2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

The profitability of any economic entity depends on the correct reflection and accounting of costs. Their optimization, control, distribution affect the cost of goods (services), reduce the risk of sanctions from the tax authorities. At the initial stage of activity, each company plans and forms a list of costs necessary for the implementation of production processes. An important aspect reflected in the accounting policy is the methods of distribution of overhead and general business expenses.

Cost classification

The pricing policy of the enterprise is formed taking into account the market situation regarding a certain type of goods, services or works, while the cost is regulated at the expense of the amount of invested profitor reallocation of business expenses. Production costs are a constant value, which consists of indicators of actual costs. The selling price (of works, services, goods) includes the cost price, commercial expenses and the amount of profit.

Each organization in the accounting policy forms provisions governing the accounting of expenses, methods of their distribution and write-off. Accounting regulations (Tax Code, PBU) recommend a list and classification of costs related to prime cost. The consumption rate of each article is established by the internal documents of the enterprise. The costs are systematized according to various criteria: by economic content, by time of occurrence, by composition, by the method of inclusion in the cost price, etc. To form a cost estimate, all costs are divided into indirect and direct. The principle of inclusion in the cost depends on the number of types of products manufactured by the company or services provided. Methods of distribution of direct costs (wages, raw materials, depreciation of capital equipment) and indirect costs (OPR and OHR) are determined in accordance with regulatory documents and internal regulations of the company. In more detail, it is necessary to dwell on general and general production costs, which are included in the cost price by the distribution method.

OPA: composition, definition

With a branched production structure aimed at producing several units of products (services, works),enterprises incur additional costs that are not directly related to the main activity. At the same time, accounting of expenses of this type must be maintained and included in the cost price. The ODA structure is as follows:

- depreciation, repair, operation of equipment, machinery, intangible assets for production purposes;

- maintenance, modernization of workshop premises;

- deductions to funds (FSS, PFR) and wages of personnel serving the production process;

- utility costs (electricity, heat, water, gas);

- other expenses directly related to the production process and its management (write-off of used equipment, IBE, travel expenses, rental of space, services of third parties, ensuring safe working conditions, maintenance of auxiliary units: laboratories, services, departments, leasing payments). Production costs are the costs associated with the process of managing the main, service and auxiliary units, they are included in the cost price as general production costs.

Accounting

Methods of distribution of overhead and general business expenses are based on the total value of these indicators accumulated during the reporting period. To summarize information on ODA, the chart of accounts provides for a cumulative register No. 25. Its characteristics: active, collectively distributive, has no balance at the beginning of the month and at the end (unless otherwise providedaccounting policy), analytical accounting is maintained by divisions (workshops, departments) or types of products. During a certain period, the debit of account 25 accumulates information on actually incurred expenses. Typical correspondence includes the following transactions.

- Dt 25 Kt 02, 05 - the accrued amount of depreciation of fixed assets, intangible assets was attributed to the ODA.

- Dt 25 Ct 21, 10, 41 - goods of own production, materials, inventory written off as production costs.

- Dt 25 Kt 70, 69 - salary accrued to the staff of the ODA, deductions made to off-budget funds.

- Dt 25 Kt 76, 84, 60 - invoices issued by counterparties for services rendered, work performed were included in general production expenses, the amount of shortfalls identified by the results of the inventory was written off.

- The debit turnover of account 25 is equal to the sum of actual expenses, which are written off to the calculation accounts (23, 29, 20) at the end of each reporting period. In this case, the following accounting entry is made: Dt 29, 23, 20 Kt 25 - the accumulated expenses are written off for auxiliary, main or service production.

Distribution

The amount of overhead costs can significantly increase the cost of products manufactured, work performed, services provided. At large industrial enterprises, the concept of “consumption rate” is planned and introduced, the deviations of this indicator are carefully studied by the analytical department. In organizations engaged in the creation of one type of product, methodsdistribution of overhead and general business expenses are not developed, the sum of all costs is fully included in the cost. The presence of several production processes implies the need to include all types of costs in the calculation of each of them. The distribution of overhead costs can occur in several ways:

- Proportionate to the selected baseline that best matches the ODA linkage and output (volume of goods produced, wage funds, consumption of raw materials or materials).

- Maintaining separate accounting for ODA for each type of product (costs are reflected in analytical sub-accounts opened to register No. 25).

In any case, the methods of distribution of indirect costs should be fixed in the accounting policy of the enterprise and not contradict the regulations (PBU 10/99).

OHP, composition, definition

Administrative and economic costs are a significant value in the cost of goods, works, products, services. General expenses are the sum of management costs, they include:

- maintenance and maintenance of facilities, buildings for non-industrial purposes (offices, administrative areas), rental payments;

- contributions to social funds and remuneration of management personnel;

- communication and Internet services, security, postal, consulting, audit costs;

- depreciation deductions for non-production facilitiesdestination;

- advertising (if these expenses are not related to commercial);

- office, utility bills, information services;

- expenses for staff training and compliance with industrial safety rules;

- other similar costs.

The content of the administrative apparatus is necessary for the implementation of production processes and further marketing of products, but the high proportion of this type of expenditure requires constant accounting and control. For large organizations, the use of the standard method of accruing OMS is unacceptable, since many types of administrative expenses are variable in nature or, with a one-time payment, are transferred to the cost of production in stages, over a certain period.

Accounting

Account No. 26 is designed to collect information about the company's management expenses. Its characteristics: active, synthetic, collecting and distributing. It is closed monthly to accounts 20, 46, 23, 29, 90, 97, depending on which methods of distribution of overhead and general business expenses are adopted by the internal regulatory documents of the enterprise. Analytical accounting can be kept in the context of subdivisions (departments) or types of manufactured products (work performed, services rendered). Typical account transactions:

- Dt 26 Ct 41, 21, 10 - the cost of materials, goods and semi-finished products was debited for OChR.

- Dt 26 Ct 69, 70 - reflects the payroll of administrative staff.

- Dt 26 Ct 60, 76, 71 - general business expenses include services of third parties paid to suppliers or through accountable persons.

- Dt 26 Ct 02, 05 - depreciation of non-production objects of intangible assets and fixed assets was accrued.

Direct cash costs (50, 52, 51) are generally not included in OHS. An exception may be the accrual of interest on loans and borrowings, while this method of accrual must be specified in the accounting policy of the enterprise.

Debit

All general business expenses are collected in monetary terms as a debit turnover of account 26. At the end of the period, they are written off to the main, servicing or auxiliary production, may be included in the cost of goods to be sold, attributed to deferred expenses, or partially directed to a loss enterprises. In accounting, this process is reflected in the entries:

- Dt 20, 29, 23 Ct 26 - OHS included in the cost of production of the main, service and auxiliary industries.

- Dt 44, 90/2 Ct 26 - general business expenses are written off in trading enterprises, to the financial result.

Distribution

General business expenses in most cases are written off similarly to general production costs, that is, in proportion to the selected base. If this type of cost is of a long-term nature, then it is more expedient to attribute them to future periods. The write-off will take place in certain parts attributable toat cost. Conditionally variable general business expenses can be attributed to the financial result or included in the price of the goods produced (in trade enterprises or those providing services). The method of distribution is regulated by internal documents.

1С

Currently, accounting for general production and general business costs is carried out in accounting databases and programs of the 1C group. Methods of distribution of indirect costs are regulated by special settings. When calculating the cost of ODP and RW, it is necessary to check the boxes in front of the approved base in the "production" tab. When writing off for expenses of future periods, it is necessary to set the period and amount. To include costs in the financial result, the corresponding tab is filled in. When the "period closing" function is launched, general production and general business costs accumulated on registers 25 and 26 are automatically debited to the specified accounts. This process forms the cost of the finished product.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Accounting for sales expenses. Analytical accounting on account 44

One of the key indicators in the analysis of the financial and economic activities of a trade enterprise is the amount of sales expenses. They are the costs associated with the creation and sale of products. Let's take a look at how sales expenses are accounted for

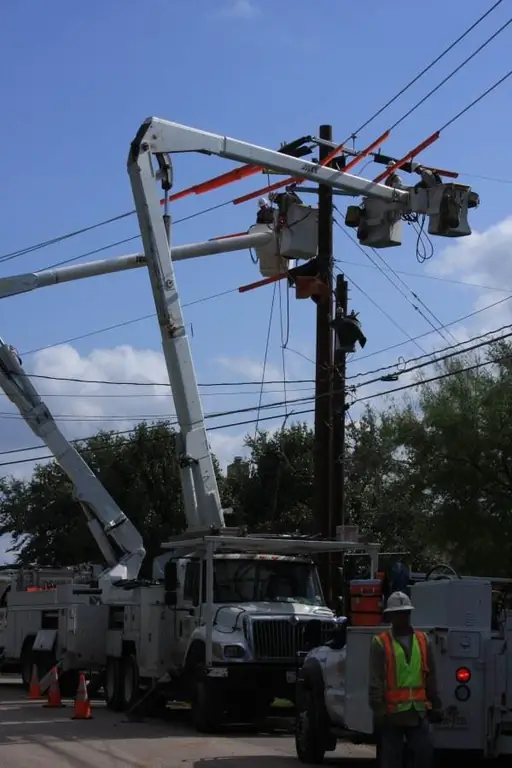

Electricity distribution: substations, necessary equipment, distribution conditions, application, accounting and control rules

Everyone knows that electrical energy is supplied to the place of its consumption from a direct source. However, such sources can be located at a great distance from the consumer. Because of this, the distribution of electricity and its delivery is a rather complicated process

Business expenses - what is it? What does business expenses include?

Selling expenses are expenses that are aimed at the shipment and sale of products, as well as services for their packaging by third-party companies, delivery, loading, etc

Accounting for working hours in the summary accounting. Summarized accounting of the working time of drivers with a shift schedule. Overtime hours with summarized accounting of wor

The Labor Code provides for work with a summarized accounting of working hours. In practice, not all enterprises use this assumption. As a rule, this is due to certain difficulties in the calculation