2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

In trading on the financial markets, there are various methods by which traders earn. Each trading system has its own features and characteristics, and most of them use special tools.

Traders enter into various transactions by duration, someone opens orders with a long-term perspective, and some use short-term transactions. A fairly large number of speculators use scalping techniques in trading. In this article, the reader will learn about different types of trading tools, including indicators for "Scalping" without redrawing.

Definition of the scalping technique

Scalping is short-term trades. Traders compare the term to Native American customs of scalping opponents by winners. Transactions opened by trading systems "Scalping" have the followingfeatures:

- Timeframe M1-M15, rarely M30.

- Profit - just a few points, on average 3-10.

- Very short time period from a few minutes, sometimes even seconds, up to 1 hour.

- A large number of transactions in one trading day.

If a trader trades in the medium or long term, then he necessarily analyzes the market movement and quite often uses fundamental analytics. In trading strategies, scalping speculators are only interested in the technical type of analysis, since they expect to make a profit and close a deal in the shortest possible time. By and large, it does not matter to them where the market will move in the future, their methodology is based on the principle of "here and now".

Therefore, it is important for traders trading on Scalping to work with very precise tools, for example, to use indicators for "Scalping" without repainting in trading.

"Scalping" - indicators and tools

Because of its peculiarities, Scalping attracts a lot of beginners. However, some of them do not know that short-term trades are quite difficult to trade. The fact is that the smaller the timeframe, the more difficult the market is to analyze, since there is a lot of interference and noise on it. As a result, forecasting is erroneous and instead of profit, transactions are closed with a loss.

To avoid many of the problems that arise in trading with short-term positions, professionals and experts have developed special tools -indicators for "Scalping" without redrawing. They allow you to more accurately find points to enter the market and close orders with a profit.

Tools for trading systems Scalping:

- Technical indicators.

- Graphic constructions.

- Japanese candles and configurations.

- Forex signals and more.

Pros advise beginners to use classic types of technical indicators. Such tools can be found on any modern marketplace, as they are there by default. Graphic constructions are figures, channels, lines, levels, among which the most popular tool is the "Fibonacci grid".

With the help of Japanese candlesticks, you can analyze the chart on any timeframes. Candlestick analysis consists of patterns and configurations that you must know.

The use of many tools also depends on the specific trading system with which the trader works and makes an analytical forecast of the financial market.

Types of indicators

According to their characteristics and functions, all technical indicators are divided into several categories.

Varieties of indicators:

- For trend movements.

- For trading in a calm market or during a flat.

- For areas of uncertainty (consolidation, redistribution).

And they are also divided depending on the duration of positions:

- For short-term trades and scalping.

- For long-term positions.

- For trades with medium terms.

The time period on which the trader trades plays a very important role here. The fact is that the same indicator, but on different timeframes, can give completely opposite results.

And it is also important to understand that if the indicator parameters are calculated for a trend movement, then this tool should by no means be used in a calm market. Any technical instrument has its own settings, features and characteristics, and if, for example, a trader uses trend indicators in trading, they will give false signals during a flat. As a result, instead of the expected profit, the speculator will receive losses.

Trend instruments

Currency pairs require a specialized approach from the trader, as they have their own characteristics compared to other assets. The task of the speculator is to determine the correct direction of the market movement. The smaller the timeframe a trader chooses for trading, the more accurate the analysis should be.

Currency pairs, like all trading assets in financial markets, can change quotes in different directions. Their movement speed, as well as their strength, can be reduced or increased. Therefore, it is very important for a trader to know what phase the market is in: trend, impulse movements, consolidation zone or flat.

The greatest profit, subject to the correct choice of market direction, traders earn during strong movements, that is, impulses and trends. Accordingly, experts have developed special tools for profitable trading in the financial markets:

- Indicator "Parabolic".

- Moving Averages (EMA, MA, SMA and other types).

- Ichimoku trend indicator.

- Bollinger Bands.

- Bears Power and Bulls Power.

- DX (ADX).

- "Alligator".

- Zigzag.

- Adx crossing (indicator for "Scalping" without redrawing) and many others.

The most popular among traders are instruments that do not redraw in the future, that is, do not change their values and symbols (signals) on the charts.

Indicators for flat trading

Most traders prefer to trade during a trend, since it is in this phase of the market that you can get the fastest and largest profit. But unfortunately, more than 70% of the market is in the zone of consolidation, accumulation, redistribution, flat, that is, in a calm state. At this time, the market movement is weak, volatility is significantly reduced, and trading occurs in some range.

But at the same time, flat trading allows traders, in particular scalpers, to make good money. The fact is that it is at this time that the market movement is the most predictable, and it lends itself perfectly to an analytical forecast.

For trading in the lateral market movement, professionals and experts developed Forex indicators without redrawing:

- Pulse Flat.

- iVAR.

- Flat.

The following indicators can be distinguished from the classic types:

- "Moving averages" (their various combinations).

- Indicator Bill Williams "Alligator".

- Bollinger Bands.

- Envelopes indicator.

- Parabolic SAR.

And also the graphical method with support and resistance levels is in great demand among traders. To profitably use these indicators in trading, you need to be able to apply them correctly. For example, using the Alligator, you can determine the market phase: in a calm market, all indicator lines will be located close to each other, and if there is a trend, they will diverge in different directions. Therefore, this tool can be used in trading in any market phase.

Switch instruments

Almost all beginners do not know how to analyze the market on their own and, as a result, they often make mistakes. Professionals have developed tools specifically for them to help them in trading - arrow indicators. They are very convenient, as they indicate on the chart with an arrow the opening of a position for a transaction.

Very popular among traders of any skill level who are engaged in short-term trading, arrow indicators for "Scalping" without redrawing are very popular. The accuracy and relevance of such signals is most important for scalpers, as they rely on relatively small profits and trade on small timeframes. In this caseany mistake results in loss.

List of arrow indicators:

- OsMagic MinMax AA TT.

- STAR 13×68 MAs TT.

- Close0 vs Close1 AA MTF TT.

- Arrow trading indicator Sidus.

- MACD-OsMA on Chart MTF 2 (developed on the basis of the MASD oscillator).

- ZZ NRP for Heiken Ashi.

- CCI T3 Divergence TT trading indicator.

- Arrow trading tool - one of the best indicators for scalping VWMA+CG 4C AA MTF TT without repaint and other types.

Pros recommend: before you start trading using any technical indicator, first test it on a demo account and only after receiving positive and stable results can it be used in reality.

Indicators for scalping without redrawing

Short-term trading requires the trader to be very precise in order to open positions. Even with occasional mistakes that are not always possible to correct, the speculator will receive losses. Therefore, for trading, he needs the most accurate indicators that exclude the issuance of false signals as much as possible. These tools include:

- Trend Strike.

- Scalper Dream.

- Trend Focus.

- Double Zigzag.

Features and advantages of scalping tools

Any trading tool has its advantages and disadvantages, and indicators for scalping without redrawing are no exception. Among the positive characteristics of tradersreveal the following parameters:

- Using these tools, you can most likely and accurately determine the moment of entering the market, as well as points for closing positions.

- Such indicators allow you to quickly analyze the market movement, which is very important for short-term transactions.

- Indicators allow you to minimize, and in some cases completely eliminate the number of false signals for opening orders.

Negative characteristics

By and large, almost all scalping indicators that do not change their readings in the future do not have any serious drawbacks. However, traders have identified a psychological dependence on them.

When used regularly in trading, speculators completely rely on these instruments, and since trading takes place on lower timeframes, on which there are a lot of market disturbances and noises that prevent them from correctly analyzing the market, periodically they have losing trades.

In conclusion of the article, it should be added that no matter how profitable, accurate and profitable the instrument is, you cannot fully rely on it and you must definitely conduct a comprehensive analysis of the market movement. Experts and professionals advise beginners to pre-test the selected instrument in a safe mode on a demo account for several months. And you should always remember about the financial risks that are constantly present in trading.

Recommended:

Indicators without delay and redrawing: types, principle of operation, pros and cons of application, expert advice

There is a wide variety of different tools in trading: graphical constructions, technical indicators, automated programs, trading signals and much more. To successfully apply them in trading, you need to understand how they work. Indicators without delay and redrawing are especially popular with traders

Soap making at home as a business: features, advantages and disadvantages, profitability

One of the most sought after cosmetics is soap. It is used by every person every day, regardless of gender, age, social status and income level. Therefore, the demand for such products is kept throughout the year. But soaps rich in vitamins, minerals and healing herbal decoctions are in the greatest demand, as they contribute to the best skin care. How to open a soap making business at home and what is needed for this?

A salary project is Deciphering the concept, advantages and disadvantages, features

Most large and small companies prefer to pay their employees wages to bank cards. This is done for many reasons, most of which can be combined under one concept - "convenience". A salary project is a program that allows you to organize such payments as simply as possible. In addition, it also allows you to receive certain bonuses in the process of its use by both the employer and the employee

Product manufacturability indicators: types of indicators and evaluation methods

Product manufacturability indicators are the most important component of assessing the quality characteristics of products, designs, parts, and so on. They make it possible to compile a comprehensive description of the effectiveness of technological products in relation to the adaptability of the design to its application in specific conditions, for example, in production

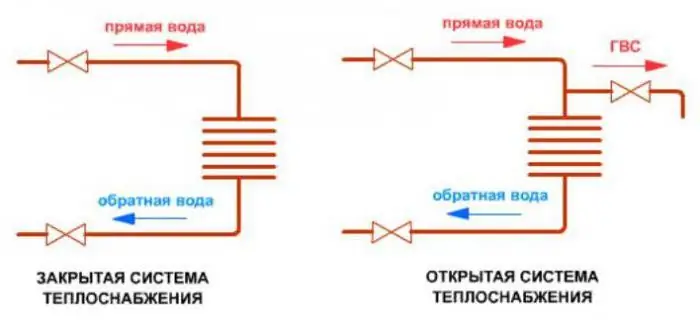

Closed and open heating system: features, disadvantages and advantages

At present, it is promising to introduce the technology of a closed heat supply system for consumers. Hot water supply allows you to improve the quality of the water supplied to the level of drinking water. Although new technologies are resource-saving and reduce air emissions, they require significant investment. Ways of implementation are at the expense of commercial and budgetary financing, competitions for investment projects and other events