2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:37

Advertising insistently assures us that any bank card holder can borrow money without interest for a fairly solid period, which can be one or two months, or even more time. Many suspect that this is nothing more than a publicity stunt. However, for serious banks, such frauds can significantly spoil the image. There is no deception here. It is only necessary to carefully study its terms before signing an agreement with a credit institution. So what is hidden under the attractive phrase: "grace period"?

Literally speaking, this is the period until the end of which you can use borrowed funds without paying interest on it. In theory, everything is simple, but in practice, credit cards with a grace period for crediting issued by different banks work differently.

What to look out for

Firstly, the concept of "grace period credit", as a rule, applies to transactions for paying for purchases with a card,not for cash withdrawals. Of course, there are exceptions, but before concluding an agreement, it is necessary to clarify this point.

The second mistake that many card users make is the assumption that you can use the money withdrawn from the card “for free” within the period stated in the advertisement. In fact, this is not always the case. So, if the grace period for lending is 60 days, this does not always mean that by withdrawing money from the card at any time, you can return it during this time and not pay interest.

In more detail, the "interest-free" use of borrowed funds consists of two stages:

- settlement (the time when you can spend money from the card);

- payment (begins after the settlement and is given to completely repay the debt).

It is these two segments that add up to the promised figure of 50, 60 or even more days of interest-free use of money. Everything is simple with the second stage, this is a fixed number of days indicated by the bank, often equal to 20. But the settlement period can be determined in different ways. If a new credit card has been received, the grace period may start at:

- card activation;

- first withdrawal from her.

In the future, this period can be defined in the same way in different ways and equal:

- remaining until the end of the calendar month the number of days;

- fixed number of days sinceperforming an action with the card (sometimes equals the billing period).

So, in the first case, if the amount was withdrawn on the 1st, then the grace period for it will be 50 days (calendar month + 20 days of the payment period), but if such an operation is carried out on the 15th, then the funds will remain (15 days until the end of the month + 20 days billing period=35 days).

In the second case, and this is typical of inexpensive plastic, the interest-free period can be only 20 days.

What is the benefit for the bank

It turns out: a certain amount of time you can use the borrowed funds for free. Why do lending institutions go for it? In fact, the grace period for lending is a service beneficial for both parties. The user has the opportunity to make purchases on favorable terms for himself (if he manages to pay off the debt on time). Well, the bank will receive its rather big percentage (over 20% per annum), if the client does not repay the debt at the end of the interest-free stage. By the way, if an amount of 30,000 rubles was withdrawn from the card, and 25,000 were repaid before the end of the grace period, then the interest for using the funds will have to be paid not from 5,000 rubles, but from the entire amount.

Thus, having carefully studied the conditions for providing funds, you can properly manage them.

Recommended:

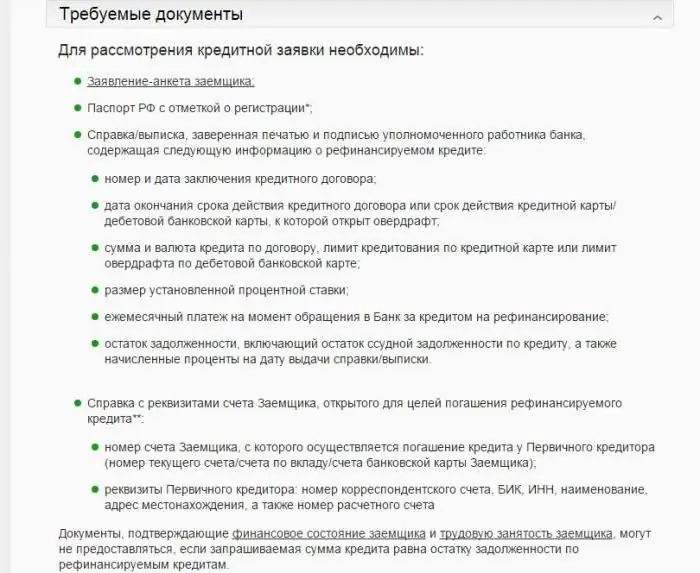

On-lending consumer loans. On-lending consumer loans with arrears

Unfortunately, there are often situations when, having issued a mortgage or other loan for consumer purposes, the client after some time realizes that he cannot cope with his obligations. There can be several ways out of this situation - from trying to arrange credit holidays to selling collateral. But there is another way out of the situation, perhaps the least painful - this is the on-lending of consumer loans (it is also refinancing)

Types of mortgage lending. Mortgage Lending Programs

Mortgage lending is now very common. Many people see this as almost the only hope for acquiring their own housing. There are many types of mortgage lending, each of which has its own characteristics

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

Features of credit cards. What is a grace period and how to learn how to use it correctly?

The number of all kinds of cards in the pockets of our citizens is steadily increasing, since cash lending is already much less popular than before. Credit cards today have become a much more popular tool, but the financial literacy of most Russians is still at a very low level. Even with “plastic”, many borrowers do not know what a grace period is and how to use it correctly

The best value credit card with a grace period. Overview of credit cards with a grace period

A credit card with a grace period, a profitable product offered by many financial institutions in Russia