2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Evaluation of an apartment or house may be needed in many cases. Yes, and it is very important to know how much income you can get from the sale of real estate. After all, this is an asset that needs to be used wisely, which means that you need to know everything about it. You can read more about appraising the market value of an apartment in this article.

What is the market value?

Now the market model of the economy dominates all over the world, which involves the purchase and sale of various goods for the money for which people are willing to purchase them. For example, if you produce cheap disposable plates, then their price is unlikely to be very high. Otherwise, you simply will not have buyers. The same principle can be attributed to real estate: to apartments and houses. But in this case, it is much more difficult to set an objective price that would not reduce the owners' investments and at the same time would not be exorbitant. The situation is often complicated by the fact that during the sale of property, the owners are rarely objective. If good memories are associated with the house, oryou spent your childhood in it, it can be difficult to correctly set a price based on market conditions.

That is why the services of appraisers are so popular, which help to soberly assign the correct value. Estimating the market value of an apartment can be tricky if the owners of the apartment have an urgent need to sell the property quickly or if the property is located in an unfavorable area.

By type, they distinguish between current, past and future market value. As you might guess, it depends on the time for which it is calculated. Most often, an ongoing appraisal is carried out, but if you are going to invest in an apartment as an investment, then the value of housing in the future may come in handy.

Do I need to know the price?

Why ask the value of a property? The purposes of assessing the market value of property can be different. But most often the object is assessed in the following cases:

- If they want to mortgage or rent out real estate. In the first case, the cost is needed to calculate the amount of funds provided (for example, for a mortgage or a loan).

- If the property was donated and you need to fix its real value.

- In bankruptcy.

- To challenge the cadastral value. When selling property, the state takes a tax to the treasury, which is imposed on the difference between the market and cadastral values. You may often need the help of an appraiser to challenge its value.

- When selling or buying.

- In any other situations when you need to find out the real price of an object.

Evaluation methods

There are three methods for estimating market value.

The most popular is the costly one. It takes into account how much of your own money you have invested in the purchase and home improvement. The criteria for this method are fairly well defined. To make calculations, you need to know how much it will cost to build exactly the same house or apartment at the current moment. At the same time, absolutely all the little things are taken into account: from the cost of doors to the price of installation services. Of course, the depreciation and disadvantages of the dwelling are also calculated, as a result of which you can quickly get the exact price of the property. Another definition to be aware of in the cost approach is replacement cost. How much will an apartment with the same area and approximately the same location, but built with different materials, cost? As a result, the owner can get a clear picture of how much his property is actually worth. After all, the buyer is unlikely to pay for an object that does not meet the stated requirements.

Another method is comparative. It consists in conducting research on similar transactions. For example, last month they bought a 1-room apartment from Vasily in approximately the same area with the same social amenities. How much did he get for it? Having collected certain statistics from several such cases, we can draw conclusions about the average price of property in this segment. At the moment, for a comparative assessment, you don’t even need to resort to helpspecialists: many sites collect information and display the result.

The income method of property valuation takes into account how much you can get after buying a property. This method is used, for example, when buying an apartment in order to rent it out later. Indeed, in this case, completely different factors are important: the proximity of the metro, design, area, etc. The income method allows you to assume with a high degree of probability how profitable or unprofitable the investment will be in the future.

Criteria

In each approach, different criteria are used to assess the market value of the premises. But in general, they are all based on the following factors:

- Transport accessibility (metro, stops, highways).

- Living area.

- Layout.

- Availability of various social facilities: shopping centers, schools, kindergartens.

- Air quality.

- Presence of nearby parks and other natural objects.

- Floor.

- The material from which housing is built.

- Availability of finishing and repair.

Appraisal

The most frequent object for evaluation are usually apartments. The customer just needs to answer the question of why he needed an assessment. Based on the response, the performer chooses the appropriate method. But most often, the assessment of the market value of an apartment takes into account all three approaches. If all of them are applied, then the market value is considered reasonable. Each approach also has a coefficient that reflects it.authenticity. For example, the comparative method has a rather low reliability coefficient, since many transactions in the Russian market are not transparent, and objects often do not have sufficient analogues. How is the property appraisal process?

- The appraiser selects the appraisal method that is most appropriate for a particular apartment or house.

- The customer can choose the timing of his order. He must also state the purpose of the study and the amount of the reward.

- If both parties come to an agreement, then a contract is drawn up between them. Often, the services of an appraiser are not cheap, so the contract is an additional guarantee of the fulfillment of obligations.

- The more methods a study uses, the more expensive it will be. Therefore, the appraiser can announce the price of each separately to understand how much it is.

- Next, the performer conducts the assessment itself, calculates the reliability coefficients and provides the final value.

- The report on the current market value of the object is filled out last.

House Appraisal

Assessing the market value of a house is not much different from a similar procedure for an apartment. To begin with, the appraiser determines the cost of not the cottage itself, but the site. To this amount, the specialist adds the cost of work and materials that are needed to build the same house. Most often, the assessment of the market value of the site is carried out by the cost method. If the customer has chosen the comparison method, then the contractor will look for similar objectsin neighboring areas in order to calculate the average cost of a plot with a house. The result is a weighted average price that you can rely on during the sale.

Buying or selling real estate is a very important step. With an incorrect assessment of the value, the owner may greatly regret that he did not use the services of a professional appraiser. After all, as a result, you can lose a much larger amount.

Procedure for compiling a value document

Report is the result of real estate appraisal, which includes all the necessary information. It contains the methods that have been applied for evaluation, analysis of characteristics, description of the market situation and much more. Simply put, the report serves as an official confirmation of the assigned market value and can be used in transactions or to obtain loans. For a report to be considered valid, it must contain the following sections:

- Title page (number, information about the contractor and the owner of the property).

- Table of contents. Although the report is not very long, the table of contents allows you to quickly understand the existing sections.

- Cover letter, which contains all the basic information presented in a free format. It usually refers to the approaches taken.

- The findings indicate the results of the evaluation.

Thanks to the convenient format of the market value report, each person can easily find the information they need, and the result of the procedure can be found simply by looking at the last page.

The difference betweenmarket and cadastral value

During the sale or purchase of real estate, you will probably have to deal with such a thing as cadastral value. This is the price of housing, which is set by the state through its own assessment. The cadastral value is not always correct, so a gap of several hundred thousand rubles may arise between it and the market price. What steps should be taken in this case?

- Order a third party property appraisal.

- If the difference turned out to be really significant, then it is necessary to apply to Rosreestr with a request to revise the value of the cadastral value based on the available documents. In this case, a well-written report can play a big role.

- If you refuse, you can challenge the decision in court. The main thing is to have time to do this within 6 months from the date of the assessment.

Expert Tips

Assessing the market value of a residential property is a very complicated procedure, which has many nuances:

- If the cadastral value is lower than the market value, this can significantly reduce taxes. But if you are going to sell real estate, then it would be better to reconsider.

- Use free consultations. Some companies provide them free of charge for promotional purposes. Also on the Internet you can get advice from experts on controversial issues.

- Evaluate early. The process can take a long time. Self-assessmentdoes not get done quickly, and unforeseen difficulties may arise along the way.

- Choose companies located in the same area as the object. In this case, you will not have to pay additional transportation costs and time of specialists.

Who should I contact?

If you decide to use the services of an appraiser, then you will need a specialist who deals specifically with your real estate segment. In big cities, there are usually a lot of options. Choosing the right company is based on reviews or recommendations from friends. If no one from your environment can share the contacts of a verified person, then when choosing a performer, you should be guided by the following criteria:

- The company must have been in the market for several years and have a good reputation.

- The website must present licenses and certificates that will confirm the right to operate the company.

- Positive feedback on the Internet can also serve as a factor for cooperation.

Cost of appraiser's services

Many people think that the services of an appraiser cost crazy money, because he has to go to the site and do a lot of work. But in fact, you will need to pay from 3,500 to 5,000 rubles for an apartment appraisal. The cost depends on the company, the size of the apartment and its distance from the city. Usually trips to the region are paid separately. There is also a price surcharge for urgent orders, usually the price increases by 20%.

Results

If you figured out what a market value assessment is, what methods exist, then you have become more competent in matters of buying and selling real estate. After evaluating the object and generating a report, you will know exactly how much your apartment, house or land costs.

Recommended:

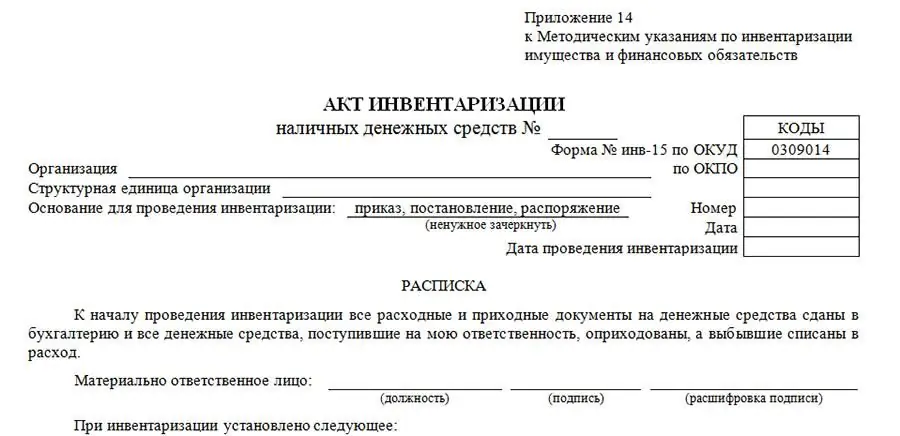

Drawing up the results of the inventory: a list of documents, the procedure for compiling

Filing out the results of the inventory is a significant step in a full-fledged and high-quality audit. To do this, the members of the inventory commission must draw up a set of documents containing the information obtained during the verification process. Based on this documentation, a decision is made by the head of the company regarding the prosecution of violators

Analysis of shares: methods of conducting, choosing methods of analysis, tips and tricks

What are stocks. How to analyze stocks, what sources of information are used for this. What are the risks associated with buying shares? Types of stock analysis, what formulas are used. What are the features of the analysis of shares of Russian companies, tips and tricks for collecting information and analyzing shares

The market value of land. Cadastral and market value

The cadastral and market value of a land plot are two concepts that are important to know about in order to navigate when selling

What is the difference between the cadastral value and the inventory value? Determination of the cadastral value

Recently real estate has been valued in a new way. The cadastral value was introduced, providing for other principles for calculating the value of objects and as close as possible to the market price. At the same time, the innovation led to an increase in the tax burden. The article describes how the cadastral value differs from the inventory value and how it is calculated

Cadastral value of the apartment. Market and cadastral value of the apartment

When calculating the tax on real estate, its division or alienation, as well as some other operations, in addition to the market, you will also need the cadastral value of the apartment. What it is, how it is calculated, in what specific cases it is used and where you can get its exact value - all this is discussed in more detail below