2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

As everyone knows, volatility is the level of price volatility. In order to determine the possible risk, you need to know everything related to this indicator. By monitoring the level of volatility, you can notice how the value of a particular currency begins to change dramatically in a certain time period. This means that her level is high. If the price does not change much, but only small fluctuations are observed, this indicates low volatility. How to measure its level correctly?

For this purpose, special charts or oscillators are developed. With their help, you can follow market fluctuations in different periods of time: both for weeks and months, and for hours and even minutes. For example, traders actively use such a tool as ATR. What is it and how does it work?

What is the ATR and what is it for?

The Average True Range indicator, or ATR, was developed by Welles Wilder specifically to determine the volatility of price changes. From the very beginning it was used in the commodity market, where this characteristic is more common, but now it is widely used among foreign exchangetraders. In Forex, however, it is rarely used to distinguish future price movements. More often, it is only needed to get an idea of the recent volatility in order to prepare a future trading plan. Setting stops and entry points at profitable levels to prevent exits or quick reversals is seen as a benefit of this indicator.

Essence and understanding of Average True Range

ATR-indicator is classified as an "oscillator", because in the display results the curve fluctuates between indicators calculated based on the level of price volatility for the selected period. It is not a leading indicator as it does not display anything related to price direction. The high values of the chart suggest that the stop boxes may be wider, as well as the entry points. This prevents the market from moving against you. By reading the ATR, a trader can effectively operate strategies that track commensurate levels of price movement.

ATR indicator: formula

The ATR indicator is a generic indicator running on the Metatrader4 trading software, and the sequence calculation formula includes the following simple steps: for each selected period, three absolute indicators should be calculated:

a) High minus Low.

b) High minus Close of the previous period.

c) Close of previous period minus Low.

TrueRange, or TR, is the maximum of the three above calculations. ATR indicator isan oscillator operating on the basis of the moving average indicator for the selected period length. A typical setting for this length is "14".

What this oscillator looks like

Computer programs perform the necessary computational work and reproduce the ATR indicator in the form of a diagram.

Average True Range consists of a single fluctuating curve. For example, when trading with the GBP/USD currency pair, it is advisable to set its range from 5 to 29 points. On the "peaks" visible in the curve, you can visually see "Candlesticks" expanding in size, which indicates the strength of the market position. If low values persist for a certain time period, then the market is consolidating and a breakout can be predicted.

How is the chart set?

Understanding how the ATR indicator works (calculation formula, etc.) will allow you to consider in detail how this generator is used in the Forex market and how to read the various graphical signals that are generated on the charts. How to use ATR in the Forex market?

For example, an ATR with a period setting of "14" can be represented on a 15-minute chart for the GBP/USD currency pair. On this chart, ATR will be displayed as a red line. The value of this oscillator in this case will vary from 5 to 29 "pips".

ATR indicator: how to use it in Forex?

Keyreference points are lowpoints or long periods of low values. It is better to work with this indicator over a longer time frame, i.e. on a daily basis. However, shorter periods can also be placed and traded with them can also be successful. The only thing to remember is that the ATR indicator tries to convey price volatility, and does not report price directions. The oscillator is traditionally used in tandem with other trend or momentum indicators to set stops and optimal entry point margins.

Possible errors

As with any technical indicator, the ATR chart will never be 100% reliable. False signals may occur due to the lagging quality of moving averages, but positive signals remain fairly consistent. In total, this allows Forex traders to receive useful information for making transactions. Some experience in the ability to interpret and understand ATR signals must be developed over time. In addition, this tool must be supplemented with any other indicator. This is recommended to further confirm possible trend changes.

Understanding the above principles will allow you to illustrate a simple trading system that can be built using the ATR indicator. Setting it up includes the above parameters divided by periods.

Highlights

Forex traders shouldfocus on the key points and opportunities of the ATR, which include the "peaks" of the lowpoints. Like any technical indicator, this chart has a certain percentage of errors in the signals it generates. However, correctly interpreted signals can be quite consistent and useful.

The trading system below is for educational purposes only. Technical analysis takes into account previous price behavior and at the same time tries to predict future prices. At the same time, it is well known that past results are not a guarantee of future results with the same market activity. Given this reservation, you should read the constructed graphs. The Gerchik ATR indicator includes the following. The green circles on the chart illustrate the optimal entry and exit points, while the ovals of the same color indicate a breakout or reversal that is inevitable in the current market trend. This use of ATR analysis is most effective in combination with the blue lines of the RSI indicator.

