2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Paying taxes - the procedure is not the most pleasant, but necessary. As the ad, often played on public television, said, "Pay your taxes and sleep well." Therefore, if you want nothing to disturb your sleep, you will have to pay taxes, and preferably on time. However, until recently, it was troublesome to do this - go somewhere, fill something out, wait in line … But now there are fewer reasons for sadness, because this procedure has become much faster and more comfortable. The Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And now we will take a closer look at how to pay taxes online easily and quickly.

Updated service of the Federal Tax Service: "Pay taxes"

You should start with the simplest thing - go to the website of the Federal Tax Service and go to the "Pay taxes" section. A page will open, which is the starting point for all further actions of taxpayers. From here you can go to specialized sections depending on the purpose of your visit. Moreover, services are offered for both individuals and legal entities, as well as individual entrepreneurs.

Online services for citizens and legal entities

Citizens wishing to use the online service of the Federal Tax Service can:

- find out your debt;

- pay transport tax, land or road;

- pay the state fee.

Individual entrepreneurs and legal entities can also pay a state duty or fill out an appropriate payment order to transfer taxes to the state.

Online service "Payment of taxes for individuals"

If you are not sure if you have a debt to the budget system of the Russian Federation, then it is better to check it first by using the appropriate service. Then you can proceed to the main stage, which interests us - how to pay taxes via the Internet. We follow the link "Payment of taxes of individuals" and get to the page of the Internet service for taxpayers-individuals. What can you do here?

Service Capabilities

First of all, without waiting for the tax notice, you can independently forma payment document for the payment of transport or road tax or in order to pay land tax via the Internet. In addition, documents can be prepared to pay debts for these types of taxes, if any.

Next, there are two options: print the generated order and go to the bank to deposit funds in favor of the Federal Tax Service, or continue using the online service and make a cashless payment.

Preparing a payment document

In the first case, a payment document is simply generated. This will require the following data:

- personal data of the taxpayer;

- type of tax (transport, land, road);

- address of the object of taxation.

After that, the rest of the payment information will be generated automatically. The document is then sent for printing.

Cashless payment of taxes

We choose the second option. Here is an instruction detailing how to pay taxes online:

- If you decide that you will pay by bank transfer, then follow the link above and fill in the following details: Full name and TIN. The latter is needed in order to check if you have any tax debts (for non-cash payments, this field is required).

- Press the "Next" button and proceed to the selection of the tax we need from the proposed list. You canpay road tax via the Internet, transport and land, as well as personal income tax and property tax.

- Having selected the required item, we proceed to fill in information about the place of residence indicating the subject of the Russian Federation and a specific address (during the filling, drop-down lists will appear, from which you need to choose your option).

- Also select the type of payment (tax/fine/pen alty) - in our case it is "tax".

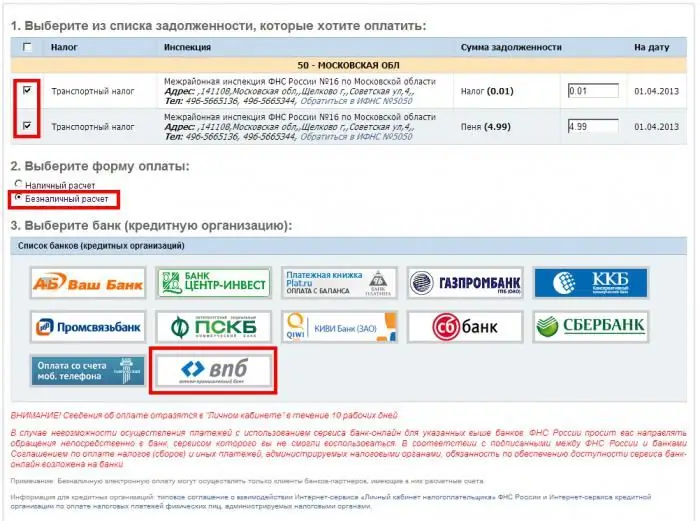

- Moving on. We determine the payment method - "Cashless payment" and go to the next page to select a credit institution.

