2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

At the end of the reporting period, each enterprise, organization summarizes its activities. As a result, the net profit or loss is determined. The second option speaks of the incorrect organization of the company's activities, inefficient management and requires a thorough, in-depth, comprehensive adjustment of processes in the course of further activities. If a company earns a net profit, it can distribute it according to its needs. This affects the further development of the organization. Where can you use retained earnings, how does it affect the company's activities? These issues will be discussed further.

What is included in the concept

Where can retained earnings be used? To understand this, you need to consider the essence and features of its accrual. This income is also called accumulated profit. It remains at the enterprise after payment of all taxes, fines, and other obligatory payments. Also, the presented concept closely intersects with net profit.

Profit,requiring distribution is the resulting indicator that reflects the company's performance over the entire period. Net income reflects how the company performed in the reporting period.

Accounting considers profit before distribution as a final indicator, which is reflected in account 84 of the organization's reporting. It is not distributed, but brought to a single result. How to distribute profits will be decided by the shareholders at the meeting, which takes place after the closing of the reporting period in the spring or summer.

Calculation of profit before distribution is made according to a certain scheme. To do this, take data from account 90 "Sales". It reflects the amount of profit from the sale of goods, the provision of services or work. This information is reflected in the loan. Debit 90 of the account shows the cost of production. VAT is also charged here and other costs are reflected.

In the process of generating income that requires distribution, the final balance from the specified account is transferred to account 99. It's called Profit and Loss. If a profit is made, the accountant posts the funds as follows:

Dt 90 ct 99

If the balance of account 90 is negative, the transaction looks like this:

Dt 99 Ct 90

The result of operations from operating and non-operating activities is reflected in account 91. It is called “Other income and expenses”. The following transactions are reflected in this account:

- sale or lease of assets owned by the enterprise;

- markdown or revaluation of non-current assets;

- profit from foreign exchange operations;

- investment in the authorized capital of other organizations;

- donation or liquidation of property;

- income (expenses) from transactions with securities.

The following transactions can be made on this account:

- Dt 91 Ct 99 - profit for the reporting period is determined.

- Dt 99 Ct 91 - a loss was received.

Formation of financial results

There are other sources of retained earnings, which are taken into account when forming the result of the company's activities. Thus, the write-off of amounts on accounts 90, 91 in accounting practice is called balance sheet reformation. However, for some companies, the procedure for generating retained earnings does not end there.

On account 99, among other things, the balance of other accounts is transferred. These could be:

- Invoice 76. It is called "Extraordinary Expenses and Income". This, for example, could be the loss of funds from natural disasters or compensation for losses through insurance compensation, etc.

- Score 10. It is called "Materials". This reflects the value of inventory items received on the balance sheet that cannot be used in the course of production.

In the report on retained earnings, the total amount is increased if errors are found in the financial statements. In this case, such actions lead to an unreasonable overstatement of costs. Also, the amount increases in the presence of unclaimed dividends, if more than three years have passed since they were accrued to shareholders.

If there are errors that overestimate the amount of profit, the amount of retained earnings for the year decreases.

This result is not always formed solely at the expense of funds in the relevant current accounts. For example, when fixed assets are depreciated, profit increases, but no money is added. When conducting an economic analysis, this must be taken into account.

On the last day of the reporting period, the organization writes off the results of account 99 to account 84. This reflects the full amount of income before distribution. To do this, the chief accountant must make postings upon receipt of profit in the reporting period:

Dt 99 Ct 84

If there was a loss, the transaction would be:

Dt 84 Ct 99

Then account 99 is reset to zero, no operations are carried out on it until the end of the next reporting period. It is worth noting that account number 84 is active-passive. Before the amount of income is credited to it, income tax is deducted from it.

Essence of proceeds before distribution and uncovered loss

Having considered which account retained earnings should be credited to, how this process takes place, you need to pay attention to the essence of the presented category. This is an absolute indicator that reflects the efficiency of the enterprise. In accounting, there are no significant differences between profit requiring distribution and uncovered loss. The difference lies in the wiring. Debit and credit accounts for profit or loss are different.

In most cases, a company that has been operating for more than a year covers excess costs with the balance of revenue from previous years. Funds can also be written off from the reserve fund, additional or authorized capital.

