2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

The Relative Strength Index is one of the most popular indicators used by traders. It provides information about the strength of price movements on charts, hence its name. So what is the RSI indicator? How to use it in trading? How to understand what it shows?

RSI indicator description

Created by J. Wells Wilder, the Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The index fluctuates between zero and 100. Traditionally, according to Wilder, the RSI indicates that the market is overbought when it exceeds 70 and oversold when it is below 30. RSI indicator signals can warn of a trend reversal, center line crossing, and also determine the strength of the trend.

Wilder wrote about all this in his 1978 book New Concepts in Technical Trading Systems. Together with the parabolic SAR, the volatility index, the range index and the CSI index, he described the RSI indicator - how to use it and how to calculate it. In particular, the author considered the following factors:

- highs and lows;

- technical analysis figures;

- failed swing;

- support and resistance;

- divergence.

Despite the fact that Wilder indicators will soon be 40 years old, they have stood the test of time and remain extremely popular to this day.

Calculation

The indicator is calculated using the formula: RSI=100 - 100/(1 + RS), where RS=average rise/average fall.

To simplify the calculation, the index is divided into main components: RS, average growth and fall of the exchange rate. In his book, Wilder proposed to calculate the index based on 14 time periods. Falls are expressed as positive numbers, not negative numbers.

First, the 14-period average rise and fall are calculated.

- average growth=sum of growth over the last 14 periods / 14;

- average drop=sum of last 14 period drops / 14.

Then calculations are based on previous averages and the current decline or rise:

- average growth=previous average growth x 13 + current growth / 14;

- average dip=previous average dip x 13 + current dip / 14.

This calculation method is a smoothing technique similar to exponential moving average. This also means that the index values become more accurate as the billing period increases.

Wilder's formula normalizes RS and turns it into an oscillator that fluctuates between zero and 100. In fact, the RS chart looks exactly the same as the RSI chart. The normalization step simplifies finding extrema since the index is in a narrow range. The relative strength index is 0 when the average gain is zero. With a 14-period RSI, a value of zero indicates that the rate has been declining for all 14 periods. There was no growth. The index is 100 when the average depreciation is zero. This means that the rate grew throughout all 14 periods. There was no fall.

Based on the relative strength index, the stochastic oscillator Stochastic RSI is calculated:

StochRSI=(RSI - RSI Low) / (RSI High - RSI Low)

The oscillator correlates the RSI level to its minimum and maximum values over a period of time. RSI values are substituted into the formula of the stochastic oscillator instead of the rate values. Thus, Stochastic RSI is an indicator indicator - the second derivative of the exchange rate. Significantly increases the number of signals, so other technical analysis tools should be taken into account along with it.

RSI indicator: how to use it?

The standard number of periods for the relative strength indicator is 14, which means it evaluates the last 14 candles, or time frames.

The indicator compares the average gain with the average loss and analyzes how many of the last 14 candles were bullish or bearish, and also analyzes the size of each candle.

For example, if all 14 price candles are bullish, then the index is 100, and if all 14 candles are bearish, then 0 (or almost equal to 100 and 0). And an index of 50 would mean that 7 past candles were bearish, 7 were bullish, and the average profit and loss were equal.

Example1. The screenshot below shows the EUR/USD chart. The area highlighted in white includes the last 14 price candles. Of these, 13 were bullish and only 1 was bearish, resulting in a value of 85.

Example 2. The screenshot below shows the EUR/USD chart and 3 highlighted areas of 14 candles each to understand how the Relative Strength Index is calculated.

- The first area highlights a very bearish period of 9 bearish candles, 4 small bullish candles and 1 candlestick pattern (doji). The RSI of this period is 15, which signals a very strong bearish phase.

- The second section includes 9 bullish candles and 5 predominantly small bearish candles. The indicator of this period was 70, indicating a relatively strong bullish trend.

- The third area includes 6 bullish candles, 8 bearish candles and 1 doji, resulting in an index value of 34, indicating a moderate decline in the price.

As you can see, the analysis of 14 candles quite accurately corresponds to the RSI value for this period. Nevertheless, the indicator is useful in that it reduces the time required for data processing, and also allows you to avoid mistakes during volatile market behavior.

