2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:25

Each trader uses some technique or system in trading. In most cases, the trading method is based on two or more indicators. Those traders who have at least minimal trading experience know very well that most of them are late or change their readings in the process of further trading.

This is very inconvenient, and sometimes even risky, since the profitability of the transaction depends on the accuracy of entering the market and closing the position in a timely manner. Therefore, this article will provide information about indicators without delay and redrawing. It is these parameters that are very important for each technical trading instrument.

Types of market conditions in trading

Every trading day of a trader begins with the study and analysis of the market movement. He finds out what state the market is in and predictshis further movement.

The financial market has several phases:

- Calm state, that is, a consolidation zone, or flat.

- The beginning of the growth of the momentum movement.

- Trend.

- Zone of redistribution of positions, profit taking, attenuation of impulses.

Each phase is repeated periodically. For traders, trend movements are the most attractive, as they allow you to get the most profit in a relatively short period of time.

Therefore, in trading, the most popular among traders is a trend indicator without delay and redrawing. It allows you to timely determine the beginning of the growth of an impulse movement and earn profit together with major players.

Features of trend instruments

A trend in the financial market is a special phenomenon, at this time all its participants are involved to the maximum. During impulses, demand and supply are formed, liquidity and volatility of trading assets increase. Any important events and news taking place in the world always cause strong excitement and trend movements, which speculators use to earn money.

Especially for traders, experts have developed technical trend indicators without delay and redrawing, which allow you to trade exactly when the market is in a trend state. In trading, most instruments have flaws, they lag behind the dynamics of the market movement or change over time.value, which in turn provokes the occurrence of false signals. That is why accurate indicators that do not change their values under any circumstances are highly valued.

All trend tools can work correctly only during impulses and strong movements, and in a calm market, in a consolidation zone, they either do not work and practically freeze at any values, or give inaccurate and incorrect signals to enter the market.

Types of indicators

All technical instruments for trading are conditionally divided into several groups. A brief description of the types of indicators is given below:

- Trend tools. They are applied during strong movements and impulses. Such indicators are available in any modern and popular trading platforms. They practically do not redraw, but may have such a drawback as lagging behind the real movement of market quotes. They are mainly used as filters. For example, ADX or moving average indicator.

- Tools for a calm market. This group of indicators allows you to analyze the market when its movement is in the range of market quotes, that is, during the sideways direction. This group includes oscillators, for example, Stochastic.

- Countertrend indicators. These tools are used during pullbacks in market movements. As a result, traders open trades against the main impulses, hence the name. The representative of this species is the technicalindicator - "Bollinger Waves". Traders refer to this tool as indicators without delay and redrawing market quotes, since it almost always shows the exact value and does not change it afterwards.

- Scalping tools. This is a special kind of indicators that are specially designed for short-term trades. Scalping trading strategies are a type of trading that allows you to conclude a large number of transactions in the short term. Professionals carry out several hundred trading operations in one day, and therefore it is very important for them that the instrument shows the exact value, since all transactions take place on small timeframes. Among the indicators for scalping, one can single out Scalper Dream or BinaryCash, which provide speculators with a minimum number of false signals.

- Arrow indicators. These tools are based on complex algorithms, but they are quite simple to use and easy to use on the job. The trader does not have to independently analyze the market and look for suitable points for opening a position, since these arrow indicators, without redrawing and delay, which they are in most cases, give ready-made signals. With the help of arrows or dots that are displayed on the chart, you can understand at what moment you need to open an order.

Best tech tools for beginners

The best indicators without delay and redrawing are those tools that show accurate valuesand do not change them in the future. Professionals advise beginners to use simple trading tools and familiarize themselves with the general principles of work. Even the best indicators, if used incorrectly, can bring losses to a trader.

For trading in a calm market, the Alligator or MACD are great, and the best trend indicator without delay and redrawing is the tool that gives the most accurate signals and is based on a set of standard or modified indicators, for example, LSMAinCOLOR. It consists of superimposed indicators of the instruments: MASD, Stochastic and MA, and does not change its values in the future.

