2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:27

If you received bank plastic, you need to learn how to use it. Otherwise, serious problems are not ruled out. For example, when paying for services or bills. This article will talk about how to check the balance in Sberbank. It will be about a bank plastic card. In fact, everything is not so difficult, but you will have to have some knowledge to achieve the corresponding goal.

Ways to solve the problem

How to check the balance in Sberbank? In order to achieve the desired goal, citizens must first study all existing methods and only then choose the exact algorithm of actions.

At the moment, you can check the balance of money in your bank account:

- via SMS request;

- through internet banking;

- by contacting the office of a financial institution;

- through the call center;

- via USSD request;

- by working with payment terminals;

- using ATMs;

- through a dedicated app.

Also,a citizen can check the balance on the plastic account by buying something or replenishing the card. These are not the most common scenarios, but they still take place in practice.

Personally to the bank

Do you want to check your balance at Sberbank? Then the citizen must know all the listed techniques. They do not cause significant trouble, in any case, the bulk of them.

Let's start with the least popular but most reliable solution. We are talking about a personal appeal to a financial institution. Citizens to check the card account must:

- Prepare your passport and bank plastic.

- Come to the nearest branch of Sberbank and write an application for account details.

- View the balance of the card in the issued certificate.

There is nothing difficult about this, but, as already mentioned, this technique is not in demand. Therefore, it is worth paying attention to other approaches to the task. Fortunately, there are more than enough of them. Each client of the bank will be able to pick up something to their liking.

Internet banking

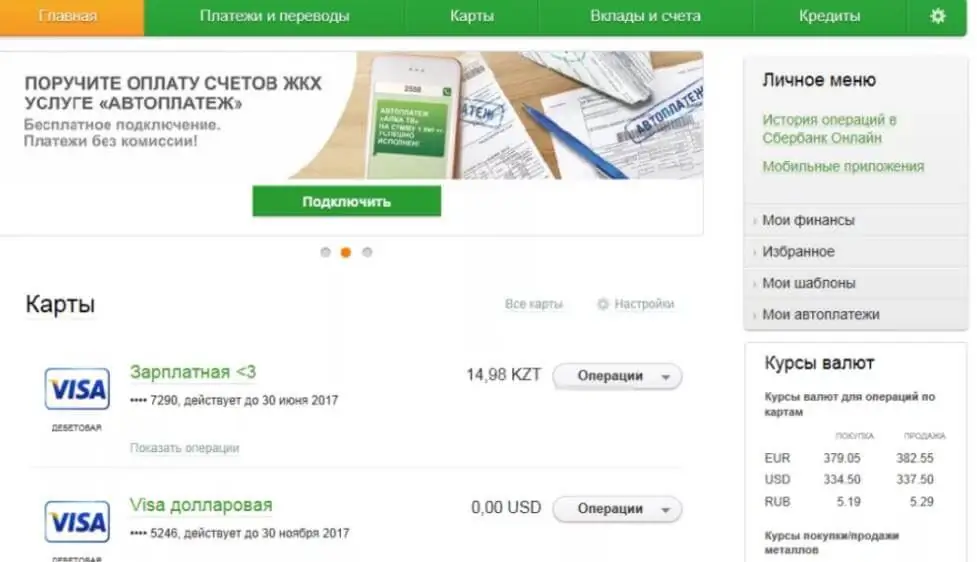

Do you want to check the balance of Sberbank via the Internet? Then you should connect yourself to the Sberbank Online service. This resource helps to quickly manage banking plastic. For example, pay bills, transfer money and check the balance of an existing account. Very comfortably. The service is provided free of charge.

Instructions for implementing such a technique comes down to the following steps:

- Connect Internet banking.

- Open the Sberbank Online website in a browser, and then log in with your name.

- Confirm authorization on the service.

- View the page that will open after a successful login.

All bank cards associated with the selected mobile phone will be displayed on the corresponding site. To the right of them is the balance of accounts. That's it.

App to help

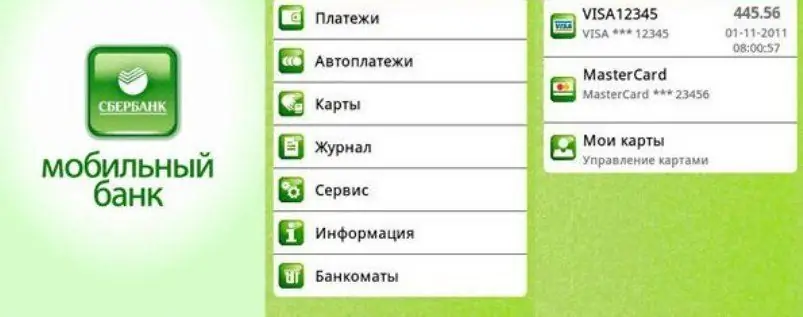

How to check the balance of a Sberbank card via phone? With this device, you can solve the problem in various ways. For example, through a specialized application.

We are talking about software called "Mobile Banking". First, you need to enable this option, and then install the application of the same name on your smartphone. Immediately after that, it will be possible to actively use the functionality of the proposed software.

In our case, it is recommended to adhere to the following algorithm of actions:

- Open the application from Sberbank Mobile Bank on your mobile phone.

- Select the "Account Operations" section in the menu that appears.

- Specify the "Request balance" parameter.

- Confirm operation and wait.

After the manipulations are done, the corresponding information will be displayed on the phone's display, or it will be sent as an SMS to the number linked to the plastic. There is nothing difficult or incomprehensible in the operation. True, this technique is also not very popular. There are simpler solutions to the originally settasks.

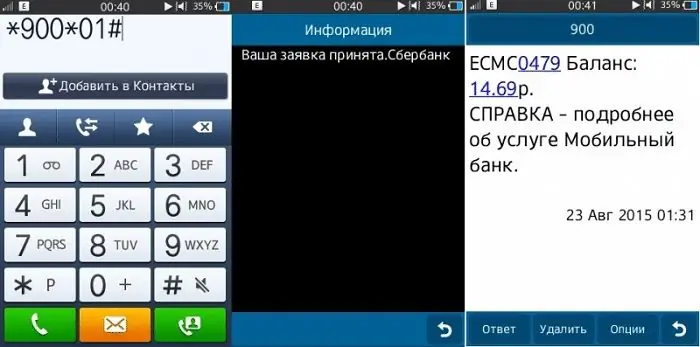

USSD request

For example, these include the formation of a special digital request. This technique works, like most of the options proposed below, with mobile banking connected. Without it, the USSD request cannot be sent for processing. This is simply not provided by the bank.

How to check the balance in Sberbank? For example, you can use the following algorithm:

- Connect the Mobile Bank option from the bank in any convenient way. If this function is already activated, you need to check if it is blocked.

- Put your smartphone or phone into dialing mode.

- Dial 90001 using the numeric keypad.

- Press the button responsible for sending the request for processing.

Now it remains only to wait. Depending on the model of your smartphone and the installed OS, the information will be displayed either as a separate message, or it will be sent via SMS.

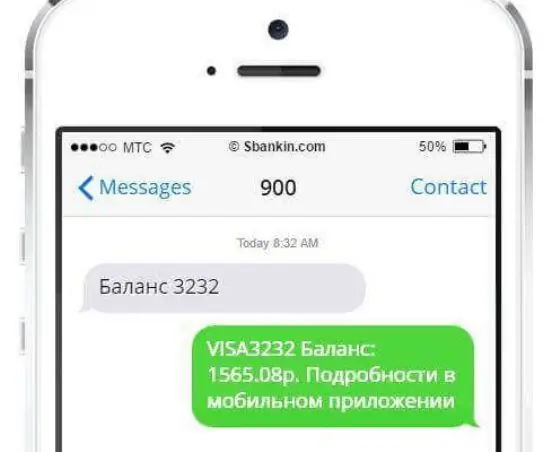

SMS request

But that's not all! How to check the balance of Sberbank via SMS? Can such a right be exercised at all?

Yes, but only for those who initially connected mobile banking. Let's assume that this option is enabled. Then you need:

- Open the messaging menu on your phone.

- Write "Balance", and after a space - the last 4 digits of the plastic you want to check. The last digital entry can be omitted if only one is attached to the phone.card.

