2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways. Let us consider further how the provision of gratuitous financial assistance is carried out.

General classification

Increasing working capital can be done in four ways. So, the company can receive gratuitous financial assistance, contributions to the authorized capital, a loan and a contribution to property. All these transactions are reflected in accounting records in different ways.

Financial grants

As a general rule, such property of an organization should be recognized as its non-operating income. This provision is established in Art. 250, paragraph 8 of the Tax Code. Under the property in this case, it is necessary to understand the objects of civil law (except real), whichbelong to this category according to the Civil Code. Therefore, this includes cash. At the same time, when taxing income, the company does not arise if:

- The share of the participant in the authorized capital is more than 50%.

- From the date of purchase of property throughout the year, it will not be transferred to third parties.

It should be noted, however, that financial grants will no longer be included in income if the participant's share condition is met. At the same time, money can be transferred to third parties at any time.

Financial assistance free of charge: postings

Money donated by a member of the company acts as other income. Free financial assistance from the founder is recognized on the date of receipt. However, according to the Instructions for the application of the Chart of Accounts, they are reflected in the accounting for the account fixing income in future periods (98), sub-account 98-2.

Controversial moment

Financial assistance free of charge, according to the Civil Code, is regarded as a donation. This provision is given in Art. 575, item 1. At the same time, gifts worth more than 3,000 rubles are prohibited between legal entities. This instruction is contained in sub. 4 of the said paragraph of this article. In accordance with this, the tax service often refuses to implement subpara. 11, paragraph 1. of Article 251 of the Tax Code regarding property received free of charge from the founding legal entity. It should be noted here that arbitration practice has not developed a unanimous opinion on this issue. Representatives of the FAS from the North-Western District considered that if NKallows the receipt of property free of charge by one domestic organization from another, subject to the necessary conditions, then subpara. 4, paragraph 1 in Art. 575 of the Civil Code is not subject to application. The judges of the Moscow District, in their decision, indicated somewhat different facts. In particular, in their opinion, the implementation of sub. 11, paragraph 1, of Article 251 of the Tax Code is only permissible if financial gratuitous assistance is transferred in compliance with the provisions of the current legislation on the prohibition of donations.

Contribution to property

It can be carried out without changing the value of the UK, as well as the nominal value of the shares in it. In this case, this refers to the obligation of the founders to invest in common property by decision of the meeting. Contributions are made by participants in proportion to the shares they own in the authorized capital, unless another condition is prescribed in the Charter. In accounting, gratuitous financial assistance from the founder in the form of a contribution will not be recorded as company income. The contribution of the participant is subject to reflection in the debit of the accounts of property accounting and the credit of the account for additional capital. This, in turn, means that the decision to transfer deposits leads to an increase in the size of the firm's net assets. The procedure for their determination by law is not established. In this regard, LLCs may apply the rules applicable to joint-stock companies. The value of net assets should be taken as the value obtained by deducting liabilities from working capital taken into account. In essence, the amount shows the size of the equity capital of the company. At the same time, according tosub. 3.4, clause 1, article 251 of the Tax Code, income, which is property transferred to the company to increase working capital, including the formation of additional capital, is not taken into account when taxing profits.

Loan

A participant can provide a firm with temporary financial assistance by signing a loan agreement with it. This provision is provided for in Art. 808, paragraph 1 of the Civil Code. In accordance with the general rule, a participant, acting as a lender, has the opportunity not only to return the amount, but also to receive interest. Their size and procedure for accrual are established in the contract. However, the same agreement may provide for financial assistance free of charge. The terms of such a loan should be spelled out in the contract directly. This is prescribed by Art. 809, paragraph 1 of the Civil Code. Financial grant assistance in the form of a loan will not act as income for the company. The repayment of the loan is not recognized as an expense. In the same way, the loan received is not included in the income taxed on profits under the Tax Code. At the same time, the expenses aimed at its repayment reduce the base on it. At the same time, with the gratuitous use of funds by the company's income under Art. 41 NK will save on interest. In ch. 25 does not establish the procedure for assessing and determining the material benefit that the enterprise will receive in this case. In this regard, such profits are not taken into account in taxation.

Capital investment

At the general meeting of the founders, it can be decidedincrease the MC by making additional contributions. For this, according to the general rule, at least 2/3 of the votes of the total number of owners of the company are required. The Charter, however, may provide for a higher number. The total value of deposits, the ratio between it and the amount by which the nominal value of the share of each will be increased is determined directly in the decision for all founders. This provision is found in Art. 19, paragraph 1 of the Federal Law No. 14. Each founder has the opportunity to make an additional contribution, which will not exceed the total cost of the additional. contributions, in proportion to its own share in the company's charter capital. This right must be exercised no later than 2 months after the adoption of the above decision. Within a month from the end of this period, the meeting must approve the results of the additional payment. contributions and corresponding changes in the constituent documentation of the enterprise. Within the same period, an application for registration of these adjustments must be sent to the tax service. The changes will take effect only after state registration. Generalization of information on the state and movement of the company's capital is carried out on account 80. Entries on it are made after the registration of changes in the constituent documents adopted at the meeting.

Taxation of additional deposits

Cash generated this way will not increase the base. However, the founders-legal entities will have to pay tax on the amount of the increase in the nominal value of their share. SimilarThe rule also applies to individual participants. This amount will be subject to income tax. In this case, the obligation to calculate, withhold and pay will lie directly with the company, acting in this case as a tax agent.

Recommended:

Is financial assistance taxed: legal regulation and laws

What is considered material assistance and personal income tax? To whom is it issued? Legislative regulation of the issue. What kind of support is not subject to income? In what cases should the state help? How to apply for financial assistance? How is the decision to appoint her made? What is the amount of the allowance? What kind of financial assistance can citizens of the Russian Federation count on?

Government assistance to small businesses. How to get government assistance for small businesses?

Today, many people are not satisfied with being hired, they want to be independent and get the maximum profit. One acceptable option is to open a small business. Of course, any business requires initial capital, and not always a novice businessman has the necessary amount on hand. In this case, help from the state to small businesses is useful. How to get it and how realistic it is, read in the article

Material assistance to an employee: payment procedure, taxation and accounting. How to arrange financial assistance for an employee?

Material assistance to an employee can be provided by the employer in the form of cash payments or in kind. Sometimes it is issued to both former employees and persons who do not work at the enterprise

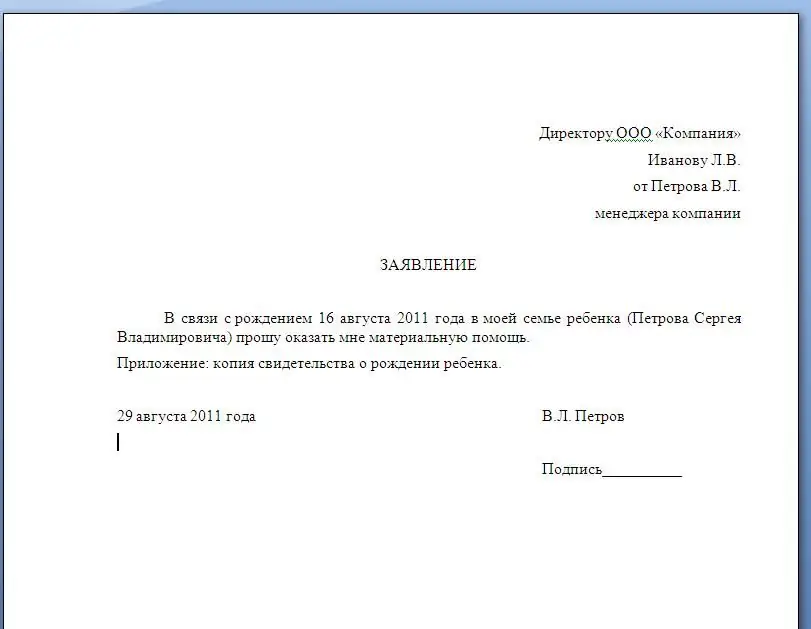

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

"RosDengi": reviews of debtors. Microloans - financial assistance or slavery?

In the context of this article, we will consider, firstly, the thesis that microcredit is another form of slavery or a really profitable financial instrument with which you can solve your problems; secondly, we will characterize one of the largest microloan companies called RosDengi. Reviews of the debtors of this institution, as well as information from open sources will help us better understand this issue