- Determine the bank through which we will pay by clicking on the appropriate logo. Credit institutions that currently allow paying taxes via the Internet: Sberbank of Russia, Gazprombank, Promsvyazbank, Bank Center-Invest, ATB and others. These banks entered into an agreement with the Federal Tax Service of Russia on the implementation of the service through their Internet banking. It is important to note here that you can use the online service only if you have a personal account in the Internet bank in one of the offered credit organizations. If there is none, then before paying taxes via the Internet, you need to conclude an agreement with the bank serving you to provide the appropriate service.

- If everything is in order, the online service of the Federal Tax Service will transfer you to the page of your Internet bank, from where you can make a payment.

You will only have to log in and confirm the payment via SMS. At the end of the day, information on the tax paidmust be changed on the website of the Federal Tax Service.

Cashless payment of tax through the Qiwi system

For those who do not want to connect the Internet banking service, there is another option - to get a Qiwi wallet. You can do this on the official website of the service. First replenish it with the amount of the tax that you plan to pay (you can deposit more - the money will not be lost, but can be used to pay for any other services). So, you have a qiwi wallet, now let's go to the website of the Federal Tax Service. Step-by-step instructions for paying taxes using the Qiwi service:

- We repeat all the steps discussed above, and when we get to the choice of a non-cash payment method, click on the Qiwi Bank logo (which is presented among credit organizations).

- We get to the authorization page, where you need to enter your mobile phone number and password from the qiwi wallet. Fill in your details and click "Login".

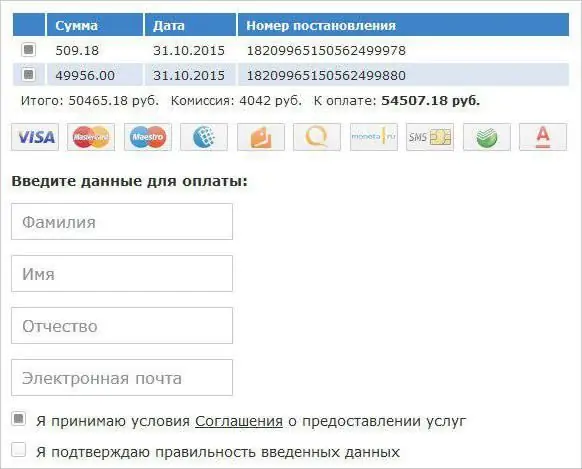

- In the window that opens, fill in information about yourself and agree to the terms of the offer (check the box).

- Next, let's move on to the list of taxes that you can pay. If you had a debt, then the first line will be the principal amount, and then the pen alty / late fees.

- First, select the first line and pay for the main part. To do this, select the method (terminal / wallet / card) - mark the icon in the middle (payment from Qiwi wallet) and click the "Confirm" button.

- You should receive an SMS message with a confirmation code,which we enter in the field that appears below, confirm the action again.

- After that, you will be taken to a page with information that the payment was made successfully.

- If you had pen alties and fines, then you need to return to the line selection item and pay all your debts in the same way.

This procedure may seem long, but in fact it will take no more than 10 minutes, while paying in cash is much longer and not at all as comfortable as via the Internet.

Paying taxes is now easy

Thanks to the fact that now you can find out the taxes (via the Internet) that you need to pay and pay them in a non-cash way, you can do it on time and avoid delays. This will help you save your time, nerves, as well as money that could be used to pay pen alties and fines that have arisen due to the constant postponing of such an unpleasant and tedious procedure. Pay your taxes on time - be a responsible citizen of your country.

Recommended:

The land tax does not come - what to do? How to find out land tax

Describes what taxpayers should do if the land tax does not come. The main reasons for the lack of notification are given, as well as the rules for determining the amount of the fee

Transport taxes in Kazakhstan. How to check transport tax in Kazakhstan? Deadlines for paying transport tax in Kazakhstan

Tax liability is a huge problem for many citizens. And they are not always resolved quickly. What can be said about the transport tax in Kazakhstan? What it is? What is the procedure for paying it?

Road tax in Belarus. Road tax in Belarus

Two years ago, the transport tax in Belarus went up. In the period 2014-2015. the base value, on the basis of which this type of fee is calculated, increased by 20%, i.e. from 150 thousand BYR (Belarusian rubles) to 180 thousand. In this regard, many car owners have a natural question: will the road tax in Belarus rise in price in the new year 2016?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way