If a profit is made, the organization has the right to independently decide for what purposes it should be directed. The decision is made at the meeting of shareholders. Depending on the current situation in the market, as well as within the company itself, the direction for financing is chosen. There are several directions for the distribution of net profit received in the reporting period.

Retained earnings are reflected in the liability form No. 1. In this case, there is an increase in capital due to retained earnings. These are the organization's own funds that can be reinvested in production. According to the indicator of profit before distribution, it is possible to draw a conclusion about the effectiveness of the funds used in the course of production. If we analyze in detail the information that is used when calculating the presented indicator, we can draw conclusions about what factors influenced it in the reporting period.

If the organization has received a loss, its amount is reflected with a minus sign, taken in parentheses in the balance sheet. In this case, it is extremely important to determine why the company did not make a profit in this period. There are many factors that lead to a drop in income. They must be identified, and then a methodology should be developed to prevent a negative effect in the future.

Calculation technology

Equity and reserves can be filled bynet profit. To calculate it correctly, a simple technology is used. This will require determining the amount of net income, income before distribution at the beginning of the year, as well as the amount of dividends. If the company is a JSC, the payments are made to the holders of the relevant securities. For an LLC, dividends are paid to the founders.

The corresponding data is presented in the balance sheet in line 1370 and in the income statement in line 2400. If the company received a net profit, the calculation looks like this: NP=NPt.y. + PE - D. Where:

- Ne.g. - profit before distribution at the beginning of the year.

- PE is net profit.

- D - dividends paid to owners.

If no income was received in the current period, it will not be able to fill capital and reserves. In this case, the calculation is made according to the following formula: NP=NPn.g. - U - D. Where:

Y is the amount of the company's net loss

Loss may be greater than the amount of accumulated net profit at the beginning of the year. In this case, a negative value is indicated in the balance sheet. It is enclosed in parentheses. This is already an uncovered loss, which reduces the balance sheet.

Varieties of accounting

The amount of retained earnings can be accounted for in different ways. There are two options in total:

- Cumulative.

- Annual.

With the accumulative accounting system, the opening of separate sub-accounts for the profits of previous periods and the current year is not performed. The entire amount is reflected inaccount number 84. It accumulates starting from the first year of the organization's operation. If there is a loss, it is covered by the previously created savings.

The accumulative accounting system is most often found in small enterprises. The weather approach is more detailed. In this case, there are separate sub-accounts for accumulating amounts for previous reporting periods. Accounts of the second order can be of different formats. For example, there are accounts 84.1 and 84.3. The first of them is used to account for profit before distribution for the reporting year, and the second - for past periods.

To get detailed information, data is taken from the explanatory note of the annual report (attached to the balance sheet by large and medium-sized organizations) or from the account of accounting entries 84. Reporting of past periods is also used for analysis. If errors from previous years are found, they will be taken into account as a result of this year.

Information in the current period

Retained earnings of the company are reflected for the current period in different sub-accounts. For example, accounting can be kept like this:

- Subaccount 84.1 - Profit received.

- Subaccount 84.2 - Profit before distribution.

- Subaccount 84.3 - Profit used.

If the company receives net income this year, the accounting department reflects it using the following entries:

Dt 84.1 Ct 84.2

If an operation was carried out with an account of 84.3, this means that the profit wasused for various needs of the company.

When using different accounting methods, using the last posting in the reporting period, the accounting department will write off funds from account 99 and transfer them to account 84. From this amount, the tax must first be deducted, and after that it is applied to the result. Make the following postings:

- Dt 99 Kt 68 - tax is being calculated.

- Dt 84 Kt 75 - accrual of dividends (account 70 - employee bonuses can be used).

Who is eligible to use?

Before considering where retained earnings can be used before distribution, you need to pay attention to who can direct it to certain needs. Only the owners of the company have the right to decide what expenses to cover at its expense. These may be shareholders or members. Therefore, 84 accountant's account is often called the owner's account.

According to the current legislation, the decision on the distribution of profits is made at the general meeting of participants or shareholders. Accounting for the distribution of revenue will depend on what decisions the owners make by open voting. Further, the accounting department receives the relevant instructions recorded in the minutes of the meeting.

But owners sometimes make serious mistakes in the distribution of profits. But the further fate of the company depends on the correctness of this decision. It is the accountant and the analyst who can tell the shareholders what is the right thing to do in this case.

