2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Tax audits are not the most pleasant aspect that arises in the course of a company's business activities. Even if the tax authorities do not come to visit, they continue to pay close attention to the reporting and movement of the company's turnover. For this purpose, tax claims are intended, which are a mini-variant of a remote check called by numbers incomprehensible to the system.

Why is it necessary to respond to demands?

A tax claim arrives at an enterprise in different ways:

- by mail;

- through the electronic document management system;

- by courier.

Under current law, since 2017, the company is obliged to respond to requests from the Federal Tax Service. If earlier inspectors recommended not to ignore their requests, since such companies could arouse increased interest from the control authorities, then from 2017 the absence of an explanatory note to the tax office upon request within the deadline set for the response will lead to a fine of 5,000 rubles at the firstfaults. Repeated late response within a year increases pen alties to 20,000 rubles. In addition, the IFTS can block the company's bank accounts.

Required explanation attributes

Due to the tightening of rules, a sample of an explanatory note to the tax office on demand has become in demand among accountants and lawyers. In fact, the IFTS does not have a mandatory clarification template, but there are response rules. Their claims to the design of the explanatory note include a number of mandatory items:

- letterhead;

- details and contacts of the enterprise;

- presence of outgoing number and date of the note;

- mention in the body of the letter of the details of the received requirement for the promptness of identification;

- deciphering the position and signature of the person who put the stroke on the letter.

In what form to write explanations, the taxpayer decides. The answer mainly depends on the nature of the requirement. In any case, we must remember that it is not good to answer the demand with empty phrases. The taxpayer must refer to specific facts, figures and the letter of the tax code, providing documentary evidence.

When documents are required?

When receiving a request for the submission of documents, you need to know that the tax authorities have the right to demand materials only during an on-site or desk audit. Such requirements include:

- counter checks;

- Identified discrepancies in reporting;

- applying tax incentives by the firm;

- eventstax control.

In other cases, the organization is not required to provide documents and may directly indicate this circumstance in its response. An explanatory note to the tax office upon the request for the provision of documents is drawn up depending on the nature of the information. But, in any case, copies of the requested materials must be attached to such a note.

How are apps designed?

The presentation of evidence must be strictly within the law. If the taxpayer refers to the documents, then he must list them in the body of the explanatory note. A duly compiled set of copies of materials is attached to the letter. Documentation is copied onto blank sheets, stapled, numbered. On each page is affixed:

- Ordinal number.

- Copy is correct.

- Transcription of position and signature of the certifying copy.

- Signature.

- Seal of the organization.

The set is accompanied by a copy of the power of attorney of the person who certified the documentation. If the letter was signed by an employee who does not have the right to do so in the IFTS, then you must attach a copy of the power of attorney to perform actions.

Answer with counter check

When writing responses to requests, you must comply with some conditions related to the nature of the requirement. If a company receives a request for a cross check, the company is obliged to provide the necessarydocumentation. In this case, a sample explanatory note to the tax office at the request of a counter audit will look like a list of copies of the submitted materials. Of course, it is necessary to mention the name, TIN / KPP of the company, the period being checked.

It is not recommended to provide information that is not asked for, even if you want to share. The responsible person must answer the questions as concisely and clearly as possible, strictly according to the points of the requirement. A lot of bewilderment is usually caused by the desire of the tax authorities to find out the nature of the counterparty's activities, additional contacts, staffing.

Lawyers do not recommend providing such information, referring to the fact that the organization is not required to be aware of what is happening with the counterparty. Therefore, in the explanatory note to the tax office on demand, the reference will be to the information contained in the contract with the counterparty.

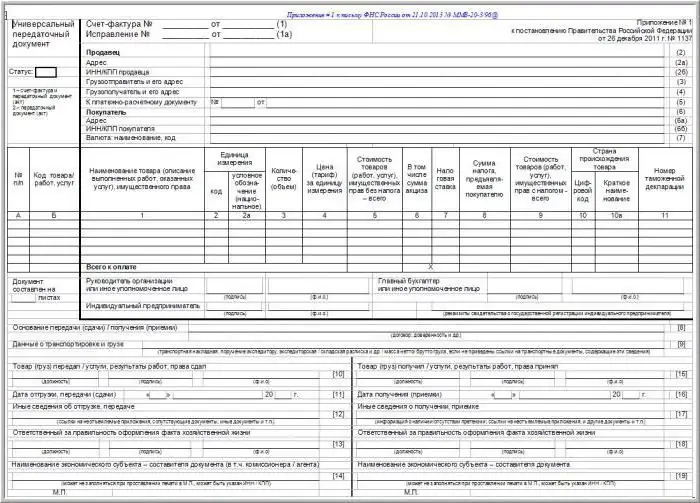

If a VAT claim has arrived

If you were “lucky enough” to receive a claim regarding value added tax, then, most likely, errors and inconsistencies were found in the submitted declaration. Since 2017, all VAT correspondence has been conducted electronically via telecommunication channels. The inspector will not accept a paper response as this is prohibited by law. If errors are found in the declaration, the taxpayer is obliged to submit an updated calculation with the appendix of books of purchases and sales within the time limits established in the requirement.

