2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:25

Only people for whom personal income tax is transferred to the Federal Tax Service can receive a tax deduction. It is represented by income tax refund. Appointed only when certain conditions are met. It can be social, professional, standard or proprietary. Deductions can be made at the branch of the Federal Tax Service or with the employer. But at the same time, people should be aware of who can receive a tax deduction. Some citizens are not eligible for this benefit.

Terms of receipt

Often, many people wonder "Can I get a tax deduction?". The following persons can count on such a benefit from the state:

- citizens of the Russian Federation for whom personal income tax is transferred to the Federal Tax Service;

- entrepreneurs working for OSNO and paying income tax for themselves;

- pensioners who are working citizens, and their income must exceed the minimum wage;

- foreign citizens who are residents of the Russian Federation and receive income in Russia;

- parents or legal guardians of the child,who can expect to receive a property refund.

Therefore, before applying to the Federal Tax Service for a benefit, you should decide who can receive a tax deduction.

Who can't apply?

There are some citizens who will not be eligible for a refund. These include:

- unemployed citizens;

- people who receive a gray salary;

- pensioners, since personal income tax is not transferred from the pension to the state budget;

- persons receiving various social benefits that are not taxed;

- individual entrepreneurs working under the simplified regime, since in this case personal income tax and some other taxes are replaced by a single payment.

Therefore, if a person wishes to receive a benefit from the state, then it is initially advisable to study who can receive a tax deduction. You can get reliable and up-to-date information directly from the employees of the Federal Tax Service when contacting the department of this service.

When can I not get a property return?

Most often, citizens want to receive a tax deduction for the purchase of an apartment. This is due to the fact that it has a large size, since you can count on 13% of the cost of housing, but the amount cannot be more than 260 thousand rubles. Additionally, you can get a second deduction for interest if the home is purchased with a mortgage.

But sometimes Russian citizens, after buying real estate, are faced with the fact that they cannot getthis return. This may be due to the following reasons:

- housing was bought with state support, for example, mother capital was used or a military mortgage was issued;

- the apartment was transferred to the citizen by the employer under a special agreement;

- The deal for the sale of housing was concluded between people who are relatives.

You should not deceive the employees of the Federal Tax Service, since before transferring the amount of money, all documents submitted to the tax office are subjected to a thorough check. If it is found that the documentation contains false information, then the return will be refused.

Legal regulation

Information about who can receive a tax deduction is contained in Art. 220 and 221 NK. It also provides information on exactly what actions you need to perform in order to apply for this type of benefit.

In art. 78 of the Tax Code states that a deduction is provided within 30 days after a thorough check of the documentation.

Types of deductions

There are several types of returns that are assigned in different situations. These include:

- standard, outstanding for children, and it is also assigned to the disabled;

- property provided after the purchase of any property;

- social, represented by the return of expenses for treatment or education;

- professional related to the occupation of a citizen.

Any kind of returnis provided exclusively on a declarative basis, so the citizen must independently take care of the preparation of the application and the preparation of the necessary documentation.

Standard return rules

It is considered the most popular and frequently requested by citizens. It is granted only to taxpayers who have a certain preferential status. These include the following individuals:

- disabled;

- people with minor children.

Payout varies for the above categories. When calculating this benefit, it is taken into account that in one tax period the amount of salary cannot exceed 289 thousand rubles.

Benefits are accrued after a citizen submits an application to the Federal Tax Service in the prescribed form. Parents receive a payment from the moment the baby is born until they reach the age of 18. If a child enters a university on a full-time basis, then in addition, parents will be able to count on a deduction until graduation from this educational institution or until the student turns 24.

Property return

It is provided only after the purchase of any property. Housing may be in the primary or secondary market. It is even allowed to use a mortgage loan for such an acquisition. You can get a tax deduction for buying an apartment through a branch of the Federal Tax Service or through an employer.

You can submit an application and other documents to the tax service annually until this benefit is completely exhausted. But atThis takes into account the following nuances:

- maximum return of 13% of 2 million rubles;

- if housing costs more than 2 million rubles, then the maximum amount equal to 260 thousand rubles is issued;

- if you buy an object that costs less than 2 million rubles, then there is a balance, and you can get it if a citizen buys another property in the future;

- the benefit is returned not only for the cost of buying an apartment, but also for the costs associated with the repair of residential premises;

- if a mortgage loan is used, then another refund equal to 13% of 3 million rubles is additionally assigned, but the balance is not transferred;

- you can get a refund even after the construction of a residential building, but all expenses must be supported by official documents.

If a citizen has purchased a home, he must figure out how to get a tax deduction for an apartment. The procedure is considered not too complicated, so you can perform all the necessary steps yourself.

Even a pensioner can get a deduction for three years of work. If the beneficiary is a minor, their parents or guardians should handle the processing.

Methods of getting a refund

You can get a tax deduction all at once or with a monthly tax reduction. The taxpayer who bought the property chooses which method will be used.

If you contact the Federal Tax Service, you will have to fill out a 3-NDFL declaration annually, requestthe employer has a 2-NDFL certificate, fill out an application and prepare other documents to receive a refund. As a result, a benefit equal to the amount of personal income tax paid for the year of work will be assigned.

If you apply to the employer, then until the return is completely exhausted, the citizen will receive a full salary, from which income tax is not levied.

