2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Work with this system occurs without leaving the chair or sofa. This is exactly what they say about a fairly common interactive service called "Client-Bank". This is a unique product of a financial institution. It is he who allows you to perform various actions with client accounts, but with minimal effort. What is this system? How does it work and how difficult is it to install?

General information about the system

"Client-Bank" is a special service for regular bank customers. It is a specialized software package that provides access to various account transactions.

Within the framework of the system, clients can exchange documents and information with their partners, as well as representatives of a financial institution. And you can do all this remotely. And the exchange process itself is carried out through a computer or mobile phone connected to the Web.

A little historical background

The "Client-Bank" system is far from a new service. According to preliminary data, financial institutions have been providing it for 6-7 years. According to representatives of banks, the system was created to facilitate and simplifywork of clients with their accounts. Moreover, with its help, bankers not only gain the favor of their current clients, but also completely new users.

Where do banks get this program?

Most financial institutions that want to add "Client-Bank" services to their existing services try to place an order directly with the developer. In this case, they don't need to reinvent the wheel. You just need to connect the "Client-Bank" (this is not at all difficult to do) and adapt it to a specific credit institution.

Other banks are trying to make an exclusive product on their own. In this case, they themselves create a system of their own. However, as such, there are no general rules for the production of such software. There is also no general approach of bank representatives when connecting the service. For example, in some financial institutions, money is not taken for access to the service. For others, such services are paid. Still others offer customers a monthly paid service, etc. In a word, each organization has its own “Client Bank”. Logging into the system and its connection most often involves the use of one-time and permanent passwords.

What types of service are there?

"Client-Bank" can be conditionally divided into two types:

- Fat Client.

- Thin Client.

In the first case, we mean the classic version of the program, which involves installing a separate service on the user's workstation. What does it mean? In other words,The program is installed on a computer or mobile device. All necessary data, including various account statements and documents, are also stored on the PC and in the Client-Bank service. Sign in with a portable device connected to the Web.

"Thick client" involves various options for connecting to the bank. The simplest among them is the option using telephone lines, a modem, or an Internet connection. This type of system does not require permanent access to remote banking technology (RBS for short). The thing is that initially such a program can be installed on its own database management system. This approach helps to back up the relevant databases and provides users with a network version of the service. Moreover, all this happens at a high speed of processing documents, which is very convenient for accountants and large entrepreneurs.

In the case of a “thin client”, the system is logged in through an Internet browser. At the same time, the program itself is installed on the virtual service of the credit institution, and all user data is stored on the bank's website (in the "Personal Account" section). In fact, this is the same Internet banking for PC or mobile banking for phones and smartphones. However, everything in the complex is called "Bank-Client". Credit, sending transfers, paying bills and other financial functions become available after connecting this program.

Bank "Opening": "Client-Bank"

Let's give an example of connecting the system. As a sample, we will choose the Otkritie bank. To work with the program of a financial institution, you need to follow four simple steps:

- Install and run the special Rutoken driver.

- Set up Explorer Internet Browser.

- Install and connect special ActaveX components.

- Invent or implement a ready-made electronic signature.

All settings can be found on the bank's official website ic.openbank.ru. After completing all the above steps, you can register and log in.

What is the purpose of the "Client-Bank"?

The main function of the "Client-Bank" system (for legal entities this is a real find) is to provide an opportunity to make payments to an enterprise without a personal visit to a financial institution. Moreover, this service makes it possible to track movements on the company's current accounts. As a rule, such duties are assigned to the shoulders of accountants. With the help of this service, for example, they can learn about the transfer of funds from the clients of the enterprise. After the payment is made, the organization has the right to ship the goods.

In addition, within the system, company executives or people authorized by them can receive ready-made account statements, find out the current exchange rate, and keep records of existing counterparties. And also with the help of "Client-Bank" you can always be aware of the latest news of a financial institution, includingthe emergence of new products, a decrease in interest on loans, an increase in deposit rates and various promotions.

What are the benefits of the program?

Among the main advantages of banking software are the following:

- Easy to connect.

- Easy to manage (no additional training or skills required).

- Ease of use (no need to visit a bank branch).

- Control of all account movements remotely.

- Ability to create ready-made templates for making payments.

- Receive the latest news about banking products.

- Providing information about current exchange rates (indispensable when performing exchange transactions).

- Ease of use of electronic document management.

And of course, the system is famous for its efficiency. When using it, the bank's customers, including legal entities, admire the high speed of making payments. Moreover, all data is stored in a single electronic registry and does not require documentary confirmation. Since most documents have an electronic signature of the head of the organization, this equates them to real forms and eliminates the need to print or scan.

Finally, the system works around the clock. This allows the organization's customers to control their accounts throughout the business day. Moreover, the system is reliably protected. It controls actions using one-time passwords, as well asadditional electronic keys.

Negative aspects of working with the program

Sometimes, unpleasant situations can arise in the operation of the system. In particular, most of them are associated with uncoordinated actions of the heads of the enterprise and the bank. The problem is especially acute when the system is purchased and installed independently. At the same time, a completely different software part can operate in the bank itself. As a result, they are not compatible and the workflow is interrupted.

Recommended:

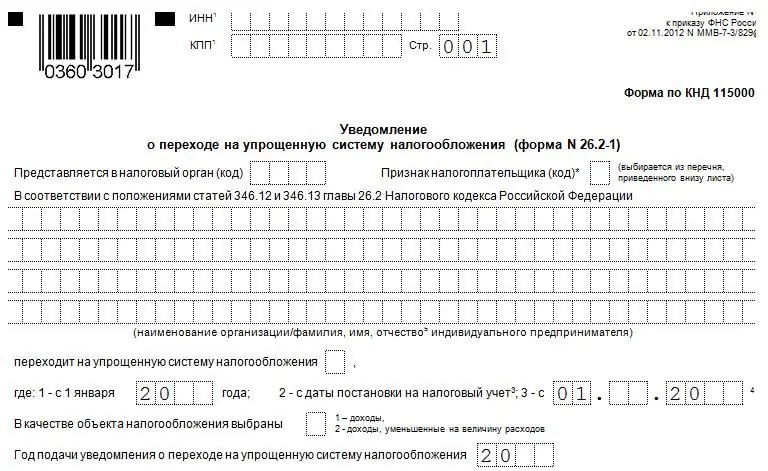

Using the simplified tax system: system features, application procedure

This article explores the characteristics of the most popular taxation system - simplified. The advantages and disadvantages of the system, conditions of application, transition and cancellation are presented. Different rates are considered for different objects of taxation

Staffing of the personnel management system. Information, technical and legal support of the personnel management system

Since each company determines the number of employees independently, deciding what requirements for personnel it needs and what qualifications it should have, there is no exact and clear calculation

Centralized management: system, structure and functions. Principles of the management model, pros and cons of the system

Which management model is better - centralized or decentralized? If someone in response points to one of them, he is poorly versed in management. Because there are no bad and good models in management. It all depends on the context and its competent analysis, which allows you to choose the best way to manage the company here and now. Centralized management is a great example of this

Deposit insurance system: system participants, bank register and development in Russia

The problem of ensuring the safety of cash deposits in banks is one of the main ones for the positive development of the country's economy. In order to ensure the stable functioning of the banking sector in Russia, a system of deposit insurance has been developed

Anti-aircraft missile system. Anti-aircraft missile system "Igla". Anti-aircraft missile system "Osa"

The need to create specialized anti-aircraft missile systems was ripe during the Second World War, but scientists and gunsmiths from different countries began to approach the issue in detail only in the 50s. The fact is that until then there simply were no means of controlling interceptor missiles