2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way. In addition, you need to understand the rules for calculating your debt. This is not so difficult to do if you properly prepare for the process.

Register

The first step to go through is registration on the corresponding portal. In our case, this is "Public Services". You should not have any questions - allthe process is extremely simple. Visit gosuslugi.ru, and then in the right part of the window (in the corner) click on "Registration".

You will see a small form to fill out. Here you should write only real information about yourself. In principle, you will have to do the same at all subsequent stages of filling out the profile. Here you will need both TIN, and SNILS, and passport data. Without them, payment of tax through the "Gosuslugi" is simply impossible. And in general, you won’t be able to use the portal to the fullest.

Have you finished filling in the fields? You will receive a special activation link at the specified email address. As soon as you go through it, you can work with the portal. What's next?

Service search

The second step is to search for the corresponding service in the list. As a rule, many experience difficulties during the implementation of tax payments through the "Gosuslugi". After all, finding the right item can be extremely difficult.

If you do your own research, you will have to look in the "Authorities" section. Here, of course, you need to select "Tax Service". Next, open the appropriate section and click on the desired line. In our case, this is the "transport tax". Click "Get Service" and see what happens. Here you will see a window in which you have to fill in some data. This is usually information about the payer and his vehicle. In addition, there is also an item in which you need to enter the amount of tax. Best after fillingdetails, use a bank card to complete the action. You will be presented with this method. Enter the details of the bank card and the recipient, and then confirm the actions.

In addition, if you are thinking about how to pay the transport tax through the "Gosuslugi", just enter the corresponding request in the special search line (upper right corner). And you will immediately be given a page with detailed information on how to make a payment. Not as difficult as it might seem, right? But there is one small problem - this is the question of how to calculate the transport tax.

Settlement rules

Fortunately, for those who plan to work with the "Gosuslugi" website, this is not such a big problem. Why? All data is stored directly in the system. All the user needs to do is retrieve them and remember.

Calculate transport tax with the help of "Gosuslug" is easy and simple. Like last time, we go to "Authorities" - "Tax Service". Here now you need to pay attention to such an item as "Free information". Click on it. Next, you need to click "Get a service".

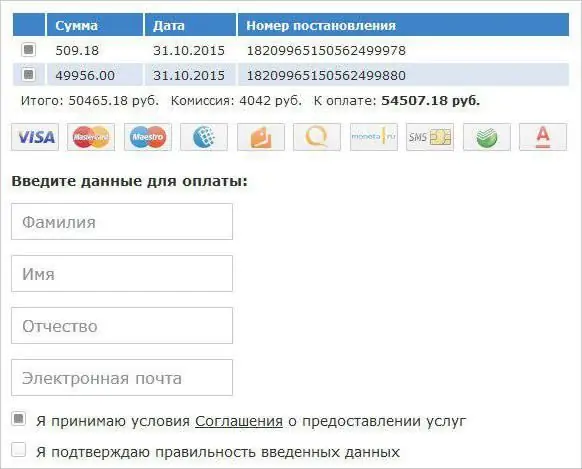

Your debt information will appear on the screen. This is the vehicle tax. Now you can remember this amount, and then enter it in the appropriate field. Sometimes the tax is "prescribed" on its own in a virtual receipt. Please note that it will be processed within 14 days. And thereforeimmediately after the end of work with the system, your payment will still be displayed as a debt.

When to pay?

Now it is clear how you can pay the transport tax. The Tax Code of the Russian Federation also establishes the deadlines in which all taxpayers must "keep within". Otherwise, a fine will be imposed on you, plus pen alties will be charged. By what date do we need to resolve our today's issue?

Everything is extremely simple here. Transport tax (TC RF includes clarification of payment terms) is paid by citizens of the Russian Federation before July 1 of the next year, which came after the reporting year. For example, for 2014 you need to pay before 2015-01-07. In principle, there are no problems here. Portal "Gosuslugi" (Moscow and any other region) contains information about the timing of payment of taxes. If you suddenly forgot about them, you can find the relevant items in the description of the vehicle tax payment. There is nothing special about this. But it is not always convenient to work through the portal. Paying tax with a regular bank card is more popular.

Bank to help

Let's consider our today's idea on the example of Sberbank. After all, many citizens in Russia use it. Paying tax through "Gosuslugi" is very convenient. But it's still a bit odd. But in a bank or through an ATM, if you have the appropriate receipt, you can resolve the issue faster. You can check the debt after through the "Gosuslugi".

You must have a receipt and payment details. We approach the ATM, insert a plastic card into the receiver, enter the pin code. Now you need to select "Payments in your region". Click on "Search for a recipient", and then select "By TIN". Enter the data from the recipient's receipt.

If you did everything right, the system will give you all the necessary data on the payment of transport tax. Check each item carefully. There is nothing special about this. Sometimes you have to enter all the necessary information yourself in the appropriate fields. The transport tax calculation will either be displayed automatically or you must enter it and then confirm.

Confirm our actions, after which we take the check and save it. It can come in handy at any time. All necessary funds will be debited from your card automatically. It's easier than working with the "Gosuslugi" portal. Moscow, St. Petersburg or any other region is not so important, because everywhere this process is the same. However, if you do not like using an ATM, you can simply come with a passport and a receipt, as well as money to the cash desk of Sberbank. You give the payment document, present an identity card and all problems are solved.

E-wallet

Transport tax, the sample payment of which can be seen on the portal "Gosuslug" can be paid not only by more or less familiar methods. For example, every citizen is able to use payment via the Internet using an electronic wallet, for example, WebMoney.

What do you need for this? First, the availability of funds in the account. Secondly, your authorization. We go to your profile and select "Fine and taxes" - "Taxes by TIN" there. Next, enter the relevant data. The system will give you tax returns. Select Transport and click Next. The required amount will be debited from your account. There will be no more problems here. Unless your data on the payment receipt (if any) and in the electronic wallet are different. This is a frustrating moment that should be addressed before making a payment.

Results

Now we understand how to pay the transport tax through "Gosuslugi" and not only. As you can see, if you organize all the actions correctly, the process will not be too difficult. The main problem, as a rule, lies in the calculations, as well as the loss of the receipt. If you lost it, then the bank cannot pay.

But don't be upset. After all, it is always possible with the help of the State Services portal or your electronic wallet to deal with the task set before us. And remember the deadlines before which you need to pay the state. Otherwise, the fine (pen alties) will also have to be issued as a separate payment.

Recommended:

Transport taxes in Kazakhstan. How to check transport tax in Kazakhstan? Deadlines for paying transport tax in Kazakhstan

Tax liability is a huge problem for many citizens. And they are not always resolved quickly. What can be said about the transport tax in Kazakhstan? What it is? What is the procedure for paying it?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

How to pay the transport tax. Transport tax rate

Transport tax is a huge problem for many taxpayers. How to pay for it? How to correctly calculate the payment amount? And who has the right not to pay for it? About all this - more

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

What taxes do citizens of the Russian Federation pay. How much taxes do citizens pay

How many taxes are available to citizens of the Russian Federation? How much do the most popular taxes take?