

The Bollinger Band forms a corridor that widens during times of high volatility and narrows during times of low volatility. A band squeeze occurs when volatility shrinks to historically low levels. The theory is that something significant will follow such periods.

However, the Bollinger Bands indicator does not indicate the direction of the breakout. In a momentum squeeze strategy, momentum is used as a measure of where the market is headed.

In closing

Overall, the momentum indicator is a tool that will be useful for a wide range of applications. It can be used both for stock market analysis and as a Momentum indicator on Forex. It provides three trading signals: 100 crossovers, moving average crossovers and divergences.

The versatility of the oscillator also means that trading systems can be easily created that work both in the short and long term. As a general rule, for a momentum indicator, the shorter the time period used, the moremore sensitive. However, this generates more false signals.

Of course, this indicator is not the only way to measure the strength of a trend. There are many other movement indicators.

Recommended:

Momentum card (Sberbank): how to get and how to use. Terms, instructions and reviews

Sberbank instant issuance cards are simple and non-registered entry-level bank cards. In this regard, they have a minimum amount of opportunities. The most important advantage that the Momentum card (Sberbank) has is the ability to issue and receive it ready-made in no more than 15 minutes at any branch

Volume indicator: description, classification, setting and use

Technical indicators are indispensable tools in trading. A special role is played by instruments showing volumes, for example, the Volume indicator. We will talk about its characteristics, features, varieties, as well as how it can be used in trading and for analyzing the financial market

ATR-indicator: description and use on Forex

What is the ATR indicator and how is it used in the Forex market. How to understand its signals, what can be seen with its help

CCI indicator: what is it and how to use it? Combination of CCI and MACD indicators when trading on the Forex market

CTI, or the commodity channel index, was developed by Donald Lambert, a technical analyst who originally published an article about it in Commodities (now Futures) in 1980. Despite its name, CCI can be used in any market. And not just for goods. The indicator was originally designed to detect long-term trend changes but has been adapted by traders for use on time frames

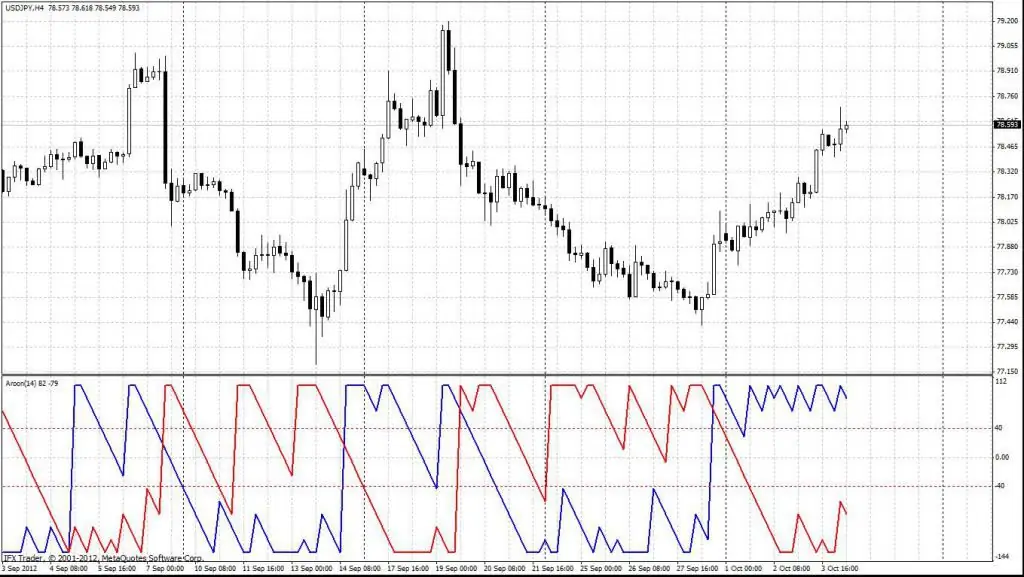

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement