2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:37

With the joy of owning a car comes new responsibilities. In particular, the need to insure motor third party liability. Everyone knows that in the event of an accident, the damage is compensated by the company that sold the policy. The question arises of how its value is formed and what it depends on.

One of the main components of insurance is KBM. Not so long ago there was information that it was canceled in Rosgosstrakh. Is it so? We will discuss in this article.

KBM: deciphering the term

KBM - what is hidden behind the indicated abbreviation? This is the so-called bonus-malus coefficient, which depends on the driver's experience and the number of accidents that happened to him. This rule may seem redundant to some. However, its purpose is to encourage drivers to drive carefully. After all, without accidents and repairs, no one can payneed. And without losses, the profit of the insurance company will only increase.

To better understand the meaning of CBM - what this parameter means, just think about the phrase "bonus-malus". That is, we are talking about a kind of reward that relies on driving without incident. In OSAGO, the bonus is 5% for each year of accident-free driving.

But the question arises in further deciphering the concept of CBM: what is "malus"? If the owner of the OSAGO policy gets into an accident on his car, the culprit of which is, then the discount is canceled or reduced. But if you are not to blame for the accident, then it will not affect the cost of insurance next year. This condition will remain even when the accident was registered without the participation of traffic police officers.

The reason why the cost does not change in this case is very simple - OSAGO is liability insurance, not car insurance. And, of course, only the guilty party bears it.

When changing companies, does the CBM change?

In OSAGO insurance, calculation is not an easy task. The full insurance history of the driver is taken into account. Consider a few common options for how you can find out your odds.

- When serving in the same insurance company, the data is stored in the internal database. Then, when applying for a new policy, the agent looks into it and announces the final cost.

- If the car owner wants to change the insurance company, then in order to keep discounts, he needs to submit a certificate from the company in whichhe had insured before.

- But even if there is no certificate, there is an automated database of the PCA operator, where information is stored about all citizens who have received policies. However, it is best to personally control this process, as it happens that the information of the UK was not entered or there were failures in the system.

- On the official websites of some insurance companies, a special service is provided that allows you to calculate the CBM for OSAGO insurance. It is an online calculator service. At the same time, the driver is checked against the database of the Russian Union of Motor Insurers.

- It also happens that some IC prescribe CBM in the policy. Study it carefully: is there a coefficient opposite the driver's name or in the "special marks" column. However, since this information does not have to be reflected in the policy, it is entered infrequently.

- Try calling the insurance company at the number listed on the stamp in the insurance policy. Ask to be connected to the OSAGO department and say that you intend to renew the contract, so you want to get acquainted with your class for the next year.

How is it calculated?

Earlier, KBM was tied to a specific car when insuring. Therefore, when one car was sold, all bonuses were reset to zero. This method was clearly inconvenient and unprofitable. Therefore, when the shortcomings of the system were identified, it was changed, and the KBM began to be associated with a person, not a car.

MBM indicators in insurance are 15 classes, the values of which vary from 2.45 to 0.5. A client who applied to an insurance company inthe first time, receives the third class and has a standard cost.

Each year, when there are no driver-caused accidents, the MSC decreases. That is, next year, with a 5% discount, the class will already be the 4th. However, in the event of an accident due to the fault of the OSAGO owner, the class will inevitably decrease, and the cost of insurance will increase. Calculations are made according to a special KBM table.

If there are several drivers in the policy, then the calculation is made according to the maximum CBM of one of them. And if it provides for the use of a car without restriction, then the calculation is based on how many payments were made for the previous policy.

Nothing but the truth

When issuing OSAGO, the agent may ask how many accidents there were. Of course, an automated system is very good, but still, the IC, as a rule, prefer to play it safe.

According to OSAGO rules, it is forbidden to provide false information. If this is found out, then the compulsory insurance contract will be declared invalid, and the money spent on it will not be returned. Not the best fate awaits those who are deceived after the accident. Then the contract is terminated through the court, and the payments will have to be reimbursed personally. And that is not all. The next time the driver takes out insurance, the price for it will increase by half, that is, the MSC will rise to 1.5 times. Therefore, it is better never to deceive the UK when signing OSAGO.

CBM=1

It happens that the CBM is equal to one. This happens in the following cases:

- When vehicles owned by foreigners are insured (such cars are usually temporarily in Russia).

- When insuring trailers.

- When insuring for an extremely short period of time.

Insurance overcharge

Sometimes not only unscrupulous car owners try to deceive an opponent, but also the UK itself. This is an unreasonable increase in the cost of the policy.

Most often this is a simple silence about the KBM. A standard calculation can be offered to a driver who is accurate, but not knowledgeable in insurance matters.

That is, it turns out that the same amount of CBM when insuring for the first time remains the same from year to year. And this can seriously affect the amount of insurance.

Another common method used by agents is to sell additional insurance. Thus, the cost can also increase significantly. Often, management requires employees to try to sell insurance to customers that they do not need.

Of course, one should react strongly to such things. First, demand that you issue a policy without unnecessary offers, and if this does not help, then threaten that you will complain to the appropriate authorities. In most cases, this works convincingly.

It also happens that when moving from another company, insurers give the client a coefficient of one.

Please note - if you lose your KBM, then it will take a lot of time to recover, and finances will disappear along with it.

Howsave money?

So, let's figure it out: how to do it in order to pay less for the policy. The following aspects matter here:

- Territorial coefficient. We are talking about a driver whose permanent registration is in the province or in the village. For him, the cost of insurance will be significantly lower than that of a metropolitan resident. Many citizens who have relatives in the outback register vehicles for them and drive a car under a general power of attorney.

- It is better to include specific people in the policy who can be trusted with the vehicle than to buy insurance with permission to drive a car for everyone. The latter option is much more expensive. In addition, you should carefully consider whether the BMR will change with insurance without restrictions.

- If you are not going to drive in winter, it is better to purchase a policy for several months - when you plan to use the vehicle.

Recent RSA changes

Since December last year, the Russian Union of Motor Insurers has introduced a new procedure for the use of KBM in insurance. What are these changes? The algorithm is that if the policyholder does not agree with the values of the coefficient, the IC is obliged to check the value in the AIS RSA. In the event of a discrepancy with the insurer used, that which has been identified shall apply. Then the coefficient will be taken into account not only in the current policy, but also in all subsequent ones. Let's look at the table.

Legal basis

Regulatory documents that govern the MSC system:

- CTP Law, articles 9, 15.

- OSAGO rules,paragraphs 20, 35.

- Government Decree 739.

In addition, there is a detailed "Methodological manual of the PCA on training employees of insurance organizations No. 7".

Case in Rosgosstrakh

Several years ago, in one of the largest insurance companies - Rosgosstrakh, one day they decided that KBM was canceled when insuring OSAGO. Moreover, there was a convenient moment for unscrupulous insurers - other companies did not have forms available, so drivers had to buy a policy with a zero class in Rosgosstrakh.

Moreover, in some offices they also imposed additional insurance, as well as passing a technical inspection even in the case of a valid diagnostic card.

Justice was sought by those who stood up for their rights: in this case, the KBM class. Is it necessary to sue? For the court, as you know, it is necessary to have a base that consists of written evidence (you should write in advance to all instances in order to get an official position from them in writing), as well as witnesses, audio, video recordings, and the like. But more often such issues can be resolved without bringing the case to court.

Of course, it is not very profitable for insurance companies to pay a discount of up to 50% for accident-free. Therefore, employees go to various tricks to reset it. In addition, car owners can pay for their illiteracy. After all, some do not even know about the existence of KBM.

Therefore, if an error occurred and your KBM was reset, then the following steps must be taken to restore it:

- if since the mistakehappened less than a year, send a letter to the PCA with a request for verification;

- copies of the driver's license and the old policy with the correct KBM should be attached to the letter;

- if there is no answer for more than a few months, then you should contact the Central Bank of the Russian Federation, from where the correct KBM will be received with recalculation.

Conclusion

From the article we learned about KBM: what does the abbreviation mean, how is it calculated, what problems can there be with its design and how to solve them. “Forewarned is forearmed” - well, this is the case. Is KBM valid for OSAGO insurance today? Of course. Be careful when applying for insurance, do not succumb to pressure and do not settle for additional “options” that you do not need, and if a violation of the calculation of the BMF is revealed, dispute it and achieve the correct indicators.

Recommended:

How valid is the 2-personal income tax certificate for a loan: validity period, procedure for obtaining

How valid is the 2-personal income tax certificate for a loan, why else do people need it, and also, how can citizens get it? Such questions often arise from people. In short, this document is provided upon request to various organizations, it discloses information about the income of an individual

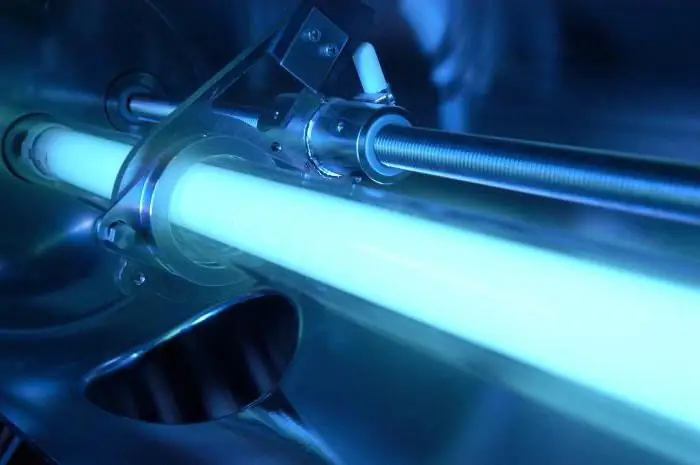

UV water disinfection: principle of operation, installation. Drinking water - GOST valid

Technologies in the field of water treatment do not stand still. Today, many methods are used to ensure the required quality of drinking liquids that meets the requirements of GOST. One of them is ultraviolet disinfection of water. It will be discussed in the article

Insurance: essence, functions, forms, concept of insurance and types of insurance. The concept and types of social insurance

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties

Can I pay with a Sberbank card abroad? What Sberbank cards are valid abroad?

The article describes the features of using Sberbank cards abroad. Considered the commission and its reduction

How to become an OSAGO insurance agent? What are the responsibilities of an OSAGO insurance agent?

Working as an insurance agent at home (OSAGO, CASCO, property policies and much more) is quite prestigious and in demand, and under certain conditions it can bring considerable income