There are several options where you canuse retained earnings. The procedure for the implementation of this process is regulated by the legislation in the field of regulation of LLCs and JSCs. There are several options for how to distribute the resulting net profit of the organization.

Reserve fund

When considering options for how to use such income, first of all, you need to pay attention to it. The law stipulates that joint-stock companies are obliged to form a reserve fund from net profit. Moreover, its size must be at least 5% of the amount of the authorized capital.

In case of losses, the accumulated reserve funds will be able to cover it. Also, this fund is used to buy back own shares, redeem bonds. If the organization is a limited liability company, they can create a reserve fund at will, on a voluntary basis. The charter of such a society should state the size of such a fund, the purposes for which these funds can be spent, as well as the amount of annual deductions.

To create a reserve fund, the accountant records the following entry:

Dt 84 Ct 82

In the balance sheet, this amount is reflected in line 1360 of the third section. This improves the capital structure. Owners are prohibited from withdrawing funds from the organization for the amount of the reserve fund. This increases the safety of the company, increases its stability and, as a result, investment attractiveness.

Dividends

Dividends are being paid out of retained earnings. This leads to a decrease in the assets of the organization. This is the sumthe remuneration that owners receive for providing their capital to the company. Such a procedure in accounting is reflected in the posting:

Dt 84 Ct 75

When the money is paid to the owners, the following entry will be reflected:

Dt 75 ct 51

Money can be pre-withdrawn from the account. In this case, they are issued in cash from the cashier. And the wiring will be as follows:

Dt 75 ct 50

Dividends can be paid not only in money, but also in property. But this practice can be recognized in a judicial proceeding as unlawful. Therefore, the company must first sell the property, deduct VAT from the amount received, and then pay off the owners. If goods or fixed assets are issued as dividends, the sale of which does not require this tax to be paid, VAT is not charged. This, for example, can be land.

Cover the loss

If a company has received an uncovered loss, it must write it off in different ways. There are several possible ways:

- From the reserve fund.

- From the accumulated profit fund for previous years.

- Due to additional capital.

- Reduction of authorized capital.

- From the owners' own funds.

Be sure to establish the reasons why the company received a loss. Measures are being taken to prevent this from happening in the future.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

General concepts of the balance sheet: assets, liabilities, balance sheet currency

The balance sheet contains important information for assessing the company's financial results. Each section of the asset, liability, as well as the balance sheet currency is necessary to calculate many financial indicators

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

Retained earnings in the balance sheet is Account "Retained earnings"

Retained earnings in the balance sheet is a special line that reflects the profit or loss of the company after tax. It is from this amount that you can pay dividends or buy fixed assets

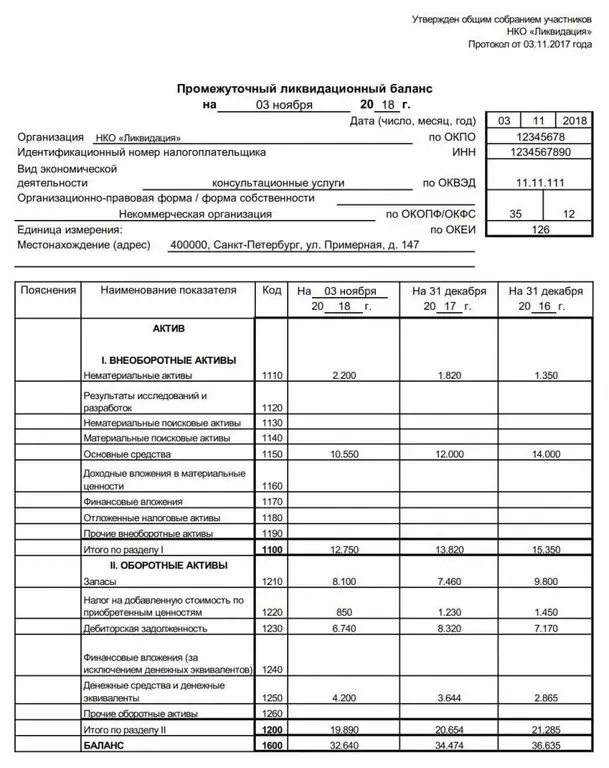

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service