2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Financial transactions are an integral element of business activity, necessary to ensure its stable operation. Each enterprise carries out various financial transactions, which is associated with its organizational and legal form and line of business. In the article, we will consider the main types of financial transactions, we will study their features.

What is finance?

This term began to be used much later than financial relations actually originated. The history of this concept originates from the slave system. The first procedures that are commonly called financial transactions are those transactions that were carried out in order to pay mandatory payments, fees, taxes.

For the entire period of existence and development of economic relations, there is an interconnection between various areas of activity and interaction of subjects. Financial transactions cannot arise by themselves. This is the result of natural processes that determine the socialeconomic and political development of society. Despite the fact that chronologically, the first financial manipulations arose in parallel with statehood, modern relations in this area have long gone beyond tax obligations to the state.

Finance is a unit of calculation in the economic sphere, which cannot be imagined without a variety of financial transactions. Enterprises that conduct economic activities are engaged in attracting funds on a commercial basis to increase trade turnover, expand the service sector, develop new products, and introduce modern technologies in production. Finances can also be placed on bank deposit accounts, invested in securities, investment projects of other entrepreneurs. The profit received as a result of financial transactions is distributed among business owners and other participants in economic relations.

The purpose of money

Individuals and legal entities are required to pay taxes and other payments to the federal and local budgets, have the right to purchase state and municipal securities. In addition, there are also reciprocal financial transactions: the state pays social benefits, scholarships, provides subsidies, subsidies and other types of assistance, and finances public sector institutions that provide services to the population. All these operations are united by monetary forms.

Previously, the main function of money was considered to be their use as a means ofcirculation, that is, a payment instrument and a settlement unit when performing basic financial transactions on the basis of purchase and sale transactions. Another function of money is cumulative. Its essence lies in the possibility of accumulating funds and the correct formation of income, distribution of income and determination of costs.

Thus, the purpose of financial transactions is the actual distribution of income of some business entities and expenditure of others. The object of distribution, which is carried out by carrying out various payment actions, is the gross domestic product, which is an indicator of the national welfare, the standard of living of the population. Thanks to financial transactions, it is possible to correctly distribute the funds received from the sale of goods or the provision of services by a legal entity or a private entrepreneur.

GDP is a generalizing link in the distribution of income, including profits received by the state from foreign economic activity. In the course of economic and financial transactions, the indicator of gross domestic product is used in distribution, being, for example, a tax on the extraction of natural resources, therefore all financial transactions are carried out in monetary terms.

Varieties of financial transactions

At each enterprise, different types of financial transactions are performed. This is due to the direction of the company and its form of ownership. For example, banking institutions conduct transactions for lending, opening depository accounts, issuing fundsetc. Firms whose activities involve the leasing of vehicles, equipment and other objects are directly related to leasing, while organizations whose main commercial activity is the collection of funds by debt obligations use completely different financial instruments.

In addition, each business entity automatically participates in monetary relations. Thus, financial transactions are any settlement actions within the enterprise or those in which customers, partners, investors take part.

Forfaiting

This type of financial transaction involves the purchase of debt, which is expressed in the negotiable documentation of the creditor, most often from banks. This type of financial transaction assumes that the purchaser of the debt, called the forfaiter, accepts the obligation of the creditor to refuse to present claims against the debtor. In fact, it is this refusal that is called forfaiting. As a rule, the purchase of negotiable obligations is carried out under conditions favorable to the forfaiter.

The forfaiting principle is used not only in the financial transactions of banks. Such a mechanism for fulfilling debt obligations is used in various transactions, including export agreements, when, for example, exporters provide forfaiting to foreign buyers in order to facilitate the early receipt of cash into accounts. A bill of exchange is mainly used as a forfaiting security. It can be translated or simple. With these papersany monetary and financial transactions are carried out quickly, without difficulties in calculations.

In addition to bills of exchange, a promissory note issued in the form of a letter of credit can act as an object of forfaiting. Such a settlement document is an instruction from the bank to conduct a credit financial transaction at the expense of reserve funds. As the accompanying documentation, waybills for the shipped goods are used. Payments are made to the bearer of a letter of credit in which the amount of money is clearly defined. As an object of forfaiting, a letter of credit is used infrequently, which can be explained by the complexity of the financial transaction, taking into account all the nuances (observance of terms, terms of the transaction, etc.).

The importance of syndicates in economic development

Syndication is a new direction in improving the mechanisms for conducting transactions on forfaiting markets. A syndicate is an association of several business entities. This trend is most often resorted to by associations of banking institutions. The process of association of creditors is carried out by the voluntary consent of all parties to the agreement. In forfaiting, financial transactions by banking organizations are carried out by mutual agreement, including the distribution of forfaiting securities on the allocation of shares for each of them. Basically, such securities are purchased by several forfaiters, however, when it comes to large sums of money, bills are distributed among the participants, each of which receives equal rights. Suchmethod prevents the free circulation of securities and minimizes the likelihood of their secondary sale.

It is worth noting that the legal status of such transactions is currently not defined, therefore, in practice, organizations rarely use this method of conducting financial transactions. Experts believe that the primary direction for improving the forfaiting market is to increase the volume of financing using discount calculation and a floating interest rate. From an economic point of view, it can be explained by the lack of stability in interest rates and a reflection of the reluctance of banks to provide loans at fixed rates.

If we are talking about export sales based on floating rates, then such a settlement mechanism contributes to a decrease in benefits. As practice shows, primary forfaiters sell securities on the secondary market at a discount, which adheres to the prevailing interest rate. In addition, the sale of goods is carried out subject to the settlement of financial issues within the specified period, taking into account subsequent changes in interest rates. In fact, before the expiration of the bill, the end dates can change several times. Therefore, the transaction involves a high degree of risk for the forfaiter and may give rise to additional obligations. Forfaiting deals are especially scrutinized by auditors.

Features of franchising

If we consider this type of financial transactions in a broad sense, it would be more correct to understand the use of a trademark or brand as a "lease". Franchise Eligibilityis given by an agreement between the franchisor (seller) and the franchisee (buyer). The content of the transaction can be very different, include one simple or several complex conditions indicating the smallest details of the use of the brand. The franchise agreement specifies the amount of deductions for the use of the trademark in the form of a fixed fee, a lump sum for a specific period, or as a percentage of sales. If there is no requirement to make deductions in the contract, this means that the franchisee undertakes to purchase a certain amount of goods from the franchisor, use its services, etc.

Separately, the terms of use of the brand are prescribed in franchise agreements, which may consist in requirements for the use of goods only in a specific industry, the use of equipment only in the manner required by the franchisor, up to compliance with the size, color of shelves, work clothes of sellers and etc.

The concept of leasing

Leasing is understood as granting the right to temporary possession of real estate, a vehicle, equipment or other type of movable property, by transferring it to use for a certain or unspecified period for a fixed monetary compensation. Leasing is a model of financial relations, in which it is supposed to lease an object belonging to one party to another participant in the transaction. But most often a leasing agreement is concluded in the form of a tripartite transaction, in which one of the participants is a leasing company. With the consent of the userthe company purchases equipment from the manufacturer, then rents it to the buyer for temporary use for a cash fee, and after the expiration of the leasing agreement, the property becomes the property of the tenant.

Factoring as one of the directions

This term refers to the assignment by a factoring company of unfulfilled debt obligations, including invoices and bills of exchange, which were issued between counterparties when selling goods and providing services under a commercial lending agreement. According to the Convention on International Factoring, the result of a financial factoring transaction is considered satisfactory if at least half of the following requirements are met:

- preliminary conclusion of a loan agreement and no debt;

- accounting and tax accounting of the supplier;

- collection of financial debt;

- insurance of suppliers against credit risks.

Customer service using the factoring mechanism is considered the most effective for small and medium-sized businesses, as well as enterprises that are constantly experiencing financial difficulties due to the inability to repay debts to creditors in a timely manner and having limitations in the choice of credit sources. However, not all organizations that belong to the category of small or medium-sized businesses have the opportunity to use the services of a factoring company. For example, the right to use factoring does not apply to firms:

- with a large number of debtors;

- indebted tocreditors;

- manufacturing non-standard or highly specialized products;

- construction offices that work with subcontractors in production.

Factoring financial and accounting operations are not performed on debt obligations of citizens, branches or structural units. These limitations are due to the fact that in some cases factoring companies are not able to assess credit risks or the degree of benefit when performing an increased amount of work. The insured risk that arises from the assignment of contractual claims cannot be objectively assessed.

Currency transactions

Acquisition and sale of foreign currency at the rate of the national currency takes place in the foreign exchange market. In Russia, its participants are commercial banking organizations. Financiers who talk about the foreign exchange market often mean the mechanism for the sale and exchange of currencies on international exchanges, and not the process of buying and selling banknotes. To purchase foreign currency used to pay for import transactions, participants in foreign economic relations export proceeds from official sales in rubles at the Moscow Interbank Currency Exchange and other official exchanges of the Russian Federation.

To control financial transactions in the foreign exchange market in Russia, settlement and payment relations of foreign trade are not used. In countries where there are no restrictions on the conversion of the national currency, the main requirement for cash payments is the availability of a personal account. Andlarge companies with a significant volume of export-import operations, in parallel with accounts in the national currency, open additional accounts in order to minimize losses on exchange rate fluctuations. In states where currency restrictions are established, opening a foreign currency account aims to control settlements with foreign partners and regulate this financial industry.

As already noted, the main participants in the foreign exchange markets, which serve all forms of relations, are commercial banking organizations. They exchange currencies, participate in investment financial transactions. The receipts account is made by buying and selling telegraphic money transfers not only in national, but also in foreign currency at a special rate.

Swap - what is it?

This is one of the varieties of financial transactions in the bank. Translated from English, the word "swap" means "to make an exchange." Thus, we are talking about the exchange of assets or liabilities between entities that have a currency expression. The purpose of a currency swap is to improve their structure, reduce risks and costs. Banking institutions make currency or gold exchanges. Banks resort to the interest rate swap method much less frequently. This set of financial transactions may include:

- acquisition and simultaneous sale of currency;

- sale when making a forward purchase of foreign currency;

- getting a cash loan in different currencies;

- national debt swapcurrency, for liabilities in foreign currency.

When making a swap, the parties sign agreements that have a different focus for each of them. The settlement dates may not coincide, but at the same time, under any contract, the currency is purchased in exchange for another currency with delivery at the specified time.

Financial transactions of a swap refer to the types of report or deport - options for combinations of sale and urgent purchase of cash currency. An urgent transaction, during which the seller of the currency gives it to a banking institution and undertakes to redeem it after a specific period, but at a higher rate, is called a report. This operation is especially beneficial for banks, since it involves making a profit due to the difference in the exchange rate: at the time of repayment of the debt, it will be higher. In fact, a report is a kind of loan from a bank secured by foreign currency, and the interest fee for using the loan is the difference between the selling rates.

Unlike a report, a deport is a transaction that is carried out according to the opposite pattern. To carry out this financial transaction, the investor buys currency in a banking institution, subject to its sale after a certain period at a more favorable rate. It is assumed that the exchange rate in the market will be lower, and the bank will receive its benefit in the form of profit from the difference in rates. If a report is a currency analogue of a loan, then a deport is a kind of ruble deposit on a deposit. These financial transactions are carried out on the interbank foreign exchange market with both ruble and foreign exchange resources. Currency swap transactions can be of several types:

- "tomorrow"- the most popular type of transaction, involves an order for the supply of currency with its subsequent redemption from the bank is scheduled for the next day;

- "today" - the terms of the contract are executed on the day of its signing;

- "sport" - deferred currency redemption, that is, the transaction is executed after a certain number of days.

Currency swap can be used in a loan agreement. Accounting for financial transactions in the contract means that the loan will be issued in one currency, and it will have to be repaid in another. A swap with gold is the purchase of a precious metal for a specific period with a guarantee of a subsequent sale at a higher price. The algorithm for conducting a currency swap and a swap with gold is regulated by the ratio of asset prices for international transactions and the weight of the metal. So, for example, in Russia the unit of transaction volume is 1 g of gold, and in the USA it is one troy ounce.

Recommended:

Long-term investments are The concept, types, characteristics and possible risks of long-term investments

Is it profitable to invest money for the long term? Are there any risks for investors? What are the types of long-term investments and how to choose the right source of future income? What steps should an investor take in order to invest money for the long term safely and profitably?

REPO transactions. REPO transactions with securities

REPO transactions are procedures during which the sale of any valuables is carried out, accompanied by their repurchase after a specified period at a price fixed at the time of the transaction. Repurchase is mandatory, representing the final (second) stage of the transaction

Currency transactions are a special type of financial transactions

Currency transactions are transactions the subject of which are monetary values. They must be regulated by law or by certain international agreements

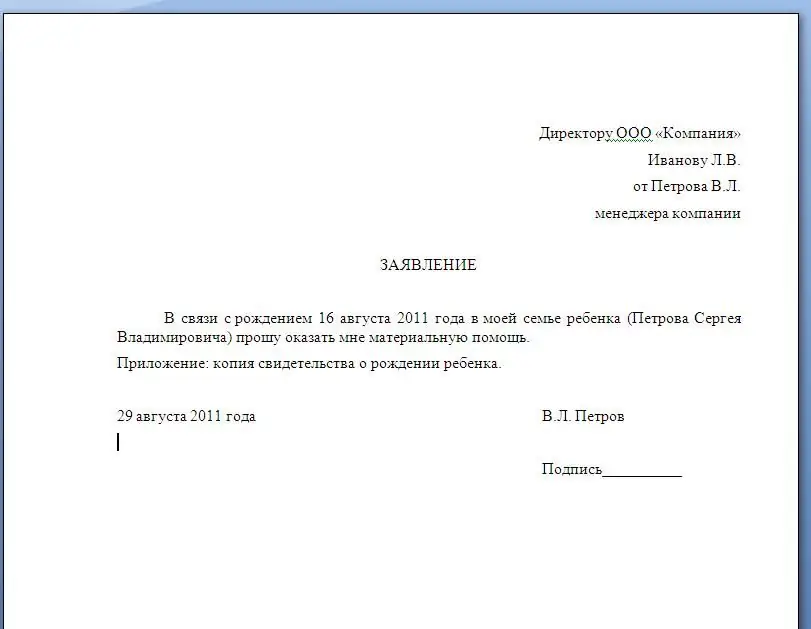

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

Financial institutions, their types, goals, development, activities, problems. Financial institutions are

The financial system of any country has a key element - financial institutions. These are institutions that are engaged in the transfer of money, lending, investing, borrowing money, using various financial instruments for this