2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Car enthusiasts can relax and celebrate an important event - the vast majority of insurance companies have begun to issue an electronic OSAGO policy. That is, you can forget about the queues and get a policy in any convenient place, for example, at work, sitting in front of a computer. Only now you have to check the list in order to know which insurance companies issue an electronic OSAGO policy. If there is no verified company among them, then you can arrange the service in the usual way or choose another insurer.

Situation in practice

Every year, the process of obtaining the necessary documents is simplified. But it is too early to say that queues are a thing of the past. Here are many motorists deliberately ignore the need for an insurance policy. The fine for its absence is not yet very large, so drivers prefer to drive without it at their own peril and risk. In doing so, they jeopardize their own safety and the safety of theircar. It is dangerous to rely solely on yourself, because an accident can occur due to the fault of an oncoming car, but no one will pay you anything, since there is no insurer!

In 2015, innovations occurred in the insurance field, and the OSAGO policy was allowed to be issued remotely. This made the procedure less formal and easier. In fact, the driver provides all the data on his own, and the system substitutes them into the formula to calculate the total amount. It turns out that the process becomes as transparent as possible and the driver sees how the result is formed.

At the same time, you can also choose where to issue an electronic OSAGO policy. You may be at home, at work or traveling. The main thing is to have a computer, tablet or phone with Internet access. And, of course, you will have to choose an insurance company whose services you rely on. If you have been taking out insurance for a long time, then you are probably loyal to one company. Is it on the list of companies issuing an electronic policy? If there is, then everything comes out much easier, since you know who you are dealing with. Otherwise, you will have to choose a new company or issue a policy the old fashioned way, offline.

Is there a difference?

First, let's figure out what is an electronic policy? Its powers are not reduced in any way when compared with its paper counterpart. It is mandatory to provide insurance for a motorist in case of an accident occurring through the fault of the insured, if there is damage to the victim’s car or harm to he althanother person. Thus, the OSAGO policy guarantees you protection if such an unpleasant event occurs due to your negligence. This allows you to feel more confident in material terms, since the policy is reimbursed for losses. The amount of such compensation, of course, varies. Thus, damage to the he alth of the victim can be compensated in the amount of up to 500 thousand rubles. If damage is caused to the car, then the amount of insurance is limited to a limit of 400 thousand rubles.

How to buy?

So, an electronic policy can be bought at a company that is territorially related to the region where the motorist lives. This is an important point, since the process of obtaining reimbursement is simplified, and cases are excluded when the search for insurers goes beyond the region. There is no online registration fee. On the Internet, the calculation of the cost of insurance is carried out according to uniform basic rates that apply throughout the country. Next comes the adjustment by region of residence, type of vehicle, age and experience of the driver. All data must be entered on the website of the insurance company. It is not difficult to find it, you can first visit the websites of the Russian Union of Motor Insurers, where there is a special tab dedicated to the registration of OSAGO. Here you can see which insurance companies issue an electronic OSAGO policy, and make a choice.

How is the clearance going?

So, you have decided to try out the novelty and take out insurance via the Internet. What are the advantages of such a choice? First, yousave time. After all, you can do without queues and standing in traffic jams.

Secondly, get the policy in a very convenient form. Electronic OSAGO can be stored in your phone, tablet. In principle, you can simply write down the policy number for yourself and just call it to the inspector, who will be able to punch the number through the database.

Thirdly, when applying for OSAGO via the Internet, the price does not suffer in any way. You pay the amount that came out when calculating through the form. No commissions, duties or other charges.

For registration, you need to look through the list and find out which insurance companies issue an electronic OSAGO policy. The initial algorithm is the same on almost all sites - you need to register in your personal account on the company's website. Here, enter the last name, first name, patronymic, as well as gender and passport details. Contact details will be required, namely a phone number and mailing address. And at the next stage, it is especially important which insurance companies issue an electronic OSAGO policy and which insurance application form needs to be filled out. They may vary slightly.

Let's look at an example

After you have access to the sample insurance claim, the boring routine of entering data into the required lines begins. To help a novice computer user - a drop-down menu. Fill in the information about your car in order, using the technical equipment passport. Then check the registration certificate and diagnostic card. At the end of the questionnaire there will be fields for information from the driver'scertificates. The easiest way to fill out is to use the previous auto insurance to eliminate the presence of errors. There will be a pause after registration. During this time, there will be an automatic reconciliation of data with the PCA database. During this time, the system will determine whether the specified documents actually exist. If everything is in order, then after verification you will be offered a form of payment.

The amount is calculated according to existing tariffs. There is also a bonus system. In particular, if you have not had any problematic situations during the past insurance period, you will receive a 5% discount. Those drivers who drive consistently without incident are en titled to an annual increase in the discount. Payment can be made in any convenient way for the client. But, of course, everything happens online. When paying for insurance, the client can indicate how he wants to receive it. In the standard version, the policy is sent by e-mail, but for fans of the classics, it can be printed and delivered to the address specified in the application form.

Where is OMTPL issued online more often?

"Rosgosstrakh" remains consistently among the leaders in car insurance. The lion's share of motorists turns to this company. First, it is a company with a name. Secondly, it is a proven quality. Thirdly, this is one of those companies that are innovators in the field. Of course, there are plenty of competitors, because insurance via the Internet today is offered by more than sixty organizations. If you decide to issue OSAGO online, Rosgosstrakh provides comprehensive information on itssite. There you can also get news about changes in legislative acts and the allowable amount of damages. It is convenient that before filling out the application, you can calculate the cost of your insurance. Customers are also impressed by the fact that the site highlights fields in a different color that have not passed the system check. You can make a printout of the mistakes made.

Golden mean

Other companies are also in demand. For example, it is worth buying an electronic OSAGO policy, which Sogaz offers. The company has a high rating in the insurance market, and the trust of customers is growing every year. The site has enough information about insurance, tariffs and bonuses. Before applying, you can calculate the amount of the final amount on the calculator. Customers are attracted by the opportunity to buy an electronic OSAGO policy (Sogaz) because the company does not boast of its status and does not have scandalous stories in the media.

Bet on fame

Pretty proudly declares itself another organization that offers to issue an electronic OSAGO policy. RESO is a fairly well-known company. Some clients praise the insurer to the skies, while others are skeptical, believing that they don’t think about the benefits of the applicant at all. So where is the truth? I must say that the interface of the company's website is quite simple and pleasant to perceive. There is comprehensive information about insurance, tariffs and possible errors. There is also an algorithm for possible solutions to troubles. In the insurance section,addresses of the support service, so that not a single client will be left without a consultation. If you have any questions about the errors that occur, then answers can be obtained instantly. So, among other things, an electronic OSAGO RESO policy is the fastest and easiest to issue. By the way, you can fill out an application in two ways - as a new client and as a RESO-Garantia client.

Pros and cons of insurance companies

Speaking of popular companies, one cannot ignore the electronic OSAGO policy, which Ingosstrakh draws up. The site of this company is easy to navigate, the system works perfectly, and all possible misunderstandings are resolved at the same minute. Very quickly there is an information exchange with base. The site service offers the client to first get acquainted with the amount of insurance, and only then buy an electronic OSAGO policy (Ingosstrakh). The client can choose the desired type of contract - to conclude a new one or to prolong the old one. It is worth noting that Ingosstrakh has very contact managers of the support group who promptly respond to calls. The client does not feel abandoned. On the site, you can discuss the possibility of delivering a printed policy to your home.

Not the most perfect in technical terms is the electronic OSAGO policy, which "Renaissance" offers. There are quite a few complaints about the interface of the site and the services of this company. But there are a lot of necessary notes and news on the topic of auto insurance.

Recommended:

How to enter a driver in an electronic OSAGO policy? How to make changes to the electronic OSAGO policy

How to calculate the cost of the policy if you need to enter a driver or make other changes to it? The principle of calculating the cost of an OSAGO policy with a new driver

How to issue an electronic OSAGO policy at Alfastrakhovanie? Electronic policy "AlfaStrakhovanie": reviews

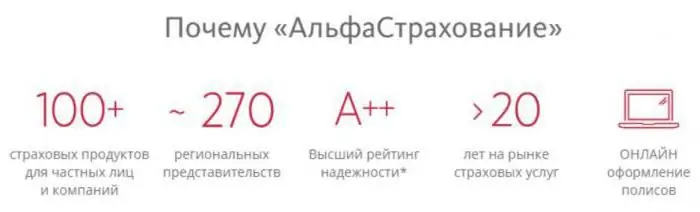

AlfaStrakhovanie is one of the most popular and most reliable insurance companies in the country. In more than 400 additional offices in all regions of Russia, the insurer provides a wide range of insurance products. But especially in demand today is the electronic OSAGO policy. How to apply for it in AlfaStrakhovanie?

What is the funded and insurance part of the pension? The term for the transfer of the funded part of the pension. Which part of the pension is insurance and which is funded

In Russia, the pension reform has been in effect for quite a long time, a little over a decade. Despite this, many working citizens still cannot understand what the funded and insurance part of a pension is, and, consequently, what amount of security awaits them in old age. In order to understand this issue, you need to read the information presented in the article

How to issue an electronic OSAGO policy? Insurance companies, instructions

Since the middle of last year, car owners have the opportunity to get an electronic OSAGO. This new method allows you to issue a document without queues and visits to the insurance company. The article discusses how to issue an electronic OSAGO policy and how it is convenient. Methods for obtaining it will also be studied in detail

How to add a driver to an electronic OSAGO policy? Rules for issuing an electronic OSAGO and making changes

Many are interested in the question of how to add a driver to an electronic OSAGO policy? In fact, the possibilities depend on the chosen insurance company. Some provide their customers with the opportunity to correct data directly via the Internet for some parameters, while most require a personal visit to the office