2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:38

Today we have to figure out how to pay property tax. Consider all possible scenarios for the development of events in relation to individuals. After all, taxes not paid on time can lead to a number of negative consequences. And therefore it is better to immediately find out how to pay the state for the existing property. Doing this with the right preparation is not difficult.

Payment due dates

First, let's try to find out until what date the bills will have to be paid. In Russia, there is a certain deadline for paying property taxes.

In 2017, citizens must make the relevant payments by December 1 inclusive. Otherwise, they will have to list more pen alties. They are credited daily.

About payment transfer facilities

How to pay property tax? You can deal with the task in different ways. Usually the answer directly depends on the skills of a particular person, as well as on his personal preferences.

Today you can pay taxes:

- personally;

- via the Internet.

Most often, citizens act independently. But the payment of property tax receipts throughthe Internet is also in demand.

Online payment methods

A few words about what Internet resources will help to cope with the task. It is necessary to know about them due to the fact that the Web is full of scammers. And sometimes citizens simply transfer money not to the Federal Tax Service.

How to pay property tax? Receipt of payment in the hands of a citizen? Then on the Internet it is recommended to look at the following resources:

- "Public Services";

- "Sberbank Online" (and other Internet banking services);

- "Payment for public services".

These 3 sites are in high demand. They work flawlessly today. Below we will explain how to use them to pay taxes.

Pay in person

But that's not all. Every modern citizen can personally pay tax payments. This is a fairly common scenario.

How to pay property tax? For example, you can do it like this:

- go to the cash desk of any bank;

- use a special payment terminal (available in most Federal Tax Service);

- use ATMs/terminals of financial institutions;

- carry out an operation on the Russian Post.

It's actually easier than it looks. Next, we will consider in more detail all of the listed methods of paying taxes. And after that, everyone will be able to decide what suits him.

Necessary for payments

Let's start with a little preparation. Without it, some problems may arise in the process of paying property taxes.

What will be useful for making the studied payments? It is mandatory to have with you:

- citizen's passport;

- tax amount;

- Details of the recipient's Federal Tax Service;

- tax type.

Ideally, a citizen should have a tax receipt. Its presence greatly simplifies life. After all, in such a document there are details of the recipient of funds, and the amount due for payment.

For some payment methods, you will need to find out your TIN. It is not necessary to have a certificate of the established form. A simple tax number is sufficient. As a rule, it can be seen on the payment receipt. Such papers are sent no later than one month before the deadline for transferring money to the Federal Tax Service. In our case - until November 1.

Cashier

How to pay property tax through Sberbank? You can contact the cash desk of this financial institution and deal with the task.

This will require:

- Take the papers listed above with you. Don't forget about money.

- Apply to the cash desk of any branch of Sberbank for individuals.

- Give tax receipt and money.

- Show your passport.

- Get your change, receipt and payment receipt.

That's it. This is usually done in cash. And it requires significanttime costs. Therefore, this method is not in great demand.

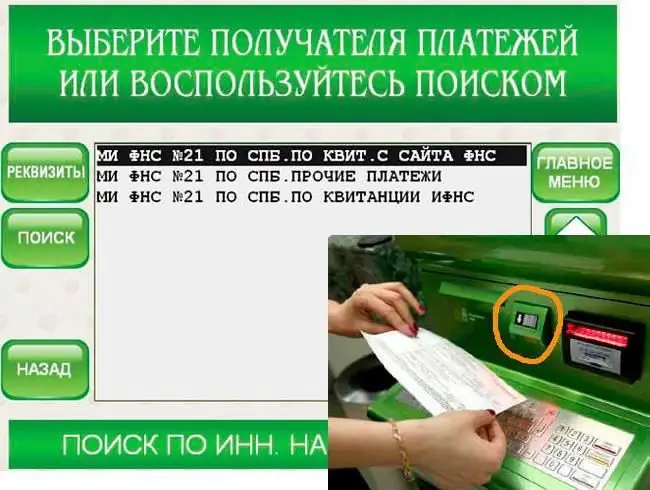

Terminals and ATMs

Where to pay personal property tax in Russia? For example, in Sberbank. More precisely, in its terminals and ATMs.

Such methods usually involve cashless payments. But you can also pay with banknotes. But how?

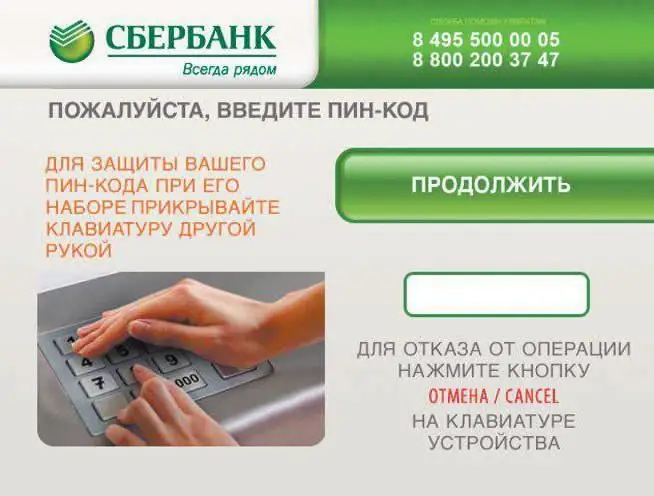

The ATM property tax guide looks like this:

- Insert a plastic card into ATM from Sberbank.

- Enter PIN code.

- Go to the "Payments in my city" block.

- Click on "Taxes, duties".

- Go to the "Taxes" section. Sometimes this step is missing due to the peculiarities of the ATM system.

- Click on the "Search payee" button.

- Specify a convenient search method. For example, "By TIN".

- Dial the TIN of the recipient of the money.

- Click on the "Search" button.

- Select the desired recipient, click on "Next" and check the "Property Tax" option.

- Indicate data about the payer.

- Enter payment amount.

- Check details.

- Confirm payment.

- Collect check from ATM.

Everything is extremely simple and clear. You can search for the recipient "By the number of the payment order". Then the bulk of the listed steps will be skipped - the system will fill in some of the fields automatically. You can choose to search"by barcode". After that, it is necessary to bring the tax payment receipt to a special reading laser. And then it will be possible to immediately start checking the details of the recipient.

How to pay property tax through the payment terminal? The previously proposed instructions will help to cope with the task. The difference is that after checking the details, the user will have to deposit banknotes into the bill acceptor, as well as indicate the phone number for transferring change.

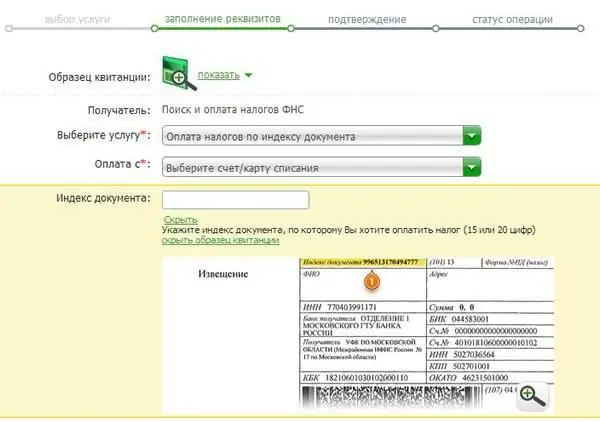

Internet banking

How to pay property tax? Sberbank Online is a service that almost every modern user is familiar with. And he will help to cope with the task.

To bring the idea to life you need:

- Get login and password from Sberbank Online. For example, by registering in the system through an ATM.

- Go through authorization on the Internet banking site from Sberbank.

- Go to "Payments and transfers".

- Click on "FTS, taxes".

- Select "Pay Tax".

- Specify how to search for payment information.

- Fill in the fields that appear.

- Click on the "Search" button.

- Click on "Proceed to payment".

- Fill out the form. All fields have hints.

- Confirm payment.

- Save or print your tax receipt immediately.

Fast, simple and very convenient. But this alignment is not used by everyone. In the Internetfull of resources to pay taxes and other receipts.

Payment for public services

For example, there is a website called "Payment for Public Services". With its help, it will be possible to quickly answer the question of how to pay property tax via the Internet. The service does not require registration, does not charge a commission, allows you to make transactions using bank cards or using Internet wallets.

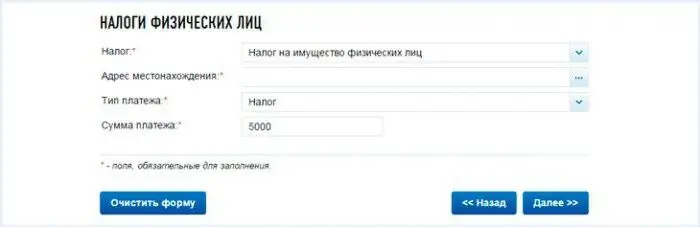

The algorithm of actions in this situation will look like this:

- Open the page oplatagosuslug.ru in the browser.

- At the top of the window, click on "Taxes".

- Check the box next to the appropriate way to search for information. For example, "By TIN".

- Fill in the fields that appear on the screen.

- Press the "Search" button.

- Click on the appropriate payment.

- Click on the "Pay" button.

- Select a payment method.

- Specify the details of the account from which the money will be debited. Usually we are talking about data from bank plastic.

- Perform payment confirmation.

In a minute the user will be able to save the receipt to his computer. And only after that print it. Money for property tax is debited from the specified card/wallet immediately.

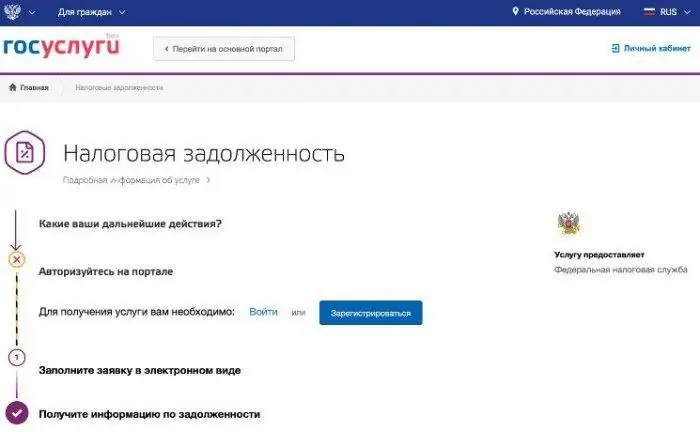

"Public services" to help

And how to pay property tax through "Gosuslugi"? This question is asked by many modern citizens of the Russian Federation. After all, if a personthere is a profile on this portal, he will not receive paper receipts for paying taxes. And then it's easier to deal with the payment through the "Public Services Portal".

The most difficult thing here is to register on the service and verify your identity. These procedures take about 15 days. Therefore, you will have to worry about registration in advance.

How to pay property tax through "Gosuslugi"? Once a person has a verified profile, they will need:

- Go to gosuslugi.ru.

- Go through authorization in the "Personal Account".

- Open personal account. It is located in the upper right corner.

- Click on the "Tax Debt" block.

- Select "Property tax".

- Click on the "Pay" button.

- Specify the method of transferring funds.

- Enter your account details.

- Press the "OK" button.

This is the fastest way to solve the problem. All tax debts are displayed in the "Personal Account" on the "Public Services". After the transaction, the new data will appear in the system in about 2 days. Therefore, the debt check will have to wait.

You can go to the block "Public services" - "FTS" - "Search for debts". By specifying the TIN of the taxpayer here, it will be possible to find all taxes that are currently unpaid. Further algorithm of actionswill be exactly the same as above. Where to pay personal property tax? Now the answer to this question will not cause trouble!

Recommended:

What is a property deduction, who is en titled to it and how to calculate it? Article 220 of the Tax Code of the Russian Federation. property tax deductions

Russia is a state in which citizens have a lot of rights and opportunities. For example, almost every citizen of the Russian Federation has the right to receive a property deduction. What it is? Under what conditions can it be issued? Where to go for help?

Property tax on children: should minor children pay property tax?

Tax disputes in Russia are something that brings quite a lot of problems to both the population and the tax authorities. Payments for the property of minors require special attention. Should children pay taxes? Should the population be afraid of non-payment of the specified fee?

Property tax for pensioners. Do pensioners pay property tax?

Pensioners are eternal beneficiaries. Only not everyone knows what their capabilities extend to. Do pensioners pay property tax? And what rights do they have in this regard?

What is the property tax for retirees? Reimbursement of property tax for pensioners

Taxes are an important obligation of citizens. Almost everyone has to pay. Some categories of citizens are completely exempted from these obligations, someone only receives a tax rebate. What can be said about pensioners?

Types of property insurance. Voluntary insurance of property of citizens of the Russian Federation. Property insurance of legal entities

Voluntary property insurance of citizens of the Russian Federation is one of the most effective ways to protect your interests if a person owns some property