2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

It is believed that charitable assistance in Russia appeared at the time of the Baptism. Then people from higher classes, at the behest of their hearts or to create a positive image, helped the crippled, the poor, the sick. For example, already in 1016 Prince Yaroslav opened the first shelter, where several hundred orphans received assistance and education. The same ruler introduced sections into the Zemsky and Church Charters, where the main ideas of charity were documented.

Later, such a concept as “philanthropy” appeared, without which wonderful collections of beautiful works of art, created, for example, by the Tretyakov dynasty, would not have been collected in Russia. And the word "sponsor" was first uttered in the last years of perestroika, in 1988, at KVN. After that, it firmly entered our lives.

It is believed that sponsorship is a somewhat more selfish manifestation than charity. The sponsor, as a rule, receives positive advertising of his person or enterprise in the form of mentions for financial injections, for example, during somesponsored person's performances. Charity, for the most part, is not advertised. In marketing, this is called the “reach difference.”

In modern legislation, the concept of "sponsorship" is revealed in the regulatory act of the Federal Law "On Advertising". It was adopted in December 2006 (on the 18th). According to him, a sponsor is a person who gave money or ensured their receipt in order to hold an event, broadcast or create another result of creative activity. Instead, he is mentioned without fail in advertising.

Sponsorship offers some benefits. For example, an individual can receive a tax deduction when paying personal income tax in the amount transferred for the needs of, say, physical education of citizens to the relevant organizations (but not more than a quarter of the sponsor's income for the tax period). In addition, there are benefits for VAT and income tax. In order to find out what benefits a particular philanthropist has, you need to familiarize yourself with the tax code (Articles 284, 149), as well as with the regulatory act "On charitable activities and charitable organizations" No. 135-FZ (issued in August 1995).

There are more than enough objects for assistance in accordance with the law. It is possible to help the disabled, the unemployed, the low-income, the victims of various catastrophes and natural disasters, to protect childhood, motherhood, etc. The latter is very important,because assistance to orphanages is in great demand in the country. Institutions in large cities are more or less provided with financial resources and attention, while in the outback there is a shortage of toys for children, equipment, funds for repairs and labor. Also in high demand is such a direction as the adaptation of pupils to the conditions of real life, assistance in acquiring family communication skills and finding work. Here we need not only sponsorship, but also a large amount of time that those who wish can spend on children left without parents.

Recommended:

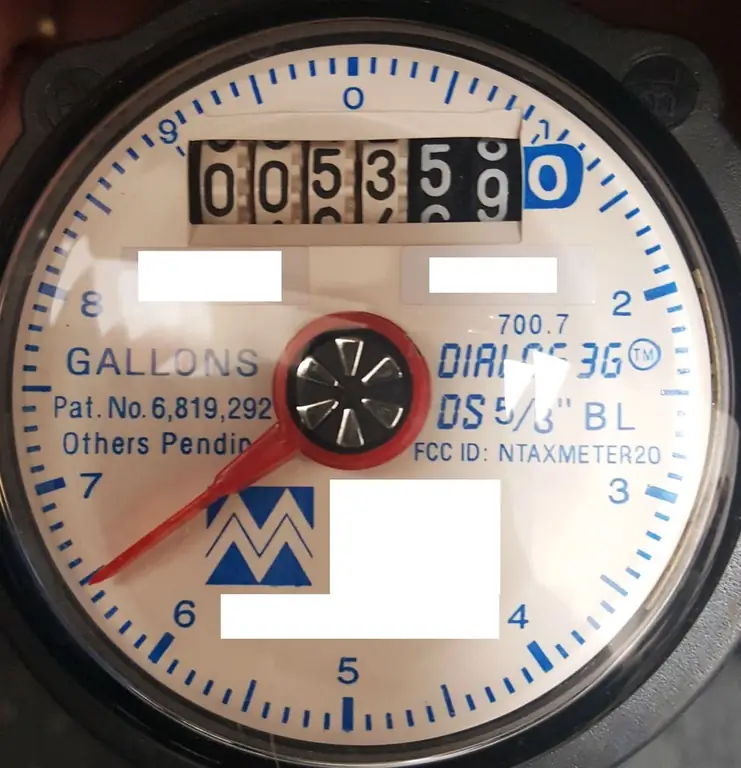

Shelf life of water meters: period of service and operation, verification periods, operating rules and time of use of hot and cold water meters

The shelf life of water meters varies. It depends on its quality, the condition of the pipes, the connection to cold or hot water, the manufacturer. On average, manufacturers claim about 8-10 years of operation of devices. In this case, the owner is obliged to carry out their verification within the time limits established by law. We will tell you more about this and some other points in the article

Tax preferences: concept, types, who is supposed to

Tax preferences - benefits, benefits that are provided to individual enterprises, organizations for state support of certain types of activities. The article will tell about their features

Construction of "Akkuyu" - nuclear power plant in Turkey. Origins and fate of the project

Everything about the Akkuyu NPP project: history, essence and brief description, as well as the attitude of people to the project. Why has the NPP project become so discussed lately? What will happen to the project after the events of November 2015? Answers in this article

The cheapest real estate in the world: country ranking, top 10, country selection, exchange rates, personal preferences and convenience of living

Despite any crises, the demand for real estate in the world is quite high. But still, with a sufficiently large demand outside of Russia, you can find good housing with a fairly small budget. Although it should be understood that the worse the economic situation in the country, the lower the cost of housing

What you need to work in a taxi: necessary documents and requirements, regulations and legal aspects. Feedback and advice from taxi drivers, customers and dispatchers

According to many passengers, the job of a taxi driver is the easiest. You sit, listen to pleasant music and drive back and forth. And they give you money for it. But this is only the outer side of the coin. The reverse is much less rosy. We will talk about it in this article. And we will also highlight what you need to work in a taxi