In addition, he must upload a scanned copy of the explanation. Sampleexplanatory note to the tax office on demand for VAT must contain the following justifications:

- causes of errors and inconsistencies;

- taxable difference affected by clarification;

- tendency of tax towards arrears or overpayments;

- promise to correct the declaration;

- list of attached scanned copies of documentary evidence, if any.

Documentation is uploaded to the TCS in separate files in accordance with ownership and details. It must be remembered that the electronic delivery method does not exempt copies from certification in accordance with all the rules.

Can I check personal income tax?

A sample explanatory note to the tax office on demand for personal income tax must also correspond to the requested information. Unlike VAT reporting, personal income tax statements are not tax returns, so the IFTS cannot conduct desk audits. However, she has the right to check the correctness of the preparation of certificates and the calculation of tax.

If the organization received a claim for personal income tax, it means that there were errors in the calculations when compiling the certificates. These errors can be:

- discrepancies between calculated, withheld, paid tax;

- incorrectly applied deduction;

- significant reduction in personal income tax compared to the previous period.

Responding to the request of the fiscal authorities, it is necessary to make corrections to the certificates and indicate this in a note. In this case, you will have to list by name each employee for whom a mistake was made, and enteraccounting adjustments.

How to respond to other taxes?

A sample explanatory note to the tax office on a demand regarding other taxes is approximately similar to the answer for VAT. Since all submitted reports are subject to desk verification, it is first of all necessary to exclude the possibility of making mistakes. If the taxpayer is nevertheless mistaken, then he is obliged to submit updated calculations within the specified period. In the response, the company mentions how the new calculations will affect the amount of tax in terms of amounts.

To its sample explanatory note to the tax, upon request, the organization attaches certified copies of evidence. It happens that a tax inquiry regarding discrepancies in reporting is caused by the legal actions of the enterprise. For example, such discrepancies between income and expenses reflected in the VAT and income tax returns may be caused by the presence of non-taxable amounts. Many types of income and expenses reported on income tax returns are exempt from VAT.

Reasonable discrepancies

However, they must be included in other income and expenses for income tax purposes. In this regard, there are no errors in the declaration, and the taxpayer in an explanatory note to the tax office on demand, a sample of which can be easily found on Internet resources, just needs to indicate this circumstance, referring to an article of the tax code. There is no need to submit revised declarations in such cases.

Often there are demands for a discrepancy between the income statement and the income tax return. You should not be afraid of such requests. The reason for the discrepancies lies in the difference between accounting and tax accounting. A sample explanatory note to the tax office on demand in this case may be a reasoned reference to different reporting and accounting principles.

Suspicious losses

Income tax causes a lot of questions from the IFTS, especially if instead of profit in the declaration there is a loss. If the loss is of a one-time nature, then usually this does not attract the attention of control authorities. But in the case of constant losses, the organization should expect quarterly requests from the IFTS. Such results of commercial activity seem suspicious to the tax authorities, especially if the company is not going to start bankruptcy proceedings.

Factors affecting the unprofitability of the enterprise can be very different. In most cases, this is due to the high proportion of non-operating expenses that are not related to making a profit. For example, an organization has a large amount of overdue accounts receivable and is required by law to create a reserve, the amounts of which fall into non-operating expenses.

An explanatory note to the tax office on a claim for losses should contain explanations about the occurrence of reasons for the excess of expenses overincome. If the results were influenced by macroeconomic factors, it should be written that the company is not able to change the economic situation in the region, the exchange rate, the inflation rate, and the like. At the same time, it is desirable to promise to optimize costs in the near future.

It must be remembered that the company is suspected of illegal actions and has the right to call senior officials for a commission if the answer is not sufficiently substantiated. Explanations are written in free form.

Recommended:

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Demand: demand curve. Aggregate demand curve. demand curve chart

The national economy is in constant motion under the influence of changes in capital, labor resources and scientific and technological progress. But sometimes firms cannot sell the entire volume of output, which leads to a slowdown in production and a decrease in the gross domestic product. This can be explained by the economic model of aggregate supply and demand

Tax refund when buying an apartment: detailed return instructions

Refund of tax when concluding certain transactions is an important and responsible process, but it can be de alt with in the shortest possible time. This article will tell you how to get a refund when buying an apartment. What should everyone know about this?

Explanatory note to the balance sheet and its role in reporting

Explanatory note is a mandatory part of financial statements. This is regulated by paragraph 5 of the Accounting Regulations No. 4/99 “Accounting statements of the organization”. This document discloses data on the accounting policy of the enterprise, necessary for a full analysis of all indicators of economic activity

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?