2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Many trading tools use mathematical calculations. With their help, indicators for technical indicators are calculated, levels are calculated, the possibility of making a profit and minimizing losses, and they are also used in Money Management.

One of these tools is the Demarker indicator. It can be used in various trading options: Forex, binary options, commodity, commodity and stock markets. This is a universal tool that is used in trading by many professional traders, and experts - to predict changes in market quotes.

Demarker indicator description

This tool, quite well-known among traders, was developed and created by one of the founders of the financial market, Thomas Demark. It is presented as a line showing the overbought and oversold zones of the market. The technical indicator, like many other classic instruments, is available on all populartraders trading platforms: MetaTrader, Thinkorswim and in the "live chart". It belongs to the class of oscillators and has all the relevant characteristics inherent in this type.

Mathematical formula shown in the photo.

Where:

- High (i) - high of the last or current candle/bar;

- High (i-1) - high of the previous candle/bar;

- N - time period for calculation;

- Low (i) - low of the last or current candle/bar;

- Low (i-1) - previous candle/bar low;

- SMA - Moving Average indicator.

The formula is quite simple and clear, but in order not to constantly perform all these calculations, Demark developed a special technical indicator and named it after himself. This greatly simplifies the task for traders, since all calculations are done automatically, and they do not have to do the calculations themselves, which significantly reduces the time during market forecasting and analysis.

To use the Demark indicator in trading, you just need to place it on the chart, and the line that defines the overbought and oversold zones of the market will be built continuously. For the convenience of traders, in order not to close the price chart, this tool is installed in a separate window.

Indicator value:

- from 0 to 0, 3 - oversold zone;

- from 0.3 to 0.7 - uncertainty or neutrality;

- from 0.7 to 1 - overbought zone.

Levels 0.3 and 0.7 aresignificant indicators and determine what state the market is in at the moment and what changes can occur in a given time period in the future.

Technical indicator functions

The purpose of this tool is to determine the maximum and minimum market values using supply and demand for trading assets. The description of the Demarker indicator also states that it identifies financial risks for selling and buying in real time.

Indicator functions:

- Determination of overbought and oversold market zones.

- Identification of local highs and lows of quotes.

In addition, the significant levels of the Demark indicator (0.3 and 0.7) show reversals in market movements or inflection points, such as pullbacks in market prices during long-term trends and momentum.

Scope of application

This versatile tool can be used in various trading strategies in both Forex and binary options, as well as in the stock market. Based on it, traders have developed several dozen methods that, when used correctly, bring them good profits.

Overbought and oversold zones are the most important characteristics in trading. Experts who analyze the financial market, its fluctuations, movements and changes use the Demarker indicator to understand what kind of market is in mood and who is more on it - sellers or buyers, and also draw up on the basis of this toolforecasting market quotations. Traders, using analytical data from this technical indicator, open trades and make a profit.

Tool settings and parameters

We can say that this indicator is installed literally in one click. It does not require any additional settings, you can use the recommended parameters from the developers.

To install the indicator on the chart, just select this instrument from the list. For example, consider the settings in MetaTrader:

- Go to the "Insert" section.

- Select "Tools" and find the Demarker indicator ("Oscillators" -> DeMarker), after which the settings window will open.

- In the "Parameters" section, you must leave the original value - 14. You can choose any style: blue, green, black, brown, the one that the trader likes.

- Display leave "Line".

- Check the box with a value of 0 in the "Lock minimum" section and 1 in the "Maximum" section. After these steps, you must confirm the selected settings and click "OK". No further action is required.

If the trading strategy requires the use of additional levels, then they can also be set in the indicator settings in the "Levels" section.

Trading with Demarker

In trading on the financial market, this technical indicator is quite popular with traders. Beforeof all, this is due to the fact that it perfectly shows divergence and gives signals to open positions.