Can a spouse get a tax deduction?

If citizens buy property together, each of them can request a refund, and it is also possible to receive a deduction for only one citizen. This is true if only one spouse works officially or receives a high salary.

You can get a tax deduction for your husband by drawing up a special agreement, on the basis of which the spouses independently determine in what percentage they will apply for this benefit. This document is transferred to the employee of the Federal Tax Service. It is necessary to draw up such an agreement only once, after which the wife can annually apply to the tax office only with a standard package of documents.

Can a wife get a tax deduction for her husband if the man refuses to make such an agreement? In this case, each citizen will be able to receive a refund solely on the basis of their share, registered in Rosreestr.

Social deduction

He is appointed in the presence of official documents confirming spending on certain significant purposes. A benefit is issued if there are the following expenses:

- charity;

- treatment in an official medical facility licensed for this activity;

- purchasing medicines for yourself or your close relatives;

- paying for tuition at a university that has a license for educational activities;

- directing money to co-finance pensions;

- conclusion of an agreement with any NPF;

- buying a voluntary insurance policy.

You can issue such a refund only at work, and the payment stops when a certain salary limit is exceeded.

Professional benefit

This deduction can be issued by individual entrepreneurs, lawyers, notaries or other professionals performing any work on the basis of official contracts. Additionally, it is issued in the presence of roy alties.

For its registration, you must submit an application to the employer or the Federal Tax Service. Documents that confirm expenses are required.

What documents do I need?

You can get a tax deduction only if you transfer a certain package of documents to an employer or an employee of the Federal Tax Service. Documentation can vary significantly depending on the type of benefit. The following papers are required:

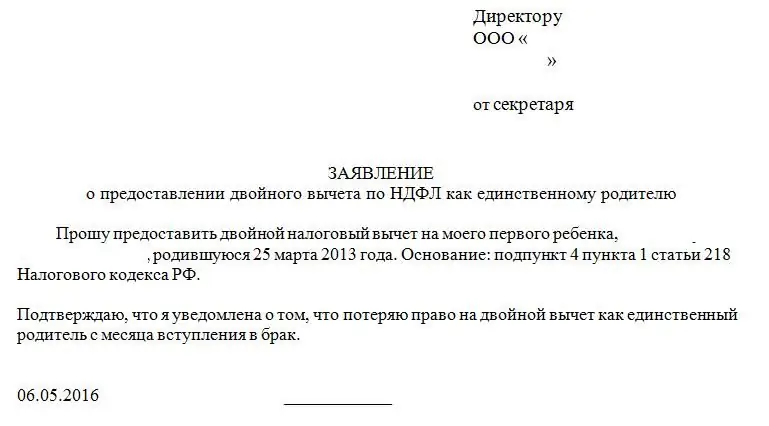

- if a standard return is issued, then an application is prepared, the applicant's passport, as well as documents for minor children;

- if a social benefit is requested, then documents are needed confirming certain costs, so they can berepresented by checks, an agreement drawn up with a medical or educational institution, receipts, contracts or other similar papers;

- when receiving a property return, you need an application, a 2-NDFL certificate, a correctly drawn up 3-NDFL declaration, documents for the purchased property, payment papers confirming the transfer of the due amount of funds to the seller, as well as documents from the bank if the object was bought with the help of mortgage loan;

- when applying for a professional benefit, papers are required confirming the expenses incurred during the conduct of this professional activity.

You can get information about which documents are required in a given situation directly from the tax service employees.

Deadline for funds transfer

If you apply for a refund to the employer, then the citizen from the next month will receive a salary without collecting personal income tax. To do this, you will first have to obtain a certificate from the Federal Tax Service, which confirms that a person is really en titled to this benefit from the state.

If a person submits an application to the Federal Tax Service, then a large amount of money will be transferred to the bank account indicated in the application in 4 months. This is due to the fact that verification of the transferred documentation is carried out within three months.

What are the problems?

If a person wants to receive this type of benefit, then he must figure out how to get a tax deduction when buying real estate orspending on medical treatment and education. This will avoid various problems and pitfalls. The main difficulties in implementing this process include:

- may be rejected due to lack of required documentation;

- if you seek treatment in an unsuitable medical institution, you will not be able to reimburse the expenses incurred, as the hospital or clinic does not have a license to operate;

- sometimes citizens have difficulty filling out the declaration on their own, so it is advisable to seek help from specialized companies or directly from employees of the Federal Tax Service;

- if fake documents are used, the applicant will not only not receive a deduction, but will also be held liable.

Most often, citizens prefer to apply for a refund after buying a home at the FTS office. This is due to the fact that you can receive a large amount of funds, which can then be spent on any purpose.

Conclusion

Deductions are presented in several forms, and for their registration, you can contact the department of the Federal Tax Service or the employer. To process any return, you need to prepare a full package of documents.

During the self-preparation of documentation, certain difficulties may arise. Therefore, it is advisable to seek advice from tax officials.

Recommended:

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Deduction of taxes when buying a car. How to get a tax deduction when buying a car

Tax deductions are quite an interesting question that interests many. Of course, because you can get back 13% of the transaction! But is there such an opportunity when buying a car? And what is required for this deduction?

What can I get tax deductions for? Where to get a tax deduction

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children