How indicators work

The work of all tools is based on their analysis for a certain period of time. However, there are those that periodically shift indicators. For example, initially they analyze the first 10 candles, then there is a shift by one candle, and the indicator calculates from candles 2 to 11, then from 3 to 12 and so on.

As a result of such actions, the values are redrawn. Stable indicators can be obtained if the algorithm is based not on shifts, but on additions: 1 more candles are added to 10 candles, and as a result, 11 candles are analyzed, then 12, then 13, and so on. This method is the most accurate and does not create value redraws.

Each indicator (according to a given individual algorithm) makes calculations, on the basis of which it evaluatesmarket conditions and looking for the most suitable entry points. They are the signals for opening positions.

Description of the ZigZag indicator

This is a fairly popular trading tool, and it can be conditionally classified as a group of indicators without delay and redrawing, if you correct additional settings in it or use its modified version. This article will consider it as an example.

"Zigzag" shows extremums, that is, the maximum and minimum values of market quotes, and builds broken lines on them, which are very important in trading on the financial market. It is widely used in trading strategies as an independent element and in combination with other technical indicators.

How to work with the technical standard tool "Zigzag"

The Zigzag indicator is most widely used in trading in building significant levels - support and resistance. They are set on the chart by the minimum and maximum points of the instrument. The "ZigZag" indicator without redrawing and delay allows you to determine the global levels at which market quotes reverse.

In addition, it is used in trading to determine supply and demand zones, and its broken line is used to plot the trend direction. From the maximum to the minimum, a downward movement is fixed, or vice versa - an upward direction.

And also"Zigzag" is used in the analysis of graphical figures and candlestick patterns during market forecasting using candlestick analysis.

Description of the trading strategy based on the "ZigZag" on the rebound from the level

This technical tool is used in the basis of many trading strategies in conjunction with other tools as a trend reversal indicator without redrawing and delay. However, it can be used separately and use strategies for trading on a rebound or breakout of levels.

Working on a strategy to rebound from the level:

- At the minimum value of the "ZigZag" you need to open a buy position. Stop loss must be set below the extremum min. Its size depends on the volatility of the trading asset, but not less than 10 points. The deal is closed when the price reaches the maximum formation value.

- A sell position should be opened at the ZigZag maximum point. A protective stop-loss order must be placed above the extremum max. All calculations, as well as order closing, are made in the same order.

Strategy with the ZigZag indicator for level breakout

This is a fairly simple method and may well be suitable for beginners.

Strategy description:

- Before opening a position, you need to wait for the right moment when the market price at the maximum drops to such a distance that you can set a pending Buy stop order at the level of max.

- Stop loss is set withminimum values.

- At the lows, the trader should wait until the price rises and place a pending Sell stop order at min. A protective Stop Loss order is placed in the same way.

- "Take Profit" trader sets individually, its size depends on personal preferences. Usually it is several times larger than the protective order.

As a result of trading, the speculator constantly has 2 pending orders set at the extreme values of the ZigZag indicator.

Positive and negative characteristics

"Forex" indicators without delay and redrawing greatly facilitate trading and help in predicting changes in market movements.

They have benefits:

- Automated mode (the trader does not have to do the calculations himself).

- Displaying the values of indicators on the chart or in a separate window below it.

- Indicators significantly reduce the time in the analysis of market quotes.

- Give ready-made trading signals or recommendations for opening positions.

Disadvantages of standard indicators:

- Some of the instruments are late and provide the trader with outdated information.

- Many standard indicators change their values during operation, that is, they can redraw indicators.

- Gives false signals if applied incorrectly.

One of the rookie mistakes isuse of indicators that do not correspond to the given market situation. For example, in a calm market, they use trend indicators, which as a result give a large number of false and inaccurate signals.

Tips for beginners

You can make money in the financial market only if you follow the rules of trading, know their patterns and the basics of predicting market quotes. In trading, there is a wide variety of different tools: graphical constructions, technical indicators, automated programs, trading signals, and much more. To successfully apply them in trading, you need to understand how they work. Professional advice for beginners:

- Don't rush and carefully analyze the market before opening each trade.

- Choose timeframe from H1 and above.

- Use in trading only an understandable trading system that has no more than two, maximum three technical instruments, and it is desirable that these be indicators without delay and redrawing, giving the most accurate and relevant signals.

The chosen method must be tested for at least two or three months on a special demo account, which allows not only to try your hand at trading, but also to get stable positive results before entering the real market.

Recommended:

Amphoteric surfactants: what they are made of, types, classification, principle of action, additives in household chemicals, pros and cons of use

Today there are two opinions. Some say that amphoteric surfactants are harmful substances that should not be used. Others argue that it is not so dangerous at all, but their use is necessary. To understand why this dispute arose, it is necessary to understand what these components are

Indicators for scalping without redrawing: features, advantages and disadvantages

In trading on the financial markets, there are various methods by which traders earn. Each trading system has its own features and characteristics, and most of them use special tools. In this article, the reader will learn about different types of trading tools, including indicators for "Scalping" without redrawing

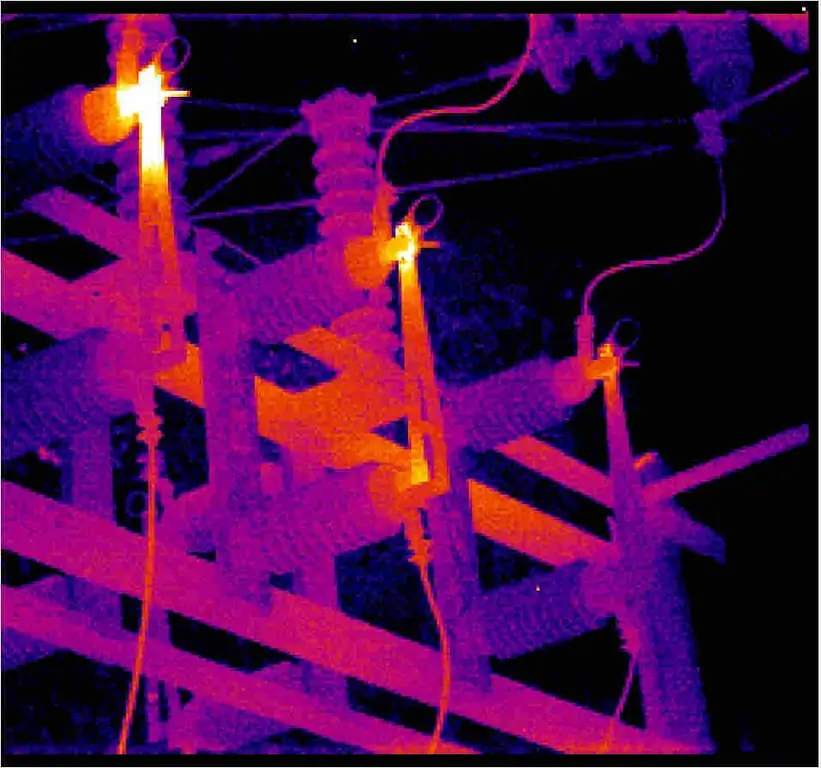

Thermal imaging control of electrical equipment: concept, principle of operation, types and classification of thermal imagers, features of application and verification

Thermal imaging control of electrical equipment is an effective way to identify defects in power equipment that are detected without shutting down the electrical installation. In places of poor contact, the temperature rises, which is the basis of the methodology

Low pressure heaters: definition, principle of operation, technical characteristics, classification, design, operation features, application in industry

Low pressure heaters (LPH) are currently used quite actively. There are two main types that are produced by different assembly plants. Naturally, they also differ in their performance characteristics

Engine on alcohol: description, device, principle of operation, pros and cons, photo

Many people should be reproached with the inertia of the mind, which prevents them from seeing new possibilities and the application of ordinary things. For example, the engine on alcohol. Let not the best solution among all possible, but quite working. Moreover, there are a large number of embodiments. There is spirit gasoline. But not only him. Let's talk about everything in order