2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:30

The family budget in Russia gives citizens a lot of problems. Quite often, the irrational use of money in the family provokes scandals. Some cells of society are disintegrating due to financial problems. Therefore, today we will study the structure of the family budget. We have to learn the basics of financial planning in the family. In addition, consider a few secrets of saving in Russia.

Definition

What is a family budget? The structure of this important component of the life of a cell of society is complex and multi-component. And not everyone understands how to do home bookkeeping. But next we will study the relevant issues.

Family budget is the management of household finances. Money that comes to the family from different sources. They need to be distributed rationally. After all, only then will a cell of society be able to live normally and even save money for some needs.

Structure

The structure of the family budget, as we have said, is diverse. It includes many items. First, let's look at the largest sections.

Among them are income and expenses. It is this balance that each cell needs to maintain.society. Then you will be able to live within your means and even make large purchases.

Next, each major section of the budget is divided. Structuring can be completely different, at the discretion of the one who plans expenses in the family. Next, we will study the most common items of expenditure and income.

Functions of home accounting

But first, let's find out why exactly it is necessary to maintain a family budget. What does it allow you to do?

Home bookkeeping is a time-consuming process, especially at first. At the moment, the functions of the family budget can be as follows:

- saving money;

- creating savings;

- training for value for money;

- family living on available money;

- exclusion of the need to obtain loans for certain needs.

In any case, if the family does not keep a budget, sooner or later problems may arise in the unit of society. For example, due to loans or unreasonable expenses.

Types of family budget

Some people ask - "Tell me about the structure of the family budget." Usually such requests arise from women - they have to plan purchases all the time and not allow spontaneous expenses. Especially when funds are severely limited.

Family budget is different. At the moment, the following forms of finance in the family can be distinguished:

- joint;

- separate;

- mixed.

All these types have their own characteristics. Depending on thethe chosen method of monetary "behavior" will change the structure of income and expenditure of the family budget.

What is a joint budget

The most common and easiest scenario is a joint budget. In this case, the income structure of the family budget will include all the finances received by the family. Both from the side of the husband and from the side of the wife.

In other words, with a joint budget, the income of all family members will be summed up. Further, the funds received are distributed for general needs. We will talk about the classification of expenses later.

Shared budget implies that everything in the family is shared. This situation helps to maintain family relationships. Especially if the woman went on maternity leave.

What is a separate budget

What is the structure of the family budget? It, as we have already said, can be different. You can find a separate budget in the cells of society.

This is the least acceptable scenario. It is often taken as a "last resort" when educating spouses financially.

With a separate budget, the structure of income and expenses for each family member will be separate. Husband's salary is his money. They go only to his needs. The wife's earnings are her funds that she can spend on her needs.

This model of financial behavior is disastrous. It is not suitable for families with children. After all, then one of the family members will be left without income. Plus there will be common children who will have tocontain.

What is a mixed budget

What is the structure of the family budget? In a mixed type of financial management, the husband and wife distribute their income somewhat differently than in the cases listed above.

With a mixed budget, a couple is usually invested in the "common fund" in equal shares or in proportion to earnings. First, common family needs are formed. They are funded by each spouse. The rest can be spent on your desires.

The expense item "children" usually also implies mutual investments from the spouses. But in real life, more and more children are supported by working women.

What income consists of

Now let's take a closer look at the structure of family budget income. This is an extremely important point. Let's study the issue using the example of a joint budget in a cell of society.

In the "income" column, you can write:

- earnings;

- scholarships;

- prizes;

- gifts;

- cash compensation;

- awards;

- kalym;

- social benefits;

- help from friends/relatives.

In other words, any material receipts. It is desirable to divide them into regular (like wages) and irregular. When planning finances, it is better to rely on permanent sources of income.

Classification of expenses by significance

The structure of family budget expenditures is even more complex than income. Here every cellsociety independently determines the articles of its needs.

You can make some classification of all expenses in the family. For example, in importance. At the moment, it is customary to highlight:

- Important/mandatory expenses. These are all necessary expenses. It is customary to include food, rent, utility bills, loan payments, household and family items. Expenses for medicine, clothes and shoes are also included here. This item should ideally not exceed 50% of all family income.

- Desirable. This is everything you want to buy, but without which in austerity mode you can do without. For example, a new phone, cosmetics, hobbies and entertainment expenses, cafes, books, sections.

- Luxurious. It is customary to make large purchases here. Usually such expenses correspond to high earnings or great family needs. For example, appliances and gadgets of the latest models, cars, apartments, cottages, and so on.

Classification by frequency

The structure of the family budget in terms of spending can be divided by frequency.

Here are the most common sections:

- Monthly. These are expenses you can't live without. For example - pocket expenses, mugs, gardens, sections, paying for housing, buying groceries.

- Annual. This includes taxes, vacations, insurance payments.

- Seasonal. These are expenses that arise only at a certain point in time. For example, large purchases for the winter, preparing children for school, and so on.

- Variables. A very ambiguous category. into herinclude all non-fixed expenses. Paying for medicines, medicine, clothes, shoes and buying household appliances, for example. Anything that money is spent on when there is a real need.

Classification by size

We have almost studied the structure of income and expenses of the family budget. You can classify spending by size.

Namely:

- Small expenses. These are groceries, transportation, buying newspapers and magazines, household expenses.

- Average spending. These include clothing, entertainment, small appliances, and so on.

- Big purchases. Furniture, holidays, renovations, large appliances.

To save money, it is recommended to reduce large and medium expenses. But don't forget the little ones either. It is possible that among them there are optional expenses.

How to do home accounting

We studied the structure and types of the family budget. And how to keep accounts now?

It is recommended to act according to the following principles:

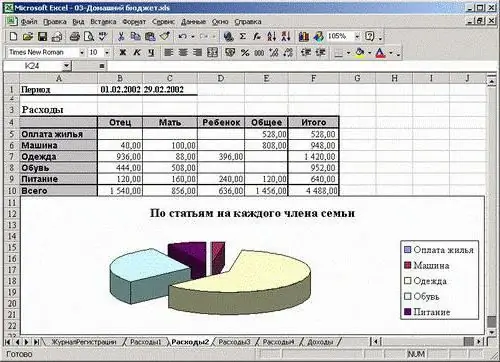

- Record all sources of profit in a special table. Finally calculate the final amount.

- In the same plate, write down all mandatory and current expenses. It is advisable to keep receipts from stores.

- Add up all monthly expenses in each category.

- Compare expenses and receipts in the family budget.

Today you can find a lot of programs and applications for managing a family budget. Some simply create a multisyllabic table in Word or keep notes in specialnotebooks.

How to save money

A few words about how to save money the right way. Reasonable savings will help save money and live at the expense of yourself.

Here are the principles every home accountant should know:

- Record every product purchased in the expense and income ledger. This will help analyze spending and exclude unnecessary and spontaneous purchases.

- In the strong economy mode, go to the store with only a list of products. Do not deviate from it.

- Buy long-term storage products (pasta, cereals, "freezing") at wholesale depots.

- Try to buy products and things on sale. This applies even to children's things. Children's stores are always running great deals.

- Refuse loans, installments and credit cards.

- Don't borrow. It is advisable not to lend money to anyone. This can be done only when the family is ready to "let go" of the borrowed funds.

- Set aside 10-15% from each source of income. From these funds, the so-called NZ will be formed. So it is customary to call the emergency reserve. It is used in emergencies. For example, for treatment or life in case of layoffs.

That's it. In fact, home bookkeeping becomes quite simple over time. The main thing is to analyze your purchases correctly and be able to refuse excesses.

Conclusion

Your attention was presented to the structure of the family budget. Now it’s clear how you can save and distributecash.

At first, home accounting is scary and a lot of trouble. But over time, a home accountant will be able to easily distribute money in the family. Especially when it comes to the joint budget.

Important: even with a sharp increase in income, you should not abandon the previously developed principles for managing home finances.

Recommended:

Additional income. Additional income. Additional sources of income

If, in addition to the main income, you need additional income to allow you to spend more, make gifts for yourself and your loved ones, then from this article you will learn a lot of useful information

Pension Fund budget: adoption, fixed assets, income and expenses

How is the PFR budget formed, who forms it, where is it located? How is it reviewed and accepted? What are intergovernmental transfers? The main items of expenses and incomes of the budget of the Pension Fund, their ratio. How is the shortage problem solved?

Organizational structure of Russian Railways. Scheme of the management structure of Russian Railways. Structure of Russian Railways and its divisions

The structure of Russian Railways, in addition to the management apparatus, includes various dependent divisions, representative offices in other countries, as well as branches and subsidiaries. The head office of the company is located at: Moscow, st. New Basmannaya d 2

Business expenses - what is it? What does business expenses include?

Selling expenses are expenses that are aimed at the shipment and sale of products, as well as services for their packaging by third-party companies, delivery, loading, etc

Family income and expenses - calculation features and recommendations

Maintaining a family budget is not an easy question. You need to know how to properly carry out this operation. What can help? How to budget? How to save and even accumulate it? All the secrets of this process are presented in the article