2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Financial institutions, mainly banks, with the development of the economy, take the status of co-owners of industrial-type enterprises, trade, transport and others by acquiring shares and bonds. The owners of enterprises, in turn, acquire ownership of shares and bonds of banks that are directly related to them. This leads to the formation of an interweaving of capitalist capital and industrial capital. As a result, a new type of capital appears - financial.

Interlacing of capitals - the formation of personal unions

The interweaving of banking and industrial capital leads to the formation of personal ties between the owners of industrial monopolies and the founders of banks. Some individuals dominate the largest monopoly industrial enterprises, over banking institutions, over other companies from the branches of the capitalist economy. The phenomenon was called "financial oligarchy". This is not an isolated situation in any country. The scale of interweaving of material assets is international.

Oligarchy in the world

Financialoligarchy is a phenomenon that is clearly manifested in many countries of the world. Consider Germany, where on the eve of World War I, 6 banks had representatives in management positions in 344 companies from the industrial sector, 407 representatives in the government and 751 representatives in the public sector. The number of managing banks included at least 51 industrialists. Union flourished for a long time. The US financial oligarchy had a different format. A narrow group of four hundred people, which included industrialists and bankers, held about 705 leadership positions in 250 companies that owned 42% of the country's total capital.

In each of the capitalist countries, all vital branches of the economy and the vast majority of social we alth are under the control of the union of influential bankers and industrialists. The management of the capitalist monopoly is the financial oligarchy. This is not an exact definition, but in a literal translation, the phrase is interpreted as “the dominance of the few.”

Financial oligarchy is a widespread phenomenon and characteristic of most countries of the world, including Russia. Due to the fact that Russian capital is the youngest of all European capital, it was forced to use the help of foreign capital even in pre-revolutionary times. Foreign loans are actively used today both as a subsidy and as assistance to private production. Russia's interest in loans made the state attractive to Western European groups. So the financial oligarchyThe country is concentrated for the most part abroad and interacts closely with foreign capitalists.

The situation in the economy

The dominance of a few affects all branches of the state, including the economy. The financial oligarchy, the definition of which depends on the direction of its influence, is reflected in the economy in the format of the “participation system”. The essence is based on the possession of a group of people by the main joint-stock company that heads the concern. The same company, owning controlling stakes, also has power over “subsidiaries”, which also have their own trust capitals. The financial oligarchy and the methods of its domination allow financial tycoons to manage huge amounts of other people's money.

Formation of an oligarchy

In the USA, the oligarchy includes 8 financial groups, in England the reins of government belong to several hundred people, in France there are 200 well-known families, in Italy - a little less than 150. The financial oligarchy is a complex management structure, the formation of which is given great importance. Branch unions and cultural associations, belonging to orders and all kinds of clubs contribute to strengthening the structure. The integrity of the ideological society makes it possible to extend power from the sphere of production to the superstructure. It is social life that submits to such subjective associations as the financial oligarchy. Importance is attached even to such moments as the education of technical personnel and the cultivation of intellectuals.

Acceptancesociety

For the adoption of a narrow government apparatus by society, an artificial public opinion is formed with the help of popular media. A kind of psychological base is being formed, which subordinates entire states to the dominance of the elite. The political ruling class maintains its powers through ideological influence. This is not only the media, which was mentioned above, the impact on society is exerted by schools, assistance in everyday life. So, people who hold leadership positions, but do not support revolutionary sentiments, automatically become part of the ruling apparatus.

Financial oligarchy is a massive phenomenon

The financial oligarchy actively uses the principles of virtual monopoly, while receiving huge and constantly increasing incomes from the organization of joint-stock companies, from the issuance of shares with bonds, from the provision of government loans and large-scale government orders. Concentrated in the strongest hands, finance capital constantly collects tribute from the public and is to some extent the top of the monopoly bourgeoisie.

Forms of governance of world society

The financial and industrial elite exercises constant control over decision-making not only in the field of economic policy, but also in the social sphere. It fuses into a single whole the economic strength of the monopolies and the state bourgeois power. Programs of the state and monopolyregulations are designed to eliminate conflicts in capitalism, serve, in the end, the interests of powerful people.

