2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:38

In the last twenty years, Russia's investment funds have changed and expanded. Each of them has its own scheme of work and level of risk. The highest returns are offered by those funds where the degree of risk is quite high.

What is an investment fund

A mutual fund is an association of several investors, whose funds are “invested” by a professional manager in securities to receive income from invested capital. All property of the fund belongs to shareholders, and the management company only manages in the interests of investors.

Legislation forbids mutual investment funds in Russia to advertise the expected income, they can only provide potential investors with their previous profitability. Based on this data, citizens decide whether to become shareholders or not.

A little about Pai

An investment share is a registered security, it certifies the right of its owner to a part of the fund's property. It can be transferred to another person (as a gift, by inheritance, etc.) or sold.

The share of a shareholder in a mutual fund directly depends on the funds contributed. Share contributiondifferent for each PIF. It can have a cost of several thousand rubles, the upper limit is not outlined.

You can withdraw the funds invested in the fund by selling a share. As an option - to other shareholders, but usually the management company is engaged in its implementation.

Pros and cons of mutual funds

The advantages of Russian investment funds can be considered as follows:

- The fund is run by professionals. Managers who carry out management have certificates from the Federal Commission for the Securities Market.

- Risk minimization. Competent managers make every effort to diversify investments and reduce the dependence of the investment portfolio on the decline in the value of securities and other risks.

- Reliable investment protection. It includes licensing of the company, certification of specialists, control over the activities of the fund.

- The investment conditions are very convenient. A shareholder can enter and exit the fund at any time.

- Preferential taxation system. Income is not subject to income tax.

- Regularly providing investors with up-to-date information about the fund.

It is necessary to mention the disadvantages of this kind of investment:

- Mutual funds will bring income in the medium or long term no sooner than a year.

- The services of an investment company are not free, they charge a commission for their work, regardless of whether the investor made a profit or "left" at a loss.

- Each investor can bothget income from invested funds, and "go to zero" without earning anything.

Types of funds

Investment funds in Russia are diverse. For convenience, we present the differences between funds of various types in the form of a table.

| Criterion | Types of funds | Description |

| By openness | Closed |

Shares are issued and redeemed during the formation of the mutual fund. You can redeem the shares after the expiration of the mutual fund. Such funds are most often formed for a specific project. |

| Open | Shares are issued and redeemed every business day. The assets of an open-end mutual fund are highly liquid securities with stock quotes. | |

| Interval | On specific dates specified in the rules of the mutual fund (twice or thrice a year for 2 weeks). The fund's assets are usually securities with low liquidity. | |

| By direction of investment | Money Market Funds | Funds are invested in promissory notes, certificates of deposit and other short-term deposits. |

| Bond funds | Investing in bonds brings monthly income. The most reliable of the bond funds are government bonds, since securities are issuedstate. | |

| Equity funds | Joint-stock investment funds in Russia are very popular due to their high yield, but the value of the assets of such mutual funds varies greatly depending on the situation on the securities market. | |

|

Mixed Funds |

Funds are invested in both stocks and bonds, so that shareholders receive both a fixed income from bonds and a good high-risk return (from stocks). | |

| Real Estate Funds | Profit comes from renting or reselling real estate. | |

| Funds of funds | Funds are invested in other funds, thus ensuring high reliability of invested funds. | |

| Sector Funds | Funds are invested in companies operating in the same industry. | |

| Foreign equity funds | Money can be invested in companies located around the world. |

Other types of funds

In addition to those presented in the table, there are other types of mutual funds:

- Pension. They invest in both bonds and stocks. The length of the investment period depends on the age of the investor. This type is suitable for those who wish to receive income, the rate of which does not exceed 10% per year, after retirement.

- Funds invest only in industries where they can gethigh profits with minimal risk, which is why such funds are also called guaranteed. Most often, the safety of investments is ensured by large foreign banks, but only with long-term investment (5-15 years).

- Socially responsible funds invest in organizations that improve the quality of life of citizens (for example, he alth centers).

Yield Rating

Potential shareholders should have information about the reliability of Russian investment funds. The yield rating looks like this:

- The leading positions are held by funds organized by Sberbank. They are reliable, but not highly profitable. The maximum income is 25% per annum.

- In second place are mutual funds of the German Raiffeisen Group. The level of profitability of the company is average (about 40% per annum).

- The third position belongs to the Trust Investment Company. 50-60% yield and a life of more than 10 years make it very popular.

These are only the most popular investment funds and companies in Russia, which are most widely used.

Mutual investment funds have been operating in Russia since the mid-1990s. During this time, they managed to win the trust of citizens as a good way to invest free finances to generate additional income. However, before making a final investment decisionfunds to a particular fund, you must carefully study the information about it.

Recommended:

Evaluation of investment projects. Risk assessment of an investment project. Criteria for evaluating investment projects

An investor, before deciding to invest in business development, as a rule, first studies the project for prospects. Based on what criteria?

Investment: investment multiplier. Investment multiplier effect

The investment multiplier is a coefficient that shows the change in gross product along with investment. Its effect can be seen by considering a specific example

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

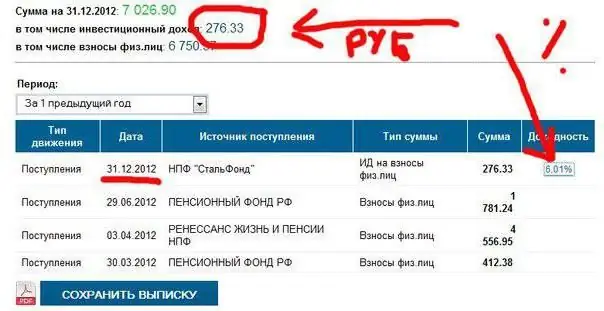

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?