Divergence is a discrepancy between the values of indicators on the chart and in the indicator. For example, a trader drew a trend line at the tops of the candles and revealed that in the future the movement will have an upward direction. However, the indicator shows the opposite value. Therefore, there is divergence in the analysis of market quotes. Such a phenomenon in trading is desirable for most traders, since in more than 90% it is justified and the speculator makes a profit.

Important: to open a position, you need to choose indicators of the direction of the indicator, not market prices, as the chart may show residual impulses that no longer correspond to market sentiment and cause divergence with the indicator.

To understand how to use the Demark indicator, you need to familiarize yourself with the rules for working with this instrument.

Using the indicator in trading:

- Determine the global trend.

- Analyze the indicators.

- With values from 0 to 0.3 (oversold zone) and a pronounced upward direction of the market, open a buy deal.

- If the indicator has values from 1 to 0, 7 (overbought zone), and the market quotes are directed down - to sell.

To confirm signals and filter them, you need to use additional tools, for example, the Moving Average indicator.

Trading strategy using Demarker

Before you start trading, you need to prepare.

To do this, set on the chart:

- Demarker indicator.

- SMA, "Moving Average".

- Timeframe - 15-minute chart.

- Currency pair - euro/dollar.

Trade Rules:

- To open a buy position, you must wait until the Demark indicator starts to leave the oversold zone. The "moving average" should be directed upwards as a confirmation of the signal, and the indicator itself should have a value from 0 to 0, 3.

- Protective stop-loss order must be set at 15 pips (below the open order).

- "Take Profit" can be omitted or set as desired. If it is not used, then the position is closed manually. Usually, "Take Profit" is set at least twice the value of the "Stop Loss".

- To open a sell position, you need to make sure that the indicator leaves the overbought zone and has a downward direction. The SMA confirmation tool should be pointing down. The indicator value is in the range from 1 to 0, 7.

- "Stop Loss" is set 15 pips above the open order.

- "Take Profit" at the request of the trader.

This trading strategy with the Demarker indicator is quite easy to understand and therefore suitable for beginners. It has good results and allows you to earn in the financial markets. The main thing is not to rush and use it correctly.

Application of Demarker in binary options

This universal tool can be used in the financial market in any direction of trading. The Demarker indicator for binary options is absolutely no different from Forex instruments and has the same settings.

Its use in binary options is similar: at values from 0 to 0, 3, a Call option is bought, while market quotes should be directed upwards, that is, leaving the overbought zone.

To buy a Put option, it must have a value from 1 to 0.7, that is, it must leave the oversold zone and have a downward direction.

The benefits of the tool

Many traders who use the Demarker tool in trading consider it indispensable. The opinion that this super indicator in binary options is the Grail is, of course, exaggerated.

The advantages include the automation of the indicator, the definition of overbought and oversold zones, as well as the ability to use it to find divergence.

When used correctly, traders have consistently positive results.

Negative sides

This tool does not have any major drawbacks. However, there is a category of traders who, using it, receive losses. This is due to several factors:

- opening deals in neutral zones when the indicator has a value from 0.3 to 0.7;

- traders openpositions without confirmation and filtering of false signals;

- haste.

No need to rush, the market is constantly in motion, and for more than one century, so you can always have time to open a deal. The main condition when working with this indicator is to wait for a signal from it and use filters that filter out noise and interference that periodically occur in the market, especially on small timeframes.

Trading instruments for binary options

Working with binary contracts has its own peculiarities. The fact is that in order to make money in this type of trading, you must be able to accurately predict changes in the market movement, taking into account a certain time range. Therefore, experts and professionals have developed special tools and trading strategies for traders. Popular binary options tools:

- Technical indicators.

- Trading signals.

- Copy deals.

- Automated programs.

Trading binary contracts is quite easy when the market is in a calm state, that is, in a consolidation zone, and the situation is much more difficult during strong movements. Therefore, they use special tools in trading - binary options trend indicators, which allow them to determine the direction of movement with greater probability.

