2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:26

Productive financial activity of any enterprise is practically impossible without borrowing capital from outside. Borrowed funds can significantly expand the volume of the subject's main activity, accelerate the formation of the necessary financial funds, ensure a more cost-effective use of financial own funds, and as a result, increase the liquidity and financial value of the enterprise. It is so established that the concept of funds is applied not to the treasury notes of the Central Bank of the Russian Federation that are familiar to us, but to non-cash monetary sources, which include settlement accounts and funds from credit institutions.

Ideally, the basis of an economic entity should be its own funds, but practice in our country shows that, for the most part, borrowed funds are the basis. That is why the market for borrowed funds is the most important aspect of both the financial and economic activities of the enterprise. It aims to achieve a high end result of the activity.

By definition, borrowed funds are funds received for a specified period of time and subject to repayment with a certain amount of interest for their use. It can beloans from banks and other credit organizations, as well as from the state, funds received from the issuance of securities debt securities (bonds). The mobilization of borrowed funds is carried out in several ways, the main of which are public financing, attraction of credit resources, mobilization of capital through securities. Cash received through the issuance and localization of securities is the main source of investment.

Loan funds can be raised in the following forms:

- in national currency;

- in foreign currency;

- in the form of a commodity (delivery of materials with an agreed deferred payment);

- lease (use in production activities of fixed assets that do not belong to the subject, on a paid basis);

- other forms (use of intangible assets on a rental basis, etc.).

The choice of using any of the forms of raising borrowed funds is made by the enterprise independently, based on the specifics of the main activity, as well as the purpose of raising.

Based on the foregoing, it follows that the main creditors for business entities can be commercial and state banking structures, as well as other organizations involved in the issuance of funds at interest, buyers and suppliers of products, as well as the stock market, acting as issuer of securities.

An important nuance in lending to an enterprise is that borrowed funds, in whatever volume and form they mayinvolved should be secured by the organization's own assets. This is especially true for those funds that are attracted in monetary terms. Borrowed funds are necessarily secured by the most liquid assets.

Another feature concerns the loan agreement concluded between the lender and the borrower. The fact is that all the obligations in the document relate only to the borrower - the safety of material resources, the timely return of interest and principal, etc. The creditor reserves the right to demand the fulfillment of all the terms of the contract.

Despite all the shortcomings and difficulties in attracting borrowed funds into financial activities, enterprises, especially developing ones, will not be able to do without them.

Recommended:

What is better - own funds or borrowed funds?

Some founders of enterprises invest exclusively their own funds in the development of their business and use only them, while others, on the contrary, use only borrowed funds. What are these types of capital and what are the advantages of each of them?

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

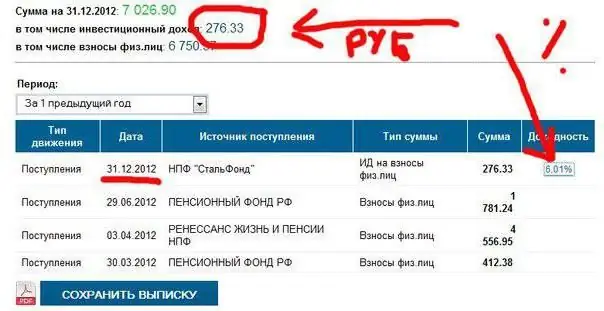

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?