2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification?

Balance: types of balance

The variety of accounting records is determined by a variety of factors: the nature of the information that forms the basis of the balance sheet, the time of its formation, the direction, the method of displaying information and other conditions. Types and forms of balance sheets are very diverse.

According to the method of displaying information, the types of balance sheet can be:

- balance, that is, reflected on the appointed date;

- negotiable - formed according to the turnover for a specific period.

In relation to the time of reporting, the main types of balances are distinguished:

- opening - at the time of activity;

- current - formed on the reporting date;

- liquidation - upon liquidation of the organization;

- rehabilitated - when reorganizing an institution approaching bankruptcy;

- separating - when dividing an enterprise into a number of companies;

- unifying- when combining small firms into one production.

Based on the volume of data on institutions, the main types of balance sheets are distinguished:

- single - for one institution;

- summary - according to the sum of the data of some institutions;

- consolidated - according to several interdependent institutions, the internal expressions of the amounts of which are eliminated when summarizing reporting.

Balance by type of activity can be:

- predictable;

- final;

- reporting.

Depending on the nature of the initial information, the balance is:

- inventory (formed according to the results of the inventory);

- book (formed only according to account information);

- general (generated according to the credentials, providing for the results of the completed inventory).

By data display method:

- gross - with the connection of information of stabilizing items (wear, stocks, margin);

- net - with the withdrawal of these stabilizing articles.

Balance: types of balance sheet for formation assets

Schematically, the balance sheet is a table. The asset contains 2 bars:

- "Non-current assets".

- "Current assets".

And displays company property.

All funds of the company are grouped in the assets of the balance, and their list of sources of creation - in the liability of the balance. The areas in the asset balance are placed in the modeincrease in liquidity. Debt contains 3 divisions: "Capital and reserves", "Long-term liabilities" and "Short-term liabilities".

Types of enterprise balances

The accounting code can be carried out according to the signs:

- formation period;

- formation resource;

- data size;

- type of work;

- property model;

- display item;

- cleansing method;

- according to the location of the asset and liability;

- according to the expression display figure.

According to the time of formation, accounting balances are divided into:

- Introductory, or initial - before compiling it, the company conducts an inventory of property and an analysis of all property.

- Current balance - from time to time it is drawn up during the work of the institution. The current balance is of 3 types:

- The initial (incoming) is issued based on the reporting time.

- The final (current) is issued after the reporting time.

- The preliminary is drawn up from the stages between the main and the end of the reporting time.

- The liquidator determines the financial position of the company on the date of its stoppage for the past stage.

- Partitive balance sheets are drawn up in the process of dividing a large institution into a certain number of the smallest structural units, or during the transfer of 1 or some structural units.

- Organizational is issued during the connection of someinstitutions into 1 large company, or in the course of joining one or some structural divisions to the provided institution.

Types of balance sheet analysis

Shared by formation keys:

- descriptive balances are drawn up in accordance with the completed inventory of the company's money, this kind of balance can be provided in a simplified or in simple types;

- theoretical codes are drawn up on the basis of current accounting information (based on current documentation);

- the main balance is drawn up on the basis of accounting records and inventory information.

Balances are divided by types

By data size:

- individual balance sheets display data on the performance of only one institution;

- consolidated balance sheets display data on the work of some institutions, are drawn up with support for the machine summation of money appearing in the notes of some individual balance sheets, and the calculation of single asset and liability results.

In such balance sheets, the single columns display the position of money of individual institutions, and the column "Total" determines the total position of money of absolutely all institutions in full.

To the liking of the work:

- balance of the main production - in accordance with the statutory activities of the institution;

- Auxiliary work balance reflects other types of work of the institution (vehicles, public housing, etc.).

Poconfigurations of property balances are presented in connection with the set coordinating-legal figures:

- national;

- urban;

- cooperative;

- general companies, etc.

Balance display

Based on the subject of display, the balances are divided into:

- independent - this kind of code is drawn up by companies that are represented by lawyers;

- special - this type of balance is drawn up by structural departments belonging to the same institution (lawyer's representative).

By purification method:

- "dirty" contains stabilizing notes, used for the purpose of academic studies, as well as to improve informative functions;

- "net" eliminates stabilizing notes, applied in the current balance period. It displays the true value of the institution's property.

Balance sheet contents

According to the location of the asset and liability, the balance sheet is divided into:

- balance in the figure - to the synchronous location of notes and areas of asset and liability;

- balance in the figure of the report - to the alternate location of the asset and liability (balance).

Types of balance by expression display type:

- balance sheet is drawn up by counting fragments (balance), according to accounts;

- reverse balance, except for fragments(balance), includes information about their movement (debit and credit terms) and for the past period.

The following certain conditions are imposed on each accounting code: honesty (truthfulness), validity, integrity, continuity, clarity.

The balance seems to be true, which was drawn up in accordance with the records made on the basis of the information of the papers. The papers, in turn, display data on the work of the institution for a specific period of time.

Balance, the types of balance discussed above, proves and determines accounting data.

Veiling techniques

The following methods of data veiling are distinguished:

- The display of values in the balance sheet is not in the place where they need to be taken into account.

- Conclusion of accounts payable and receivable. Funds must be shown, really according to the asset (debtors) and according to the liability (creditors). And in the vault there is only a difference among them (remainder, balance).

- Types of balance - deduction of shortages of valuables due to the calculation of discovered surpluses.

- Incorrect (increased or reduced value of amounts than necessary) formation of funds and reserves of the institution.

- Non-writing off amounts to cost costs related to the reporting stage.

- Introduction to the balance sheet of foreign property.

- Formation of a code based on information not supported by documentation.

Reality of balance and honesty are debatabledefinitions. The vault has the ability to be honest, but it is impossible.

There are concepts of balance sheet valuations: fair valuations, individual valuations, and book valuations.

The theory of fair valuations is based on the conviction of realized values that were introduced during the realization of the institution's property during the equilibrium formation period.

The theory of individual valuations is based on the fact that the monetary valuation of an institution is directly dependent on the personal circumstances in which this system is located. This single object has the ability to enjoy different prices from different institutions.

The theory of book grades is based on the scale in accordance with which the resources of the institution appear in the account (in books).

None of the concepts mentioned is in any way able to provide a unique solution to the scale problem. Thus, one should count on the ratio of balance estimates established by regulatory acts that are functioning in the current period.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

General concepts of the balance sheet: assets, liabilities, balance sheet currency

The balance sheet contains important information for assessing the company's financial results. Each section of the asset, liability, as well as the balance sheet currency is necessary to calculate many financial indicators

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

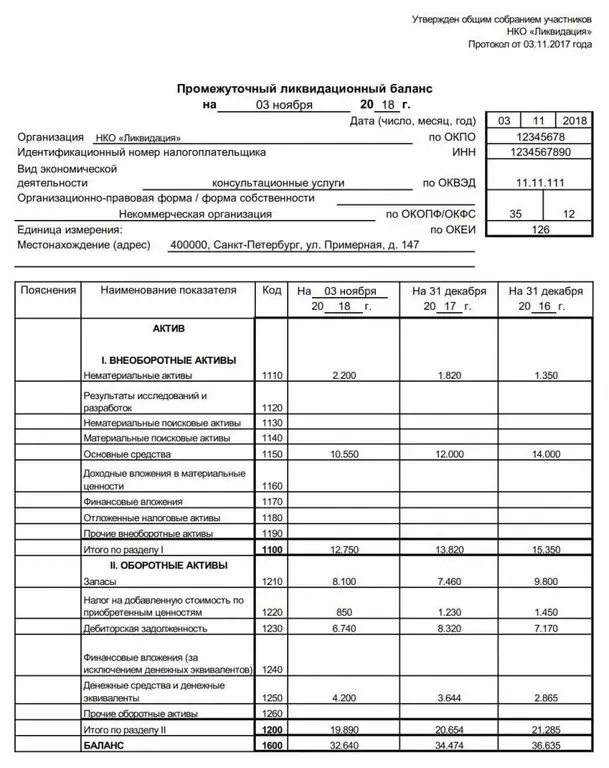

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

The book value of the assets is the balance line 1600. The balance sheet

The assets of the company, or rather, their combined value, are the necessary resources that ensure the process of manufacturing new products, the possibility of expanding sales markets and modernizing existing facilities, searching for new partners and customers, that is, the financial and economic side of the company's life