2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Successful development of the economy of most countries of the world depends on the efficiency of the banking system functioning in the state. What is its specificity? What are the infrastructure elements of the respective system?

What is the banking system?

Let's first study the essence of the terms under consideration. The banking system is understood as a set of financial institutions - banks and other credit institutions operating in the jurisdiction of a particular state. The relevant elements of banking systems are usually classified into 3 main categories:

- national banks;

- federal commercial lending institutions;

- local financial centers (opened in regions, municipalities).

It can be noted that in most modern states, including Russia, 1 national bank has been established. In our country, the corresponding function is performed by the Central Bank of the Russian Federation. In turn, there can be a lot of commercial credit institutions in the state. But what is the essence of both types of financial institutions, as well as the specificsfunctioning of these elements of the banking system? Let's study this issue in more detail.

What is a national bank?

Let's look at who is in charge of the country's gold and foreign exchange fund. The National Bank, or the Central Bank, is the key body of the financial system in the economies of most countries of the world.

Its functions are mainly regulatory. They are most often associated:

- with the issue of the national currency;

- with the implementation of the credit policy;

- with the provision of settlements initiated by various subjects of financial legal relations;

- with supervision over the activities of non-state credit institutions;

- with refinancing of issued loans;

- with the disposal of the state's gold and foreign exchange reserves.

The mentioned functions of the Central Bank characterize the activities of the Central Bank of the Russian Federation. It can be noted that the main Russian bank is state-owned, but is characterized by a fairly high degree of independence from other federal structures.

There are predominantly private central banks. These financial institutions include the US Federal Reserve. The capital of this institution is formed at the expense of contributions transferred by commercial banks. Let's consider the specifics of this type of financial institutions in more detail.

What is a commercial bank?

Along with the Central Bank, another key element of the banking system is a commercial bank, legally independent of the authorities of the country (but at the same time, state participation inownership of the assets of the relevant financial institution). One way or another, the bank should be independent in terms of making decisions on capital management.

According to the type of institution provide various financial services. A commercial bank is an element of the credit and banking system, which:

- provides loans to citizens, organizations, budgetary structures, sometimes other banks;

- refinances loans;

- performs various transactions, for example, on payments from some individuals and legal entities to others, transfers to the budget system in the form of taxes and fees;

- provides opportunities for deposits;

- promotes investment in various assets.

The Central Bank, as we noted above, performs the function of exercising control over the activities of commercial financial structures. Thus, the activities of the latter are sufficiently strictly regulated. As a rule, the start of a commercial bank is possible only if there is a license issued by the Central Bank, and also subject to successful passing of checks by the main credit and financial institution of the state.

Let's now study in more detail what is the characteristic of the elements of the banking system that we have considered. First of all, it is useful to pay attention to their functions in relation to the Russian economy.

Functions of the elements of the banking system in the Russian Federation

In Russia there are all the main elements of banking systems: the Central Bank, commercial credit institutions of the federal scale, as well as local financial structures. The main organization with the largest range of powers is the Central Bank of the Russian Federation. We have outlined its main functions. Among these are the implementation of emission policy, currency regulation of the economy, regulation of financial legal relations, establishment of legal norms and standards for the activities of private credit institutions.

The next key structural elements of the Russian banking system are federal private credit and financial structures. Among them are the largest brands such as Sberbank, VTB, Rosselkhozbank. Their functions are to make key decisions in the banking sector of the Russian Federation, primarily related to lending and servicing the largest enterprises, institutions of the budget system, and international projects.

The largest federal brands may have regional offices that operate in the constituent entities of the Russian Federation and municipalities. In addition, the regions may have their own financial institutions that are not subordinate to federal structures. These organizations perform local functions. A regional bank, whether it is a representative office of a federal brand or an organization created at the level of a subject or municipality, solves problems related, in turn, to lending and servicing enterprises and individuals that operate in the respective region.

It can be noted that in the subjects of the Russian Federation also carry out activities of the Central Bank. They mainly solve tasks related to servicing financial transactions of private banks, monitoractivities of local financial institutions.

Principles of the banking system

Having considered the essence and elements of the banking system, we can explore the basic principles of its functioning. Experts determine their specific list. So, there are principles:

- legal;

- institutional;

- functional.

Let's study their features in more detail.

Legal principles of banking systems

The main principles of the corresponding type include:

- standardization of financial transactions;

- ensure the secrecy of deposits and transactions;

- protection of deposits and payments.

Standardization of operations carried out by banks is based on the normative regulation of the activities of financial institutions. Its main subject is, as we already know, the national bank of the country. It develops the standards and rules by which federal and regional private entities must operate.

Ensuring the secrecy of deposits and financial transactions is the most important principle by which the institutions of the financial system function. A client of a credit institution should have the right to ensure the confidentiality of information about himself, as well as about his deposits and other transactions, for example, those formed in the process of servicing a corporate current account.

The principle of bank secrecy is established at the level of official legal regulations. In this case, we are talking about sources of law that have the highest legal force. In Russia these arefederal laws. So, the principle in question is enshrined in the Federal Law No. 395-1, adopted on December 2, 1990. The jurisdiction of this law includes not only the considered elements of banking systems, but also other entities operating in the financial sector. For example, the Deposit Insurance Agency, various audit structures.

Another important legal principle of the functioning of the banking system is the protection of deposits and payments of clients of financial institutions. A person or organization using the services provided, for example, by a particular regional bank, must be sure that their funds in the form of a deposit or payment will be protected from unauthorized access. The manner in which banks are required to comply with this criterion is also regulated by federal law.

In addition, the central bank of the state can issue regulations in addition to federal sources, monitor the activities of credit institutions in terms of ensuring the safety of deposits and transactions. This aspect of the functioning of banks is among the significant competitive advantages in the market. The client will prefer to apply to the very credit institution that can ensure the security of financial transactions.

The main method of ensuring the protection of deposits and payments in banks is the identification of customers. There are a large number of technologies through which it can be carried out. Because ofactive development of online transactions, the national bank of the state can pay special attention to this aspect of the relationship between clients and banks, both in terms of monitoring the activities of private financial institutions, and in terms of regulating the work of relevant organizations.

Institutional principles of banking systems

The next group of principles for the functioning of banking systems is institutional. These include:

- two-level organization of management of the credit and financial system of the state;

- centralize the management of the country's banking institutions.

The first principle is enshrined, like many others that ensure the functioning of the Russian financial system, at the level of federal legislation. It involves the classification of Russian banks into 2 levels: regulatory and functional.

At the first institutional level of the financial system is the Central Bank and its subordinate regional structures. Its task, as we have already found out above, is to carry out regulatory regulation of the activities of other credit institutions operating in the country. The latter, in turn, are located on the second level. In practice, they implement the main functions characteristic of banks: lending and servicing the population and enterprises. Actually, we also actually considered this aspect above, indicating how the elements of banking systems can be classified.

It is worth noting that the Central Bank of the Russian Federation also decidesimportant functional tasks. True, their essence in many cases is quite far from those that characterize the activities of credit institutions at the second level. Thus, the Central Bank of the Russian Federation lends to private banks, refinances them if necessary, registers federal and regional banks, and issues licenses to them. Commercial institutions are not engaged in these types of activities. The exclusive competence of the Central Bank of the Russian Federation also includes the solution of a number of tasks that are not directly related to the functioning of the banking system. Among them: regulation of inflation, emission, currency policy. These competencies of the Central Bank of the Russian Federation already relate, in fact, to the functional principles of banking systems. Consider their features.

Functional principles of banking systems

Among the key principles discussed in relation to the Russian banking system:

- monopoly right of the Central Bank of the Russian Federation to issue cash;

- exclusivity of credit and financial activities of organizations subordinate to the Central Bank of the Russian Federation.

Thus, due to the fact that only the Central Bank of the Russian Federation has the authority to provide the state economy with cash, the legitimacy and stability of the banking system is guaranteed. This is also facilitated by the fact that banking structures operating in Russia are exclusively engaged in activities in the profile, work only in accordance with the laws that regulate financial and credit operations. The functioning of banks is carried out by using the resources of a special infrastructure. Consider its specifics.

What is the specificity of banking infrastructure?

Banking infrastructure is a set of legal norms adopted by the state authorities, social institutions that ensure the functioning of financial institutions, as well as technological resources, through which various financial transactions are carried out.

The first elements include legal norms governing the activities of the Central Bank and private banking organizations, administrative norms formed within the jurisdiction of individual financial institutions, local regulations adopted by specific financial structures at the level of divisions, offices.

The key social institutions that ensure the operation of the banking system of the state can be represented by:

- authorities managing economic processes at various levels;

- educational institutions and human resources departments responsible for training competent banking professionals;

- research and expert organizations involved in the study and optimization of various business processes at the level of the country's banking system.

Technological resources that form the financial infrastructure can be represented by a wide range of solutions:

- computers and software designed to process banking transactions;

- communication lines;

- fixed assets of banks - buildings, structures, vehicles.

Tothe banking infrastructure was efficient, all subjects of the financial system of the state were interested - in fact, the authorities, the Central Bank, private credit institutions. The extent to which it is stable, functional and technologically advanced largely determines the level of economic development of the country, the sustainability of partnerships established between various economic entities. The banking system is of great importance for the state. Let's study this aspect in more detail.

The importance of the banking system for the state

So, we have considered the main structural elements of the banking system of the state, the specifics of the relevant infrastructure and the activities of the main subjects of financial legal relations at various levels. What is the significance of this system for the country?

Banks, represented at various levels, from the Central Bank to local financial institutions, ensure the functioning of most of the economic legal relations in the state. The status of a bank has a limited number of financial structures. It is received only by those organizations that meet the criteria and requirements established by law. It is assumed that the credit institution will be able to issue loans, accept deposits and ensure their protection, make payments initiated by individuals and legal entities.

The banking system is one of the key elements of the country's economy. The more stable it is, the more successfully the economy of the state will develop. Interaction of elements of the banking system established by the competent authorities,implies, therefore, the participation of citizens, enterprises, budgetary structures, foreign entities.

Financial legal relations are carried out in the economy almost constantly. A person, paying for a purchase in a store, uses the products of the banking system - cash issued by the Central Bank, or a plastic card, which, firstly, is issued by a private financial institution that operates in accordance with the norms of the law and orders of the Central Bank of the Russian Federation, and secondly, it uses an acquiring infrastructure that is managed by the same bank or partner organization. Sellers in this store pay for the supply of goods from counterparties through a bank account, as well as make other payments through it in the form of wages, social security contributions, and various taxes.

Thus, the elements of the modern banking system constantly interact with each other. Their functioning is regulated at the level of official sources of law, local sources. Elements of the credit and banking system work with the use of a special infrastructure, which is represented by a wide range of components. The state should be interested in the quality of the first functioning. This means that it is in the interests of the authorities to ensure the successful development of the necessary infrastructure components of the financial system. Of course, in this case we can talk about the involvement of private structures in this process.

CV

So, we have studied the key elements of banking systems, considered their main functions, as well as the specifics of the infrastructure that they use. The main relevant element in the economies of most modern states is the Central Bank. As a rule, he is endowed with the widest range of powers to issue currency, manage inflation, regulate the activities of another important group of elements of the banking system - commercial credit institutions. The latter also play a crucial role in the economy of the state, ensuring the conduct of various financial transactions involving citizens, organizations, government agencies.

Recommended:

Hydraulic system: calculation, scheme, device. Types of hydraulic systems. Repair. Hydraulic and pneumatic systems

The hydraulic system is a special device that works on the principle of a liquid lever. Such units are used in the braking systems of cars, in loading and unloading, agricultural machinery and even in the aircraft industry

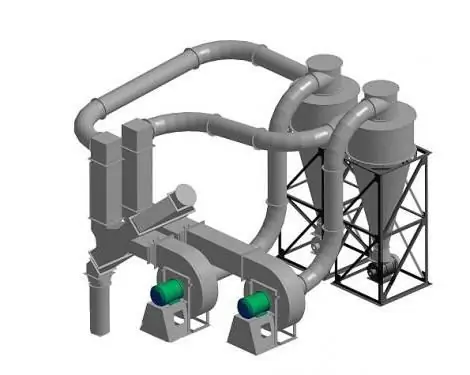

Aspiration systems: calculation, installation. Production of aspiration systems

Aspiration systems are systems that are designed to purify the air. The use of these installations is mandatory at all industrial enterprises that are characterized by harmful emissions into the atmosphere

Visa and Mastercard systems in Russia. Description of Visa and Mastercard payment systems

Payment system - a commonality of methods and tools used for money transfers, settlements and regulation of debt obligations between participants in economic turnover. In many countries, they differ significantly from each other due to the diverse provisions in the levels of economic development and the characteristics of banking legislation

Currency system: types, elements, essence. Characteristics of the types of currency systems

What is the currency system. What types of currency systems are known today, how they are characterized

Corporate systems - enterprise management systems. Basic Models

The article discusses the concepts of "corporate enterprise management systems" and "corporate project management system". In addition, the basic models of CPMS are described