2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

STS (simplified taxation system) is a popular tax regime that can be used by both individual entrepreneurs and different companies. It is considered one of the most popular regimes, as it allows entrepreneurs to pay not too high taxes. There are several options for such a system, so you can choose the STS "Income" or the STS "Income minus expenses". Any option has its own characteristics, and at the same time they differ in the accrued interest on income or profit.

System Features

The features of the application of the simplified tax system include:

- mode can only be used by certain entrepreneurs whose activities are eligible for this system;

- provides the possibility of compiling simple reporting, which even the entrepreneur himself can handle;

- calculation is also considered simple, so if you have a good understanding of what can be attributed to expenses, it will not be difficult to determine the correct amount of tax;

- this mode is not always beneficial, so entrepreneurs should evaluate the consequences of its application,because often even BASIC will be more effective for some areas of work.

The choice between the STS "Income" and the STS "Income minus expenses" should be based on the income and profit received.

Tax rates

Initially, entrepreneurs must determine how much money they will transfer to the budget if they use this taxation system. This takes into account not only transfers to the budget, but also various insurance premiums. They are equal to approximately 30% of the salary of each employee. Additionally, individual entrepreneurs must transfer these funds for themselves.

Tax rates are not considered too high, so a much smaller amount is paid than when applying the OSNO, and often with UTII. The percentage depends on the selected system option.

| Type of USN | Features of tax calculation |

| USN "Income" | Paid 6% of all cash receipts that arise in the course of the business. It is allowed by regional authorities to reduce this figure by 1%, but this is quite rare, since the local administration is interested in receiving high fees. |

| Tax STS "Income minus expenses" | Assumes the collection of 15% of the profits received by the entrepreneur or organization for the quarter. This interest rate may be reduced by regional authorities, but such a decision is rarely made by them. AtIn this way, insurance premiums can be taken into account when calculating the fee. |

Any version of the simplified tax system is considered convenient and easy to determine, so many entrepreneurs and companies use this particular tax regime. But at the same time, it is advisable to first compare it with UTII, OSNO and PSN, since often other systems can be more profitable for a specific type of activity.

With this tax, taxpayers are allowed to reduce advance payments at the expense of listed insurance premiums if they are paid in the corresponding quarter. Therefore, the choice of this option is considered optimal for entrepreneurs with employees. If the individual entrepreneur does not have officially employed specialists at all, then you can completely deduct insurance premiums for yourself from the tax. It is not uncommon for the tax to be canceled after this process. What kind of reporting is generated?

Declaration on the simplified tax system "Income" or "Income minus expenses" is considered easy to fill out, so often entrepreneurs themselves are involved in this process, which allows them to save a significant amount of money on the wages of a hired accountant. This document must be submitted only once a year, and companies are required to submit a declaration to the Federal Tax Service by March 31 of the year following the reporting one, and individual entrepreneurs by April 30 of the same year.

Declaration Filling out the simplified tax system "Income" is considered a simple process, since only all the funds received during the year are taken into account. If “Income minus expenses” is selected, then the declaration will have to correctlyindicate all costs, for which it is necessary to understand in advance all the expenses of the enterprise. With the simplified tax system “Income”, the declaration sample is considered understandable, but in the second case, you need to carefully deal with all expenses.

Additionally, companies and individual entrepreneurs in this mode maintain a book of income accounting for the simplified tax system, which indicates all cash receipts and expenses in the course of doing business.

This regime requires advance payments, so the calculation must be done quarterly. The calculation of the simplified tax system "Income" is considered simple, since only all funds received are taken into account, and in the second case, expenses must be calculated.

What disagreements usually arise with the FTS?

When using the simplified tax system “Income” or “Income minus expenses”, entrepreneurs or companies often have numerous disputes with tax inspectors. The most popular disagreements are as follows:

- if income and expenses are considered under the simplified tax system, then entrepreneurs should carefully study all the rules related to determining costs, since tax authorities often do not take into account some expenses;

- if there are serious disagreements, then taxpayers have to go to arbitration, and often decisions are made in favor of the plaintiffs in such cases;

- the book of income under the simplified tax system should contain all expenses, and each such item must be confirmed by official documents, and this takes into account the strict and complete list of costs contained in Art. 346.16 NK.

UndoubtedlyThe advantage of choosing this tax regime is that entrepreneurs do not have to pay VAT.

Combination with other tax regimes

The disadvantage of the system is that often entrepreneurs have certain problems in cooperation with other companies. The fact is that it is unprofitable with the simplified tax system "Income minus expenses" or when taking into account only income, to cooperate with counterparties who are forced to pay input VAT.

Usually, firms that transfer VAT to the budget simply refuse to cooperate with firms that calculate the simplified tax system, as they have difficulty processing the deduction.

Who can become a taxpayer?

STS is used by both legal entities and individual entrepreneurs, but for this all of them must meet the numerous requirements of the system.

It is not allowed to apply the simplified tax system "Income minus expenses" or "Income" to organizations that have received income in excess of 45 million rubles in 9 months.

Who can't use this mode?

There are certain restrictions on the use of this system, so not all entrepreneurs or firms can use the simplified regime. Therefore, it is not allowed to switch to it for firms that are:

- foreign companies;

- budget organizations;

- banks, various insurance companies, NPFs, securities firms or investment funds;

- enterprises operating in the field of gambling;

- firms whose fixed assets by valueexceed 100 million rubles;

- organizations that participate in production sharing agreements;

- firms in which other enterprises participate, and their share exceeds 25%.

There are also certain restrictions for individual entrepreneurs, which include:

- it is impossible to use the simplified tax system if the individual entrepreneur did not inform the Federal Tax Service of his decision in a timely manner;

- over 100 officially employed;

- engaged in the extraction or sale of minerals, but the exception is sand or clay, peat or other similar building materials;

- specializes in the production of excisable products.

It is not allowed to apply the USN tax "Income minus expenses" or "Income" to notaries or lawyers in private practice. In order to avoid such a situation in which an entrepreneur, by decision of the Federal Tax Service, cannot use this simplified regime, one should correctly treat the choice of OKVED codes.

What is the object of taxation?

The object can be a different amount of funds depending on the choice of the direction of the simplified tax system. If the system "Income" is selected, then all cash receipts to the company are used for calculation, so there is no need to calculate expenses. 6% is charged from the received value.

If another option is chosen, then income and expenses are taken into account for the STS tax, so you have to carefully evaluate all the costs of the enterprise. All expenses must bejustified and official, therefore, must be confirmed by documents. As a result, net profit will be received, from which 15% will be charged.

Tax base

The tax base is the amount of funds, which can be income or profit.

To accurately determine this value, it is necessary to study the basic requirements for costs, which are described in Art. 346 NK.

What tax rates are used?

If the fee is calculated relative to the company's income, the rate will be 6%. It may be slightly reduced by regional authorities, but usually you have to use the standard and constant percentage.

If it is necessary to determine the net profit of the company, then 15% is charged from this value.

In some regions, there is a special relief for individual entrepreneurs who have registered for the first time, on the basis of which you can work on the simplified tax system with a zero rate for a certain period of time, which will allow you to develop your business in order to pay really high taxes in the future.

Which option to choose?

Since the STS regime is presented in several versions, entrepreneurs often face difficulties during the choice. Therefore, when choosing a specific mode, some recommendations are taken into account:

- if the margin is low, then it is advisable to pay tax on net profit, since after all expenses are deducted from income, a low amount of funds will be received, from which a further 15% will be charged;

- if the margin has a significantsize, then it is optimal to pay 6% of all funds received by the company;

- it is quite difficult to use the system by which costs are to be accounted for, so the entrepreneur will be forced to spend money on paying a full-time accountant, since it is usually difficult to cope with the definition of costs on his own;

- not all company expenses can be taken into account when calculating the tax base, as they must be supported by documents, and it is also important that they are made in the course of business, but not always all costs can be officially confirmed, which reduces the company's profit;

- if an enterprise specializes in the resale of various goods, then to confirm income and expenses, not only documents are needed that confirm the purchase of elements, but also their sale, which is not always possible, and the books of income and expenses under the simplified tax system are not enough for this.

Difficulties with the simplified tax system, when expenses are taken into account, arise when receiving advance payments from buyers, so only really experienced and professional accountants should do the calculations.

Transition rules

The transition to this tax regime is allowed in two ways:

- immediately after registering an individual entrepreneur or enterprise;

- from the beginning of next year, and if the deadline is missed, you will have to wait again for a whole year to switch.

If at all during operation the income of an enterprise or individual entrepreneur exceeds 60 million rubles. then automatically there is a transition to the BASIC, since the right to use the simplified tax system is lost.

Howtax paid?

According to the simplified tax system “Income”, contributions are paid in the same way as for “Income minus expenses”, therefore only the procedure for calculating the fee is different.

Unified tax under this taxation regime replaces VAT, personal income tax for an entrepreneur and income tax. In certain situations, you still have to pay property tax. This applies to the situation if the property on the balance sheet of the enterprise is valued using the cadastral value. At the same time, the relevant regulatory act must be in force in the region.

VAT may be paid by ONS payers if firms import goods into Russia from other countries.

Reporting periods

For both types of STS, the periods are the same. The tax period is a year, but the tax must be paid every quarter in advance payments.

Advance payments must be made by the 25th day of the month following the end of the quarter. The final payment must be paid by individual entrepreneurs by April 30, and by firms by March 31 of the year following the reporting year.

How is income tax calculated?

If this option is chosen by the entrepreneur, then all cash receipts for a specific period of time must be calculated.

Next, insurance premiums are calculated, and if officially employed specialists work in the company, then the tax can be reduced by 50% as much as possible. If there are no employees, then the fee is reduced by the entire amount of insurance premiums, so it is often not necessarypay any funds to the budget.

How is income minus expenses tax calculated?

In this case, you will have to take into account not only cash receipts, but also the costs of the company. Costs are deducted from income. From the value obtained, 15% is determined, after which you need to find out the BCC USN "Income minus expenses" on the website of the Federal Tax Service or at the service department.

Difficulties may arise when determining various expenses, so they must be supported by official documents, and also be directly related to the activities of the company.

Responsibility for non-payment of tax

If funds under the simplified tax system are not transferred within the established time frame, then according to Art. 76 of the Tax Code, art. 119 of the Tax Code, art. 75 of the Tax Code and art. 122 Tax Code assigns different pen alties for the taxpayer:

- if the delay exceeds 10 days, then operations on the account are suspended;

- for the lack of a declaration, a fine is imposed, the amount of which varies from 5 to 30 percent of the tax, but not less than 1 thousand rubles;

- in case of non-payment of the fee, a fine of 20 to 40 percent of the amount is charged;

- an additional interest is charged, for the calculation of which 1/300 of the refinancing rate is used.

Thus, the simplified tax system is a demanded taxation regime, for the application of which individual entrepreneurs or companies must meet certain requirements. The transition is possible upon registration or from the new calendar year. It is important to understand the two varieties of such a regime, as well as correctly calculate the tax and submit the declaration in a timely manner. From correctnesscalculation and delivery of documents depend on relations with employees of the Federal Tax Service. If the requirements of the law are violated, then the entrepreneur is forced to pay various fines and pen alties.

Recommended:

How to make the transition to the simplified tax system: step by step instructions. Transition to the simplified tax system: VAT recovery

The transition of IP to the simplified tax system is carried out in the manner prescribed by law. Entrepreneurs need to apply to the tax authority at the place of residence

Taxation "Income minus expenses": features, advantages and disadvantages

Income minus expenses taxation has many significant advantages for every entrepreneur over other systems. The article explains when this tax regime can be used, as well as how the amount of the fee is correctly calculated. The rules for compiling a tax return and the nuances of maintaining KUDiR are given

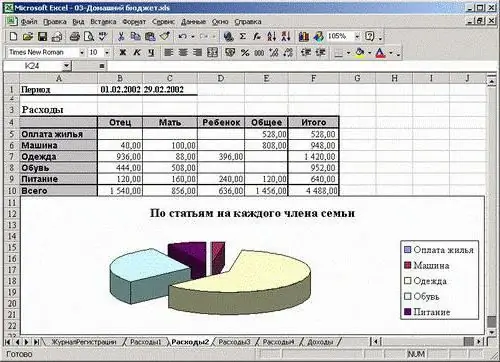

Family income and expenses - calculation features and recommendations

Maintaining a family budget is not an easy question. You need to know how to properly carry out this operation. What can help? How to budget? How to save and even accumulate it? All the secrets of this process are presented in the article

Minimum tax under the simplified taxation system (simplified taxation system)

All start-up entrepreneurs who have chosen a simplified taxation system are faced with such a concept as the minimum tax. And not everyone knows what lies behind it. Therefore, now this topic will be considered in detail, and there will be answers to all relevant questions that concern entrepreneurs

Do I need a cash register for individual entrepreneurs with the simplified tax system? How to register and use a cash register for individual entrepreneurs under the simplified tax

The article describes the options for processing funds without the participation of cash registers (CCP)