Conditions

A simple trading system will be implemented under the following conditions.

Find your entry point when the RSI falls below "30" (lower limit of the line) and add 25 "pips" (the ATR value should be "1.5X").

Set the BuyLimit to no more than 2-3% of your account.

Place a stop loss 25 "pips" (with an ATR value of "1.5x") below your entry.

Determine the exit point when the RSI crosses the upper limit of the "70" line and is accompanied by a decrease in the ATR value from the previous peak.

Steps "2" and "3" are considered risk and money management principles that should be used in trading. This simple trading system can provide profitable trading for 100 "pips". However, it must be remembered that the past is no guarantee for the future. However, the study of sequences is your goal, and technical analysis and ATR indicators will successfully provide you with this data.

Recommended:

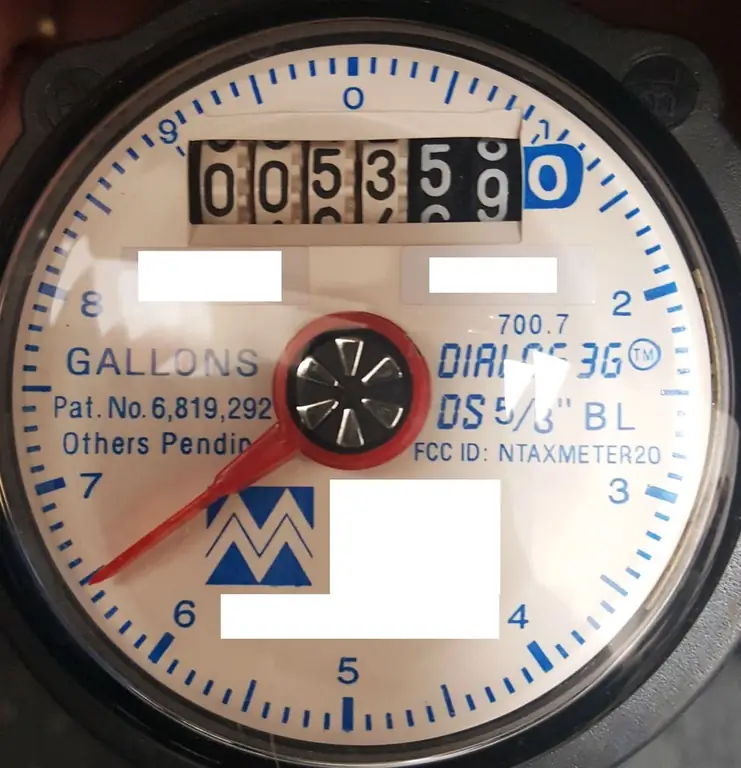

Shelf life of water meters: period of service and operation, verification periods, operating rules and time of use of hot and cold water meters

The shelf life of water meters varies. It depends on its quality, the condition of the pipes, the connection to cold or hot water, the manufacturer. On average, manufacturers claim about 8-10 years of operation of devices. In this case, the owner is obliged to carry out their verification within the time limits established by law. We will tell you more about this and some other points in the article

Castrated bull: reasons for castration, description of the procedure, purpose and use of ox in agriculture

Castrated bulls are calm and gain weight quickly. These animals are called oxen. In agriculture, they are used mainly for meat production or in animal-drawn transport. The castration of bulls on the farm, of course, must be done correctly

How profitable is it to use a credit card? Overview of credit cards and terms of use

The decision to issue a credit card comes to the client within a few minutes after sending the application for receipt. If approved, issuing a card can take up to three days, some financial institutions issue them to customers immediately upon application. A borrower over the age of 18, in order to issue a credit card to him, must provide a banking organization with his passport data, documents confirming income (certificate 2 personal income tax)

Faux suede: description, areas of use and reviews

Faux suede is a modern high-tech material that has found its application in the production of fashionable clothes, shoes, accessories, and furniture. Synthetic suede has a lot of advantages, however, it is not without some disadvantages. In appearance, it practically does not differ from natural, and consumer characteristics will please even picky buyers

Rational use of land: the concept and functions of land, the principle of use

Exploitation of the land fund involves the creation of favorable conditions for the production of agricultural products. However, it is impossible to achieve high economic efficiency in this area without a careful calculation of the costs of energy, power and natural resources. The concept of rational use of land is of key importance in maintaining sufficient production indicators in this area without harming nature