Oversold and overbought

The basic idea is that when the Relative Strength Index shows very high or very low values (greater than 70 or less than 30), the price indicates oversold or overbought. A high index means that the number of bullishcandles prevailed over the number of bearish ones. And since the rate cannot endlessly stamp only bullish candles, you cannot rely only on the readings of the RSI indicator to determine a trend reversal.

If 13 of the last 14 candles were bullish and the index is well above 70, then it is likely that the bulls will retreat in the near future, but you should not rely entirely on the RSI indicator in your forecasts. The screenshot below shows two periods when it entered the oversold area (less than 30) and remained so for a long time. During the first period, the price continued to fall for 16 days before the index returned above 30, and during the second period, the price continued to fall for 8 days, when the market was oversold.

The default calculation period for the trend strength index is 14, but it can be reduced to increase the sensitivity of the indicator, or increased to reduce it. The 10-day RSI will reach overbought or oversold levels faster than the 20-day RSI.

The market is considered overbought when the RSI value is above 70 and oversold when it is below 30. These traditional levels can also be adjusted to better meet security or requirements. Adjusting the RSI indicator by increasing overbought to 80 or lowering oversold to 20 will reduce the frequency of signals. Short-term traders sometimes use the 2-period RSI, which allows you to look for overbought above 80 and oversold below 20.

The Relative Strength Indicator cannot be used solely to determine likely reversal points. Healso indicates very strong trends when it remains in the oversold or overbought zone for a long time.

Breakout of support and resistance line

As already mentioned, the relative strength index allows you to identify strong exchange rate trends. This makes it an excellent tool for trading support and resistance levels. The figure shows a EUR/USD chart, and the black horizontal line is the well-known level of 1.20 of the rate, which is the level of support and resistance.

You can see that the price returned several times to level 1, 2. The first time the RSI showed values of 63 and 57. This meant that although the trend was up, its strength was not enough. A strong resistance level is not easy to break - a strong trend is needed to overcome it.

The second time the rate returned to the resistance level, the RSI was 71, which indicates a fairly strong bullish trend, but the resistance level held again. Until the last section, when the RSI showed a value of 76, the resistance level was overcome and the RSI rose to 85.

The indicator can serve as a tool for quantifying the strength of the course. Traders using trading algorithms are in dire need of such information, and the relative strength indicator comes in handy.

RSI divergence

Another area where the RSI indicator is used is the strategy of identifying turning points by looking for divergence. Signalsthe divergences that the exchange rate generates are generally not supported by the underlying price dynamics. This is confirmed by the following.

The screenshot below shows two lows. During the first, the indicator was 26, and the price movement preceding this moment included 8 bearish candles, 3 bullish, 3 doji, the rate fell by a total of 1.45%. During the second low, the RSI showed a higher value of 28, and the price movement included 7 bearish candles, 5 bullish, 2 doji and the rate lost only 0.96%.

Although the rate made a new, lower low, the background dynamics were not as bearish and the second section was not strong. And the chart confirms it. The second low had a higher indicator (28 vs. 26), although the course showed that the bears are losing strength. Divergence often fails, double divergence is more reliable.

Positive-negative reversals

Andrew Cardwell developed a system of positive-negative reversals for the Relative Strength Index, which are the opposite of bearish and bullish divergences. Unlike Wilder, Cardwell considered bearish divergences to be bull market phenomena. In other words, bearish divergences form an uptrend. Similarly, bullish divergences are seen as bear market phenomena and indicative of a downtrend.

A positive reversal occurs when the indicator makes a lower low and the price makes a higher low. The low low is not at the oversold level, but somewhere between 30 and50.

A negative reversal is the opposite of a positive one. The RSI is making a higher high, but the rate is making a lower high. Again, the higher one is usually located just below the overbought level at 50-70.

Trend ID

The relative strength indicator tends to fluctuate between 40 and 90 in a bull market (uptrend) with the 40-50 levels acting as support. These ranges may vary depending on the RSI parameters, the strength of the trend and the volatility of the underlying asset.

On the other hand, the indicator fluctuates between 10 and 60 in a bear market (downtrend) with 50-60 levels as resistance.

Failed swing

A failed swing, according to the author, is a strong sign of an impending reversal. It is the signal that the RSI indicator gives. Its description is as follows. Failed swings are not course dependent. In other words, they focus exclusively on RSI signals and ignore the concept of divergence. A bullish failed swing is formed when the RSI drops below 30 (oversold), rises above 30, declines to 30, and then breaks the previous high. The aim is to reach oversold levels and then a higher low above the oversold level.