- Send generated request to number 900.

What's next? We need to wait a bit. After processing the corresponding request (the process takes a few seconds), the client will receive a response message, which will contain information about the balance of the selected plastic. Now it’s clear how to check the balance of a Sberbank card via SMS. This is done in minutes.

Contact the call center

Still wondering how to check the balance of Sberbank? As already mentioned, this problem can be solved in different ways. Say, by calling the Sberbank call center. This is another far from the most popular technique, but it is still found in practice.

Do you want to know the balance of bank plastic via phone? Recommended:

- Dial a single number on your phone to get this kind of information.

- Wait for operator response.

- Inform the call center worker of your intentions.

- Answer questions asked by a Sberbank employee. They usually help identify a person.

- Name the number of the card for which the question arose.

- Listen carefully to relevant data.

Easy and simple! This technique does not require a mobile bank, it can be used at any time.

Important: calls to a single number within Russia are free.

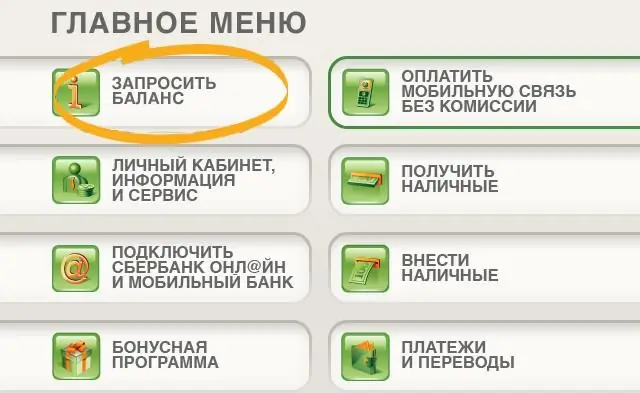

ATM and terminal

Need to check the balance of a Sberbank card through a terminal or ATM? There is only one instruction for these machines. It can be considered universal.

Guideline for checking the balance of plastic through such devices is as follows:

- Insert the card into the receiver of the selected machine and specify the PIN to start working with the device.

- Select the section "Card operations" in the functional menu.

- Click on the "Check balance" section.

- Choose how you want to receive information. You can display the relevant data on the screen or print a receipt.

- Confirm operation.

Next, it remains to study the information that will be presented in the chosen way. You can remove a bank card from a terminal or ATM.

Important: the operation is free of charge.

Change in account status

Another interesting trick to bring the original idea to life is changing the balance of the map. Each time a person spends money or replenishes an account, he will receive SMS notifications with the amount of expenses or money received, as well as with the final balance.

This feature works only when a citizen links a bank card to a mobile phone via mobile banking.

Recommended:

How to check an account with Sberbank: hotline, Internet, SMS and other ways to check an account and bonuses

Cash is slowly but surely becoming a thing of the past, becoming part of history. Today, payments in almost all spheres of life are made using bank cards. The benefits of such changes are clear. One of the most important is a convenient service that allows you to receive information about the status of your account at any time. Let's consider this possibility in more detail on the example of the largest participant in the Russian banking system. So, how to check an account with Sberbank?

Don't know how to check the balance of a Sberbank card? It's very simple

Most of the holders know how to check the balance of a Sberbank card. As you know, this action can be performed in several ways. Ideally, you should know all of them. Thanks to this, you will never experience inconvenience if one of the methods is not available

How to check a Sberbank card: by number, phone, SMS and other ways to check the balance and the number of bonuses on the card

More than 80% of Sberbank customers have plastic cards. It is easy and convenient to use them, besides, they allow you to save time when performing transactions. To always be aware of the amount of funds on a credit card, you need to know how to check a Sberbank card

Balance: types of balance. Types of balance sheet

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification

How to check the balance on Rostelecom. Balance management

To receive answers to questions to Rostelecom directly from the company, you must first become its client. By registering using the "Single Personal Account" link on the main page of the Rostelecom official website, you become the owner of a luxurious personal account with unlimited possibilities for managing services, which include balance control, payment for communication services, service consumption statistics, management of telephony services; tariff plan change, etc