One of the few phenomena in the world that covered all countries at the same time is the financial oligarchy. What it is, it will be possible to figure it out if we evaluate the scale of its influence on world society. The elite, in whose hands the entire fixed capital of the country is concentrated, actively pursues the internationalization of any activity and strengthens integration processes, systematically develops international industrial and banking monopolies. This forms the emergence of financial groups of international level. This strengthens the interweaving of interests of oligarchs from around the world, which contributes to the formation of an incredibly strong power.

Changes in the structure of the oligarchy in the process of evolution

The financial oligarchy in Russia, in America, in other countries of the world is changing over time as state-monopoly capitalism develops and as a result of the evolution of the capitalist property format. Back in the periods of imperialist dominance, the oligarchy of the financial industry was built mainly on the basis of the institution of the family and the dynasty. As an example, we can cite the Rockefeller and Dupont, Mellon and Peugeot groups, and others. The concentration of production and the increase in the volume of fictitious capital, in combination with the competitive struggle between monopoly unions, brought to the fore the regional principle of forming and strengthening the position of the oligarchy. The strengthening trend wasseen in the post-war period 1939-1945. Here, the following financial groups have taken the dominant positions in the world: Chicago and California, Boston and Bavaria, and others. Against the backdrop of growing competition already in the 50-70s. the family-dynastic principle of the formation of financial groups is being revived and activated. Example: the empire of the Getty and the Hunts, Thurn and Taxis, Kulman-Shtum. During this time period, the introduction of the world's largest managers into the structure of the financial oligarchy was recorded. The domination of the financial-type oligarchy has aggravated and continues to aggravate the contradictions not only between the proletariat and the bourgeoisie, but also conflicts between developing states and developed ones.

Recommended:

Forecasting and planning finances. Financial planning methods. Financial planning in the enterprise

Finance planning combined with forecasting is the most important aspect of enterprise development. What are the specifics of the relevant areas of activity in Russian organizations?

OECD: transcript indicates world domination

History and modernity of the Organization for Economic Cooperation and Development. Are the OECD's claims of world domination justified?

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Financial leverage or financial collapse?

Throughout the times, technologies, cultures, lifestyles and beliefs have changed, but only one thing has remained unchanged - money. For centuries, they have been daily present in people's lives, performing their functions

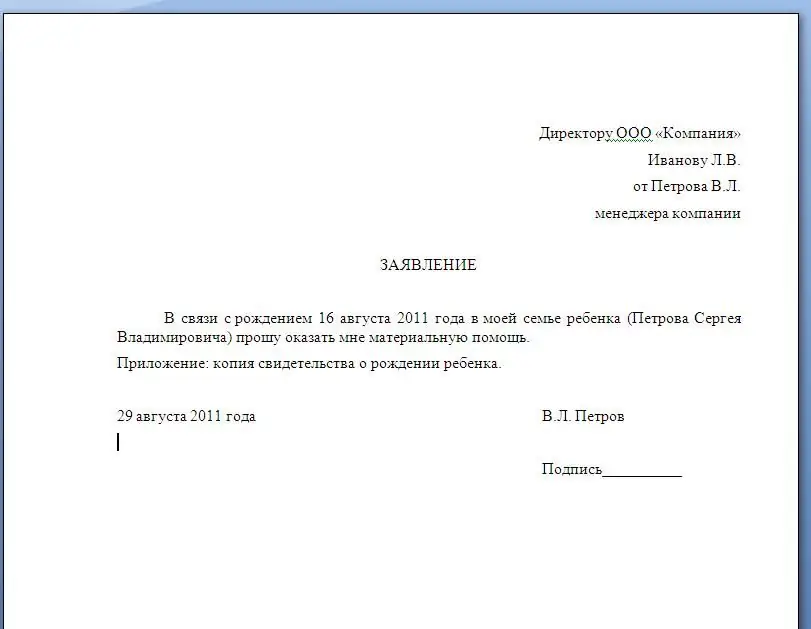

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer