2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

All traders speculating on financial markets use a trading account in their work, on which transactions take place. Under the terms of brokerage companies, they have margin lending. All financial transactions made by speculators take place with the use of leverage. What is margin, in simple words - lending for trading? This, as well as its features and rules of use, will be discussed in the article.

The concept of margin

In trading on financial markets, credits with margin conditions are provided by brokerage companies to all clients without exception. This allows speculators to trade on more favorable terms. What is margin? In simple words, this is a special type of loan for trading in financial markets. This type of provision of additional funds allows clients to use trading assets with financial leverage. That is, a trader can make transactions on more favorable terms with an excess of his own deposit money.

With the help of leverage, the speculator hasthe opportunity to use in their transactions additional funds provided by the brokerage company. It has its own parameters and conditions for each trading account, the main of which is the issuance of a loan secured by the trader's own deposit funds in his account.

Leverage

When a client registers with a brokerage company and draws up an account for work, he can choose the most suitable option for him ("Standard", "Vip", "Micro" and other types). Most often it depends on the free amount of money that the speculator is willing to risk, that is, on his deposit.

Leverage is the ratio of the total amount of funds in the trading account to the volume of the lot. Usually, these conditions are specified in the contract, however, there are brokers that allow clients to choose them themselves.

Types of leverage:

- 1:10;

- 1:25;

- 1:50;

- 1:100;

- 1:200;

- 1:500;

- 1:1000 and more.

The higher this indicator, the more opportunities a trader has in speculative operations. But it is also necessary to pay attention to the fact that financial risks are increasing. Therefore, when choosing a type of trading account, you need to take into account that trading with a large leverage in case of unsuccessful trading will quickly lead the speculator to Margin Call, that is, the loss of most of the deposit.

The essence of margin trading

On "Forex", as well as in other directionstrading financial markets, there are no actual sales. When they say that traders buy or sell any assets, in fact this does not happen, since all transactions are based only on forecasting changes in market quotes. Trading makes money on assumptions that can be determined by many tools on price changes. The trader's income consists of speculative transactions and is calculated on the difference between the purchase and sale of an asset.

The essence of the margin principle is exchange operations with trading instruments, without actual sales or purchases. All transactions take place through arbitration. For clarity, consider an example. The speculator selects a trading asset and places an order to buy. Another trader opens a sell position on the same instrument. Lot volumes must be the same. After a while there is an exchange. As a result, one speculator makes a profit and the other a loss. The earnings of the first trader will depend on the volume of the lot and the number of points earned.

Margin lending allows traders to significantly increase income. This is due to the ability to set large volumes, which are calculated in lots. Suppose a deal with one whole lot will be 10 cents per 1 point on a microaccount, in standard options this amount will increase 100 times - up to $ 10 with lot volumes of 0, 1 - 1 cent or $ 1 for standard types.

Features of margin trading

A loan thatissued by brokerage companies, differs significantly in terms of its conditions from all other loan options. Consider its features:

- Credit funds are issued for trading only. They cannot be used for other purposes.

- Additional amounts are for trading only with the broker that issued them. In exchange trading, including Forex, having registered an account with one dealer, it is impossible to use deposit funds in working with another broker.

- Margin credit is always much more than a trader's own funds, unlike consumer, bank and other types of loans. That is, it is several times more than the amount of collateral or margin.

The margin lending mode significantly increases the total volume of transactions. For example, on "Forex" the size of one whole standard lot is 100 thousand USD. e., or US dollars. Naturally, not every speculator has the necessary amount of money to make transactions. Even average market participants cannot afford such large deposits with high financial risks, against which there can be no insurance, only their minimization.

Margin lending allowed even small market participants to take part in trading through brokerage companies and earn using leverage. As a result, the total volume of transactions increased significantly.

How to calculate margin?

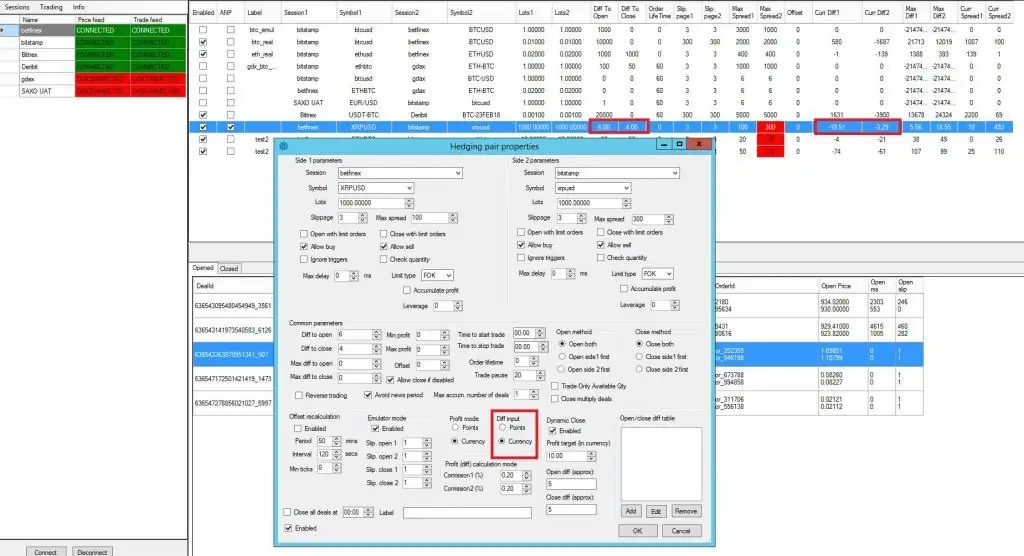

In exchange trading, margin or margin parameters are very important. When choosing a trading account, it is always necessary to take into account the size of the creditleverage and percentage for Margin Call, that is, the level of residual funds before the forced closing of the transaction by the brokerage company.

Depending on the conditions for obtaining a margin loan, this indicator may be different. Somewhere it is 30%, while other brokers have -0% or less. The higher this indicator, which is also called Stop Out, the less opportunities there will be in trading, but if the transaction is closed by force, the loss will be much lower.

For example, a trader's trading account has a deposit of $1,000. With an incorrectly opened position, when the market went against his transaction, it will be closed at a Stop Out of 30 percent, when the speculator receives a loss of 70%, that is, $ 700, and after the Margin Call is executed, $ 300 will remain on his deposit. If the Stop Out on the account trading conditions is set to 10%, then the loss will be $900, and only $100 will remain.

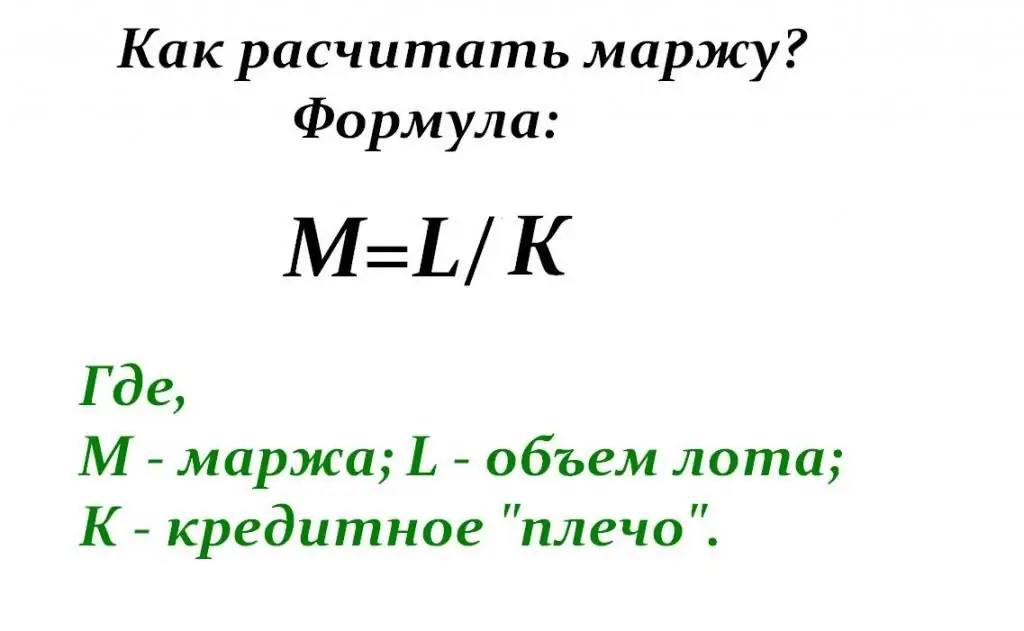

The formula for calculating the margin is as follows: the margin will correspond to the volume of the lot divided by the size of the leverage.

Variation margin

What is this? Any transaction, no matter how it was closed - with profit or loss, is displayed in the trader's statistics in his trading terminal. The difference between these indicators is called the variation margin. Each brokerage company sets a limit, that is, the minimum value for a speculator's deposit funds. If the level of variation margin in trading falls below these parameters, then the broker's client willbe considered bankrupt, and his funds from the deposit account are written off.

To eliminate possible financial losses, brokerage organizations set special levels on clients' trading accounts, upon reaching which Margin Call will follow. In the trading terminals, a warning is displayed from the broker that the deposit reaches the minimum balance limit. In this case, the trader has only one option - to replenish his trading account or it will be forced to close with a loss. Margin lending provides for a range of this level within 20-30% of the pledge of funds.

If the client does not replenish his account, then his balance will decrease, and in this case, all positions, if there are several of them, will be closed by Stop Out, regardless of the trader's desire. In other words, when the balance on the trading account decreases and the balance of the margin is 20-30%, the broker issues a warning - an offer (Margin Call) to the client. And then, when the losses reach large values, and only 10-20% will remain in the pledge, but the deposit will not be replenished, he closes the transaction - Stop Out forcibly.

Stop Out example

How is the forced closing of positions? In practice, it looks like this:

- Let's say a speculator has a trading account from the "Standard" category.

- His deposit is $5,000.

- He chose the euro/dollar currency pair as a trading asset.

- Leverage is 1:200.

- Lot volumestandard for "Forex" - 100 thousand US dollars, that is, the size of the deposit is 5 thousand dollars, multiplied by a leverage of 200.

- The deposit amount in this example will be 10%, i.e. $500.

- He opened only one trade, but he incorrectly predicted the change in market quotes, and it began to give him losses.

- Initially, he received a warning in the terminal - Margin Call, but did not take any action and did not replenish his deposit.

- The deal was closed by Stop Out with the level of 20% set according to the trading conditions of the account. The trader lost $4,900 on the trade. Only $100 left on the deposit.

This example shows how dangerous it is to use a large amount of leverage, and the consequences for the trading deposit. When trading, you should always keep an eye on the size of the margin and open positions with small lot sizes. The higher the margin funds, the higher the financial risks.

In some brokerage companies, you can independently disable the service for providing margin trading. In this case, financial risks at margin lending rates will be maximum and amount to 100%, and leverage will simply not be available.

Margin contract

All trading conditions for accounts provided by brokerage organizations are specified in contracts. Previously, the client looks through them, gets acquainted with all the points, and only then signs.

Online when the trader does not have the opportunity to visit the officebrokerage company, he gives his consent to the contract automatically when registering a trading account. Of course, there are also organizations that send documentation through a courier or Russian Post. The form of the agreement on margin lending is determined by the trading conditions, which spell out all the requirements and regulations.

Short and long positions

Every speculative trade has two stages: opening and closing a position. For any trade to be considered completed, a full cycle of the transaction is required. That is, a short position must necessarily overlap with a long one, and then it will be closed.

Types of speculative operations:

- Trading on the upward movement of quotes - opening long positions. Such transactions in trading on financial markets are designated as Long, or purchases.

- Trading on the falling movement of quotes - short positions, that is, sales, or Short.

Due to the margin lending regime, trading in financial markets has become very popular not only among large participants, such as Central Banks, commercial, insurance funds, organizations, companies and enterprises, but also among private traders who do not have large capitals.

Small speculators can earn from trading relatively small amounts, and in most cases only 1 to 3% of the total trade value will be enough. As a result, with the help of margin trading, the total volume of positions is significantly increased, and exchanges increase volatility and liquidity.trading assets, resulting in a significant increase in cash flow.

All positions opened in Long (long) are characterized by the conditions for the upward movement of the market. And short (Short) - for descending. Trades for buying and selling can be opened with different time durations. There are three types of them:

- Short-term positions ranging from a few minutes to 1 day.

- Mid-term deals - from a few hours to a week.

- Long-term positions - can last several months or even years.

Except for the time period, the trader's earnings depend on the selected trading asset. All of them have their own characteristics and characteristics, and the greater their liquidity, volatility, supply and demand, the higher the profitability of the speculator.

Pros and cons of margin trading

The more leverage a trader's trading account has, the more the financial risks of a trade increase. Margin lending provides the speculator with the following benefits:

- Possibility of opening a position with a small equity capital.

- Due to leverage, a trader has advantages in the market and can perform speculative manipulations in trading using a wide variety of trading strategies.

- Credit margin is provided in a much larger amount of available collateral and increases the possibility of deposit funds by tens and hundreds of times.

To negativemoments include the following characteristics:

- Margin trading, increasing the liquidity of the market, increases the price fluctuations of asset quotes. As a result, it is much more difficult for traders to accurately predict price changes, and they make mistakes when opening positions that lead to losses.

- The leverage used in margin lending greatly increases the speed to generate income, but at the same time, if the option is unfavorable, it has a large impact on losses. That is, with it you can both earn very quickly and lose your deposit funds.

Professionals advise beginners to be very careful in choosing the conditions of a trading account, to use the optimal leverage option in trading and pay attention to the characteristics of assets. It should be remembered that volatility can be not only a trader's friend and allow him to earn quickly, but also an enemy that leads to instant and significant losses.

Free Margin

In any trading terminal you can see such a parameter as free margin. What it is? Free margin is funds that are not involved in trading and collateral. That is, it is the difference between the total amount of the deposit balance and the credit margin. It is calculated only in open positions during the validity of the order, but as soon as the speculator closes it, all collateral is released, and the total amount of the deposit is indicated in the terminal.

Free Margin helps you determine what opportunities are available while tradingthe trader, how many and in what volumes of the lot he can still open transactions at the current time.

Conclusion

Margin lending opens up great opportunities for making money in the financial market for medium and small market participants, as well as private traders. Professionals advise beginners to pay special attention to trading conditions and leverage when choosing the type of deposit account.

Recommended:

Trading strategy: development, example, analysis of trading strategies. The Best Forex Trading Strategies

For successful and profitable trading on the Forex currency market, each trader uses a trading strategy. What is it and how to create your own trading strategy, you can learn from this article

Trading margin and its consequences

The last few years in our country there has been a rapid growth of business. Every year the number of entrepreneurs is growing exponentially, increasing not only the investment climate in our country, but also tax deductions to the budget

On-lending consumer loans. On-lending consumer loans with arrears

Unfortunately, there are often situations when, having issued a mortgage or other loan for consumer purposes, the client after some time realizes that he cannot cope with his obligations. There can be several ways out of this situation - from trying to arrange credit holidays to selling collateral. But there is another way out of the situation, perhaps the least painful - this is the on-lending of consumer loans (it is also refinancing)

Types of mortgage lending. Mortgage Lending Programs

Mortgage lending is now very common. Many people see this as almost the only hope for acquiring their own housing. There are many types of mortgage lending, each of which has its own characteristics

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it