2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Every citizen receiving income must pay income tax to the budget. Tax legislation provides for benefits that give the right to return part of the transferred tax in connection with certain expenses.

For what expenses can I return personal income tax

Almost every citizen who receives a salary, there are expenses that fall under the tax break. Depending on the type of spending, the state can return part of the paid income tax, accrued at a rate of 13%. The legislation establishes several types of tax deductions: social, property. To take advantage of this opportunity, you need to contact the local tax authority and submit a certain package of documents.

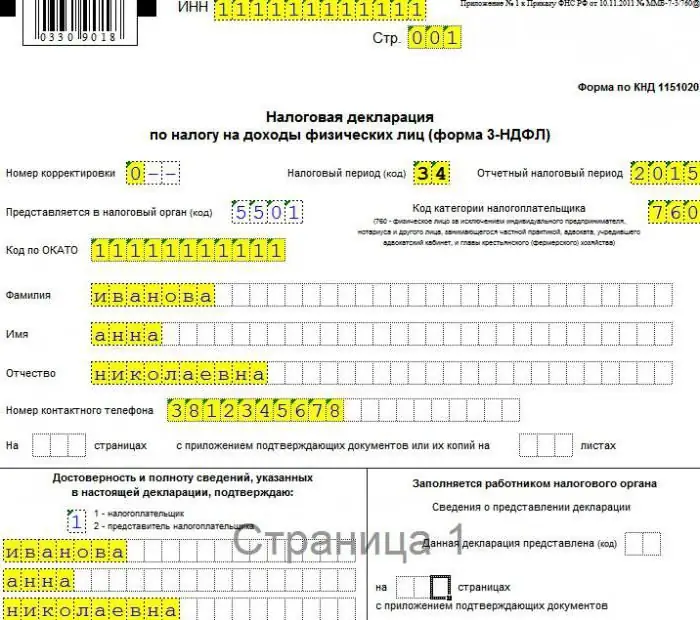

The main document confirming the expense incurred is the 3-NDFL declaration. Also, the taxpayer needs to write an application for a personal income tax return and for a deduction.

The applicant can return the tax in several ways: through the tax office or directly from the employer. Property deductions can be granted in the current year, andsocial - only after the end of the reporting period.

Who can apply

An application for a refund of personal income tax is submitted by the person who incurred the expense. If a citizen paid for the treatment or education of a child, then the contract must contain the personal data of the taxpayer. When buying a home, initials and passport details are indicated in all payment documents. A sample application for the return of personal income tax can be found on the website of the tax authority. You can also consult there about filling out the declaration.

There are cases when both spouses receive a property deduction, having previously agreed on the percentage of the amount of tax refunded. This method is used when wages in the family vary significantly, and get a deduction faster with a larger amount of income.

How to fill out a sample application for personal income tax refund yourself

Application for a refund has a standard form and is addressed to the head of the territorial office of the tax inspectorate. You can fill out the form by hand or using a computer program.

The application for the return of personal income tax contains an information part, where the personal data of the taxpayer, as well as his address and telephone number are entered. The application part of the document indicates the amount of tax to be refunded. This amount can be taken from the 3-NDFL declaration. Next, you need to fill in the bank details for which the refund will be made.

In confirmation thatall information is specified correctly, the application for the return of personal income tax must be personally signed by the applicant. In case of incorrect bank details, funds may be lost. Therefore, you should check the entered digital information several times.

How tax refund applications are submitted

There are several standard ways to submit documents to the tax office. The application form for the return of personal income tax can be taken personally to the regulatory authority, and if another person does this, then a power of attorney will be required. Also, the document can be sent by mail. To do this, it is necessary to issue a mail with a valuable letter and put an inventory in the envelope. The mail notification sent to the tax office upon receipt of the letter will be proof that the application form for the return of personal income tax has been accepted for consideration.

Income tax refund is of great importance, since this amount can reach up to 260,000 rubles. Do not neglect this possibility of receiving funds, especially since the return procedure is currently simplified as much as possible.

Recommended:

The main elements of personal income tax. General characteristics of personal income tax

What is personal income tax? What are its main elements? Characteristics of taxpayers, objects of taxation, tax base, tax period, deductions (professional, standard, social, property), rates, calculation of personal income tax, its payment and reporting. What is meant by an invalid element of personal income tax?

How to calculate personal income tax (personal income tax) correctly?

Personal income tax (PIT) is familiar not only to accountants. Every person who has ever received income must pay it. Income tax (that's what it was called before, and even now its name is often heard) is paid to the budget from the income of both Russian citizens and temporarily working in the country. In order to control the correctness of the calculation and payment of wages, it will be useful to know how to calculate personal income tax

How much personal income tax percent is? Personal Income Tax

Today we will find out how much personal income tax percent is in 2016. In addition, we will learn how to calculate it correctly. And, of course, we will study everything that can only relate to this contribution to the state treasury

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Is it possible to get income tax refund when buying a car? Documents for income tax refund for education, treatment, purchase of housing

Any officially employed person knows that every month the employer transfers income tax from his salary to the Federal Tax Service. It makes up 13% of income. This is a necessity, and we have to put up with it. However, it is worth knowing that there are a number of cases when you can return the paid income tax, or at least part of it