2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

The current economic situation can be called unstable. Most people sooner or later begin to think about how to save money with a small salary. After all, in addition to mandatory expenses, a person wants to create a financial airbag for himself, entertainment is also needed. There is a lot of information presented as the "rules of money", or rather, their receipt, preservation and increase. And often these rules contradict each other. But some of them are worth paying attention to.

Spend less than you earn

It would seem that this is an absolutely obvious truth. But many people often forget about it. Loans, debts, the purchase of unnecessary things at the expense of vital purchases - all this drives personal finance to the bottom, from which it is extremely problematic to climb. 'Cause break itthe golden rule of money is not just harmful, but, one might say, extremely dangerous. Indeed, in addition to financial problems, such a life can also cause he alth problems due to the stress associated with constant debt. And the treatment of neuroses, in addition to a significant deterioration in the quality of life, can also hurt the pocket.

But how to save with a small salary? Giving up unnecessary spending has nothing to do with extreme austerity, where a person forgoes everything but essential things like food, paying bills, transportation, and communications. In the long run, such a lifestyle will only increase psychological stress. Just make an audit of your spending and determine what you absolutely need, what makes your life more comfortable and what you buy without need. Getting rid of unnecessary demands on your consumption will become much easier for you, as the tension associated with the inability to purchase something will disappear.

Give up loans and credit cards

Another golden rule of money, not as obvious as the previous one: don't use credit money. Yes, a credit card in your pocket calms and gives a feeling of financial freedom. But this feeling is illusory: sooner or later the loan will have to be repaid. At this moment, the folk truth: "You take other people's money, and give your own" - appears before a person in all its wisdom. In addition, you will have to return with a very tangible overpayment.

The habit of living in debt relaxes and makes you make more reckless spending. One day manjust get bogged down in loans that he can no longer repay. Therefore, refuse to constantly carry a credit card with you, and even better - find out from the bank how to close it as soon as possible. Refinance the loan if you think the interest can be lowered. Find a way to find money for big expenses without resorting to the services of banking organizations.

Invest in something that will bring income in the future

It's not only about the now almost abusive word "investment", although, and about them too. Rather, it is a call to look at yourself, your desires and opportunities. Income does not have to be expressed in a fixed amount and appear immediately. Learning a valuable skill may not bring money right now, however, using this skill at work will help you achieve your financial goals much faster.

Analyze what could be such a point of development. Skills, knowledge, assets of a promising business, obtaining a specialist certificate. Any investment with the expectation of using the results to your advantage can be considered an investment. And practice shows that investments in one's he alth, education and social connections are the most profitable among all types of investments. However, when investing in this way, don't fall into the trap of self-indulgence under the guise of investing in yourself. It should be clear which contribution will move you forward, and which will only pull back and devour money and time.

Diversification

Risk sharing is also notis something completely new. But from the point of view of diversification, you can approach not only investments. Diversify all sources of income.

Most of the methods of earning money that most people can only name is work on a standard schedule. Try to find another way through which finances will come to you. Work with multiple sources of money. Develop several areas that may be of interest to you. Make diverse acquaintances. Do not tie your well-being to one thing, and then the question of how to save money with a small salary will not bother you. After all, if one source dries up, then it can easily be replaced by another. And in good times, you will receive several streams at once, which you can spend and invest at your discretion.

Save some of what you earn

Many people already know about the well-known rule of money and savings, which says that 10% of earnings must be put aside. This rule is absolutely correct, however, the strict limits that limit the amount to exactly 10% of earnings are not entirely correct. Life can change, and if yesterday 10% of what you earned seemed an insignificant part of your net worth, today this amount can be extremely useful.

Try to analyze your financial situation and adjust the percentage of deferred money to the realities of life. But never spend absolutely everything. The habit of saving at least a ruble develops in a person the ability to spend responsibly. Moreover, evena small amount can become significant if doubled for several months in a row.

Spending wisely

The most difficult rule of money. It requires not only constant thinking about what to spend on, but also about how to spend. The first step to rationalizing spending is to change the perception of money. Think about money the right way: it is nothing more than a tool. What exactly you want to get with this tool deserves real attention.

Pay attention to what your life is like, what it takes to improve its quality. Analyze all its aspects as objectively as possible. Pay attention to your values. It is necessary to clearly and without excessive emotions separate what is impossible to do without from what is acquired without necessity. And then, without regret, part with unnecessary objects of desire.

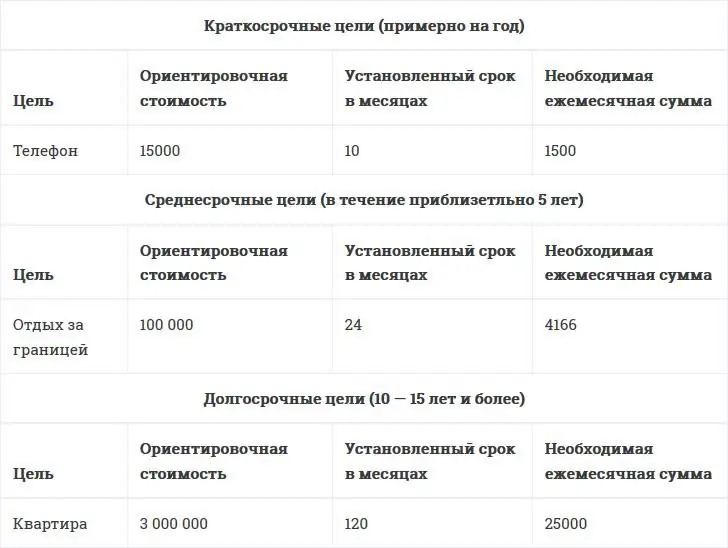

Plan to achieve your goals

Many people promise themselves to start planning tomorrow, the day after tomorrow, or next week. However, many people forget about planning because it seems boring to them and takes away the joy of sudden purchases from life.

Plan your expenses in a way that is convenient for you. It does not have to be a thick notebook for full-fledged home accounting, where everything will be written down to the last penny. If it is extremely important for you to be able to buy a small change at any time - allocate a separate budget column for this with a fixed amount and do not go beyond it.

Planning should not be oppressive, itis designed to make sure that you see exactly which path to your financial goal you have already traveled, and how much of this path you still have to go. Watching you move towards your desired goal can be very inspiring.

Keep learning

This applies not only to areas directly related to earnings. Yes, self-improvement in the profession is extremely important. Learning how the markets work and the rules of investing will also result in increased we alth if you plan to invest. However, even the usual study as part of a hobby or reading books on a financially neutral topic can help you learn how to adjust personal income.

Every time you learn something new, you expand your horizons, learn to analyze information, train attention, memory and concentration. As a result, your ability to quickly and accurately understand the situation may one day bring significant dividends, including financial ones.

Find something that really fascinates you. Read good literature, learn a new profession. Even if it doesn't make you money on its own, your ability to think, search and learn will increase your chances of increasing your income in the future.

Recommended:

How to save money with a small salary? How to save correctly?

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

A profitable way to save and increase - deposits of MDM Bank

Deposits of MDM Bank are very popular among all segments of the population. Consider the main deposits that MDM Bank offers its customers. Thanks to them, everyone will be able not only to save their savings, but also to increase

How to make money without money? Ways to make money. How to earn real money in the game

Today everyone can make good money. To do this, you need to have free time, desire, and also a little patience, because not everything will work out the first time. Many are interested in the question: "How to make money without money?" It's a perfectly natural desire. After all, not everyone wants to invest their money, if any, in, say, the Internet. This is a risk, and quite a big one. Let's deal with this issue and consider the main ways to make money online without vlo

How to increase the egg production of chickens at home? Features and ways to increase

When starting chickens, any poultry farmer plans first of all to get a large number of fresh, natural and tasty eggs. However, it is not always possible to immediately achieve the desired result. In some cases, it is necessary to master farming by trial and error before the goal is achieved. But still, if you figure out how to increase the egg production of chickens at home, you can save a lot of time and effort

Deposit "Save" (Sberbank): interest and conditions. What is the interest rate of the "Save" pension deposit in Sberbank of Russia?

Deposit "Save" is one of the most profitable deposit programs of Sberbank. There are higher interest rates for pensioners. Flexible partnership terms available