A bearish failed swing occurs when the index moves above 70, declines, rebounds, falls short of 70 and then breaks the previous low. The goal is the leveloverbought and then a lower high below overbought levels.

The rate is more important than the indicator

Universal momentum oscillator RSI indicator - time-tested efficiency. Despite the volatility of the markets, the RSI remains as relevant today as it was in the Wilder days. But time has made some adjustments. Although Wilder considered overbought a condition for a reversal, it turned out that it can be a sign of strength. Bearish divergence still gives good signals, however traders should be careful during strong trends when it is normal. Although the concept of positive and negative reversals somewhat undermines Wilder's interpretation, its logic makes sense and Wilder himself would hardly have refused to pay more attention to price action. Positive and negative reversals put the price trend first and the index second, as it should be. Bearish and bullish divergences are favored by the RSI indicator. How to use these tools depends on the trader.

The RSI indicator is a universal tool for determining the strength of a trend, looking for reversal points or a breakout of support and resistance lines. And although its value can be easily predicted by looking at the last 14 candles, drawing RSI on the price charts will add stability and confidence to trading. Quantifying the strength of the rate, its translation into interpretable numbers will allow you to make more efficient trading decisions and avoid guesswork and subjective interpretations.

Recommended:

Momentum indicator: description, configuration and use, methods of application

The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum and there are a number of indicators designed to measure it. The Momentum indicator helps identify when players have bought or sold too much

WACC - what is this indicator? Concept, formula, example, use and criticism of the concept

Today, all companies use borrowed resources to some extent. Thus, they function not only at the expense of their own funds, but also credit. For the use of the latter, the company is forced to pay a percentage. This means that the cost of equity is not equal to the discount rate. Therefore, another method is needed. WACC is one of the most popular ways to evaluate investment projects. It allows you to take into account not only the interests of shareholders and creditors, but also taxes

RSI-indicator of the Relative Strength Index in the Forex market

Included in almost any trading platform, the RSI indicator is a universal technical analysis tool that allows a trader to avoid opening disadvantageous positions

ADX indicator. ADX technical indicator and its features

ADX-indicator is a unique trading tool that allows you to determine the strength of a trend. It gives clear signals to traders about the time to enter and exit the market

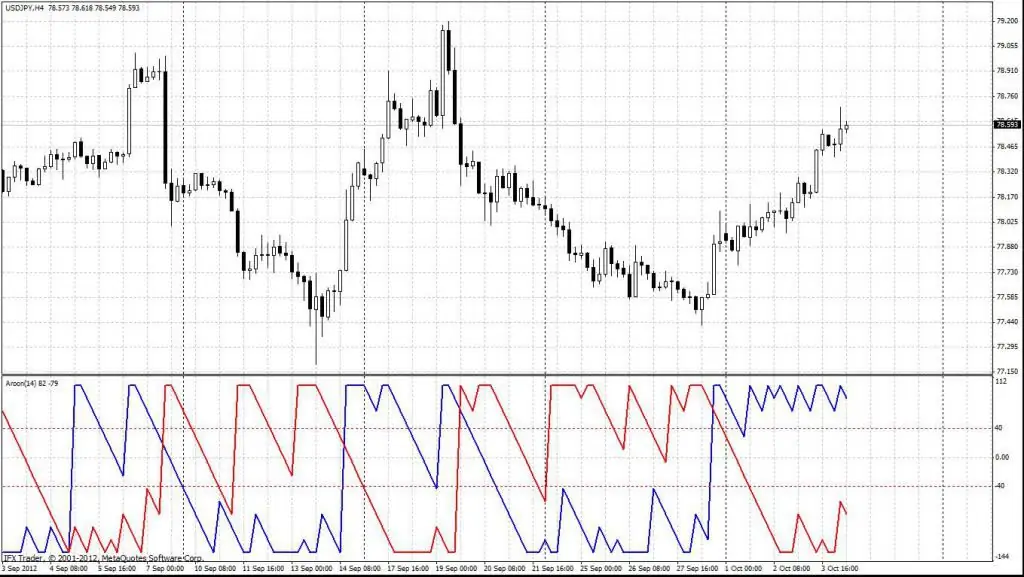

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement