2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-06-01 07:12:56

Approval of expenses of budgetary organizations involves the establishment and bringing limits of obligations, control and accounting for their acceptance. It is necessary in order to prevent the assumption of obligations that are not secured by appointments determined by budget legislation. Sanctioning the expenses of a budgetary institution is carried out taking into account the implementation of budget revenue items.

Main steps

The procedure for authorizing expenditures is regulated by budget legislation and other sectoral regulations. Authorization is carried out as follows:

- The consolidated budget list is being compiled and approved.

- Budget appropriations are approved and communicated to fund managers and recipients. Expenses and income estimates are approved for them.

- The limits of obligations accepted by the recipients of funds are being agreed upon and adjusted.

- Confirmation and reconciliation of fulfillment of obligations.

Summary painting

Funding of recipients and administrators of funds is allowed strictly in accordance with the appointments. They are provided for in the annual budget schedule with mandatory quarterly distribution.

As indicated in article 217 of the BC, the list is the body responsible for the formation of the draft budget (at the appropriate level). It is approved by the head of the financial structure (for the federal budget - the head of the Ministry of Finance of the Russian Federation, for the regional budget - the minister of finance of the subject) and sent to the treasury.

The basis for the compilation are lists formed by the main managers of funds in accordance with the codes of the economic and functional classification of budget expenditure items with a quarterly breakdown.

Expense and income estimates

A budgetary institution gets the right to use funds only after the approval of a document defining their volume, quarterly distribution, target direction.

Expenditure estimates are formed on the basis of the notice of appropriations. It is brought to the institution by a higher manager.

Changes in the summary list

According to the provisions of the BC, adjustments can be made if:

- Introduced budget cuts.

- Revenue items were executed in excess of the amounts provided for in the legislation or the decision on the relevant budget.

- Chief steward moved appropriations between recipients.

Limits

The introduction of the treasury system for the execution of budget items led to the emergencenew procedures. In the banking scheme, many of them are missing. New procedures within the framework of authorization of expenses are the setting of limits, the acceptance and confirmation of obligations.

Limits are the basis for funding costs. They reflect the maximum scope of the recipient's rights to accept financial obligations. Limits are set on the basis of the indicators present in the summary list. At the same time, the forecast of revenues and sources of funds to cover the budget deficit is taken into account.

The Treasury through its bodies brings the limits to the main managers. They, in turn, bring them to the recipients.

One of the key steps in spending authorization is control. Approved limits must be submitted to the relevant treasury authority. He, in turn, provides control over spending.

Acceptance and confirmation of commitments

Under the acceptance of obligations should be understood the conclusion by the recipient of funds of contracts with organizations providing services to him (performing work for him), within the limits.

Confirmation is the verification of compliance of payment documents with limits and approved cost and income estimates. It is carried out by a body authorized by the Treasury. The verification precedes the withdrawal of funds from the account.

Authorization of expenditures, thus, excludes the possibility of accepting for financing payments and costs that are not budgeted or not provided with income and funding sourcesbudget deficit.

Accounting

The rules for its maintenance are defined in sec. 5 part III of Instruction No. 148 (approved by order of the Ministry of Finance of December 30, 2008). Expense authorization accounting includes transaction accounting:

- with liability limits;

- with estimated appointments for profit-making activities and commitments made.

Accounting is carried out on the basis of primary documentation established by the financial structure of the relevant budget. Accounting is carried out with the reflection of correspondence on the items of authorization of expenses. This rule is enshrined in paragraph 239 of the Instruction.

KRB accounts

Accounting for the approved limits of obligations is carried out on the account. 050100000. This is stated in paragraph 241 of the Instruction. Accounting for commitments made in the current year is carried out according to budget expenditure codes using accounts:

- 150201000;

- 250202000.

The first account is used to summarize the amounts of commitments accepted within the limits of the appropriations/limits approved for it for the respective financial period (year).

On account 250202000 the recipient takes into account the amounts of obligations that were accepted within the cost and income estimates for profit-making activities, the volume of appointments for the current / next year, changes made to obligations. The relevant provision is contained in paragraph 251 of the Instructions.

Analytics

Analytical accounting for the obligations assumed by the institution is carried out in accordance with the documents confirming their acceptanceaccording to the list approved by the financial authority, the administrator of the sources for covering the deficit or the recipient of funds. The indicators are reflected in the Journal (f. 0504064).

Accounting records

When authorizing expenses, postings for bringing limits and accepting obligations within them are made out by records:

- Db KRB 150115000 Cd KRB 150113000 - shows the amount of limits of obligations brought to the recipient in the prescribed manner, the amount of adjustments made during the reporting (fiscal) year, in accordance with the notification of limits.

- Db KRB 150113000 Cd KRB 150113000 - shows the details of the indicators brought to the recipient of limits by codes of sub-articles, articles of KOSGU. If the limits were adjusted without a breakdown by KOSGU, the amounts of adjustments made during the year are also reflected.

- Db KRB 150113000 Cd KRB 150211000 - the amounts of obligations assumed by the recipient within the limits and changes made during the year are taken into account.

Entries to authorize expenditures in profit-making activities are as follows:

- DB KRB 250411000 Cd KRB 250412000 - the amounts of appointments (adjustments made) for the costs of the institution approved by the cost estimate are taken into account.

- Db KRB 250412000 Cd KRB 250212000 - shows the amount of the institution's obligations accepted within the limits of appointments approved for the corresponding reporting period.

In the event of a reduction in the limits of obligations, entries are made according to the "red reversal" principle with a "-" sign. Relevantthe rule is provided for in paragraph 239 of the Instructions.

CWR

In 2015 there were significant changes in the procedures for authorization of expenses. This was primarily reflected in the fact that the implementation of the budget from this year began to be carried out without the use of KOSGU codes for CWR (expenditure type codes) of the budget. These codes are given in Instructions No. 65n. They are divided into the following groups:

- 100 - employee benefit costs;

- 200 - procurement of services, goods, works for municipal / state needs;

- 300 - social security and other payments to the population;

- 400 - capital investments in real estate objects of municipal/state property;

- 500 - intergovernmental transfer operations;

- 700 - municipal/government debt servicing;

- 800 - other appropriations.

Public institutions

The transition to the execution of budget items for the CWR means that the founders of such organizations do not have the details of the allocated limits of obligations for KOSGU.

In 2016, the provisions of Instruction No. 162n were adjusted. First of all, the changes affected the expense authorization accounts.

In accordance with the current version of the Instruction, on most of the 500 accounts, accounting is carried out in the context of the relevant analytical articles. The latter, in turn, must be approved as part of the institution's financial policy.

Reflection of operations

When authorizing the expenses of a public institution, the entries on the 500th accounts indicate:

Commitments made. These include obligations established by legislative (other legal document) to provide funds from the relevant budget in the financial year. The amounts are determined on the basis of notices of procurement using competitive methods for determining the supplier, posted in the EIS (unified information system), in the amount of the maximum (initial) cost of the contract

- Responsibilities of a participant in budgetary relations. These obligations stipulated by the law, other normative act, agreement/agreement are borne by the public legal entity (the institution acting on its behalf). It undertakes to provide an individual or organization, subjects of international law, other public legal entity with budgetary funds in the corresponding year.

- Money obligations. These include the obligation of a state institution to pay a certain amount of funds under the terms of civil law transactions, agreements / contracts drawn up in accordance with the requirements of the current legislation.

Authorization of contracted costs

The procedure for recording relevant transactions is significantly affected by procurement legislation. Planning is done through the creation, approval and maintenance of schedules and procurement plans.

When authorizing the expenses of a public institution, the amount of obligations that are accepted in the amount of the maximum (initial) cost of the contract with the contractor (contractor / supplier) selectedusing competitive methods are recorded as follows:

- db ch. 0 50113 000 Cd rec. 0 50217 000 - obligations assumed in accordance with the notice are taken into account.

- db ch. 0 50113 000 (0 50217 000) 0 50211 000 - obligations under the concluded contract are reflected.

2017 Spending Authorization

The procedure for summarizing information on transactions was changed by order of the Ministry of Finance No. 209n dated November 16, 2016. In particular, the Unified Chart of Accounts was supplemented. The changes came into effect on January 1st. 2017. Expenditure authorization includes transactions related to advance cash commitments. The plan is supplemented with the following articles:

- 050203000 - it summarizes information about accepted advance monetary obligations;

- 050204000 - here reflect information about performance obligations;

- 050205000 - this account summarizes data on fulfilled obligations.

Completion of the current year as part of the authorization of budget expenditures

At the end of the year, balances on analytical accounts of fulfilled obligations and planned appointments for receipts and payments are not carried over to the next year.

Paragraph 312 of Instruction No. 157n includes a paragraph according to which the indicators of obligations of the current period must be re-registered in the year following the reporting one. An exception is provided for fulfilled duties.

Changes in analytics

According to the adjustments of paragraph 313 aboveInstructions, the accounting of liabilities posted on the authorization accounts is kept in the context of:

- creditors (their groups), contractors, executors, sellers/suppliers and other counterparties in respect of which obligations have been assumed;

- agreements/contracts;

- other analytics provided for by the accounting policy.

Transactions are registered in the Journal in accordance with the primary documentation approved by the institution.

Application of account. 050200000

General rules are provided for in Instruction No. 157n, in clause 318. This clause was changed by Order of the Ministry of Finance No. 209n.

As stated in the new edition, cf. 050200000 is intended to reflect the indicators of liabilities in the current (next) financial year, the 1st and 2nd years of the planning period and other regular years beyond it, changes made to the indicators not only directly by institutions, but also by the Treasury bodies.

Accounting is carried out on the basis of documentation confirming the occurrence (acceptance) of obligations. This uses the data of the list established by the institution as part of the financial policy, based on the documentation requirements determined by the financial authority or the Treasury.

Example

Let's consider the rules for recording transactions with the following initial data:

- A budgetary institution, using competitive methods to determine a supplier, signed a contract for the supply of equipment, the cost of which is 800 thousand rubles.

- Maximum (initial) purchase price - 900 thousand rubles

- Under termscontract, the institution must deduct an advance payment in the amount of 30% of the contract price - 240 thousand rubles.

- After the conclusion of the contract, the contractor received an invoice for the amount of the advance paid by the customer.

- When the equipment was shipped, an invoice was issued and a TORG-12 waybill was issued. They reflect the cost of delivery - 800 thousand rubles.

- The customer paid for the contract, taking into account the advance payment. The final payment amount was 560 thousand rubles.

The operations of the institution were carried out within the framework of activities that were financed by subsidies for the execution of the tasks of the founder. The action reflection will be as follows.

| Contents | db | cd | Amount (in thousand rubles) |

| Placement of a notice of purchase in the EIS | 450610310 | 450217340 | 900 |

| Acceptance of spending obligations when drawing up a contract | 450217310 | 450211310 | 800 |

| Clarification of the amounts of expenditure obligations when drawing up a contract based on the results of competitive events | 450217310 | 450610310 | 1000 |

| Acceptance of advance obligations for accounting | 450211310 | 450213310 | 240 |

| Acceptance of obligations | 450213310 | 450212310 | 240 |

| Fulfillment of monetary obligations | 450212310 | 450215310 | 240 |

| Assumption of obligations in the amount of the final payment for the delivery | 450211310 | 450212310 | 560 |

| Fulfillment of obligations under the transaction | 450212310 | 450215310 | 560 |

Extra

It should be noted that Instruction No. 174n was supplemented by correspondence accounts for accounting for operations on the amounts of deferred obligations assumed by institutions.

Thus, the provisions of paragraphs 166 and 167 were updated. 050299000 reflects the amount of deferred obligations, which is determined at the time of conditional (estimated) acceptance, or the time of execution of which is not set. At the same time, the institution must create a reserve for future expenses.

Approved amount of collateral

Accounting for the amounts approved by the plan of financial and economic operations of the organization for the corresponding years, estimated appointments for receipts is carried out on the account. 050700000. Analytics on it are carried out in the context of types of income (or codes, if any).

Recommended:

Message from Sberbank: "Authorization cancelled". What is it, in what cases does the error occur?

When working with Sberbank cards, customers sometimes encounter a problem when their operation is not completed. In this case, after payment, an SMS from 900 comes with the message: "Authorization cancellation". Sberbank thus warns the owner about the presence of a failure in the system. What is the reason for the error and how to solve the problem?

Bonuses "Thank you from Sberbank". Where to spend?

Did you decide to become a member of the "Thank you from Sberbank" bonus program? Where to spend the accumulated points? Do not know? You should not worry, because there are a large number of outlets that are partners in this project

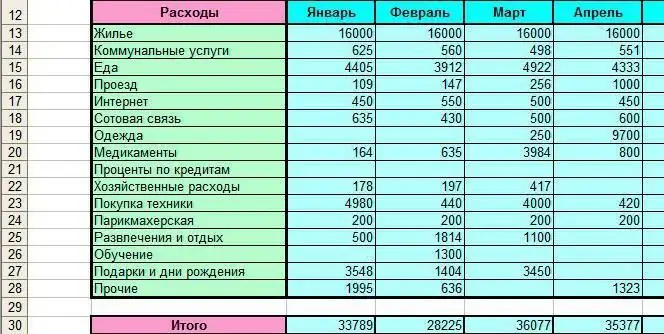

How to spend money correctly? Family budget: an example. home bookkeeping

You need to be able to spend money. More precisely, each person can learn how to properly manage money. This will help you save and save. What techniques can help? How to do home bookkeeping? Top tips and tricks next

How to spend "Thank you" points from Sberbank: program conditions, bonus accrual, accumulation and calculation of points

Have you been accumulating bonuses for a long time and now you don't know where to spend "Thank you" points from Sberbank? Or you just want to enroll in the program, but don't know how to do it. We will tell you the rules for registering in the “Thank you from Sberbank” program in question, as well as how to accumulate and spend points

What can I spend "Thank you" from Sberbank on? Features, conditions and reviews

The loy alty program "Thank you" from "Sberbank" is an accrual in the form of bonuses for purchases from the card. The amount of contributions depends on the type of card, promotion or special offer from the partner, but cannot be less than 0.5%. The accumulated points can be used by bank customers depending on their preferences: in cafes, shops, pharmacies. Active buyers are advised to know all the options for what you can spend "Thank you" from Sberbank