2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

A currency system is a set of institutions through which the government provides money to a country's economy. Modern monetary systems usually consist of the national treasury, mint, central and commercial banks. The types of the currency system can be distinguished as follows.

Commodity variety

A commodity currency system is a monetary system in which a commodity (such as gold) becomes a unit of value and is physically used as money. Money retains its value due to its physical properties. In some cases, the government may stamp a metal coin with a specific emblem or badge to indicate its weight or confirm its purity. The value of such a coin remains unchanged even if it is melted down.

Aspects

Commodity currency should be distinguished from representative money, which is a certificate or token. It can be exchanged for the main commodity, but only if the trade is mutually beneficial for that source and product. A key feature of the marketable form of a monetary system is that the value is directly perceived by the users of that money, who recognize it.utility. That is, the effect of holding the token should be as economical as actually having the money on hand. This principle guides today's commodity markets, although they use a more complex range of financial instruments.

Because payment for goods usually provides some benefit, commodity currency is similar to barter, but differs from it by having a single recognized unit of exchange.

Metals

In situations where the commodity is a metal, usually gold or silver, the state mint issues money in the form of coins. In this case, a special mark is placed on the metal, which serves as a guarantee of the weight and purity of its composition. The characteristic of a currency system of this type is as follows. When issuing the above coins, the government often imposes a fee, which is known as seigniorage.

In situations where a commodity currency is used, the coin retains its value even if it is melted down and physically changed (that is, it actually ceases to be a monetary unit). Usually the monetary value drops if the coin is turned into metal, but in some cases the material's monetary value is greater than the face value of the coin.

Functions

The stages of development of the monetary system can be traced back to antiquity. The use of barter methods involving commodity money may have taken place around 100,000 years ago. To organize the production and distribution of goods and services among the population at a time when the marketthe economy did not yet exist, people relied on tradition, command or community cooperation.

Although some commodity denominations have historically been used in trade and barter (such as barley in Mesopotamia around 3000 BC), in practice it may be inconvenient to use them as a medium of exchange or standard of deferred payment. This is due, first of all, to the problems of transportation and storage. Gold or other metals are sometimes used in the price system as a way to store money, which is not destroyed by environmental degradation and which can be stored for a long time.

Today's questions

The principles of this type of currency system have changed over time. Today, the face value of the base metal coin is set by the government, and it is this price that must legally be accepted as payment. The value of the precious metal in its composition can give it another price value that changes over time. The value of the metal is subject to bilateral agreement, even if they have not been monetized by any government.

Representative currencies

Characterization of the types of currency systems is impossible without a description of the category "money for the sake of money". They are one step away from commodity finance and are called representative. Many currencies are made up of banknotes that have no physical value of their own, but can be exchanged for a precious metal (such as gold). This rule is known as the gold standard. The silver standard was widely adopted after the fall of the Byzantine Empire and continued until 1935.

Another alternative that was tried in the twentieth century was bimetallism, also called the double standard, whereby both gold and silver were legal tender.

Representative money is any exchange rate that has some value but little or no value (intrinsic). However, unlike some forms of financial money (which may not have anything of value in their composition), they must include something to support the face value presented.

The term "representative money" has been used in a variety of ways:

- Claim for goods, such as gold or silver certificates. In this sense, they can be called "commodity money".

- Any type of money that has a face value greater than its price as a tangible substance. Used in this sense, most types of fiat money are a type of representative currency.

Historically, the use of representative money predates the invention of coinage. In the ancient empires of Egypt, Babylon, India, and China, temples and palaces often had warehouses that issued certificates of deposit as evidence of a claim to some of the goods stored in warehouses in this capacity.

According to economist William Stanley Jevons (1875), representative moneyin the form of banknotes arose from the fact that metal coins were often cut off or depreciated during their use.

Fiat money

The alternative to a marketable currency system is cash, which is designated by the central bank and government law as legal tender, even if it has no intrinsic value. The original such money was fiat currency or check coin, but in modern economies it mostly exists as data, such as bank balances and credit or debit card purchase records, and the proportion that exists as banknotes and coins is relatively small.

Money is mostly created, contrary to what most textbooks say, by banks when they lend to customers. Simply put, banks that provide credit to customers create more deposits and deficit spending.

In normal times, the central bank does not fix the amount of money in circulation, and they, in turn, "do not multiply" by more loans and deposits. Although commercial financial institutions create funds through lending, they cannot do so freely without restrictions. Banks are limited in how much they can lend in order to remain profitable in a competitive system. Prudential regulation also acts as a constraint on their activities to maintain the soundness of the financial system. Both individuals and companies thatreceive money created by new credit, can take actions that affect currency funds - they can quickly "destroy" money or currency, using it, for example, to pay off their existing debt.

Central banks control the creation of finance by commercial entities by setting interest rates on reserves. This limits the amount of money that non-states are willing to provide and thereby create, as this affects the profitability of lending in a competitive market. This is the opposite of what many people believe in money creation. The most common misconception is that central banks print all money. This does not reflect what is actually happening.

The creation and regulation of money

The essence, types and elements of the monetary system should be considered starting from the process of creating financial assets. The central bank introduces new money into the economy by buying assets or providing funds to financial institutions. Businesses then regroup or repurpose these underlying funds by creating credit through fractional reserve banking, which expands the total supply of available money (cash and demand deposits).

In today's economy, relatively little of the money supply available is in physical currency. For example, in December 2010 in the United States, out of 8,853.4 billion dollars in the form of broad money, only 915.7 billion (about 10%)consisted of physical coins and paper money. The production of new banknotes and coins is usually the responsibility of the central bank and sometimes the state treasury.

Inflation

The adoption of fiat currency by many countries from the 18th century onwards has led to large fluctuations in the money supply. Since then, there has been a significant increase in the supply of paper finance in a number of countries, causing hyperinflation - episodes of extreme inflation rates much higher than previous periods of commodity money.

Economists generally believe that high rates of inflation and hyperinflation are due to excessive growth in the money supply. A low level of liquidity reduces the severity of economic downturns, allowing the labor market to quickly adapt to new conditions, and reduces the risk that a liquidity trap will prevent monetary policy from stabilizing the economy. However, an increase in the money supply does not always cause a nominal rise in prices. It can lead to stable prices at a time when prices would otherwise fall. Some economists argue that in a liquidity trap, large cash infusions are like “pulling a string.”

The task of keeping inflation low and stabilizing is usually given to the monetary authorities. Typically, these government agencies are central banks that control monetary policy through interest rate setting and open market operations subject to bank reserve requirements.

Loss of support

What is a currency system? How canto be convinced from the above, today it is the process of issuing and circulating fiat denominations. A fiat currency loses its value significantly if the issuing government or central bank either fails or refuses to further guarantee its value. The usual consequence is hyperinflation. Some examples where this happened are the Zimbabwean dollar and the Chinese currency in 1945.

But that doesn't necessarily happen: for example, the so-called Swiss dinar continued to hold value in Kurdish Iraq even after that country's central government revoked its legal tender status.

Characteristics of modern currency systems

The use of currency is based on the concept of lex monetae. This means that each sovereign state decides which unit it will use. Currently, the International Organization for Standardization is introducing a three-letter code system (ISO 4217) for defining currencies (as opposed to simple names or characters) to eliminate confusion. It is connected with the fact that there are dozens of monetary units called the dollar and the franc. Even the name "pound" is used in almost a dozen different countries. Most of them are pegged to the pound sterling, while the rest have different meanings. In general, a three-letter code uses the ISO 3166-1 country code for the first two letters and the first letter of the currency name. The exception is the American currency, which is called the US dollar all over the world and is written as USD.

Alternative currencies

If you give descriptions of the types of currencysystems, alternative monetary units should not be overlooked. Unlike centrally controlled government currencies, private decentralized trust networks support digital denominations such as Bitcoin, Litecoin, Monero, Peercoin or Dogecoin. Branded currencies also fall into this category, for example commitment-based values such as the quasi-regulated BarterCard, loy alty points (credit cards, airlines) or gaming credits (MMO games) based on the reputation of commercial products. The concept of this type of currency system also includes highly regulated alternative financial units such as mobile money schemes (MPESA or E-Money).

Currency can be network (Internet) and digital. For example, bitcoin is not tied to any particular country and is not based on a basket of currencies (and holding assets).

Control and production

The role of the monetary system in modern conditions is obvious. In most cases, the central bank has the monopoly right to issue coins and banknotes (cash) for its own area of circulation (country or group of countries). It regulates the production of denominations by banks (credit) through monetary policy. The exchange rate also belongs to the elements of the types of the fiat-type currency system. This is the price at which two units can be exchanged for each other. This element is used for trading between two currency areas. Exchange rates can be classified as floating or fixed. In the first casecurrent movements in exchange rates are determined by the market, in the second governments intervene in the market to buy or sell their currency to balance supply and demand at a fixed rate.

In cases where a country controls its currency, this control is exercised either by the central bank or the ministry of finance. The institution that controls this policy is called the monetary authority. Such authorities have varying degrees of autonomy from the governments that create them.

Names and denominations of monetary currencies

The essence and types of the monetary system can be derived from the name and distribution of monetary units. Several countries may use the same name for their individual currencies (for example, the dollar in Australia, Canada, and the United States). On the contrary, several countries may also use the same currency (e.g. euro) or one state may declare another's unit as legal tender. This usually happens with some kinds of world currency systems. For example, Panama and El Salvador declared US currency to be legal tender, and from 1791 to 1857 Spanish silver coins were legal tender in the United States. At various times, countries have either reprinted foreign coins or used a currency board that issues one unit for every foreign government note, as Ecuador does.

Elements of the fiat currency system

Each currency usually has a base unit (such as the dollar or euro) and a fractional component, often defined as1/100 of the main unit: 100 cents=1 dollar, 100 centimes=1 franc, 100 pence=1 pound, although units of 1/10 or 1/1000 are sometimes found. In some currencies, there are no smaller units at all (for example, the Icelandic krina).

Mauritania and Madagascar are the only countries today that do not use the decimal system. Instead, the Mauritanian ouguya is theoretically divided into 5 koums, while the Malagasy artery is theoretically divided into 5 iraimbilanja. In these countries, designations such as the dollar or the pound were simply names for a given weight of gold. Inflation caused khoums and iramimbilanja to become useless in practice.

Currency conversion

After analyzing the essence and types of the world monetary system, we can conclude that in fact they are dependent on each other. Currency convertibility measures the ability of an individual, corporation, or government to convert their local unit to another, or vice versa, with or without central bank or government intervention.

Based on the above limitations or free and easily convertible functions, the world's fiat currency systems can be divided into:

- Fully convertible - when there are no restrictions on the unit that can be sold on the international market, and the government does not artificially impose a fixed or minimum value on international trade. The US dollar is an example of such a currency.

- Partially convertible - central banks control international investment in and out of a countrylimits, while most domestic trade transactions are processed without any special requirements, there are significant restrictions on international investment, and conversion to other currencies often requires special approval. The Indian rupee is an example of such money.

- Non-convertible - they do not participate in the international FOREX market and do not allow conversion by individuals or companies. As a result, these currencies are known as locked. Notable examples are the North Korean unit and the Cuban peso.

Recommended:

Hydraulic system: calculation, scheme, device. Types of hydraulic systems. Repair. Hydraulic and pneumatic systems

The hydraulic system is a special device that works on the principle of a liquid lever. Such units are used in the braking systems of cars, in loading and unloading, agricultural machinery and even in the aircraft industry

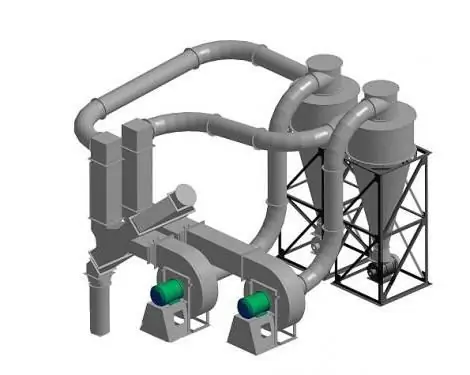

Aspiration systems: calculation, installation. Production of aspiration systems

Aspiration systems are systems that are designed to purify the air. The use of these installations is mandatory at all industrial enterprises that are characterized by harmful emissions into the atmosphere

Visa and Mastercard systems in Russia. Description of Visa and Mastercard payment systems

Payment system - a commonality of methods and tools used for money transfers, settlements and regulation of debt obligations between participants in economic turnover. In many countries, they differ significantly from each other due to the diverse provisions in the levels of economic development and the characteristics of banking legislation

Elements of banking systems. banking infrastructure

The banking system is a set of elements that perform certain functions. What is their essence? What is the specificity of the banking infrastructure as one of the key resources that ensure the functioning of the banking system of the state?

Types of accounting. Types of accounting accounts. Types of accounting systems

Accounting is an indispensable process in terms of building an effective management and financial policy for most enterprises. What are its features?