2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

Each commercial organization during the entire period of economic activity is interested in a thorough analysis of financial results. For timely monitoring of current income and expenses, several accounting accounts are used: 99, 90, 91. Obtaining reliable information about the structure, dynamics, volume of performance results is possible only if the data are correctly reflected on these accounts.

Account Feature

Account 90 "Sales" is the most complex in structure, which makes it possible to receive and evaluate the interim results of the enterprise. It should be noted that the main direction of work, which is spelled out in the statutory documents, is implied. This type of activity brings a constant financial result, which in the sum of the total indicator takes at least 5-7%, if the enterprise is able to engage in any type of work permitted by law. Asmain directions can be highlighted:

- Production of various types of products (goods, semi-finished products, raw materials, etc.).

- Providing a certain list of services (communications, transport, utilities, household, etc.).

- Performance of work of varying degrees of complexity on a contract basis (non-industrial and industrial).

90 the account is used to reflect the sums of all income from the main activity and expenses associated with it.

Reflection in accounting

Accounting account 90 is synthetic, active-passive, depending on the sub-account used in a particular situation. It does not have a balance (balance) at the beginning and end of the period, it is not reflected in the balance sheet. The main purpose of this account is to determine the financial (interim) result from the work of the enterprise for the current period. The calculated amount is carried over to form the overall profit or loss of the job. The economic result is calculated as the difference between the turnover of sub-accounts. 90 account has a distinctive feature: it is completely closed only in the process of balance reform, at the end of each calendar year. The debit of the account reflects all costs, the credit shows the income received (sales proceeds).

Analytical accounting structure

For correct operation, sub-accounts of account 90 are opened for the following positions:

- 90/1 "Trading Revenue";

- 90/2 "Production cost of goods";

- 90/3 "VAT";

- 90/4 "Excises";

- 90/5 "Export duties";

- 90/9 “Profit and/or loss on sales.”

Each sub-account is filled throughout the year with business transactions. The formed turnover at the end of each period closes at 90/9 and has no intermediate balance. The financial and economic result of the work for the month is calculated as the difference between the debit turnover and the total credit turnover on sub-accounts. Depending on the sign, the received value is posted to subaccount 9, which is closed to account 99.

Revenue

To reflect the assets recognized under PBU (accounting regulations) 9/99, sub-account 90/1 was created as income from the main activity. It takes into account the proceeds from sold products, work performed, sold goods, services, etc. The amount of income received appears on the credit of the subaccount in correspondence with account 62 "Settlements with buyers" on the debit. Postings can also be used:

-

account 90 posting Dt 76, Ct 90/1 “Proceeds from other debtors and creditors.”

- Dt 50, 55, 52, 51, Kt 90/1 “Receipts are credited to a settlement, currency, special account or to the cash desk of an enterprise.”

- Dt 79, Ct 90/1 “Income from a branch or subsidiary.”

- Dt 98, Ct 90/1 "Part of the proceeds received is attributed to the income of the next period" (for advance payments).

The total turnover on loan 90/1 is summed up and shows the proceeds from sales in the current month, which will later be used to calculate the financial result frommain business activities of the company.

Costs

The production (full) cost of manufactured products is formed on the calculation accounts and debited to accounts 41, 43, 45, 40. At this price, it is taken into account in the finished product warehouse, where it is stored until the moment of sale. When selling goods, products, providing various services and performing work, any organization incurs additional costs that are not included in the cost of manufactured products. This type of costs is called commercial costs, which arise as a result of the preparation and sale of products. These include, according to PBU No. 10/99, the costs of advertising, additional packaging, transportation and storage. Posting account 90 in this case generates the following:

- Dt 90/2, Ct 43, 40, 41 “Goods (finished products) written off at discount price.”

- Dt 90/2, Ct 42 “Trade markup carried out.”

- Dt 90/2, Ct 44 “the amount of commercial (implementation) expenses has been accrued.”

Trade enterprises do not form the cost of production, assets purchased for sale are reflected in the 45th account. Upon sale, all additional (commercial) expenses are charged to Ct 44 Distribution Costs.

Taxes

If an enterprise, in accordance with the procedure established by law, is a payer of excise duty, VAT, then the sale of works, products, services is carried out with the inclusion of these types of tax in the total cost. 90/3, 90/4 taxes billed to buyers are taken into account. In the case of conducting international trade by the enterprise, the export duty is taken into account on the account90/5. When VAT 90 is charged, the account corresponds when making a business transaction with the following posting:

Dt 90/3, Ct 68 “The amount of VAT on sold products has been set.”

All taxes payable to the budgets of various levels are reflected in a similar way.

Balance Reformation

90 the account is closed in stages, first of all, the turnover for the current period for each sub-account is determined. Each of them is closed by wiring at 90/9. Account 90 is closed in a certain order, according to the scheme:

- The sum of operations on the subaccount 90/1 is calculated, the subaccount is closed by posting Dt 90/1, Kt 90/9.

- The turnovers on expenses are summed up and the total values are posted Debit 90/9, Credit 90/2, 3, 4, 5.

- Turnovers on all sub-accounts and balances 90 must be equal to zero.

- On the 9th sub-account, we determine the financial result, which is calculated as the amount reflected in Dt - the turnover of the account Kt. Depending on the result, it is written off to the account 99.

- S/A balance 9 “Profit, loss on sales” should close at the end, i.e. be equal to zero.

Account 90 is not reflected in the balance sheet, all final registers must be checked, perhaps for the calendar year, as a result of an error, this account has an unclosed turnover. If such an amount exists, then it must be written off by the corresponding posting, the balance sheet must be reformed before reporting. At the same time, the total value of account 91 “Other expenses and incomes” is written off, inas a result of closing 90 and 91 accounts, the financial result from the work of the organization for the current year is formed by 99.

Accounting automation

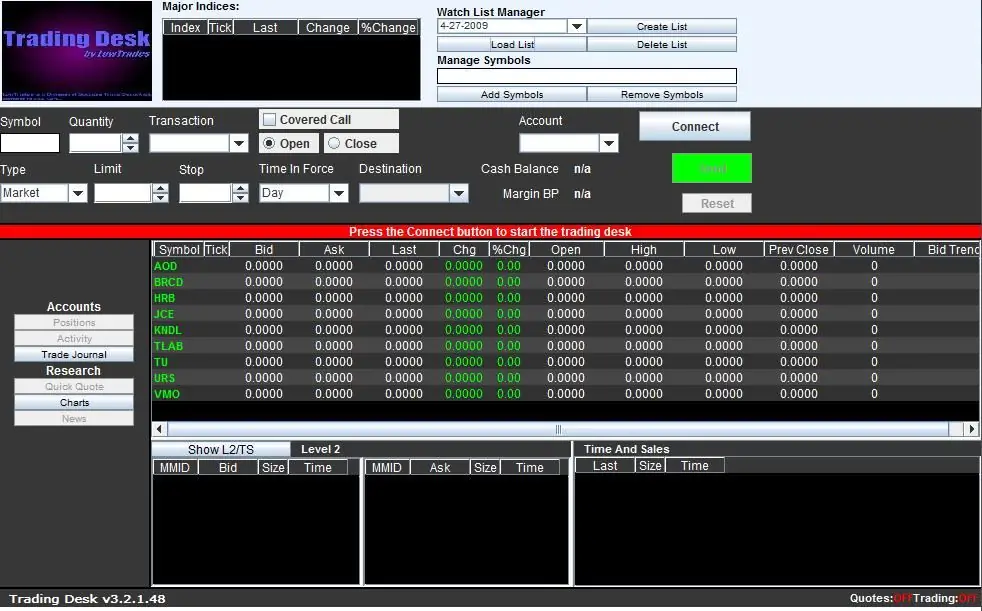

The work of a modern accountant implies the competent use of specialized programs. All necessary accounts are closed automatically when the period is closed. The duties of an accounting employee include a thorough check of the results of the conduct and reflection of business transactions. The study of the balance sheet and analysis of the account will make it possible to track the correctness of the successive closing of accounts in order to obtain an accurate result of the work. Account 90 is written off before the balance sheet is drawn up, it is of great importance for obtaining objective information. Therefore, the process of reforming the balance sheet is especially important for the chief accountant. It implies not only the correct closing of the account, but also the verification of its maintenance throughout the entire period.

Recommended:

Just2Trade: reviews, account opening procedure, personal account

Choosing a broker is a very responsible step. Every beginner who has made the decision to become a trader faces it. To understand the degree of reliability of any brokerage company, you need to study the information and find out reviews about it

How does an individual entrepreneur withdraw money from a current account? Methods for withdrawing cash from the current account of an individual entrepreneur

Before you register yourself as an individual entrepreneur, you should take into account that withdrawing funds from the current account of an individual entrepreneur is not quite easy, especially at first. There are a number of restrictions, according to which merchants do not have the right to withdraw funds at any time convenient for them and in any amount. How does an individual entrepreneur withdraw money from a current account?

Individual personal account in a pension fund: checking and maintaining an account, the procedure for obtaining statements and certificates

If you want to know how things are going with your pension savings, in order to find out what your pension will be or what it is now, then you just need to find out about the status of your individual personal account in the Pension Fund. And here's how to do it, will be discussed in the article

91 account - "Other income and expenses". Account 91: postings

Analysis of the profit or loss received by the enterprise based on the results of the reporting period should be based on the structure of this indicator. This will provide an opportunity for further planning of expenses and stabilization of income values

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?