2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Balance is the main form of financial statements characterizing the financial and economic activities of the organization. It reflects all funds (according to their composition and sources of occurrence on a given date) in monetary terms. Its structure has the form of a table, on the left side of which assets are presented - the composition of the property and its placement (money, receivables). And on the right side - liabilities, sources of formation of all capital (reserves, accounts payable). Both parts consist of several sections that combine homogeneous groups of tools, each type is called an article and is located separately (in accordance with a specific line). The total amount of items (total) is the balance currency in which the amounts of assets and liabilities are the same.

This equality will be explained by the fact that each asset arises due to some action, as a result of which the balance sheet simultaneously reflects both the funds themselves and the sources of their formation. Thus, the balance currency coincides in two parts due to different points of view on the same items. In the one case, what is expressed is the means, and in the other, the one whoinvested them. Based on the composition of the asset balance is divided into current and non-current assets. In liabilities, current and long-term obligations are distinguished with a fixed period during which all material assets must be used and existing debts repaid. However, assets, like debts, can change their original form. So, there can be a limit on the use of money, and

loan terms extended. Information about all such changes must be provided in the notes.

If the period of settlements with creditors and debtors has been extended, the balance currency may increase. Although this growth also indicates the expansion of the economic activity of the organization. To clarify the specific reasons, financial analysis should be carried out taking into account inflationary processes for existing reserves. Balance data is required to analyze and assess the economic condition of the company (when determining the total amount of obligations to counterparties). Using various coefficients of the stability of the organization, you can see a clear picture of its stability in financial terms. When calculating many of these indicators, the balance currency is used. The formula for calculating the autonomy coefficient, for example, is as follows: (CR + RBR) / WB, where CR is capital with reserves; RPR -

reserves for future expenses, and the WB is the balance sheet.

In general, this report provides information to managers and all other persons involved in the management of the enterprise about whatthe company, what are its reserves and their ratio to material assets, how they are used and who is responsible for their creation. The balance currency allows you to see the approximate value of funds that can be received upon liquidation of the company. This data is also used by outside institutions, such as the tax office, statistics authorities, creditors, etc.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

Deferred tax liabilities in the balance sheet - what is it?

Accounting is a complex system in which everything is interconnected, some calculations follow from others, and the whole process is strictly regulated at the state level

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

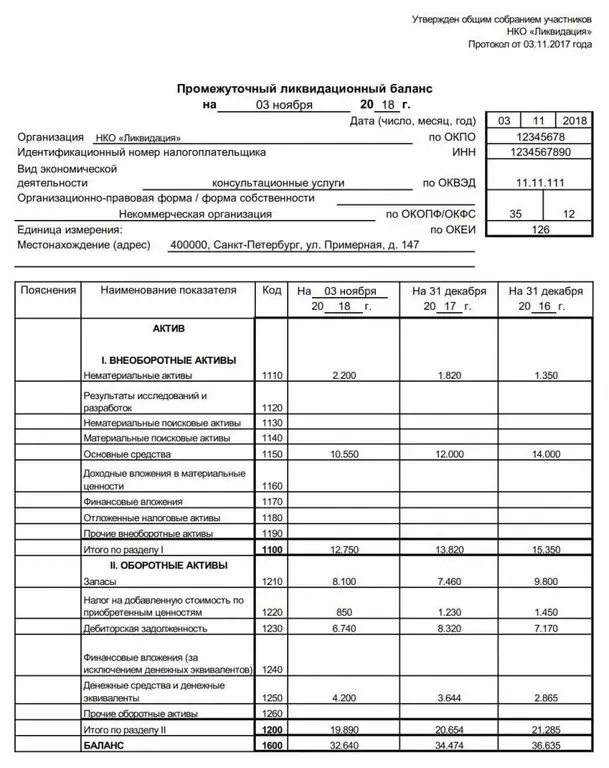

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

The book value of the assets is the balance line 1600. The balance sheet

The assets of the company, or rather, their combined value, are the necessary resources that ensure the process of manufacturing new products, the possibility of expanding sales markets and modernizing existing facilities, searching for new partners and customers, that is, the financial and economic side of the company's life