Trading signals and automated programs such as robots and experts are ready-made analytical solutions, and the trader always has a choice:follow them or not.

Copy Trades is a tool that allows you to copy trades of successful traders.

Pros advise beginners to always make a forecast of the market movement on their own beforehand and only then listen to various recommendations and make decisions to open a position.

Conclusion

The Demarker indicator is a technical tool that allows traders, when used correctly, to earn money in the financial markets. It is a universal indicator for various types of trading and is the basis of many strategies. Experts and traders have been using it for decades, both in trading and in analytics. This is a fairly popular and well-known trading tool.

Recommended:

Air conditioning system maintenance: choosing a company, concluding a contract, rules for registration, act of work performed, maintenance instructions, regulations and safe work

The main task of the ventilation system is to provide access and exhaust air, as well as its filtration and temperature control. In order for these tasks to be fully completed, it is necessary to install special equipment, as well as equip the blower system. Maintenance of the air conditioning and ventilation system is mandatory for both civil and industrial facilities

Work permit for work in electrical installations. Rules for work in electrical installations. Work permit

From August 2014, Law No. 328n comes into force. In accordance with it, a new edition of the "Rules on labor protection during the operation of electrical installations" is being introduced

A related profession is The concept, definition, classification of work performed, the performance of labor and related work and payment rules

What are related professions? How are they different from combining and retraining? What professions are related? Consider the example of a teacher and a pharmacist, an accountant and a lawyer. Working related professions. Three ways to master them. Motivation - leadership attitude

Welding in a shielding gas environment: work technology, process description, execution technique, necessary materials and tools, step-by-step work instructions and expert advice

Welding technologies are used in various branches of human activity. Versatility has made welding in a protective gas environment an integral element of any production. This variety makes it easy to connect metals with a thickness of 1 mm to several centimeters in any position in space. Welding in a protective environment is gradually replacing traditional electrode welding

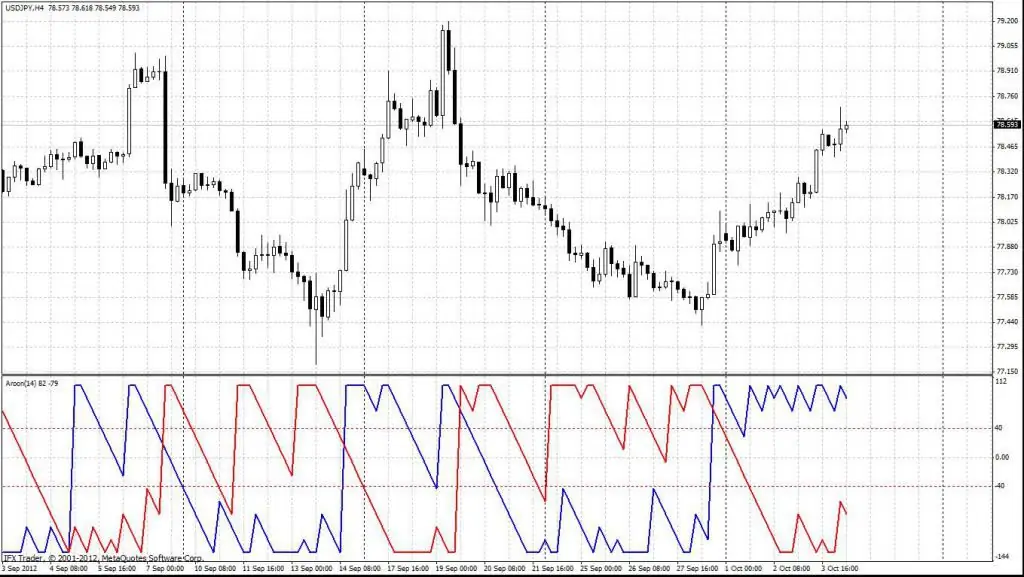

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement